In Southeast Asia, there is a country whose e-commerce market is growing at an astonishing speed—not Indonesia, nor Thailand, but Vietnam.

This country, often labeled as“underdeveloped”, has surprised many industry practitioners with the enthusiasm and purchasing power of its consumers for online shopping. It is estimated that by 2025, the scale of Vietnam's e-commerce market will exceed31 billion USD (about218.1 billion RMB), becoming one of the fastest-growing e-commerce markets in the world.

Opportunities are surging on this hot land, but the pressure of competition and regulation has also quietly escalated.

Image source:dantri

Astonishing purchasing power: love to save, but even more willing to spend

Unlike many developing countries, Vietnamese consumers show unique consumption characteristics.

Data shows that an average Vietnamese consumer has an annual income of about4,700 USD, but is willing to spend 1,500 USD to buy high-end products like the iPhone.

There are two key reasons behind this: first, Vietnamese households have a relatively low debt ratio, many residents live in self-built houses, and daily travel relies on motorcycles, so there is no heavy mortgage or car loan pressure; second, Vietnamese people value the“sense of quality” in consumption, tend to buy well-known and reputable products, and are willing to pay for what they love.

This“willing and able to spend” consumption concept provides fertile ground for the development of e-commerce.

Among them,online shopping, with its advantages of convenience, variety, and cost-effectiveness, has quickly captured the hearts of Vietnamese people, especially the younger generation. According to the forecast of the Vietnamese Ministry of Industry and Trade,e-commerce will still be one of the fastest-growing industries in the country in 2025, with a growth rate expected to exceed 25%, and its retail sales will account for about 10% of the total national retail sales of goods and services.

Looking at the region and the world, Vietnam's performance is also eye-catching,in ASEAN, its e-commerce market size has firmly ranked third, only behind Indonesia and Thailand; globally, Vietnam also continues to rank among the top ten countries in e-commerce growth rate.

Image source:dantri

Platform battle: live streaming e-commerce becomes mainstream,Tuke Shop rapidly catching up

Currently, the main players on Vietnam's e-commerce stage are undoubtedly two major platforms:Shopee and Tuke Shop. Both have placed live streaming e-commerce at the core of their strategies, and have deeply attracted Vietnamese consumers through vivid and intuitive live streaming sales models.

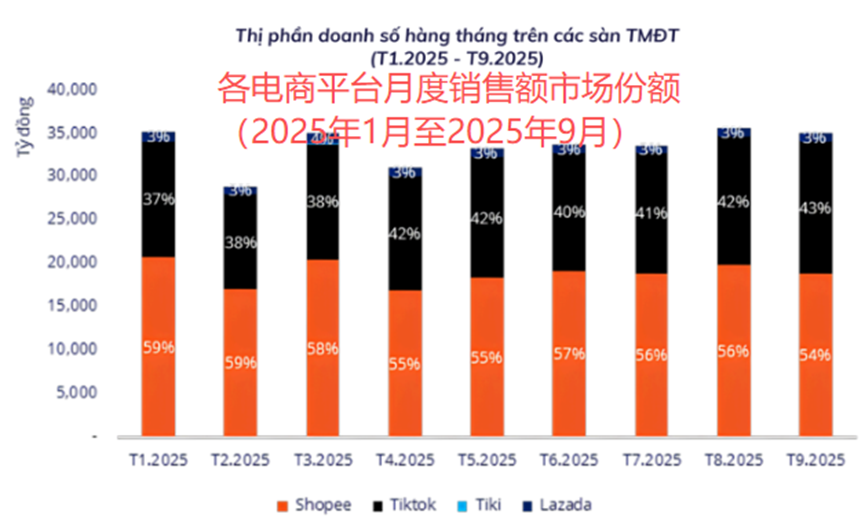

Market research agencyMetric's report reveals the intensity of this competition: in the first three quarters of this year, Shopee maintained the top market share, but Tuke Shop is catching up rapidly.

Especially in the third quarter,Tuke Shop's sales soared by 69% year-on-year, and its market share jumped to 41%, closing in on Shopee's 56%. The remaining about 3% of the market is divided by Lazada and local Vietnamese platforms such as Tiki.

