Although Tuke is currently at a critical stage in the US market, multiple projects in the e-commerce section of Tuke Shop are still being actively advanced.

Naturally, the goal remains the $50 billion GMV set at the beginning of the year.

After all, regardless of whether Tuke is ultimately banned in the US, it still has several other major markets to maintain.

Recently, Tuke Shop has provided sellers with several new paid promotion tools. Although these open up new growth channels for sellers, after analysis, Tuke believes that caution is still needed when using these tools.

First, the Tuke and Google collaboration project.

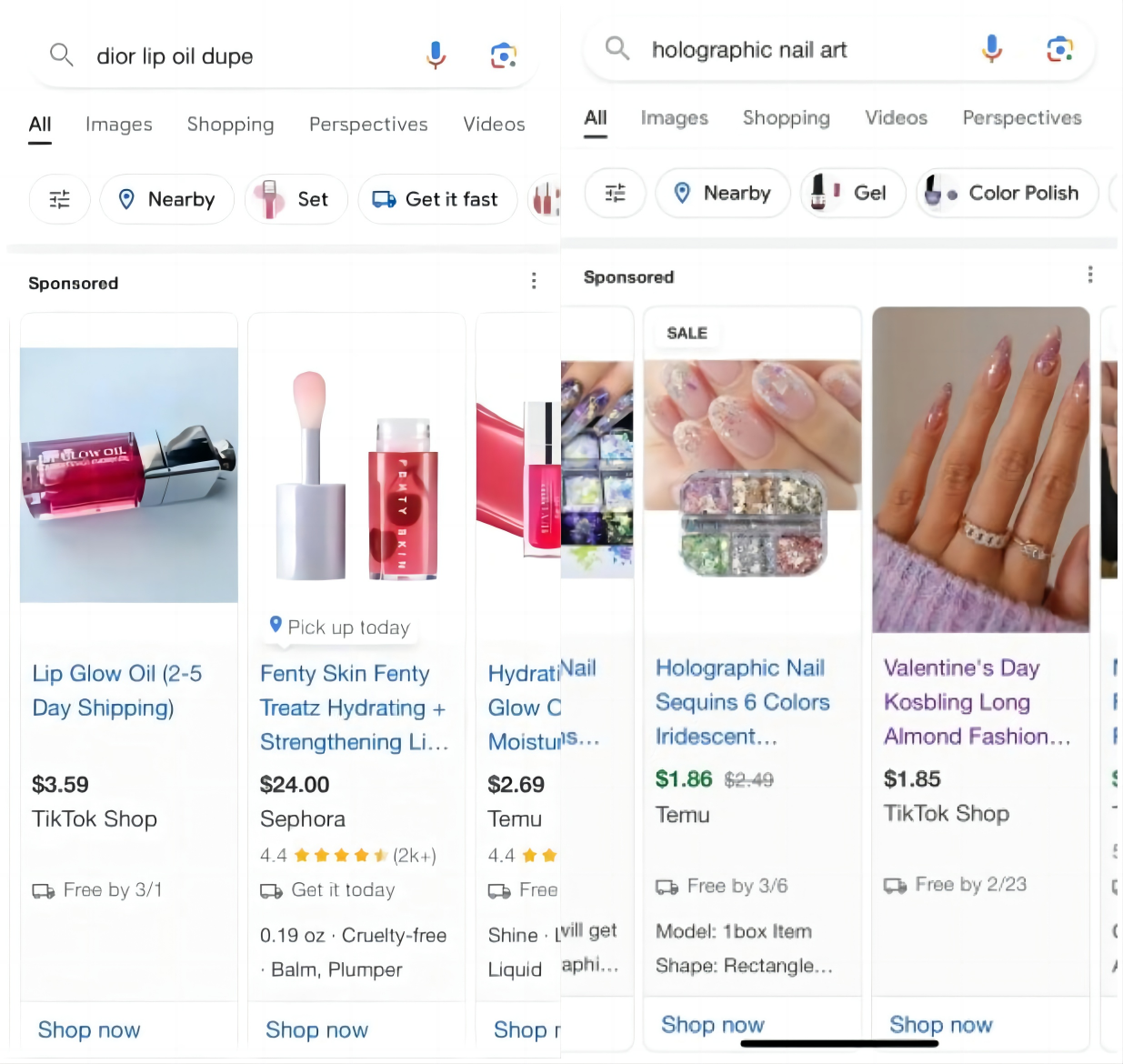

At first glance, this project is somewhat similar to Google’s SEM paid search. When we use Google to search for shopping ads, in addition to web information, Tuke videos will also appear in the search results. Some search results can even include purchase links that directly connect to the Tuke Shop product page.

