In recent years, cross-border e-commerce has enabled Chinese manufacturing to go further. First it was apparel and 3C, then small appliances and home goods, and now it's beauty products' turn.

Not every category can break into the North American market, but beauty is becoming the "new battlefield" where Chinese brands are trying to make a breakthrough on this land.

Image source: Internet

Why now?

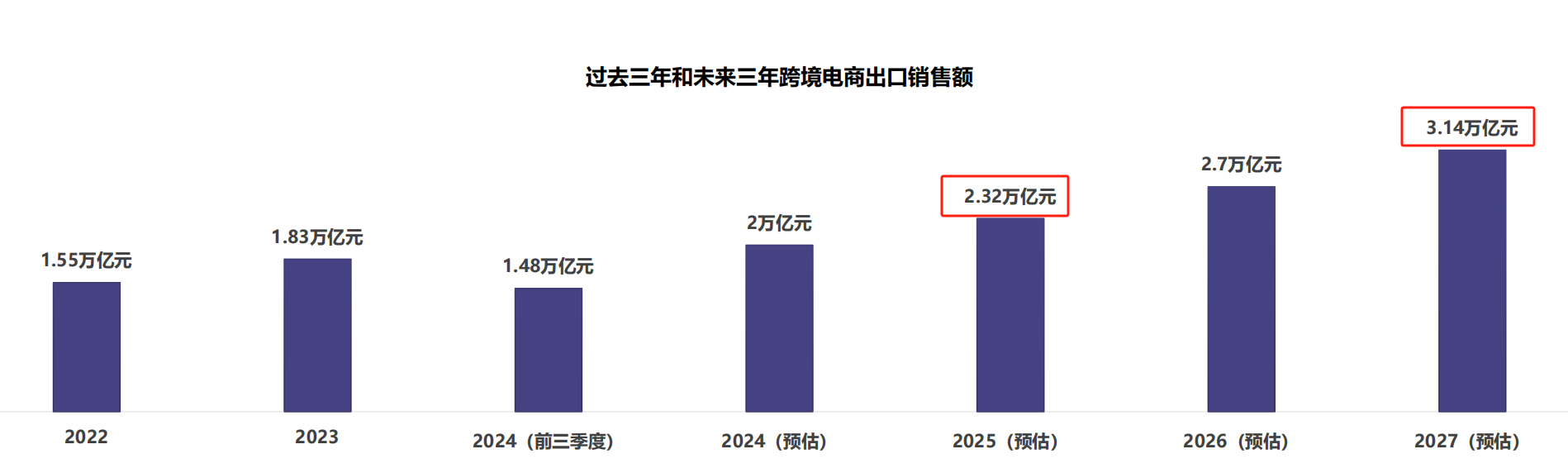

Let's look at some data first.

According to the General Administration of Customs, China's cross-border e-commerce export value reached 1.55 trillion yuan in 2022, a year-on-year increase of 11.7%. By 2023, this number grew to 1.83 trillion yuan, a year-on-year increase of 19.6%. In the first three quarters of 2024, it has already reached 1.48 trillion yuan, and is expected to exceed 2 trillion yuan for the whole year.

According to iiMedia Research's forecast, cross-border e-commerce exports will maintain an average annual compound growth rate of about 16.4% over the next three years, reaching 2.32 trillion yuan in 2025 and possibly exceeding 3.14 trillion yuan in 2027. This shows that the determination of Chinese brands to go global is not waning, but rather growing stronger.

On the other hand, the window of opportunity in the North American market is opening. In 2023, the total value of the US beauty market reached $56 billion, and is expected to exceed $70 billion by 2027, with an annual growth rate of 6%. Online sales account for more than 70%, and Gen Z young people have become the main consumer group.

What does this mean? It means that as long as your product is competitive enough, as long as you dare to push content, run ads, and bet on new products, you might be able to carve out a piece of this seemingly "mature" market!

And many brands have already started trying.

Image source: Jieshu Consulting "Beauty Going Overseas in 2025: Opening Up a New Journey in North America"

Chinese beauty is quietly entering

We saw some signs in the data of the top 100 stores in Amazon's beauty category.

As of 2024, only 5 Chinese sellers have entered this list, but this is not a bad thing. It means the competition is not that fierce yet, so there is still time to enter.

