When it comes toAfrica, most people think of vast lands or underdeveloped infrastructure.

But here, a group of Chinese entrepreneurs have captured a rapidly growing consumer sector: theBluetooth earphonemarket.

According to data from Jumia, Africa's largest e-commerce platform, the best-selling Bluetooth earphone in 2023 was not Samsung or Apple, but the Chinese brandOraimo.

Its market share in places like Nigeria and Kenya has long ranked first, even leaving many international giants far behind.

So the question is, how did Oraimo achieve this?

Image source: Google

The "Crown Prince" of the "King of Phones in Africa"

To talk about Oraimo, we must start with its parent companyTranssion Holdings.

Reportedly, in September 2019, Transsion Holdings was listed on the STAR Market at an opening price of53 yuan/share, with a first-day market value of42.4 billion yuan, becoming the first domestic mobile phone company to be listed on the STAR Market. This company, little known in China, has shown astonishing dominance in the African market, consistently outperforming Apple, Samsung, and Huawei to top the sales charts. The title of"King of Phones in Africa"is well deserved.

Transsion Holdings successfully listed. Image source: SSE Roadshow

But doubts from the capital market about Transsion have never ceased. Its revenue structure, overly reliant on the African market and mobile phone business, has always put the company up against a growth ceiling. The turning point came in2023. Financial reports showed that while its mobile phone business grew year-on-year by34.88%, new businesses such as digital accessories and home appliances also achieved16.5%growth. Transsion made it clear in its financial report: "The company is continuously advancing its diversification strategy through the expansion of categories such as digital accessories and home appliances."

In fact, Transsion had already laid the groundwork for this transformation. Currently, Transsion has built a business matrix withthree major mobile phone brands (TECNO, Infinix, itel)as the main force, andOraimo digital accessories, Syinix home appliances, Carlcare after-sales serviceas the flanks. Coupled with self-developedHiOS, itelOS and other operating systems, it has formed a"hardware + software + service"full ecosystem. This strategic deployment provides systematic support for the development of its sub-brands.

Image source: Google

Oraimo is a typical case incubated by this system. As of 2023, the brand's products have covered Africa, Southeast Asia, Latin America andmore than 50 countries and regions, reaching a cumulative total ofover 100 million users. Notably, its product design reflects deep insight intolocal needs, optimizing battery life for frequent power outages in Africa, enhancing drop and water resistance for dusty and rainy environments, and even refining battery level displays to adapt to unstable power supplies. These improvements based on real usage scenarios have become the key to opening up the market.

Image source: Oraimo

Social Media Tactics That Make African Youth "Obsessed"

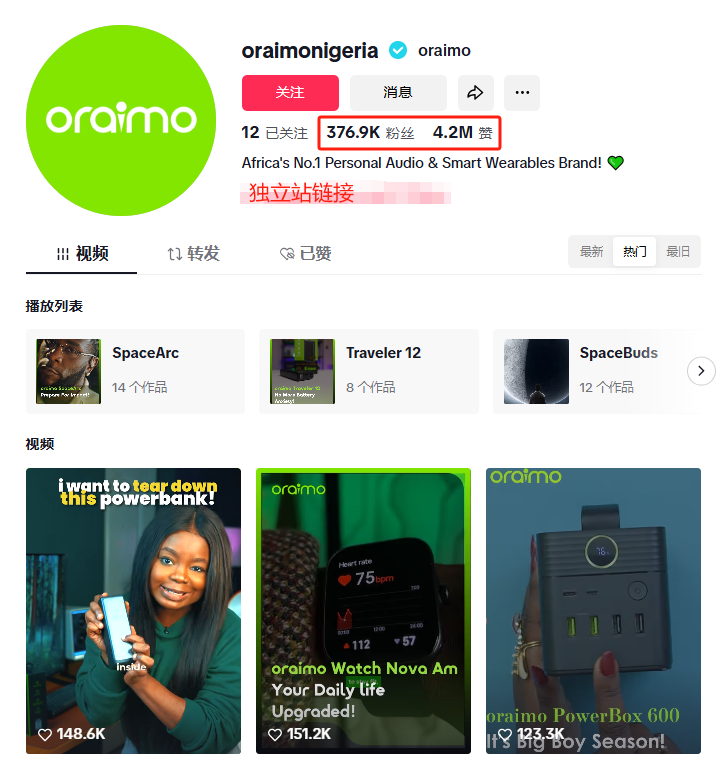

In terms of brand marketing, Oraimo has also put in great effort. TakingTikTokas an example, they have developed a down-to-earth approach. Currently, the brand operates11regional accounts, among which the official Nigerian account@oraimonigeriahas over370,000followers and4.2 millionlikes, making it one of the most active consumer electronics accounts in Africa.

