Recently, foreign media revealed that ByteDance's sales in 2023 reached an astonishing $110 billion, surpassing Tencent and becoming the focus of the global technology sector. In response, ByteDance has not commented.

As early as November, The Information reported that ByteDance's revenue in the second quarter increased by more than 40%, reaching $29 billion; revenue for the first half of the year was about $54 billion.

Tencent's financial report shows that in the first half of this year, Tencent's revenue was only about $41.3 billion.

It can be seen that ByteDance's revenue surpassing Tencent this year had already shown signs.

Tencent's main businesses are games, advertising, and enterprise services, with a stable market domestically; while ByteDance, relying on Tuke, has already entered the international market and is competing with global internet giants.

It can be said that although Tuke's development path abroad is full of thorns, it has become the best-selling Chinese app in overseas markets thanks to its unique algorithm and its experience operating Toutiao and Douyin domestically.

For domestic foreign trade merchants, Tuke, with its broad user base and communication power, is undoubtedly the best promotional channel for going overseas and entering the international market.

In fact, as early as 2022, Tuke became the fastest-growing company with a 155% digital advertising revenue growth rate, four times that of Apple and seven times that of Amazon. Tuke's online advertising business is its main source of income, bringing billions of dollars in revenue to its parent company ByteDance.

According to statistics, between 2020 and 2022, Tuke generated about $16 billion in advertising revenue for ByteDance, with $9.9 billion in 2021 alone. Consulting firm eMarketer once predicted that this figure would rise to about $13.5 billion by 2023, and it is clear from ByteDance's revenue that this goal has basically been achieved.

Globally, Tuke is the only social media platform among tech giants and retail companies to top the list of fastest-growing digital advertising revenue companies with a 155% growth rate. Currently, there are more than 1.5 billion Tuke users worldwide, and it is expected to increase to 1.92 billion by the end of 2023.

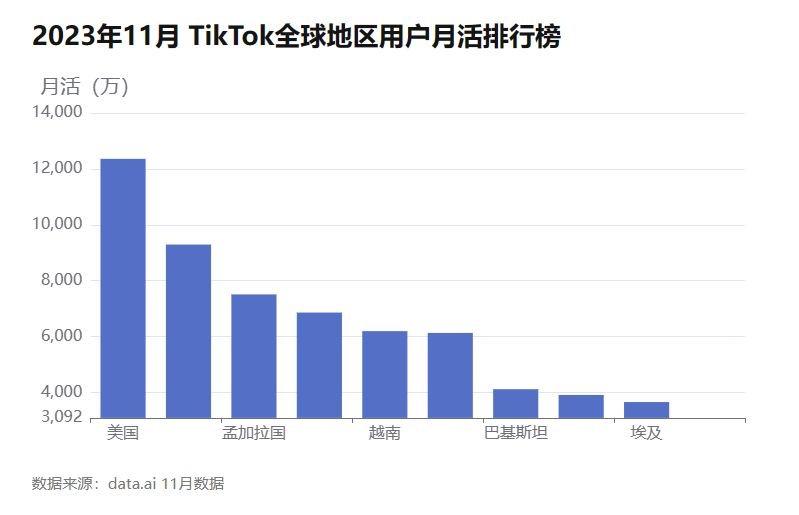

The United States is Tuke's largest market for advertising revenue, as it has the largest advertising audience in the US. According to data.ai's public data in November, Tuke has more than 120 million active users in the United States.

Brazil ranks second with 92.92 million active users. Next are Bangladesh and Mexico, with 75.09 million and 68.6 million active users respectively. Other countries' markets are relatively lagging behind.

Looking to the future, as the global digital advertising market continues to expand and consumer demand for personalized content continues to increase, Tuke is expected to maintain its leading position in the social media field. At the same time, Tuke will continue to explore new business models and innovative technologies to meet the ever-changing market demands and user expectations.

Conclusion:

ByteDance's strong support for Tuke, as well as the tremendous vitality Tuke has shown in overseas markets, have paved the way for B2B companies to go global. In today's digitalization and globalization, B2B companies can learn from the successful strategies in this "blue ocean" and use social media platforms such as Tuke to explore international markets and achieve global business growth.

Source: Jiemian News