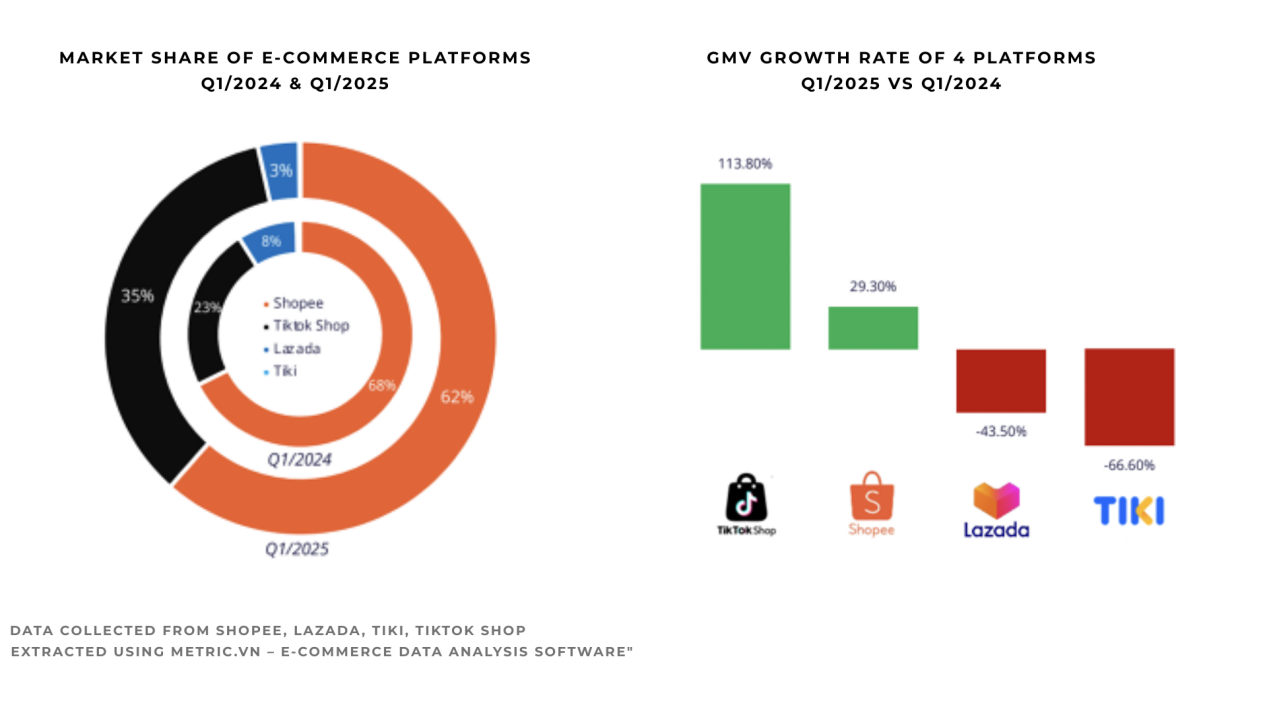

In Southeast Asia, the fastest-growing e-commerce market in the world, Vietnam is witnessing a "new king challenging the old master" scenario. According to third-party platform data, TikTok Shop Vietnam's quarterly transaction volume surged by 113.8% year-on-year, with its market share soaring from 23% last year to 35%.

In contrast, Shopee, which has long held the top spot, saw its sales grow by 29.3%, but its market share dropped from 68% to 62%. This means that out of every 100 online shopping orders in Vietnam, 35 come from TikTok live streams, while Shopee is visibly losing ground.

Image source: vietdata

Behind this reversal lies the Vietnamese enthusiasm for "chasing live streams." According to Nielsen, local consumers spend an average of 13 hours per week watching live shopping streams, which is nearly 2 hours of live shopping per day. This level of craziness has propelled Vietnam to 11th place globally in online shopping activity, and live-stream e-commerce is expanding at a rate that doubles every year. Metric.vn predicts that by early 2026, live-stream shopping will account for more than 20% of Vietnam's total e-commerce sales.

