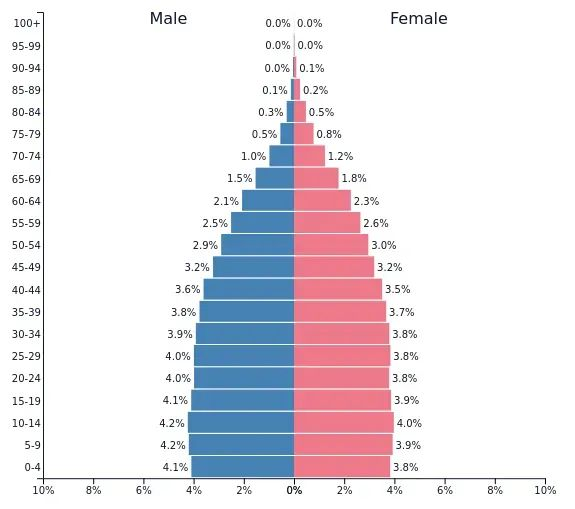

Southeast Asia has a large population base and a relatively high birth rate, resulting in strong demand in the mother and baby market. According to data from Statista, countries such as the Philippines, Indonesia, and Vietnam have birth rates higher than the global average.

For example, in 2023, the birth rate in the Philippines was 2.77, and in Indonesia it was 2.1. The proportion of multi-child families in Southeast Asia is also relatively high, with each woman in the Philippines giving birth to 2.49 children, 2.27 in Indonesia, and 2.05 in Vietnam.

Population distribution in Southeast Asia in 2023

This population structure brings huge growth potential to the mother and baby market. Especially as internet penetration gradually increases and per capita consumption levels rise year by year, Southeast Asia's mother and baby market is like a fertile ground for brand growth, where entering brands can easily find vast development space.

Compared to the fiercely competitive domestic mother and baby market, it is undoubtedly a "paradise" that everyone in the industry longs for.

However, seeing the opportunity is one thing, grasping it is another. Every year, countless brands go abroad, but how many choose the right track?

Obviously, in this wave of Chinese brands accelerating their overseas expansion, the emerging mother and baby brand MAKUKU is among those who have seized the opportunity. With its outstanding market strategy and product quality, it has quickly risen in the Southeast Asian mother and baby market, becoming one of the most popular mid-to-high-end mother and baby brands.

Why has it succeeded?

01

Localized Product Strategy

Founded in 2020, the MAKUKU brand is affiliated with Sands Talk Indonesia. It was created by a Chinese overseas team that has been deeply involved in the Southeast Asian market for many years and has a profound understanding of the local needs. Therefore, MAKUKU quickly occupied the mid-to-high-end mother and baby market in its early days.

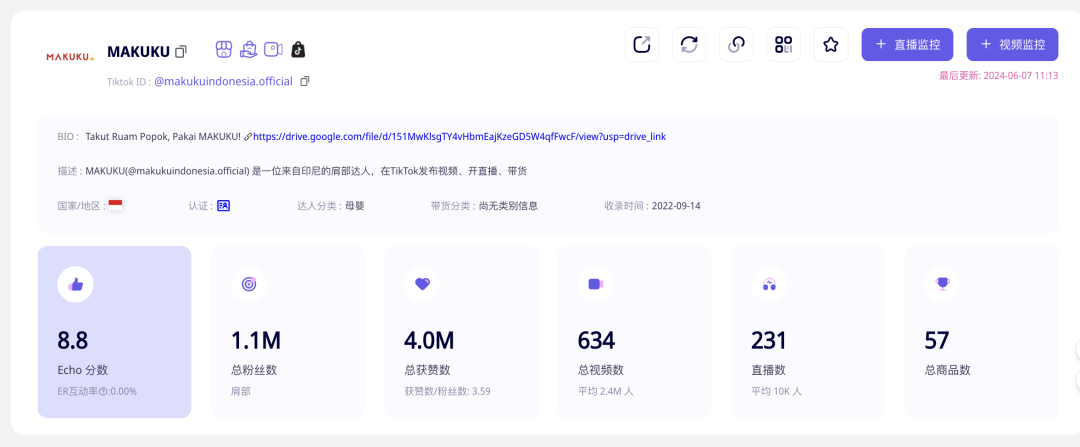

According to EchoTik data, MAKUKU has opened multiple stores on TikTok, with the largest store being the Indonesian shop, which has reached 1.1 million followers. One of the Philippine shops, since its launch last year, has achieved total sales of 182,000 units and a total GMV of 10.9 million RMB.

