In the past, when it came to hardware tools, most people still associated them with traditional factories, heavy industry, or even "street stall goods." However, in recent years, if you pay attention to Amazon's best-seller lists or DIY influencer videos on TikTok, you may notice—hardware tools have changed.

They are no longer just the old trio of "screwdriver+pliers+wrench," but have been upgraded to smart electric drills, multifunctional tool sets, ergonomic welding equipment, cordless electric gardening tools, and other diverse forms of new industrial consumer products.

Image source: Internet

Market Potential: The Trillion-Dollar Market Continues to Expand

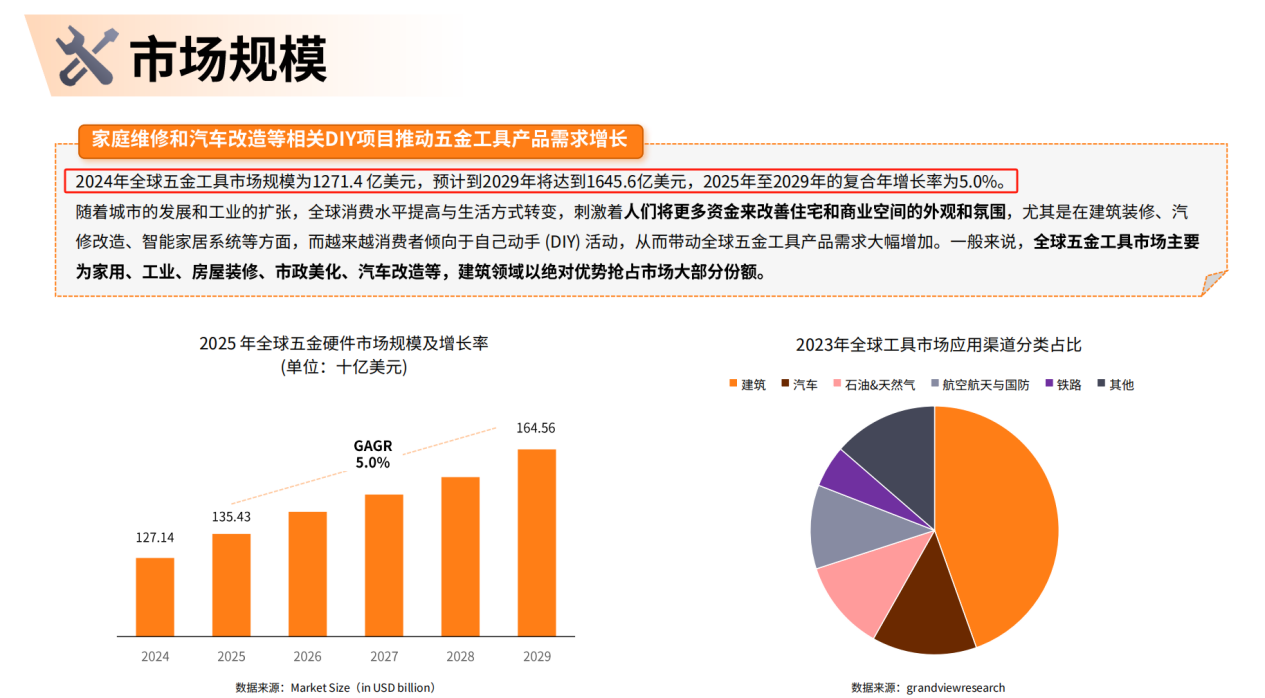

According to the "2025 Hardware Tools Going Global Research Report" released by Dashu Cross-border, the global hardware tools market size reached $127.14 billion in 2024 and is expected to grow to $164.56 billion by 2029, with a compound annual growth rate of 5.0%.

Driven by urban expansion, consumer upgrades, and the spread of DIY culture, the usage scenarios for hardware tools have become more diverse, covering construction and renovation, automotive maintenance, smart home, and many other fields.

Google Trends data also shows that the global search popularity for the keyword "Hardware tools" has remained between 57 and 100 over the past five years, reaching a peak in 2022. Although it has slightly declined since then, overall it remains at a medium-high level of popularity.

Meanwhile, on Amazon US, the search popularity for keywords like "tool box" rises significantly from September to December each year. E-commerce platforms have become important channels for hardware product sales, especially during holidays.

Image source: Dashu Cross-border "2025 Hardware Tools Going Global Research Report"

Segmented Categories: Manual, Electric, and Pneumatic Tools Each Show Vitality

In specific segmented markets, manual tools, electric tools, and pneumatic tools each show different growth trajectories.