Image source: TikTok

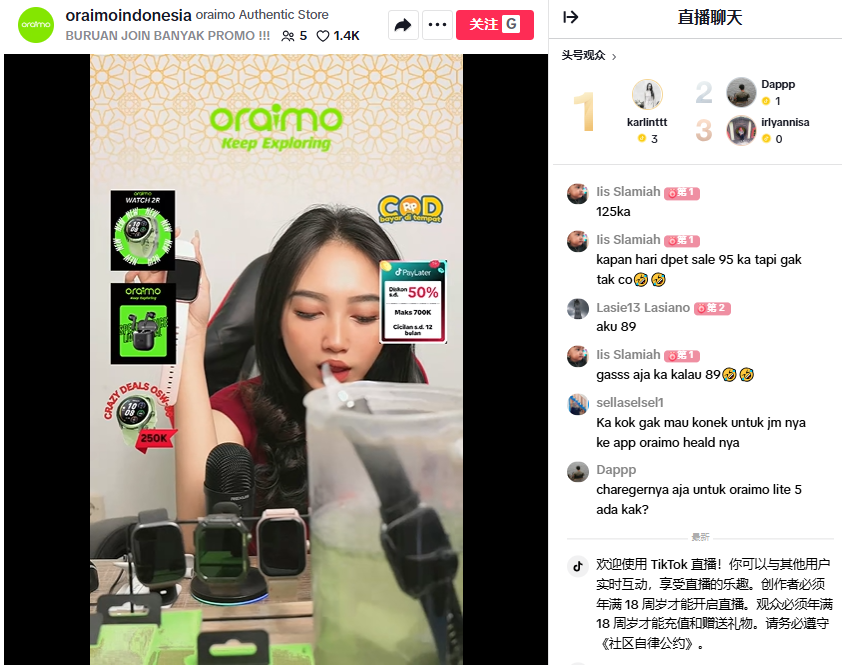

Livestream E-commerceis a key strategy for Oraimo. In the African and Southeast Asian markets, they use a model oflocal hosts + influencers selling products, showcasing product performance through TikTok Shop livestreams. For example, hosts may demonstrate the earphones' waterproof function live or test battery life, while offering limited-time discounts to boost conversion. In 2023, Oraimo's single-session livestream sales on TikTok Indonesia exceeded$100,000, and some hot-selling earphones saw monthly sales grow by200%. In the Indonesian market, they also integrated TikTok short videos with Shopee livestreams to form a closed-loop for traffic.