Product Series

In the Philippine market, MAKUKU has launched three series: Slim, Comfort, and Ultra Care, each targeting different segments of the mid-to-high-end market.

Slim Series: Thin and skin-friendly, with excellent absorbency and breathability, suitable for hot tropical climates. This series has earned MAKUKU a good reputation.

Comfort Series: Focused on cost-effectiveness, aiming to quickly capture market share.

Ultra Care Series: Focused on high-end experience, meeting the needs of premium users.

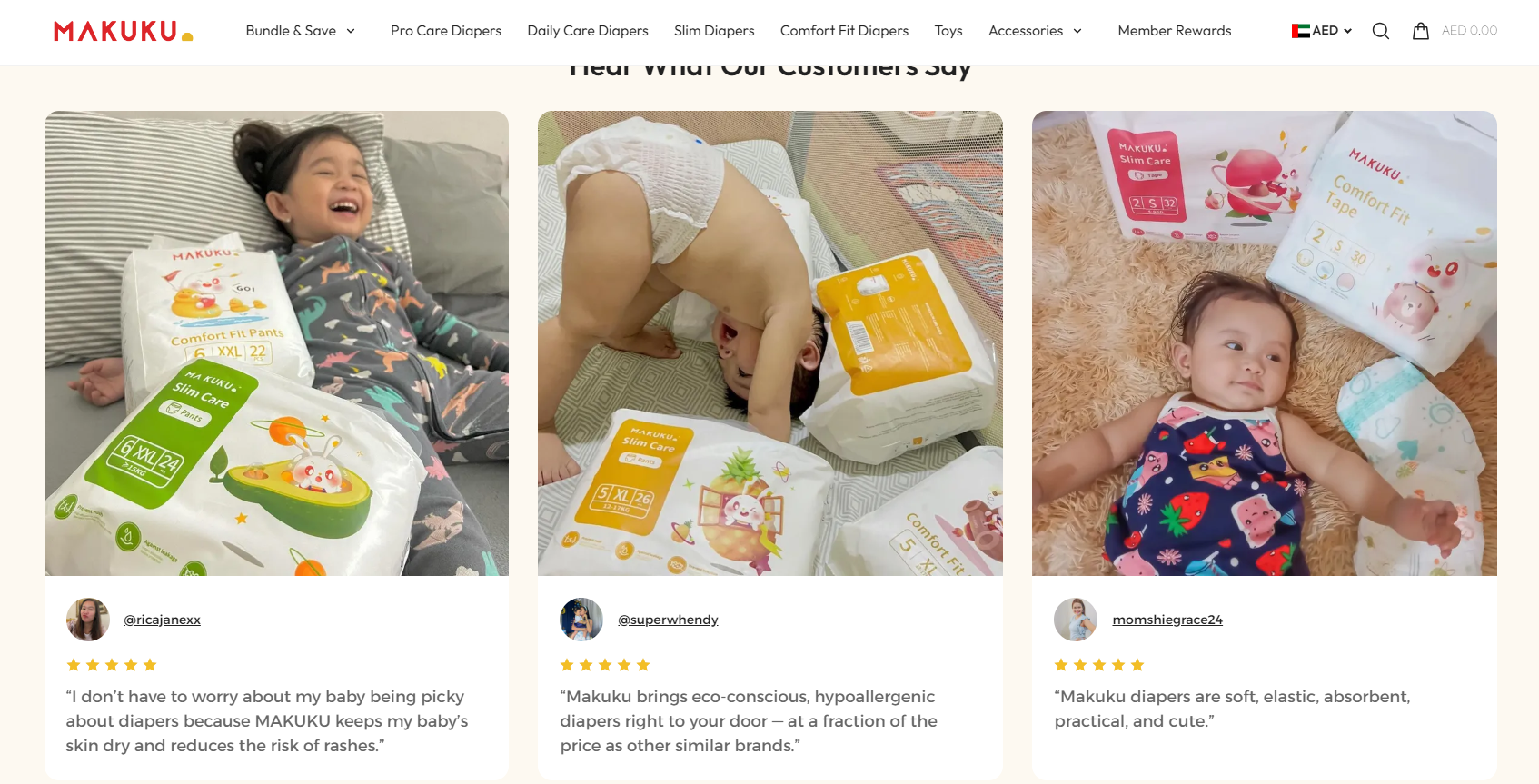

By collecting user feedback on the TikTok platform, MAKUKU continuously adjusts its product development direction to further enhance user experience. On its independent site, some consumers have commented that MAKUKU's diapers are soft and elastic, with good breathability and absorbency, making them very suitable for the tropical regions of Southeast Asia.

02

Integrated Online and Offline Marketing

MAKUKU is well aware of the importance of integrating online and offline channels, so it actively develops traditional offline sales channels while fully utilizing online internet resources to achieve grasping both ends and making both strong.