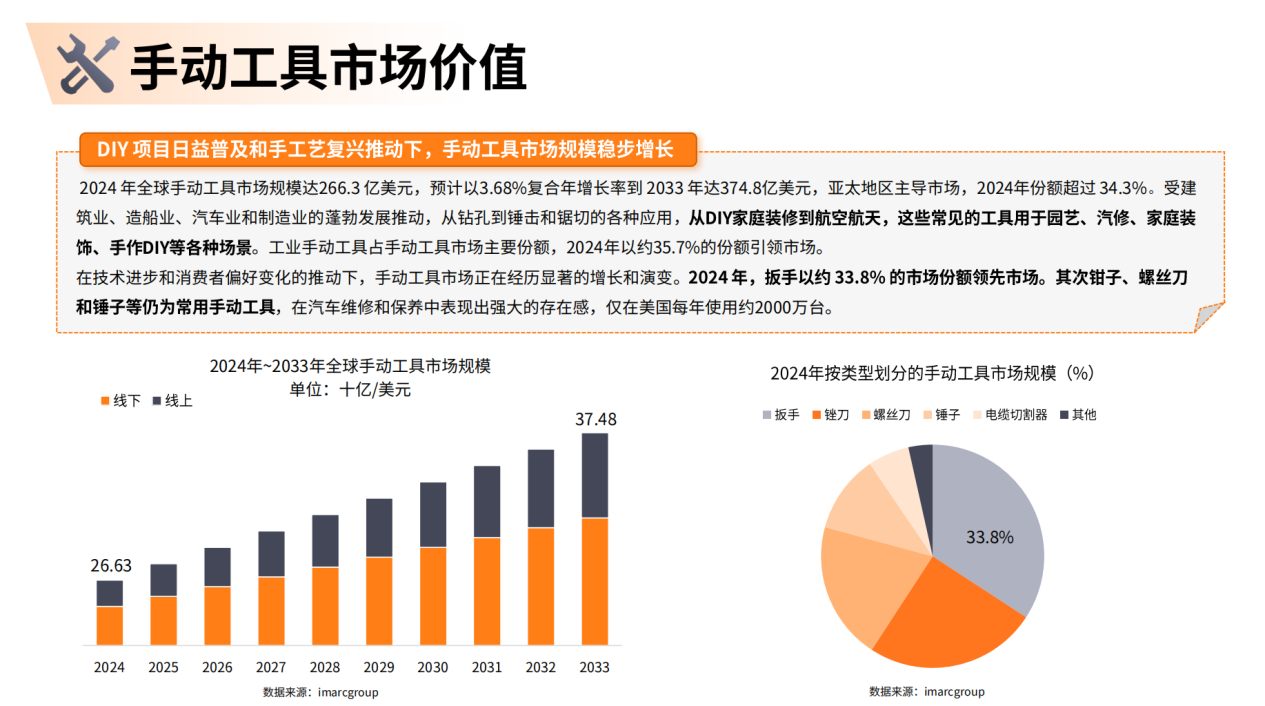

For manual tools, the global market size reached $26.63 billion in 2024 and is expected to reach $37.48 billion by 2033, with a compound annual growth rate of 3.68%. The Asia-Pacific region dominates this field, accounting for 34.3% in 2024. Among them, industrial manual tools account for about 35.7%, becoming the main supporting force.

Electric tools show even higher growth momentum, with a market size of $34.14 billion in 2024, expected to double to $68.04 billion by 2034, with a compound annual growth rate of 7.1%.

The Asia-Pacific region's performance is particularly outstanding, with a market size of $11.14 billion in 2023, expected to expand to $23.82 billion by 2034. The growth is driven by demographic dividends, urbanization, technological innovation, and policy support.

Pneumatic tools are also continuously growing, with a market size of $12.56 billion in 2024, expected to reach $18.1 billion by 2034, with an annual growth rate of 3.72%.

These products are widely used in automotive, manufacturing, construction, shipbuilding, and other fields. Driven by demands for environmental protection, efficiency, and durability, their growth potential is still highly regarded.