This project is making its debut in the United States, marking a deep integration of Google and Tuke in video content and social media attributes.

However, this project is still in internal testing and is limited to specific categories such as beauty and skincare. For example, when searching for beauty products like “nail art” and “Dior lip oil” on Google, in addition to products from well-known brands such as Elf, Tower 28, and Rhode, some search results now also provide seller links from Tuke Shop.

According to previous information released by ByteDance, this project may launch as early as the second quarter or later. It signals the possibility of a brand-new alliance SEM model, which could bring more traffic and conversion potential to Tuke Shop in the future.

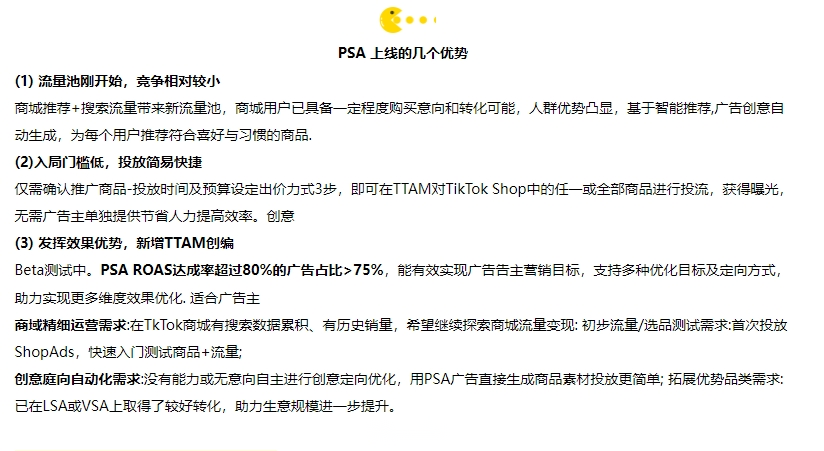

Second, the Product Shopping Ads (PSA) project launched by Tuke Shop.

