Last month, a dark horse stirred up the Southeast Asian nail market:

“Chinese cross-border merchants achieved over 100,000 sales in a single month through TikTok Shop!”

The popular Indonesian TikTok shop @grosiran nailart quickly sparked a craze in the Southeast Asian market with its unique press-on nail designs and innovative marketing strategies.

From Thailand to Malaysia, and then to the Philippines, more and more consumers are showing off their press-on nails on TikTok, driving explosive growth in the entire social e-commerce industry.

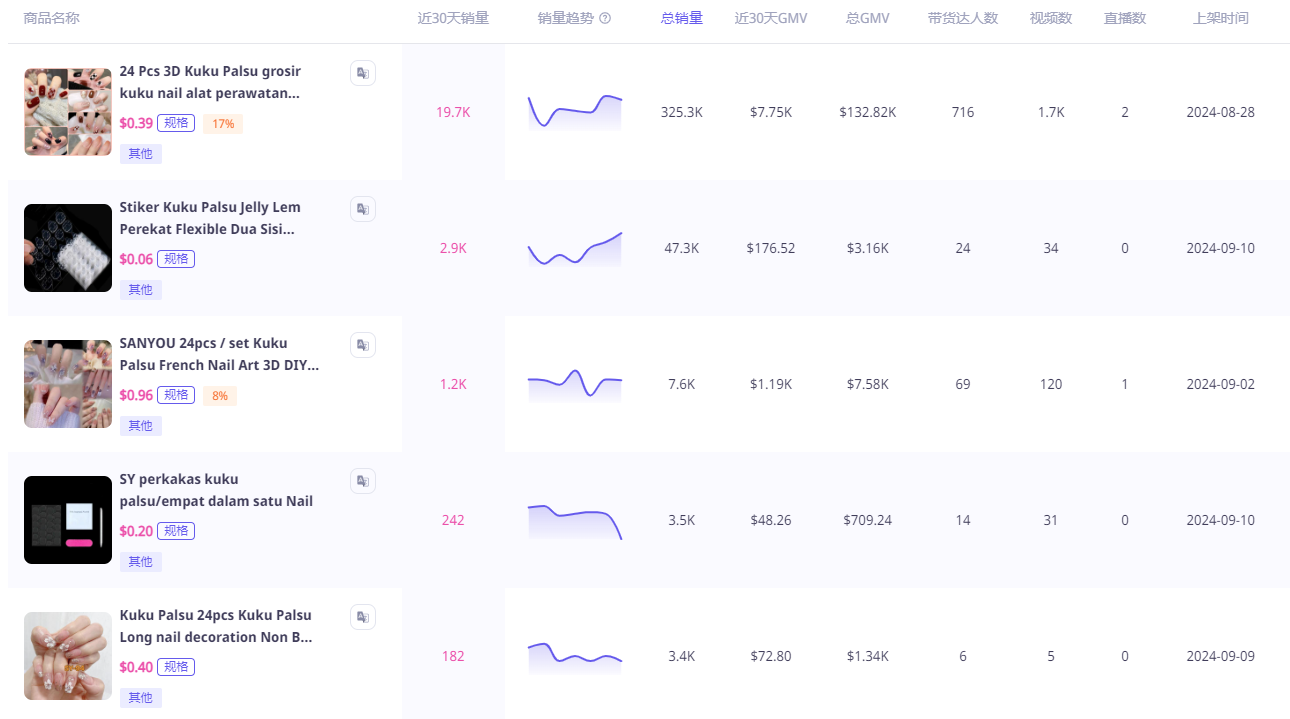

Image source: Echotik

With so many beauty products, why are press-on nails the ones going viral?

Whether at home or abroad, aesthetic trends are mostly similar, especially in Southeast Asian countries neighboring China, where beautiful nails are also highly sought after.

However, traditional nail art is time-consuming, prone to breakage, difficult to remove, and inconvenient in daily life. Frequent manicures in a short period can also damage nails.

Thus, the press-on nail category emerged.

Compared to traditional nail art, press-on nails are not only easy to apply but also quickly satisfy consumers' demand for fashionable nails.

Moreover, their removable feature makes them suitable for various occasions, making them a must-have item for many young people to showcase their personalities and create unique styles.

Some sellers have seen the benefits and started selling on TikTok Shop in Southeast Asian countries, earning “a fortune.”

The aforementioned Indonesian shop @grosiran nailart is one of these sellers.

Influencers drive sales, from “small goods” to “big business”

According to data analysis site Echotik, the main customer base of @grosiran nailart comes from short videos and influencer marketing.

The shop’s top-selling 3D press-on nails have sold over 300,000 pieces in total, collaborated with 716 influencers, and released over 1,700 videos.

Moreover, the product is priced at only $0.4, making it great value for money and perfectly matching the consumption needs of the Southeast Asian market. So even though the account itself has only 3,882 followers, the shop still achieved over 60,000 yuan in sales in just one month!

Even supporting products like jelly glue and nail tools are among the top sellers.

Products sold by grosiran nailart Image source: Echotik

Similarly, another TikTok shop in the Philippines, JFY Boutique Shop (@sanyou.ph), also performed well, with nearly 25,000 sales in the past month! Influencer marketing is also its main growth driver.