Image source: Dashu Cross-border "2025 Hardware Tools Going Global Research Report"

Key Regions: Asia-Pacific and North America Form a Dual-Core Pattern

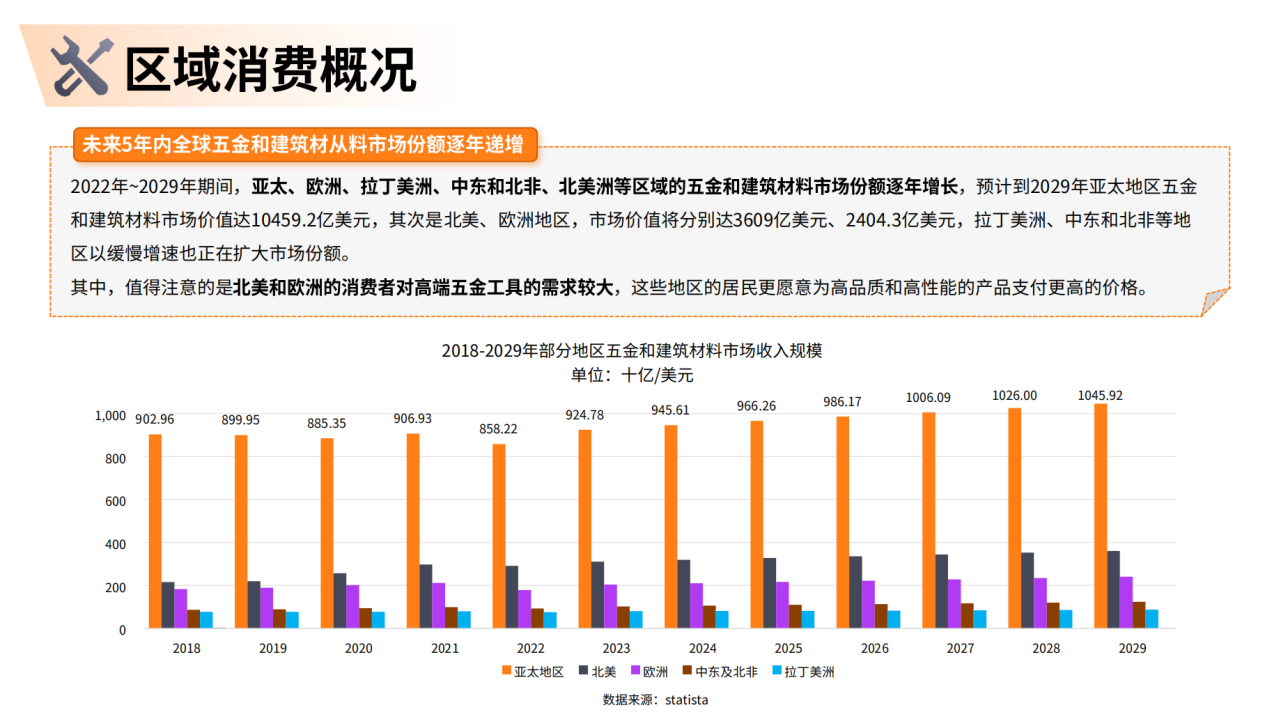

In terms of regional distribution, Asia-Pacific is the world's largest consumer market for hardware tools. In the global market share in 2022, Asia-Pacific reached 40.44%, far surpassing North America's 27.31% and Europe's 24.94%.

By 2029, the hardware and building materials market in Asia-Pacific is expected to reach $1,045.92 billion, while North America and Europe will be $360.9 billion and $240.43 billion, respectively.

In the US market, the retail scale of hardware stores was $55.09 billion in 2023, expected to reach $88.12 billion by 2033, with an annual growth rate of 4.81%. Among them, tools and hardware products account for 30% of sales, serving as an important pillar for market expansion.

Meanwhile, the manual and electric tool markets in Asia-Pacific are also strong. In 2023, the market size in this region was $20.71 billion, expected to rise to $31.8 billion by 2030, with an annual growth rate of 6.3%. Industrial demand accounts for 59.5%, residential demand for 40.5%, with construction, energy, and automotive as core application scenarios.

Image source: Dashu Cross-border "2025 Hardware Tools Going Global Research Report"

Consumer Behavior: Expanding from Professional Markets to the Masses

As the industry develops, the consumer groups have changed, bringing new opportunities.

