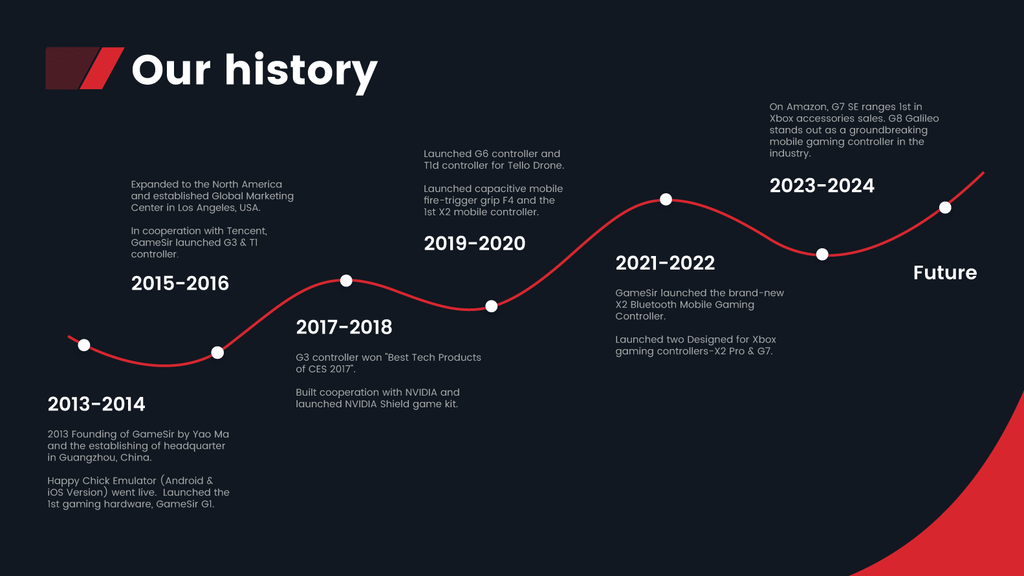

Turning a game controller into the “top choice” in player reviews sounds a bit idealistic, but the GameSir brand has indeed spent more than a decade gradually making this a reality..

Starting in Guangzhou in 2013, it has now grown into a global brand with annual sales exceeding 1 billion RMB and annual shipments of over 1 million units. It is both a player in the traditional peripherals track and a representative sample of Chinese brands going Tuke.

Image source:GameSir

From Software Accumulation to Hardware Breakthrough

According to public information, the GameSir brand was founded in 2013. When the founding team established the company in Guangzhou, they did not start with hardware, but instead accumulated a large number of early player users worldwide through the “Happy Chick Emulator”.

Around 2015, the global mobile game market exploded. The team keenly seized the blue ocean of mobile gaming peripherals, launching the G series controllers adapted for smartphones, successfully opening up the market with high compatibility and cost performance.

The real brand leap occurred around 2021, when GameSir reached a strategic cooperation with Microsoft Xbox and obtained official authorization. This was not only a ticket to the core console ecosystem, but also proof that its R&D and quality control systems were recognized by top international platforms.

Afterwards, collaborations with top game IPs such as “Black Myth: Wukong” further proved that the brand could participate in the global wave of cultural consumption.

Image source:GameSir

In emerging markets, the GameSir brand stands out, with GMV in Latin America growing 400% in two years, market share in Mexico second only to Microsoft, and several products in Brazil consistently ranking in the top 3 on e-commerce platforms; in 2024, sales on AliExpress exceeded 200,000 units, with some products topping Amazon category rankings. With over 170 technical patents, GameSir has entered the ranks of global leading game controller brands, competing alongside international giants like Microsoft and Sony.

Looking at the overall pace of brand development, the entire journey of the GameSir brand is more like a long-term experiment from product Tuke to brand Tuke and then to ecosystem Tuke.

Image source: Internet

The Rise of Emerging Markets and Structural Opportunities

Fundamentally, the reason why the GameSir brand can succeed in this way is largely due to the rapid expansion of the gaming industry globally, especially in emerging markets like Latin America.

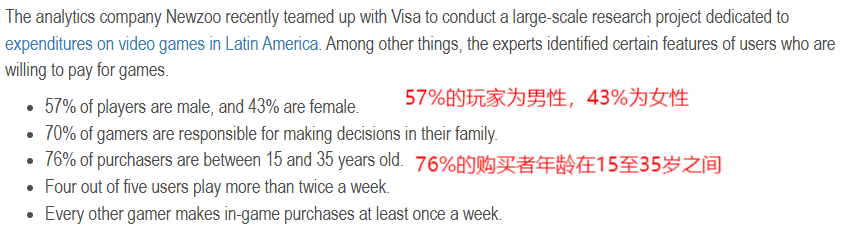

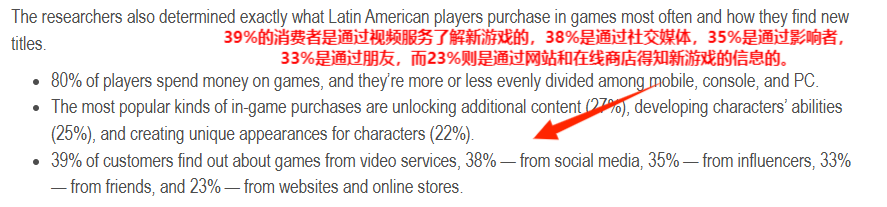

Take Latin America as an example. Research by Newzoo and Visa shows that about 146 million players in Latin America have paid for games or in-game purchases in the past six months, with Brazil, Mexico, and Argentina being the top three markets in terms of paying users.

