If you have been following the Southeast Asian market recently, the development of e-commerce in Vietnam is definitely a topic you can't ignore.

As one of the fastest-growing markets in the region, Vietnam's e-commerce industry has gained strong momentum in recent years. Since 2022, it has grown at an annual rate of 18%, and by 2023, the overall increase exceeded 30%. This hot land has attracted more and more attention from cross-border platforms, and competition has become increasingly fierce.

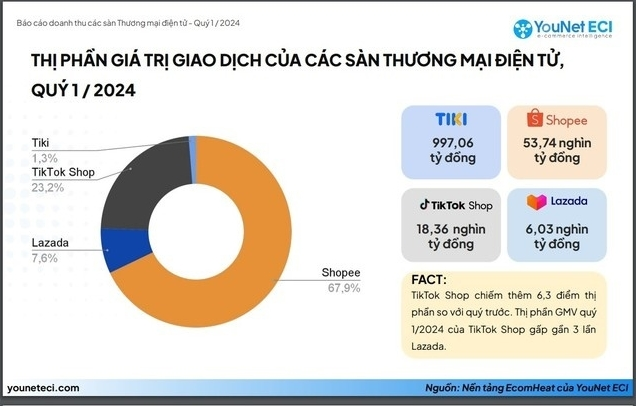

Currently, Vietnam's e-commerce market presents a highly concentrated competitive landscape, with Shopee and TikTok Shop almost "taking" nearly 90% of the market share, becoming the two undisputed giants. At the same time, foreign platforms represented by Temu and Shein are also making great strides in Vietnam, injecting more variables into this market.

E-commerce platform market share Source:YouNet ECI

Shopee and TikTok Shop: A Battle of Two E-commerce Giants

As the leader of Vietnam's e-commerce, Shopee has almost become the default first choice for Vietnamese consumers with its rich product selection and localized logistics services. Promotional activities, fast delivery, and explosive marketing such as holiday promotions have firmly captured the hearts of consumers. Especially through deep cooperation with local logistics companies, Shopee is far ahead in delivery efficiency.

TikTok Shop, on the other hand, has quickly risen with its "social + e-commerce" model. Relying on short videos and live-streaming sales, TikTok Shop has attracted the attention of the younger generation in Vietnam, especially young women, who are both the core users of TikTok and the main consumer force. The participation of content creators and KOLs has further boosted the platform's popularity, continuously narrowing the market gap with Shopee.

Foreign Platforms Accelerate Entry, Intensifying Market Competition

Although Shopee and TikTok Shop occupy most of the market, this does not mean that other players have no opportunities. In recent years, foreign platforms such as Temu and Shein have entered the market one after another, injecting fresh blood into Vietnam's e-commerce market.

Temu has captured a group of price-sensitive consumers with its extremely low-price strategy. Its global supply chain and cross-border logistics capabilities ensure a rich variety of products at affordable prices. Shein, on the other hand, has accurately captured young Vietnamese women's love for fashion, shaping a "cheap fast fashion" brand image through deep penetration of social media.

In addition, the wholesale model of 1688 is also gradually opening up the Vietnamese market. As a treasure trove of goods for small and medium-sized enterprises, it plays an important role in helping Vietnamese merchants save costs and expand product supply.

The "Defensive Battle" of Local Platforms: Policy Support and the Rise of Live-streaming E-commerce

In the face of the strong entry of foreign platforms, Vietnamese local merchants have not sat idly by. Thanks to government policy support, live-streaming e-commerce is booming in Vietnam. Local enterprises have quickly mastered live-streaming skills through short-term training and started live-streaming sales with the support of platforms. The monthly viewership of many emerging brands' live-streaming rooms has even exceeded the one-million mark, directly driving sales growth.

At the same time, the Vietnamese government has introduced stricter e-commerce regulatory policies to prevent vicious competition, such as limiting promotional discounts to no more than 50%. Such policies not only regulate the market but also enable local merchants to participate in competition in a healthier way.

Vietnamese Prime Minister calls for strengthened regulation Source: nhandan.vn

The Future of Vietnam's E-commerce: Opportunities and Challenges Coexist

Vietnam's e-commerce market is clearly still in a period of rapid development, but the complexity of competition is also increasing. The price wars and logistics competitions brought by foreign platforms, coupled with Vietnamese consumers' higher demands for shopping experience, are constantly raising the market threshold.

In the future, whoever can achieve breakthroughs in logistics, user experience, and compliant operations will have the last laugh. For local Vietnamese merchants, seizing the dividends of government policies and continuously innovating content forms are the keys to competing with foreign giants.

Overall, Vietnam's e-commerce market is a hot land full of opportunities, but the real winners will definitely be those players who can both understand consumer needs and quickly adjust their strategies. This competition has only just begun.