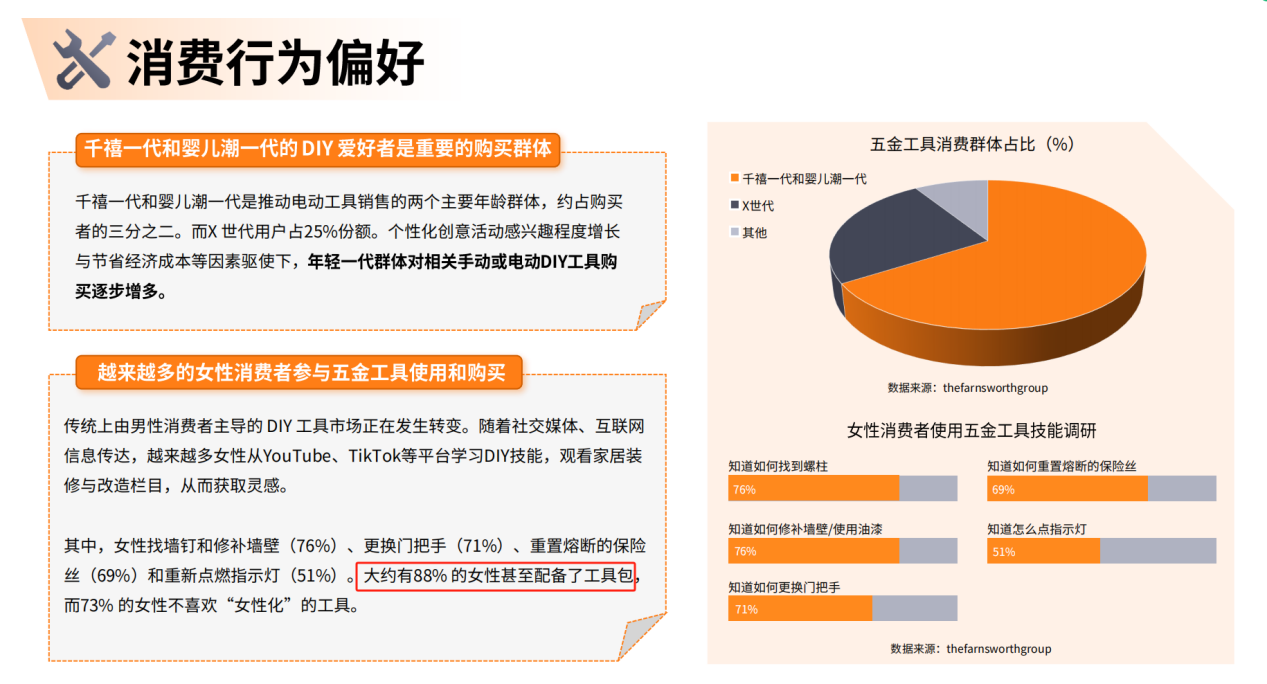

In the US, Millennials and Baby Boomers together account for about two-thirds of electric tool buyers, while Generation X accounts for 25%. Surprisingly, the DIY market, originally dominated by men, is quietly welcoming a large influx of female users.

The report shows that 88% of female respondents have a complete tool kit, and 73% do not prefer "feminized" tools.

Among them, 76% actively look for studs and repair walls, 71% replace door handles, and 69% can reset fuses, showing strong hands-on ability and tool demand.

In terms of purchase motivation, consumers pay more attention to product quality and durability: in 2022, when buying hardware tools, 53% of consumers first considered durability, 45% focused on quality, and only 29% considered price. Multifunctional and highly portable combination tools are increasingly favored, further driving product innovation.

Image source: Dashu Cross-border "2025 Hardware Tools Going Global Research Report"

China Going Global: From OEM Manufacturing to Brand Export

As one of the world's largest producers of hardware tools, China occupies an important position in the global market.