About 76% of paying users are aged 15–35, with male players accounting for about 57% and female players 43%. This young group has high consumption frequency and high acceptance of new brands, making them the ideal target for third-party hardware brands.

Image source:games.logrusit

The research also points out that about 80% of players are willing to pay for game content, and spending is relatively balanced among mobile, console, and PC, meaning that whether it’s mobile game controllers, console controllers, or PC peripherals, there is ample room for growth.

More importantly, about 39% of players get game information from video platforms, 38% from social media, and 35% are influenced by bloggers and streamers. This “video + social media + KOL” chain almost completely overlaps with GameSir’s overseas marketing approach.

Image source:games.logrusit

Social Media Battlefield: On TikTok, Let the Product “Speak” for Itself

However, from today’s perspective, it’s hard to summarize GameSir’s growth logic with a single blockbuster product or channel dividend. After all, a brand’s success is always the result of multiple factors, which won’t be detailed here.

In this issue, we mainly focus on the social media channel.

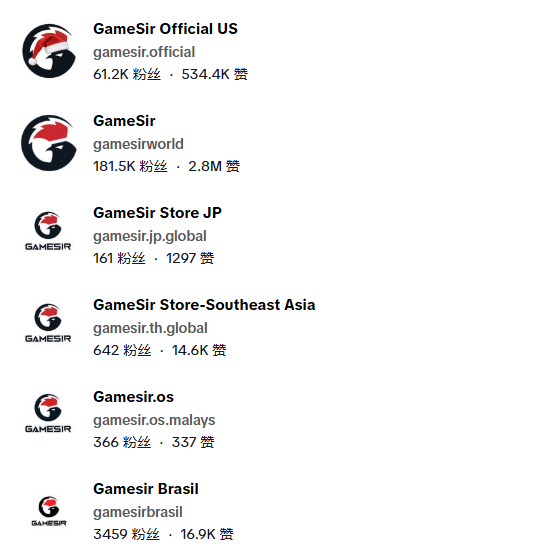

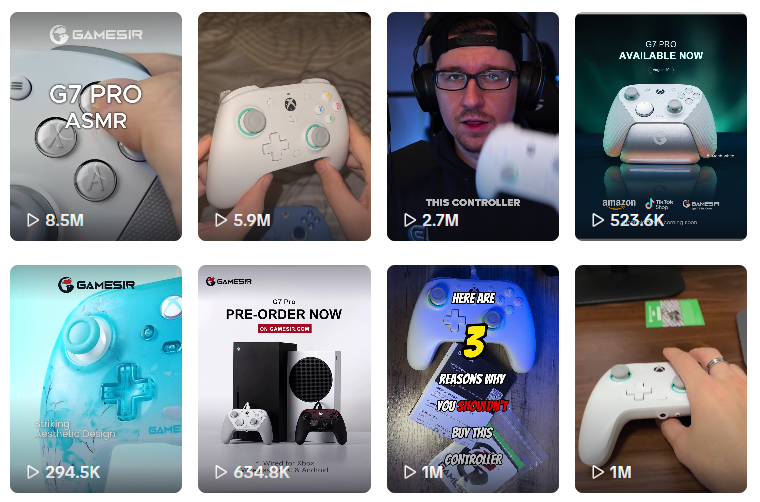

Among all social media platforms, TikTok’s importance to the GameSir brand is “visibly obvious”.

Currently, they have built an account matrix for different regions, such as @gamesirworld for global players and @gamesir.official for the US market, covering different regions through differentiated content styles and languages.

Image source:TikTok

In terms of content, besides specific new product promotions, GameSir is also continuously refining ways to communicate that resonate with younger players.

For example, on the brand’s US TikTok account @gamesir.official, they use short unboxing videos, feature demonstrations, and color displays to present technical highlights visually and with strong rhythm, allowing players to understand in seconds what makes the controller unique.

Image source:TikTok

For example, in a promotional video on August 14, they used the popular ASMR format, featuring close-up shots of controller button presses and linear operation tracks, directly showcasing the features of the GameSir G7 Pro controller.

This creative and internet-savvy content successfully attracted a large number of young players. According to kalodata, since its release, the video has generated 2,298 orders and a transaction amount of 1.2397 million RMB, which is impressive in both traffic and sales.

Image source:TikTok (left) & kalodata (right)

You may have noticed the ad metrics in the image above, which is a key part of GameSir’s TikTok operation model.

For this video with 1.2397 million RMB in sales, the total ad spend was 143,000 RMB over 29 days, with an ad ROAS of 2.96.