Image source: YouTube

Interestingly, in the four-way competition among Vietnam's e-commerce giants, Lazada and Tiki saw their first-quarter sales plummet by 43.5% and 66.6%, respectively. Experts believe these two lost out because they failed to keep up with the short video shopping trend, neither optimizing user experience nor building effective sales channels.

At this rate, Vietnam's e-commerce market will sooner or later become a two-horse race between TikTok and Shopee.

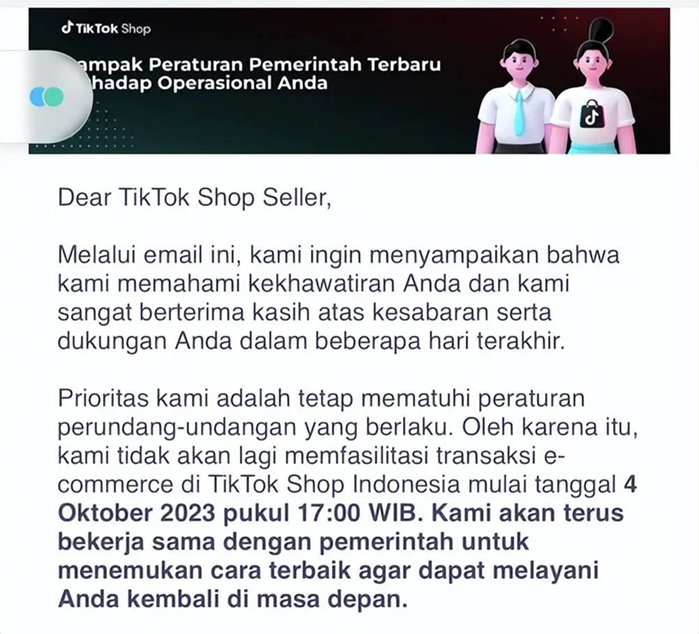

Image source: Internet

Although TikTok is thriving in Southeast Asia, its expansion path is not smooth. In October last year, the Indonesian government issued a ban, forcing social and e-commerce businesses to separate, causing 6 million seller accounts to be wiped out overnight.

To re-enter this market of 270 million people, TikTok had to bow to local e-commerce platform Tokopedia, investing $1.5 billion for a 75% stake, thus regaining its entry ticket to the Indonesian market.

Earlier this year, the US also staged a "sell or ban" drama, forcing TikTok to accelerate its expansion in Southeast Asia.

Moreover, the North American battlefield is equally fraught with danger. In early 2025, the US Supreme Court upheld the "sell or ban" ruling on TikTok, requiring ByteDance to divest TikTok's US business within 180 days. Although the final execution date has been postponed until after the 2026 election, this tug-of-war has already forced TikTok to speed up its global expansion.

Image source: TikTok Shop

According to Thai agency sources, TikTok has significantly increased its investment in the Southeast Asian market this year: the customer service team is busier than ever, and merchant onboarding meetings are held non-stop.

Under pressure, TikTok has chosen to go all-in on Southeast Asia. In March this year, it announced that it would invest 300 billion baht (about $8.8 billion) in Thailand over the next five years, with the funds going toward building data centers, training 50,000 AI talents, and developing localized anti-fraud systems.

Image source: Bloomberg

During this period, the newly launched Mexico site also performed well, with first-week sales reaching 2.36 million yuan.

Currently, TikTok's global expansion is still accelerating. After Spain and Ireland, e-commerce operations in Germany, Italy, France, Japan, and Brazil are all counting down to launch.

It is reported that the Japan site will focus on anime merchandise and cosmetics, while the Brazil site will target football gear and beachwear. Despite facing regulatory differences in various countries (such as the EU's strict data privacy laws), TikTok has clearly learned to "adapt to every move."

