In recent years, the Latin American e-commerce market has emerged as a "dark horse" in the global arena, becoming one of the most promising growth poles in the field of cross-border e-commerce.

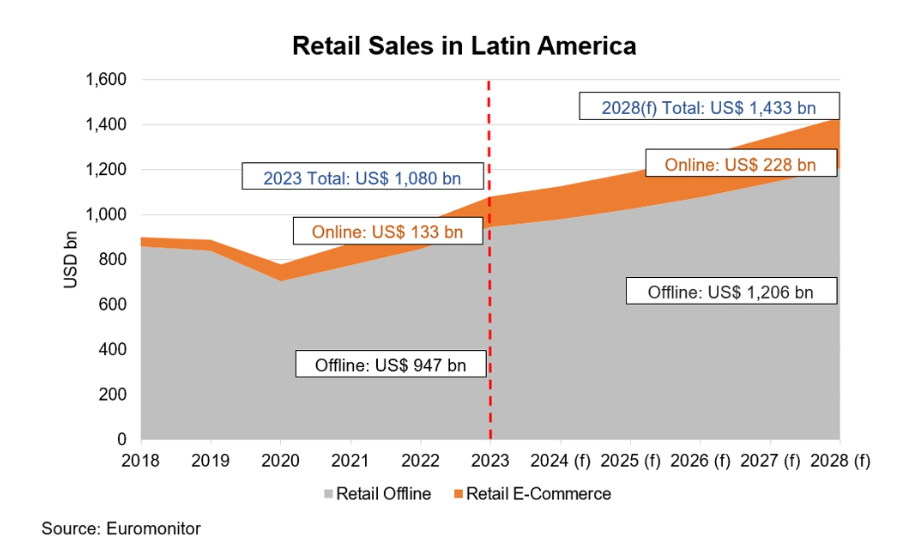

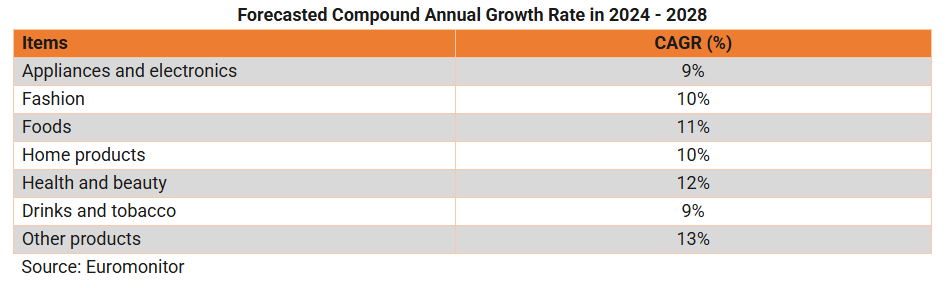

According to Euromonitor forecasts, from 2024 to 2028, the region's total retail sales will expand at a compound annual growth rate (CAGR) of 6%, while online retail is growing at twice the rate of offline channels, with an expected CAGR of 11%. Although online retail currently accounts for only 12.3% of total retail sales in Latin America (2023 data), this proportion is expected to rise to 15.9% by 2028, unleashing nearly a trillion-scale market increment.

Image source: Euromonitor

Brazil and Mexico Lead the Way, Emerging Markets Poised for Growth

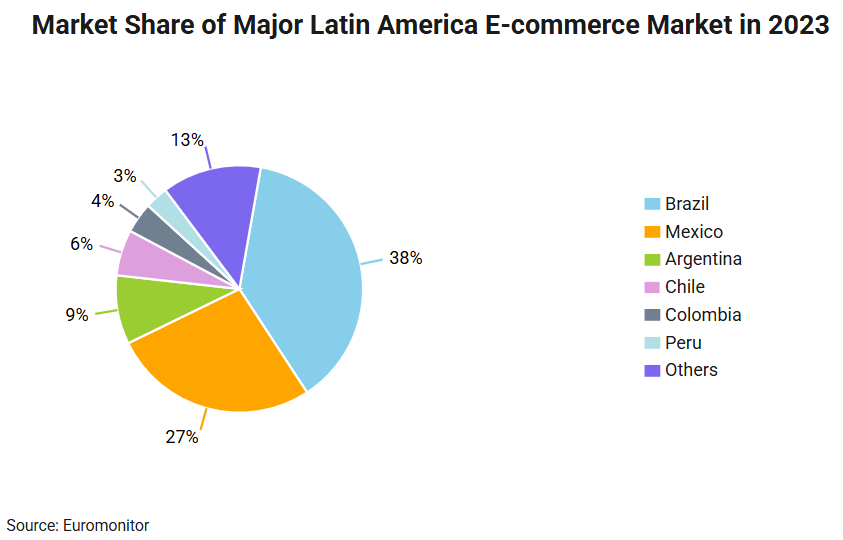

As the "dual engines" of the Latin American economy, Brazil and Mexico together contribute 60% of the region's GDP and nearly two-thirds of the e-commerce market share. In 2023, the combined e-commerce retail sales of the two countries exceeded $70 billion, forming the core map of the Latin American e-commerce market together with Argentina (9%), Chile (6%), Colombia (6%), and Peru (3%).

According to data from the International Monetary Fund (IMF), Brazil ranks first in the region with a 33% share of GDP, followed closely by Mexico (27%). However, "second-tier" countries such as Chile and Peru are attracting cross-border enterprises with faster online penetration rates.