By comparison, Chinese brands account for 55 out of the top 100 in women's apparel, and even 86 in the phone case category. Clearly, the cosmetics market is still a blue ocean, but the "beginner's game" will soon become a "pro's game".

Image source: Internet

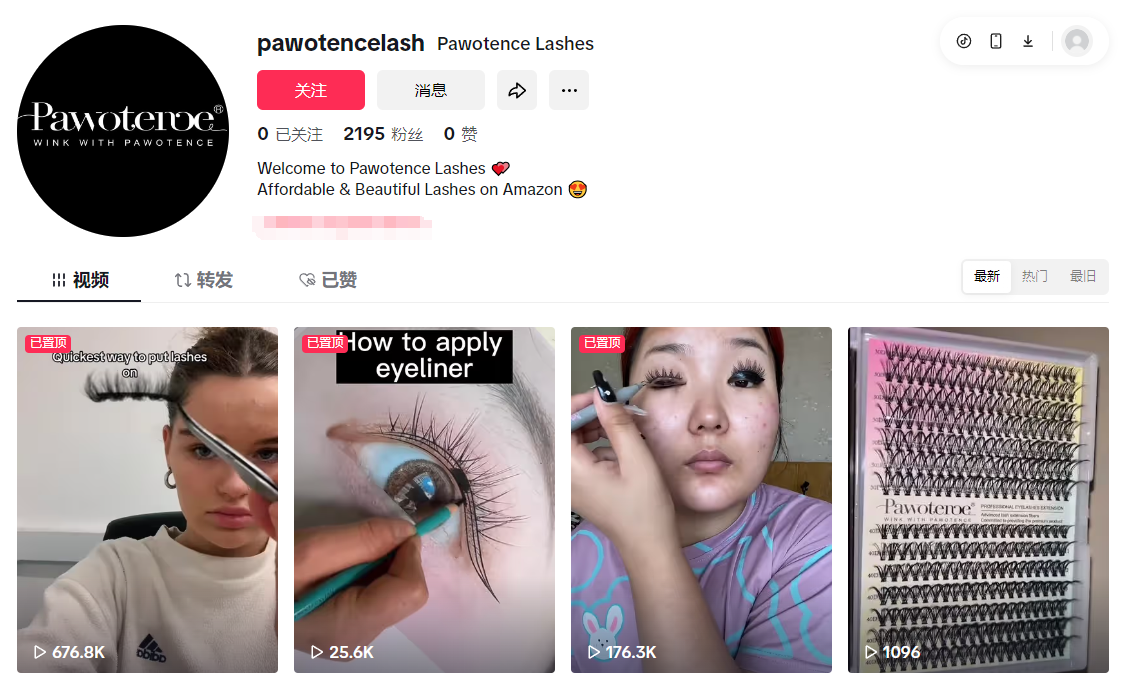

Take Pawotence as an example. This waterproof mascara set is produced by Shandong Chuangmei Sanitary Products Co., Ltd., with low-cost OEM by Pingdu Yifei False Eyelash Factory, keeping the price at $13.98, achieving "large volume and full supply", and quickly becoming a dark horse in Amazon's eyelash category.

In December 2023, Pawotence sold 48,045 units in a single month, with sales exceeding $670,000. By December 2024, this number jumped to 79,900 units, with sales reaching $1.11 million.

On TikTok, the brand has released 836 effective product-selling videos, with total sales exceeding 330,000 sets and generating more than $4.52 million in revenue.

Behind this is a strategy of low-price entry + multi-platform penetration: in the early stage, using keyword ads to boost volume, in the mid-stage, using brand ads to create memory points, while linking Facebook and Instagram for seeding, and driving conversion through influencer testing.