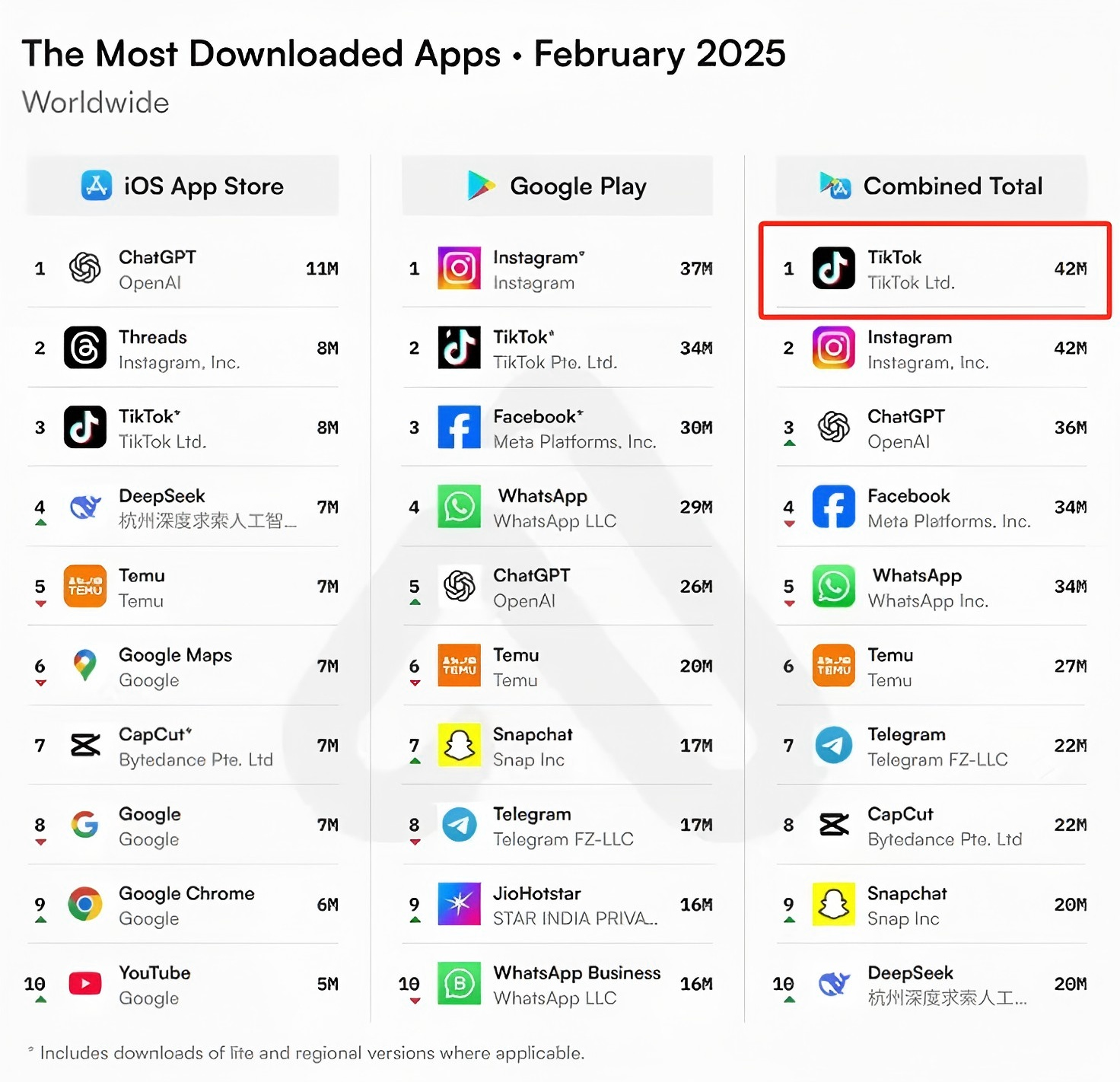

Image source: AppFigures

Data shows that in February this year, TikTok still ranked first globally with 42 million downloads, and the growth of Southeast Asian users successfully offset the policy risks in the US market.

At this pace, with its unique "watch videos and shop at the same time" strategy, TikTok's e-commerce expansion across the globe is just getting started.