Image source: TikTok

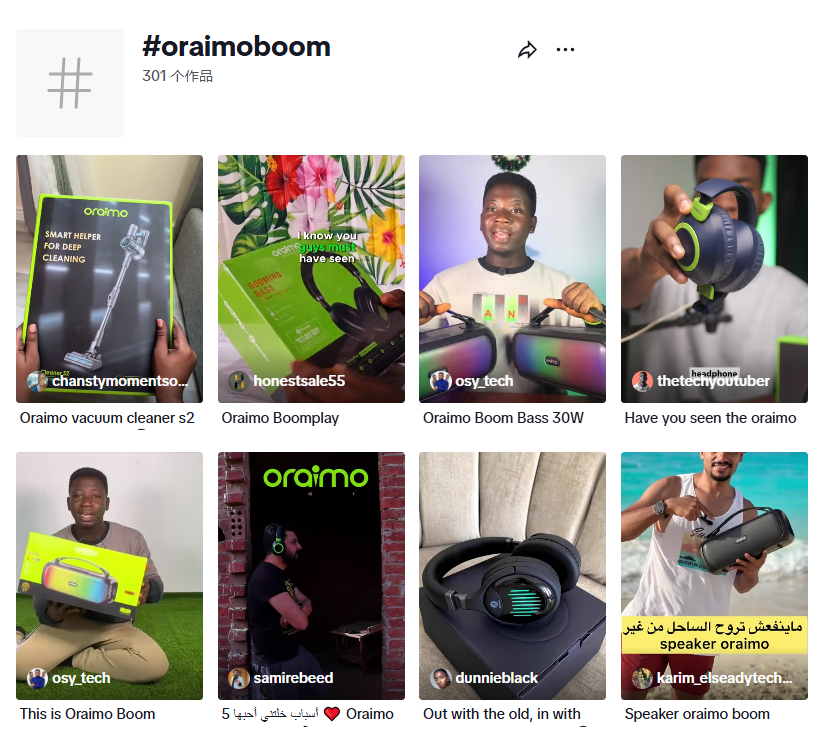

As foradvertising, Oraimo has also adopted an effective combination. They pay great attention to content creation, cleverly integrating product features with TikTok trends. For example, when promoting theBoom Speaker, influencers use popular audio on the platform, naturally blending the product into trending content, making the ad look more like a user-generated video rather than a stiff commercial promotion.

During the campaign, Oraimo also made full use of TikTok's user data system forprecise targeting. They filter target audiences based on age, gender, location, interests, and other dimensions, ensuring that each ad reaches the users most likely to be interested in the product, thus significantly improving advertising efficiency.

This strategy achieved remarkable results in the Kenyan market. In the Boom Speaker promotion campaign, the related hashtag received5 millionviews in just one month, fully demonstrating that by integrating products into trending content, Oraimo successfully attracted a large number of users' attention and effectively increased brand awareness.

Image source: TikTok

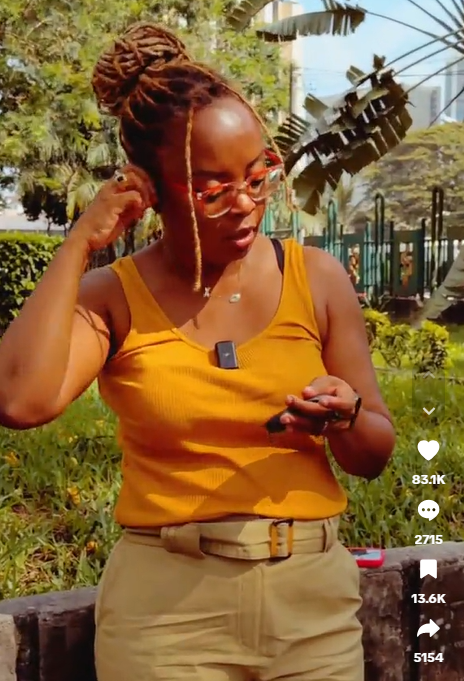

In terms ofinfluencer cooperation, Oraimo also has a strict selection standard. They not only focus on the influencer's follower count, but also on the match between content style and brand tone. For example, in their cooperation with tech influencer@edithbroutv, who has156,100 followers, @edithbroutv did not use the traditional product introduction method in the collaboration video, but brought Oraimo earphones into daily life scenarios, from noisy roadsides to crowded coffee shops, recording the earphones' noise reduction effect and wearing comfort throughout. This real-life product testing eventually garnerednearly one millionviews and83,100likes, far outperforming ordinary ad videos.

Image source: TikTok

Independent Website: Shortening the Last Mile to Users

Oraimo has also played new tricks in building its independent website.

The website adopts asimple and moderndesign style, with clear product categories. From earphones and chargers to smartwatches, each category is equipped with high-definition product images and detailed function descriptions. This intuitive display allows African users to quickly understand product features even under poor network conditions.

Image source: Oraimo independent site

In terms of traffic acquisition, Oraimo has also mastered the"social media + independent site"combination. For example, they put related links in the TikTok homepage bio, so users can click to go directly to the independent site to place orders, greatly shortening the conversion path.

Localized operationsis another key. For different markets, the brand's independent site not only provides local language versions, but also integrates mainstream African payment methods such as M-Pesa, and even supports "cash on delivery," which is especially important in regions with low credit card penetration.

Image source: Oraimo independent site

Chinese Brands Going Global: Try a Different Approach

When the European and American markets continue to fluctuate due to tariff policies, Oraimo's success in Africa serves as a wake-up call for Chinese companies: rather than fighting in the red ocean, it's better to focus on emerging markets that are on the rise.

Although infrastructure in Southeast Asia, Africa, and Latin America is relatively underdeveloped, the penetration rate of mobile internet is rapidly increasing, and the purchasing power of young consumers cannot be underestimated.

For Chinese companies, now is a good time to lay out in these markets. With a complete supply chain system and a deep understanding of local needs, it is entirely possible to find new growth points in these blue ocean markets.

Going global has never been a single-choice question, and the European and American markets are not the only standard answer!