JFY Boutique Shop Image source: Echotik

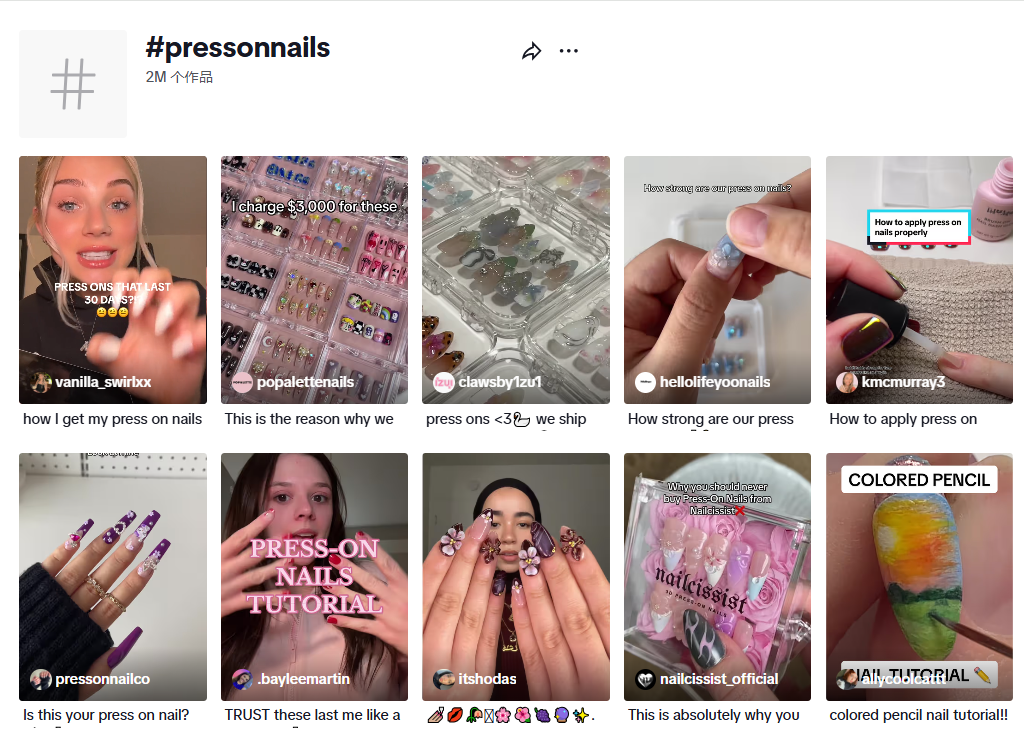

On TikTok, searching for the hashtag #pressonnails reveals over 2 million posts, and the trend is still growing. Adding this hashtag when posting products can directly reach a vast target audience.

Image source: TikTok

The underlying logic of Chinese cross-border press-on nails

“We don’t have a brand, but we have traffic and supply chain.”—This is the core strategy used by most press-on nail merchants expanding to Southeast Asia.

As the most active social platform among Southeast Asian youth, TikTok can be called the “accelerator” for the popularity of press-on nails.

Among TikTok users in Southeast Asia, women aged 18-34 account for over 60%, which highly overlaps with the target consumers of press-on nails.

Most TikTok videos are very short, and a 15-second video can showcase the effect and usage scenarios of press-on nails. On average, it takes users only 72 seconds from seeing the video to placing an order.

Coupled with the driving effect of influencer marketing and the price advantage of affordable products, users’ trust in merchants is enhanced, greatly increasing the probability of transactions.

Moreover, the “quick response capability and ultimate cost control” of the Chinese supply chain also provide a solid guarantee for the popularity of press-on nails.

For example, a 7-day delivery cycle. From design to mass production, Chinese factories can complete the process within 7 days, meeting the explosive demand during Southeast Asian festivals (such as Ramadan in Indonesia and Christmas season in the Philippines).

The cost of ABS resin nail tips is less than 1 yuan, and the terminal retail price is 5-15 yuan, resulting in low cost and high gross margin (70%), which is much higher than the 50% of traditional nail services.

In addition, by catering to the aesthetic preferences of Southeast Asian consumers and launching localized designs such as gold embossing and gradient glitter for festivals, the premium space can be increased by 30%.

All these factors fully demonstrate the tremendous vitality of the cross-border press-on nail industry.

A cross-border seller once admitted: “This business is much better than selling clothes—fewer SKUs, high repurchase rate, and you can ride the TikTok traffic wave.”

The future potential of the Southeast Asian market

Industry data shows that in 2023, the global press-on nail market reached $1.64 billion, with the Southeast Asian market becoming the main driver with a growth rate of over 35%. Indonesia and the Philippines contributed most of the increase.

Press-on nails (no glue required) account for 44% of the overall market, and the compound annual growth rate from 2024 to 2030 is expected to reach 6.5%. Meanwhile, supporting nail tools (such as portable trimmers and nail tip storage boxes) have also become new growth points, with some shops’ related categories accounting for over 30% of sales.

These data not only reveal the huge potential of the press-on nail market, but also reflect consumers’ strong demand for convenient and personalized nail solutions.

As the consumption power of young people in Southeast Asia continues to rise, press-on nails and their supporting products are expected to continue leading the beauty retail market in the coming years.