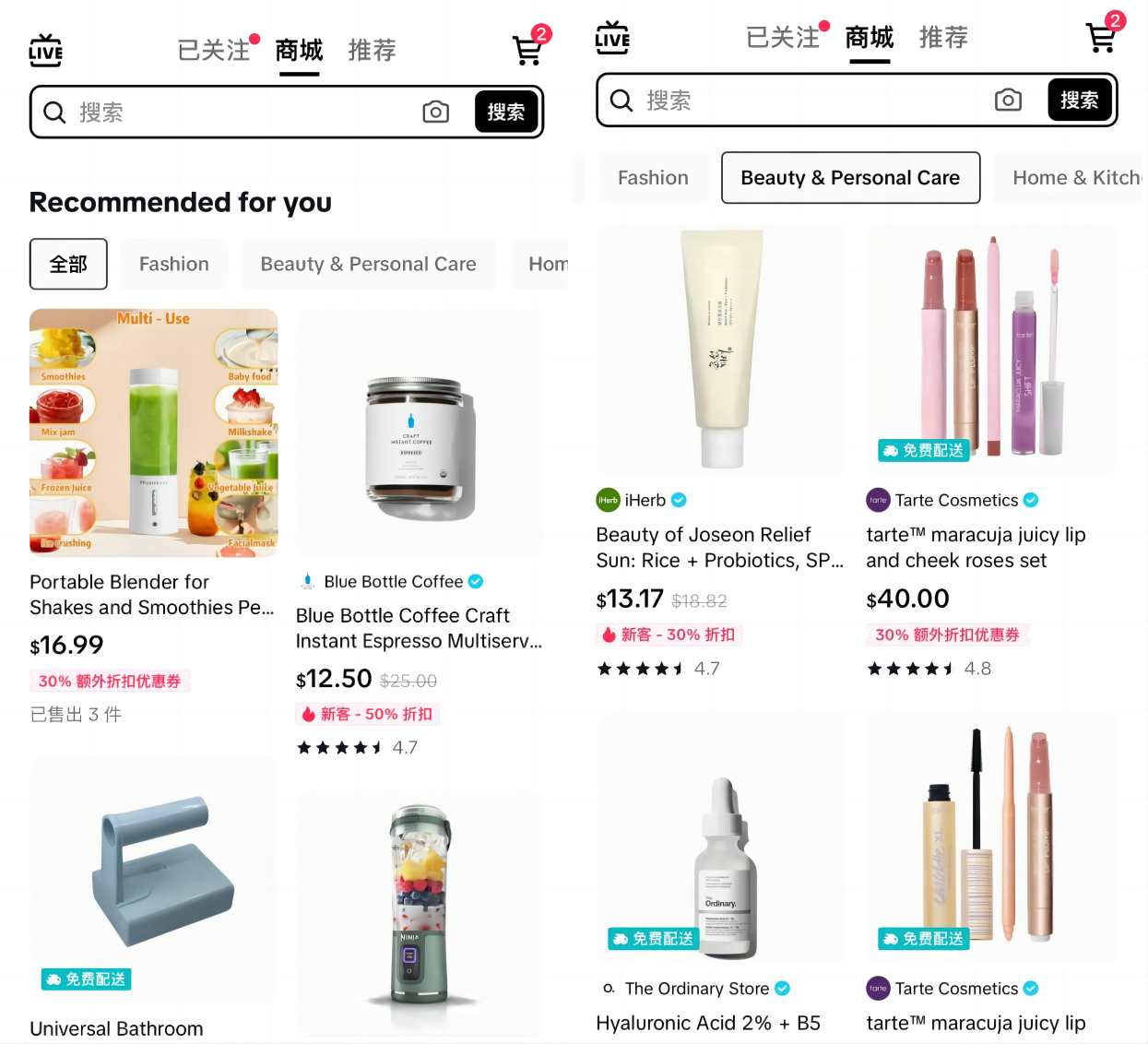

PSA, commonly known as product cards, should be familiar to those who have done e-commerce in China.

This advertising model allows brand sellers who have listed products on Tuke Mall to directly increase sales through paid traffic within the platform.

Currently, this project has not started testing but has been launched simultaneously in multiple regions, including the United States, Indonesia, Vietnam, the Philippines, Malaysia, Singapore, and Thailand.

It covers three main traffic entry points: comprehensive search, the recommendation page, and product cards with ad labels on the search page, providing users with more precise product recommendations and is expected to significantly improve conversion rates and sales performance.

However, the operation of this part is completely different from the Tuke Shop influencer sales model, so for merchants who have only played with influencer sales, it may be a bit challenging. But for merchants with domestic advertising experience, it will be very easy to get started.

Especially for sellers with strong brand influence, competitive pricing, and ample profit margins, now is the best time to use the PSA project to seize market opportunities.

But as Tuke mentioned at the beginning, these two models are new projects for Tuke Shop’s overseas operations, and it remains to be seen how well they will be received and what results they will achieve in the early stages.

The only visible advantage is that the project is just starting, the threshold is very low (no need for separate applications or special approval, it can be activated directly in the backend), and the initial budget and test launch costs are not excessive.

Nevertheless, sellers still need to evaluate the applicability of these projects based on their own specific circumstances and the market characteristics of their region.

Specifically, sellers can analyze backend data or communicate with their account manager (AM) to understand how these new projects fit their business strategy, so as to make wise marketing decisions and maximize their sales potential on Tuke Shop.