Tuke officially disclosed a set of numbers: In March 2023, Tuke's monthly active users in the United States reached 150 million, close to 50% of the U.S. population.

At the same time, the development momentum of Tuke Shop in the U.S. has been exceptionally strong. According to data provided by EchoTik, as of October 2023, the number of Tuke Shops in the U.S. had surged from around 5,000 in July 2023 to 30,000 in October, with a very rapid growth rate.

Among these sellers, some have shifted from Amazon, some already have experience operating Tuke Shops in other countries, and others have moved from the Southeast Asian market to the U.S. market in search of opportunities.

But regardless of which group they belong to, it all indirectly points to one issue—the U.S. market for Tuke seems to be full of opportunities?

Multiple Forces at Play, Fierce Competition Among Tuke Shop U.S. Stores

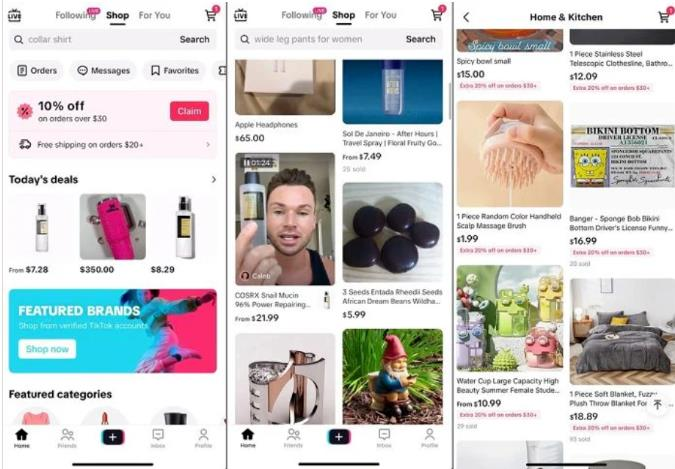

In September 2023, Tuke announced the official launch of Tuke Shop e-commerce services in the U.S., instantly sparking fierce competition. Three models—local stores, cross-border stores, and fully managed stores—were all launched online, kicking off a "war" without gunpowder.

According to EchoTik data, the U.S. e-commerce market on Tuke showed strong growth in October, with total sales jumping from $140 million in September to $200 million, a year-on-year increase of 43%. In contrast, sales in July were only $27 million.

However, this is only reflected in the data. In reality, among the sellers who have entered the U.S. Tuke Shop, those with poor sales still account for a large proportion.

For example, I once saw a seller complain: "The store has over 2,000 visits, and the video has more than 7,000 organic views, yet not a single order has been placed."

This is a typical case of having views but no conversions.

Tuke Shop is just starting out in the U.S., and there are still many aspects that need adjustment. For now, its U.S. local store ACCU model is quite friendly for Amazon sellers with annual sales over $2 million.

It allows products ranked in Amazon's top 100,000 to be prioritized for display in the Tuke Mall, so as users see them more, sales will naturally increase.

In addition, many local U.S. brands are also making efforts.

According to EchoTik data, the well-known American curling iron brand The Beachwaver was the top-selling store on Tuke Shop in the U.S. in October. In July, the brand ranked sixth among beauty and care category stores, with sales already exceeding $10 million.

Influencer Collaboration Creates Bestsellers, Real-Name System Sparks New Controversy

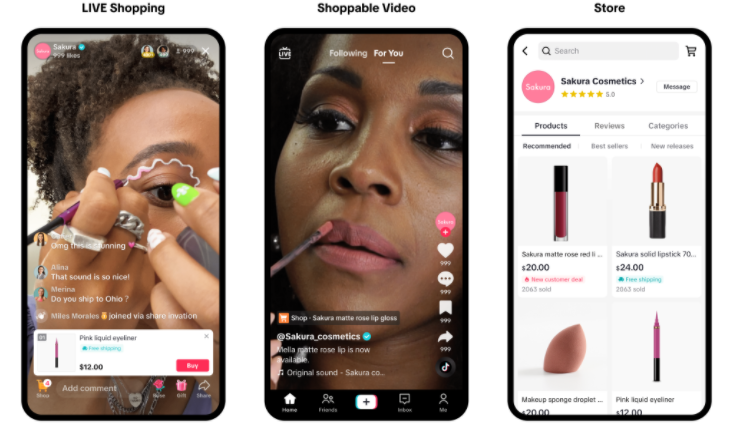

In addition to merchants posting videos and livestreaming to sell goods on Tuke, collaborating with local U.S. Tuke influencers is also an important way to boost product views and sales.

Tuke Shop is just starting out in the U.S., and it's clearly not feasible to directly copy the domestic livestream selling model. But this does not prevent short videos from maintaining their core position.

A widely recognized method for creating bestsellers is to invite hundreds of influencers to promote a product with distinctive features and sufficient supply, using full-network exposure to quickly turn the product into a hit.

This method is also used by some brands domestically and is considered a traditional and effective way to boost single product sales.

Once the brand or product becomes popular, even if you don't reach out to influencers, they will keep coming to you, because it's a win-win process.

Now there are websites in the U.S. dedicated to inviting influencers, and there are reports that starting November 15, Tuke has strengthened real-name verification for influencers in Thailand and the U.S., ensuring one account ID per person and eliminating the possibility of influencers operating multiple accounts simultaneously.

This move has impacted video traffic for merchants who have already collaborated with influencers, but it also provides greater security for merchant-influencer partnerships.

Moreover, Tuke will not always give a group of people such high traffic; without continuous and stable content output, such influencers will be replaced by newcomers in just a few months.

For influencers who truly want to earn commissions through selling goods, the real-name system is not necessarily a bad thing, and it is a kind of purification for the entire Tuke ecosystem in the U.S.