This means that for every 1 RMB spent on ads for this video, GameSir gets a return of 2.96 RMB, which is a small but profitable margin.

Looking at the past 30 days of account video data from kalodata, almost all the top-selling and top-traffic videos have signs of ad promotion, with the top-selling video’s ad transactions accounting for 72.6% of total sales, showing the importance of ad promotion in the sales process.

Of course, this doesn’t mean blindly investing in ads, but making reasonable choices based on video performance and future trends.

Image source:kalodata

In addition to self-operated accounts, GameSir brand also collaborates extensively on TikTok with vertical influencers in esports, 3C digital, and other categories, forming a cooperation model of “small influencers for reviews and material, mid-tier influencers for amplification, and top-tier influencers for explosive growth”, allowing products to penetrate different circles.

Image source:kalodata

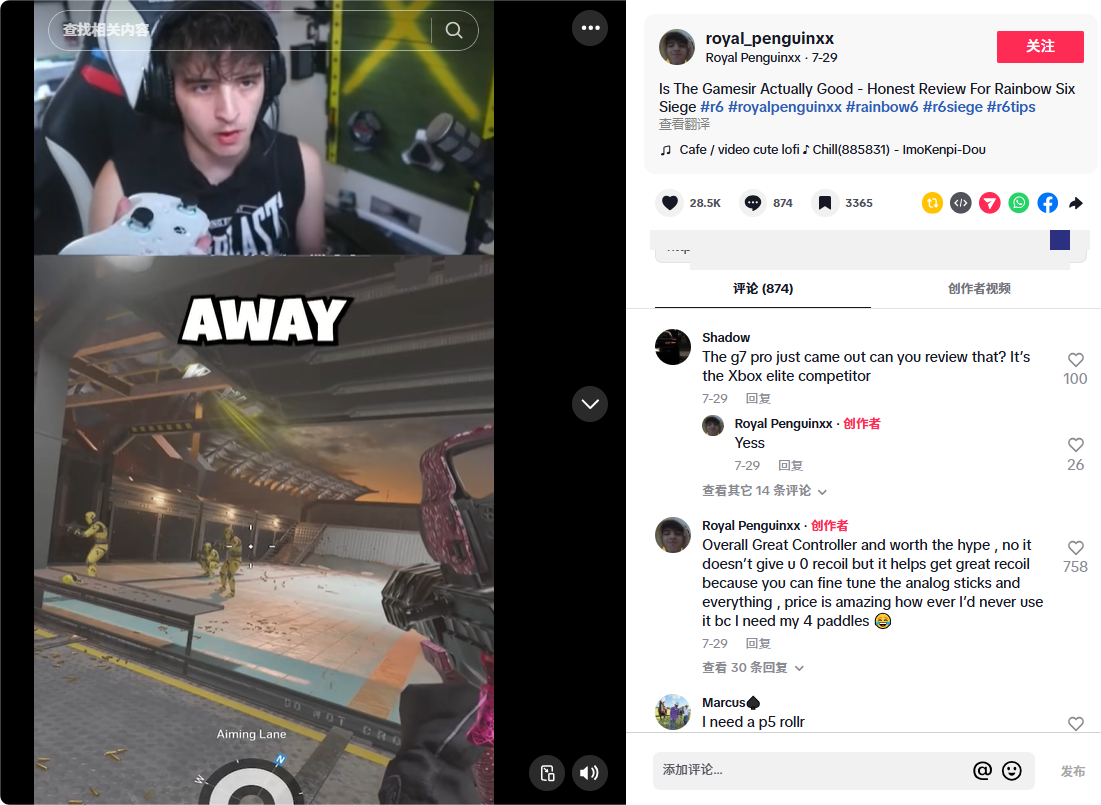

One representative case is the brand’s collaboration with TikTok influencer @royal_penguinxx. This influencer is well-known in the Rainbow Six: Siege community as a “controller player on PC”, with over 540,000 followers on TikTok, making him a prominent figure in this niche.

In related videos, @royal_penguinxx unboxes and reviews the GameSir G7 SE controller from the perspective of a “hardcore FPS player”, demonstrating joystick response speed, button layout, and long-term comfort through real gameplay, allowing viewers to directly see the controller’s performance in high-intensity ranked matches and decide if it suits their gaming style.

Image source:TikTok

Conclusion

From the trajectory of the GameSir brand, we can clearly see that the external environment for Tuke is very different from a few years ago.

It is no longer just about exporting goods based on cost advantages, but a full-scale competition involving ecosystem cooperation, precise market insights, localized operations, and deep social media communication. The booming digital consumption wave in emerging markets is crashing onto the shore with unprecedented force, waiting for more prepared Chinese brands to set sail.

The overseas market does not wait for anyone, but it is not a “winner-takes-all” closed game either. For more and more Chinese companies, now is both a fiercely competitive period and a rare window of opportunity: as long as you are willing to dig deep into product strength and invest long-term in content and channels, you have the chance to become the next name remembered by overseas players in a specific niche.