Image source: TikTok

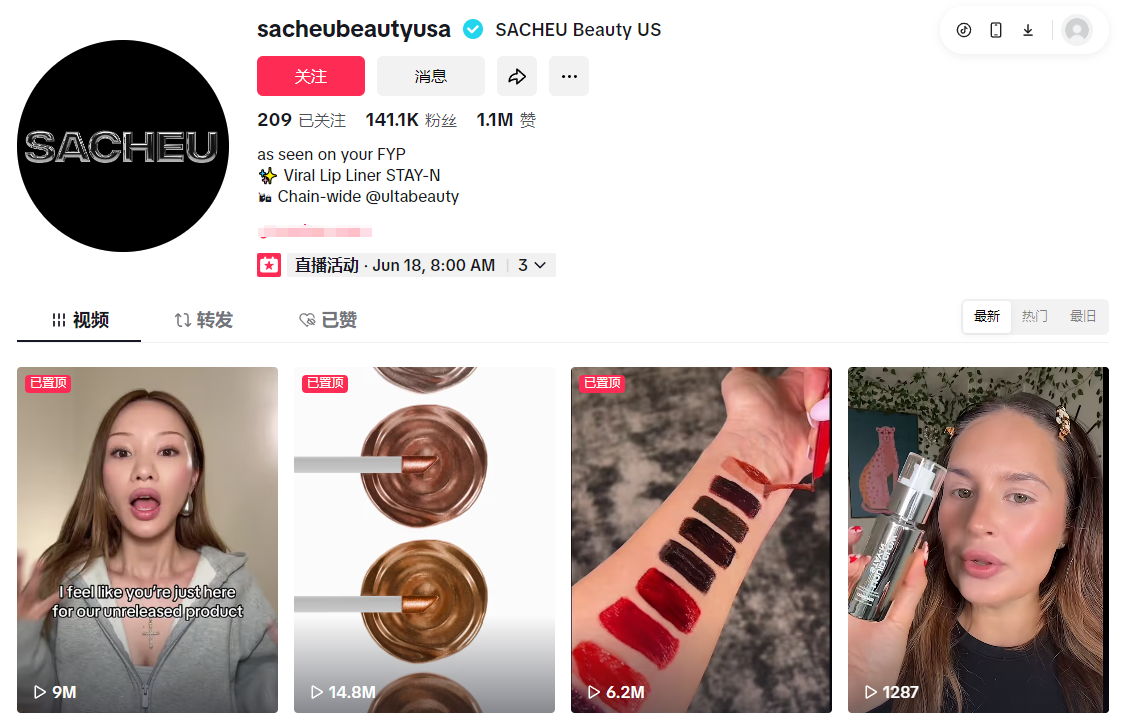

Coincidentally, Sacheu lip liner is also playing a similar combination punch.

This lip liner, OEMed by Shenzhen Xizhiyue, features peel-off and 3D makeup effects, and is popular among European and American users. There are as many as 2,700 product-selling videos on TikTok, with total sales reaching 960,000 units and total revenue exceeding $14 million.

Compared to traditional brands like NYX and Wet n Wild, Sacheu's unit price is higher, but it quickly captured consumers' minds through product innovation and precise advertising.

The logic behind it is clear: it's not about being cheap, but about cost-effectiveness + new experiences.