Image source: Euromonitor

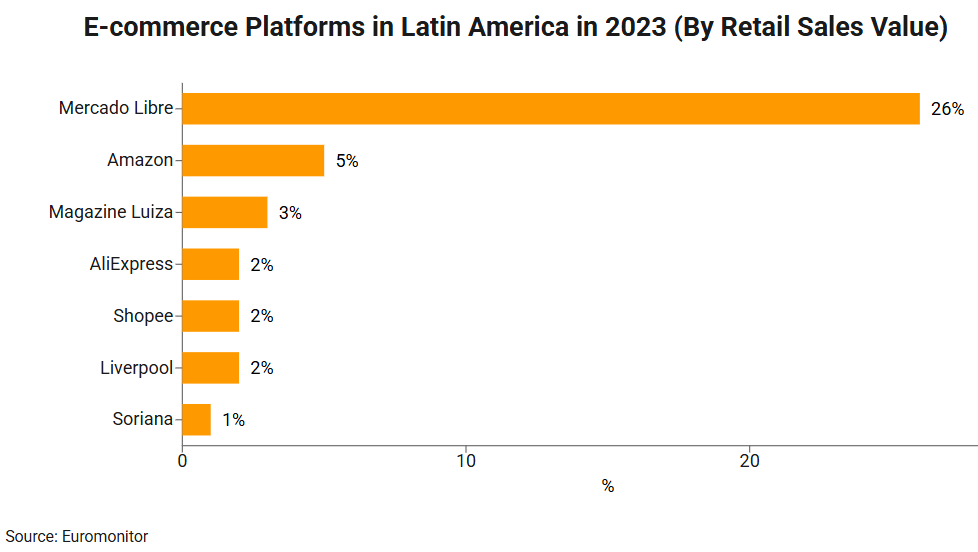

Local Giants Build Ecological Barriers, Asian Platforms Accelerate Penetration

In the highly fragmented Latin American e-commerce market, local platform Mercado Libre holds an absolute advantage with a 26% share of retail sales, far surpassing Amazon (5%) and Magazine Luiza (3%). Founded in 1999, this company covers 18 Latin American countries through a full-chain ecosystem of "e-commerce + fintech + logistics"—its payment tool Mercado Pago has extended into investment, insurance, and other financial services, while its logistics network Mercado Envíos ensures 80% of orders are delivered within 48 hours.

Image source: Mercado Libre

Meanwhile, Asian e-commerce forces are competing for the market with differentiated strategies. AliExpress, Shopee, and SHEIN are rapidly rising in high-demand categories such as digital appliances (accounting for 22% of online retail) and fashion (14%), thanks to supply chain efficiency and high cost-performance products. Although these platforms currently have limited market share, their penetration among young consumers is growing exponentially.

Image source: Euromonitor

High-Frequency Consumption Drives Growth, Health & Beauty Become New Hotspots

In the post-pandemic era, Latin American consumers' reliance on online shopping continues to deepen. Data shows that digital appliances and electronics remain the main force in online sales (accounting for 22% in 2023), but health and beauty categories are becoming the most promising track with an expected growth rate of 12% (2024-2028), while food categories (11%) remain at the forefront due to high-frequency repurchase characteristics. Notably, Latin America's Generation Z (accounting for 69% of the population) prefers social media recommendations and instant consumption, reshaping the competitive landscape of categories—brands seeking to gain an edge need to increase investment in social commerce and content marketing.

Image source: Euromonitor

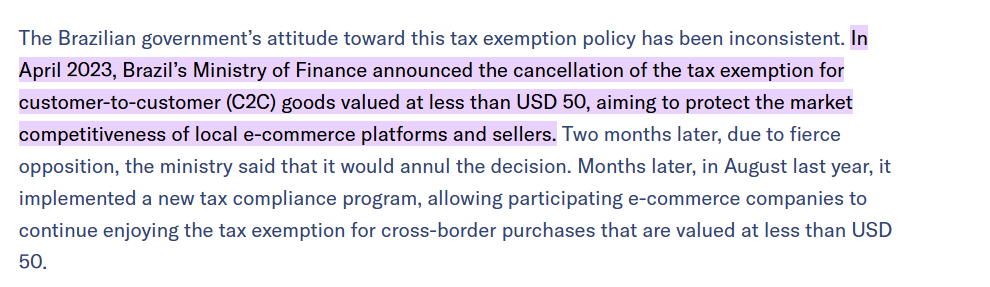

Social Media Marketing Becomes Standard, Compliance Thresholds Require Attention

Facing 400 million young internet users in Latin America, 93% of companies have made social media their core marketing battleground (NTT Data). Through short videos, live streaming sales, and KOL collaborations, brands can not only directly reach consumers but also leverage user-driven social fission to expand their reach. However, this hot land also hides compliance risks: the "duty-free amount" policies vary significantly among countries, for example, Chile is $30, Brazil and Mexico are $50, and Peru is as high as $200. If the value of goods exceeds the threshold, companies will face the dual pressure of surging tariff costs and customs clearance delays.

Image source: kr-asia

In addition, many Latin American countries implement strict safety certification and labeling regulations for products such as cosmetics and dietary supplements. For example, in Brazil, imported medical devices require advance application for ANVISA approval, and textiles must meet INMETRO quality inspection standards. It is recommended that cross-border enterprises prioritize registering legal entities in target countries (most countries require a minimum registered capital) and seek support from local compliance teams to avoid legal risks.

Image source: tuvsud

Conclusion

The explosive growth of the Latin American e-commerce market is no accident—multiple dividends such as increased internet penetration, improved payment infrastructure, and changing consumption habits are creating a superimposed effect. Although Brazil and Mexico remain must-win markets, the structural opportunities in emerging markets such as Chile and Peru are more worthy of long-term investment. For cross-border enterprises, deepening localized operations, building a social commerce matrix, and strictly adhering to compliance red lines will be the three key keys to unlocking this "new blue ocean".