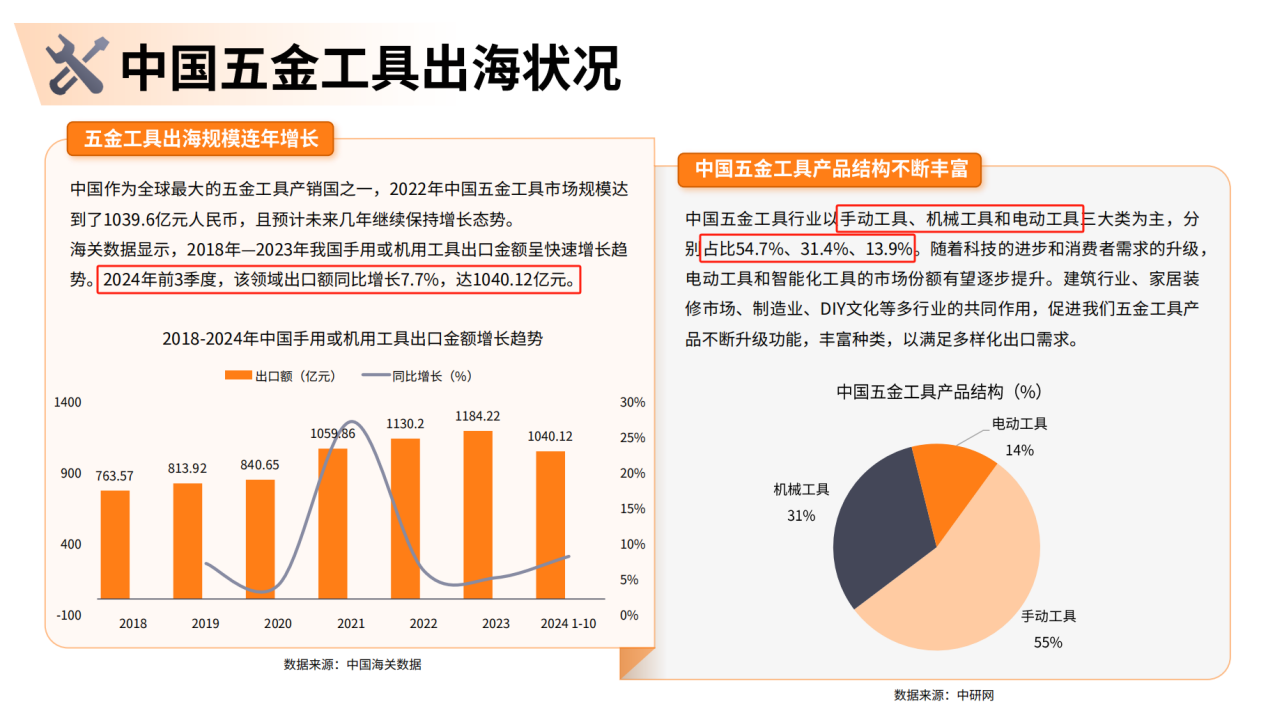

In 2022, China's hardware tools market size reached 103.96 billion RMB. In the first three quarters of 2024, export value grew by 7.7% year-on-year, reaching 104.012 billion RMB, continuing a good growth trend.

In terms of export structure, manual tools, mechanical tools, and electric tools account for 54.7%, 31.4%, and 13.9%, respectively.

China's total hardware tools export sales reached 98.67 billion RMB in 2023. Among them, welding accessories performed outstandingly, achieving a 17.04% growth against the trend.

In segmented categories, China is particularly strong in manual tools, with export value reaching $997 million in 2023, firmly ranking first in the world.

Major export markets include the United States ($184 million), Russia ($53.1 million), Germany ($51.8 million), Mexico, and Australia.

In terms of regional industrial belts, China's hardware tool production capacity is widely distributed. Zhejiang, Jiangsu, and Guangdong are traditional core regions, while Sichuan, Shandong, and Chongqing are rapidly emerging in segmented fields.

For example, wrench production in Yongkang, Zhejiang accounts for more than 75% of the national total; fastener production in Handan, Hebei accounts for 55% nationwide; steel tape measures from Changjiang, Jiangxi are exported to more than 120 countries, making them highly representative export categories.

Image source: Dashu Cross-border "2025 Hardware Tools Going Global Research Report"

Brand Breakthrough: YesWelder's Path to Going Global

YesWelder is one of the most representative Chinese brands going global in recent years. Founded in 2018 by five businessmen from Wenzhou, YesWelder focuses on the home welding machine market, targeting North American C-end users. After its launch, it quickly filled the gap in the European and American markets, which had been dominated by expensive industrial products.

In 2022, the brand's GMV exceeded 500 million RMB, a year-on-year increase of nearly 100%. Among the top ten welding machine categories on Amazon, YesWelder occupies six spots; its official website's organic traffic reaches 30%. Sales channels cover Amazon, Walmart, eBay, AliExpress, and more. It has also built an independent site and established a Facebook welding community with over 4,000 members.

The brand also pays great attention to humanistic marketing, opening a "#WhyWeWeld" column on its official website, dedicated to telling the stories of female welders, full-time mothers, and other users.

YesWelder brand products Image source: Internet

Conclusion

Overall, the global hardware tools market is at a key stage of steady expansion and consumption upgrade, moving from the toolboxes of professional craftsmen to the storage rooms of more ordinary households.

Against this backdrop, for Chinese companies, going global today is no longer just about "selling goods abroad." It is a comprehensive contest of brand strength, product strength, content expression, and channel integration capabilities.

YesWelder is just one representative. In the future, more Chinese brands will find their own paths and rhythms in different tracks.

Of course, this road is not easy. Issues such as tariff fluctuations, brand awareness, and channel dependence are still unavoidable realities that need to be actively addressed.

In short, whoever can move from "cost-effectiveness" to "being recognized" next will be able to stand firm and go further in this global competition.