The younger generation is gradually taking over the main stage of consumption, and their shopping habits are also driving new changes in payment methods.

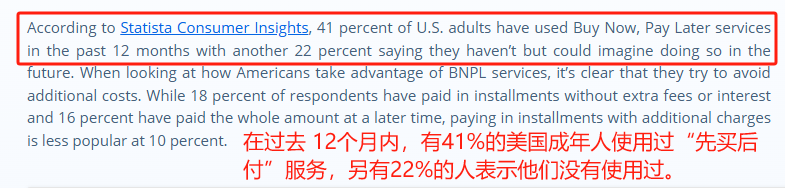

The "Buy Now, Pay Later" (BNPL) model has risen rapidly, changing consumer shopping habits from social media shopping to offline retail payments. According to Statista data, in the past year, 41% of American adults have used BNPL services, and 22% plan to try it in the future. This emerging payment model is having a profound impact on global markets.

Image source: Statista

A Revolution in Consumption Patterns

Simply put, "Buy Now, Pay Later" allows consumers to delay payment when shopping, and even choose interest-free installments, enabling more consumers to enjoy goods in advance when funds are insufficient. This model is especially popular among young consumers, particularly those sensitive to budgets, as it greatly lowers the psychological barrier to purchasing high-value items.

Statista's research shows that in the United States, 18% of BNPL users choose interest-free installment payments, while 16% prefer to pay in full at once. In contrast, only 10% of consumers are willing to pay extra fees for installments. This indicates that young consumers are particularly sensitive to "zero interest" payment forms and have more flexible needs for financial planning.

"Buy Now, Pay Later" is popular in the US. Image source: Statista

Not only in the United States, BNPL is also showing a hot trend globally.

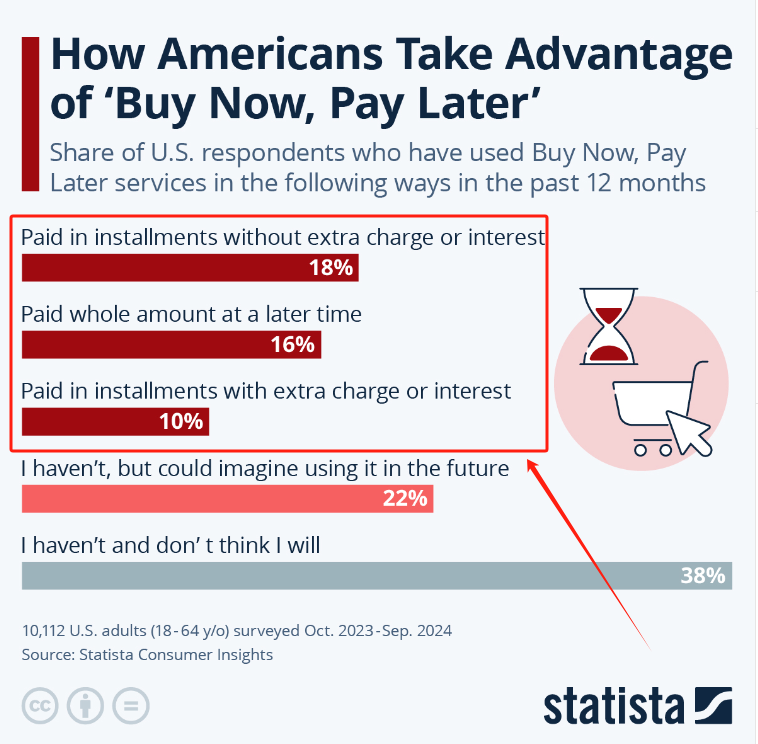

In Southeast Asia, surveys in the Philippines show that 49.6% of respondents have heard of or used BNPL services, with 38% using it every month. In Malaysia, since the launch of BNPL, the credit card usage rate among platform users has even dropped by 9%. This new consumption method is gradually becoming a strong alternative to traditional credit card payments.

High BNPL penetration rate in the Philippines. Image source: philstar GLOBAL

Digitally Driven Growth and Future Potential

Globally, BNPL is unleashing huge market potential.

According to Market.us data, in 2023, the global BNPL market size is expected to reach $16 billion, and will continue to grow at a compound annual growth rate of 25.5%, reaching $115 billion by 2032.

Huge growth potential in the BNPL market. Image source: Market.us

Why has BNPL risen so quickly? It is not only due to changes in the consumption habits of the younger generation, but also thanks to the keen business acumen of e-commerce giants.

Giants Compete: BNPL Becomes the New Battlefield for E-commerce

To seize the opportunities brought by this wave of payment transformation, major e-commerce platforms have entered the market, competing for this "big cake".

Amazon is one of the pioneers in the BNPL field. As early as 2021, it partnered with Affirm to launch BNPL services for US consumers. Last September, Amazon teamed up with JPMorgan Chase to add this feature to Amazon Pay. This June, it joined forces with Visa to expand installment payment services to the Canadian market. By continuously expanding payment options, Amazon continues to optimize the shopping experience and attract more budget-sensitive users.

Amazon partners with Visa to launch installment payments. Image source: Visa

Walmart is also accelerating its follow-up to this trend. At the end of last year, Walmart expanded its partnership with Affirm, introducing BNPL services to more than 4,500 self-checkout machines in stores across the US. Consumers can choose monthly installment payments when shopping, alleviating the financial pressure of high-value goods. Walmart's layout achieves both online and offline coverage, further strengthening its retail competitiveness.

Walmart stores introduce BNPL services. Image source: Affirm

Meanwhile, TikTok has also joined this track. In March this year, TikTok Shop partnered with Indonesian tech giant GoTo Group to plan the launch of BNPL features locally, combining "planting grass" with a payment closed loop to further improve shopping conversion rates. Russia's e-commerce giant Wildberries is also testing similar services, which are expected to be fully launched in the future.

TikTok Shop partners with Go To to launch BNPL services. Image source: technode.global

The Transformation of Payment Habits Has Only Just Begun

Although the BNPL market looks promising, it is not without concerns. Some consumers may overlook their repayment ability due to the convenience of "enjoying in advance," leading to financial problems. In addition, e-commerce platforms and service providers need to strengthen consumer financial education while promoting this payment method to reduce potential risks.

However, from the overall trend, BNPL is gradually changing the payment habits of consumers worldwide. Whether in the US, Southeast Asia, or Europe, the choices of young consumers are driving this model to become the new norm in payments.

In the next few years, as more consumers from different regions join this "shopping revolution," the market potential of BNPL will be further unleashed. For merchants, how to leverage this trend to increase user stickiness and sales will also become the key to success.