Image source: TikTok

The key to penetration is channel synergy

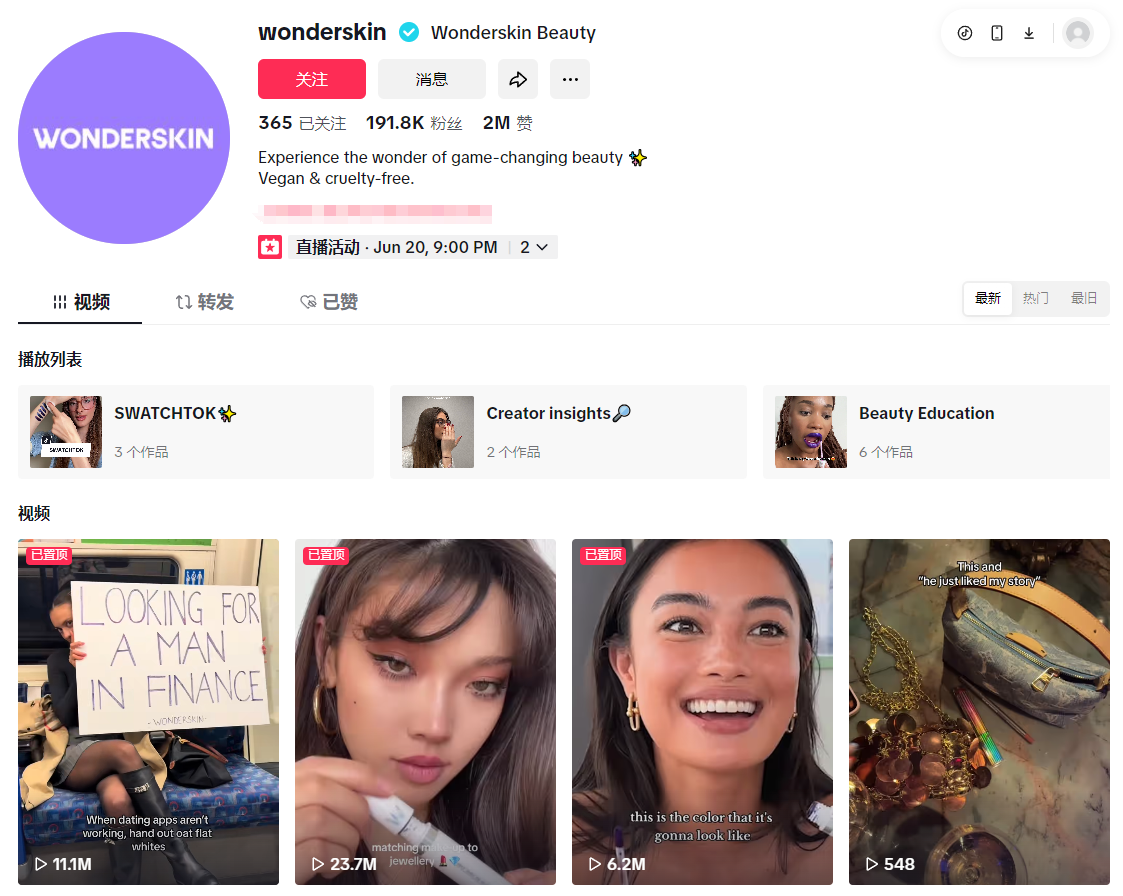

Let's look at Wonderskin lip color mask. This brand, which focuses on lip mask color changing + long-lasting color, entered the North American market in early 2023.

They released 749 product-selling videos on TikTok, with total sales reaching 215,000 units. In November 2024, Wonderskin sold 89,675 units in a single month, with sales close to $1.95 million.

Their strategy is very "content e-commerce": using short videos to create product memory points (such as mask color change demonstrations), combined with brand ads to boost search weight, and guiding retention through independent site SEO, blog content, and Facebook ad traffic.

This platform-content-channel-brand synergy is the key for Chinese brands to break into the North American market at this stage.

It's no longer just relying on Amazon, nor just doing TikTok seeding, but turning each platform into a "reservoir" and "detonator" for each other's traffic.

Image source: TikTok

Policy support is also increasingly in place

In terms of policy, cross-border e-commerce has moved from the support stage to the accelerated development stage.

Currently, eligible cross-border e-commerce export goods can enjoy VAT and consumption tax rebates (exemptions), and returned goods are exempt from import duties. Meanwhile, cross-border payment processes are being simplified, and logistics systems and overseas warehouses are being improved.

In terms of customs clearance, measures such as list release, summary declaration, and inspection before shipment are effectively improving the efficiency of goods circulation.

Not to mention that e-commerce platforms themselves are providing more empowerment, such as TikTok and Amazon's in-site ads, Prime Day, independent site's PPC ads and content traffic systems, which have long become "accelerators" for brands to quickly test, and run products at low cost.

Image source: Internet

Success is not just about selling products

Of course, traffic alone is not enough. Whether a brand can "run a marathon" depends on three dimensions:

1. Product logic must be solid: Pawotence targets "beginner needs" with its DIY eyelash kit; Sacheu lip liner doesn't follow the traditional route, but builds barriers with new technology.

2. Marketing content must be relatable: It's not just about showcasing products, but also conveying aesthetic concepts and lifestyles. Compared to blunt advertising, gentle xx is more likely to move European and American users.

3. Brand awareness must be stable: In the end, what remains is not the product that explodes in sales, but the brand that becomes a "repurchase choice". This is also why in many cases, the proportion of social ads is gradually decreasing, while the proportion of content and organic traffic is gradually increasing.

Image source: Internet

Conclusion

From Pawotence to Sacheu to Wonderskin, these successful brands all share a simple commonality: they found the right product positioning, achieved refined multi-platform synergy, and continuously polished content and experience, ultimately achieving great success in overseas markets.

In short, Tuke wants to say that North America is not an easy market to conquer, but precisely because it's not easy, it's worth long-term investment! Whoever can find their own strategy in this tough battle will have the chance to go further.