It is worth noting that the top-ranked platforms are all cross-border platforms, which also reflects the strong interest of Vietnamese consumers in overseas goods. It is expected thatby 2025, Vietnam's cross-border e-commerce import volume will approach 2.5 billion USD, accounting for the majority of overall cross-border e-commerce trade.

Facing such a booming market, the Vietnamese authorities have also formulated ambitious plans. The Ministry of Industry and Trade hopes that next year the e-commerce market can continue to maintain about20% growth, reaching a scale of 37 billion USD, and promote the proportion of enterprises participating in e-commerce operations to about 62%.

Image source:Doanhnhan

Under prosperity, challenges and regulation go hand in hand

However, opportunities always coexist with challenges. While the Vietnamese e-commerce market is expanding rapidly, sellers are also facing increasing competition pressure and compliance requirements.

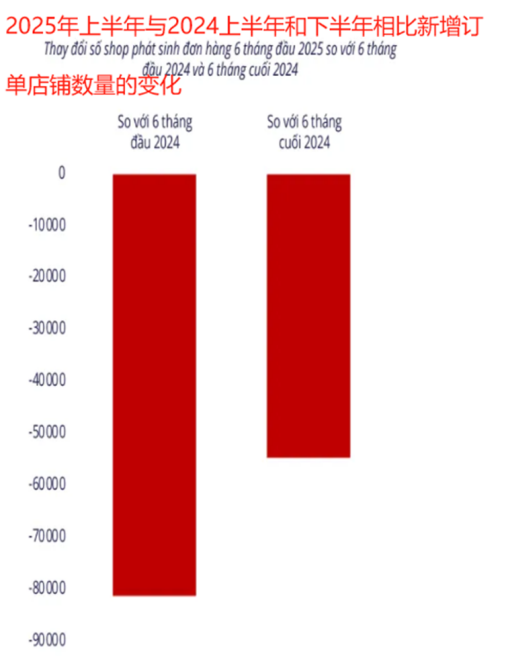

First, market competition is becoming increasingly fierce. As the market pie grows, more entrants join, and the survival battle becomes more intense.

Metric's report points out a phenomenon worth noting,in the first quarter of this year, the volume of online goods transactions in Vietnam increased by24% year-on-year, but the number of sellers who actually generated orders fell by 7.45% year-on-year, with about 38,000 stores possibly being eliminated in the past year.

At the same time, the advantages of leading sellers have become more consolidated, and the number of stores with sales exceeding50 billion VND has almost doubled year-on-year. This means that the market growth dividend may be accelerating towards the top players.

Image source:Metric

Second, the regulatory framework is rapidly improving and the degree of standardization is increasing.

This year, the Vietnamese National Assembly passed the“Overall Plan for E-commerce Development 2026-2030” and the country's first “E-commerce Law”, marking the industry's entry into a more standardized and legalized track.

The new regulations especially make clear provisions for the popular live streaming sales model, bringing the entire industry chain including platforms, sellers, streamers,MCN organizations, etc. under supervision, requiring relevant parties to verify their identities through government digital platforms, and platforms must also fulfill review and monitoring responsibilities.

In addition, cross-border trade supervision is also being strengthened. The Vietnamese Ministry of Industry and Trade stated that it will tighten the control of imported goods and pilot a supply chain traceability system to strengthen origin management.

Image source:baochinhphu

Seeking certainty in change

In summary, Vietnam's e-commerce market is in a stage where gold and thorns coexist.

A scale of over200 billion RMB and a growth rate of more than 25% are undoubtedly huge temptations. However, the intensification of monopoly by leading platforms, the rising elimination rate of small and medium sellers, and increasingly strict laws and regulations are all realities that must be faced directly.

For global sellers, this land contains not only huge growth dividends, but also fierce competitive challenges. Sellers who can flexibly respond to policy changes, accurately grasp consumer demand, and make good use of new technologies are expected to succeed in this fastest-growing e-commerce market in Southeast Asia.