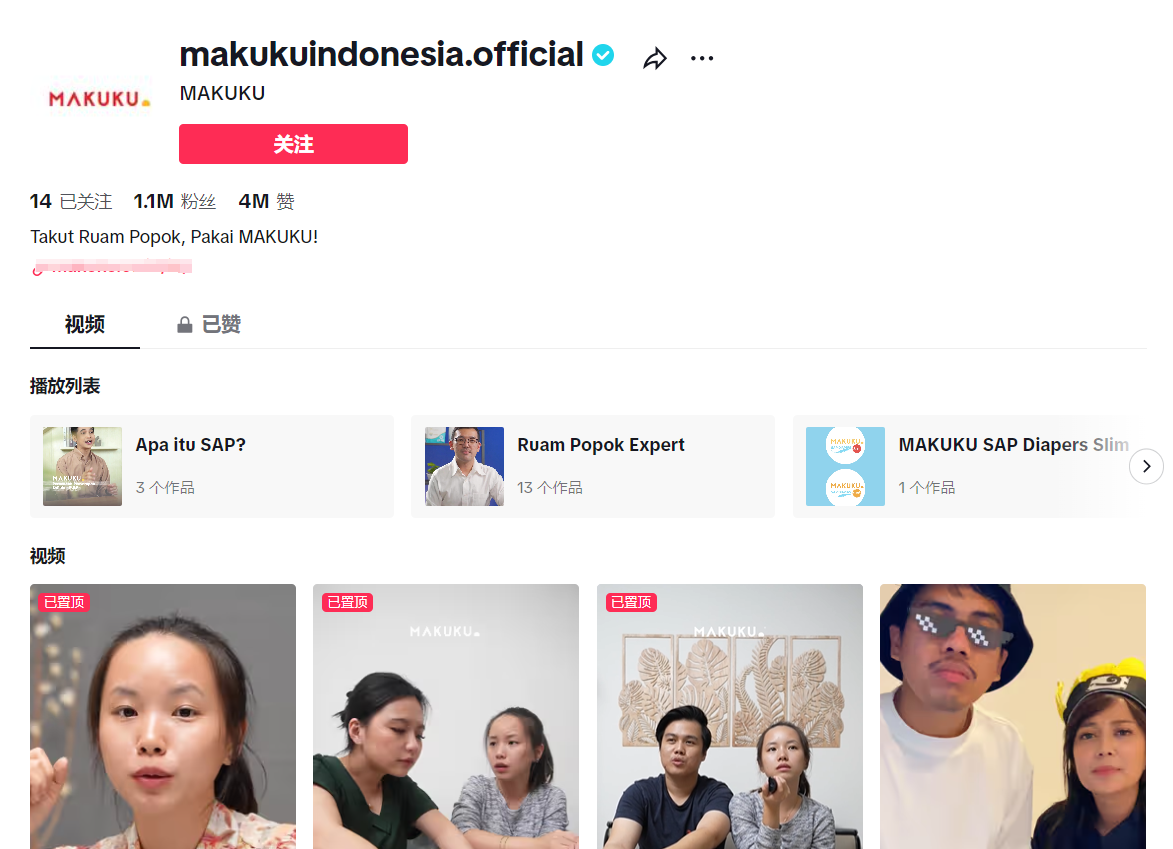

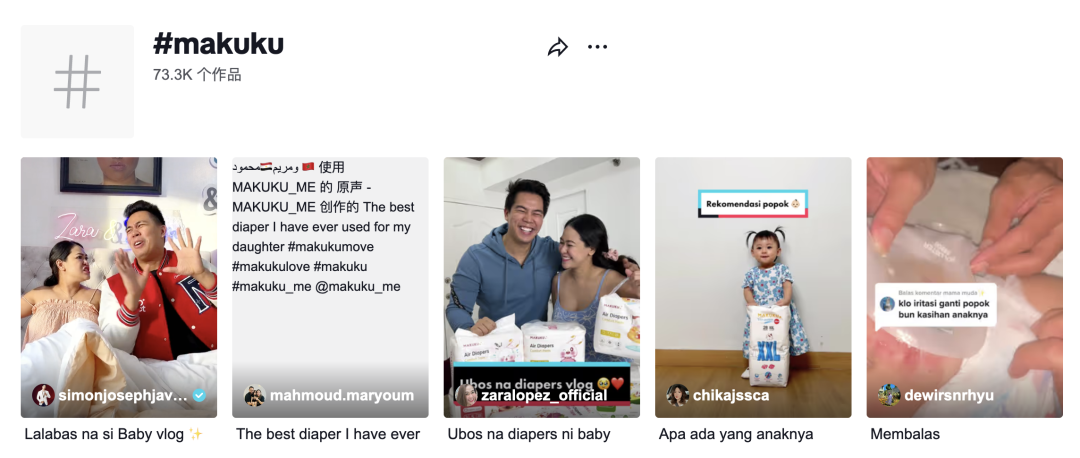

Online, MAKUKU has chosen TikTok as its main operating platform, investing heavily in video content creation and promotion. Currently, MAKUKU's official account in Indonesia has accumulated over 1.1 million followers, which is enough to prove its influence on TikTok.

In terms of content, MAKUKU's videos are rich and diverse, including light-hearted and humorous family sitcoms as well as practical videos directly introducing products. These videos not only attract a large audience but also successfully convey MAKUKU's brand philosophy and product features to potential consumers.

In addition, MAKUKU actively collaborates with local influencers on TikTok, further expanding brand awareness and influence through their promotion and recommendations.

This cooperation model not only helps MAKUKU quickly establish its brand image but also effectively attracts the attention and purchases of its target audience.

Moreover, as MAKUKU is a Chinese overseas brand, its team is well aware of the successful experience of domestic live-streaming e-commerce. They directly replicated these experiences, building influencer and live-streaming room matrices, further expanding product and brand exposure.

In addition to these promotions, MAKUKU has also launched large-scale online themed marketing campaigns, collaborating with Indonesian celebrities and TikTok mother and baby bloggers, adopting a strategy of combining store live-streaming with influencer matrix live-streaming, and receiving commercial traffic support.

Looking at MAKUKU's path to success, it's not hard to see that what it has done is simply the usual approach of current domestic overseas enterprises.

Aside from excellent product strength, whether it's localized market strategies or a powerful integrated online and offline marketing model, these are just MAKUKU's adaptive measures to the Southeast Asian mother and baby market.

At its core, it is about leveraging the traffic advantages of social platforms such as TikTok to convert brand awareness into actual sales performance.

But this does not mean that MAKUKU's experience is not worth learning from; on the contrary, MAKUKU's path to success is worth studying for all brands wishing to go overseas to Southeast Asia.

It can be foreseen that in the future, competition in the Southeast Asian market will become even more intense, and opportunities will be even broader.