In 2025, the GMV scale of TikTok Shop US will surge fivefold, ushering in a dual dividend era of "content + brand" for cross-border sellers.

Over the past year, TikTok Shop has been reshaping the global e-commerce landscape at an astonishing pace. According to the latest platform data, in 2024, the GMV of the US cross-border POP (Platform Open Plan) increased by 500% year-on-year, the number of active influencers soared by 212%, and daily paying users grew by 103%. Behind this explosive growth lies not only proof of the feasibility of the "content e-commerce" model, but also a new lever for Chinese cross-border sellers to tap into the global market.

Image source: Internet

From "Testing the Waters" to "Explosion": Content E-commerce Proven Successful

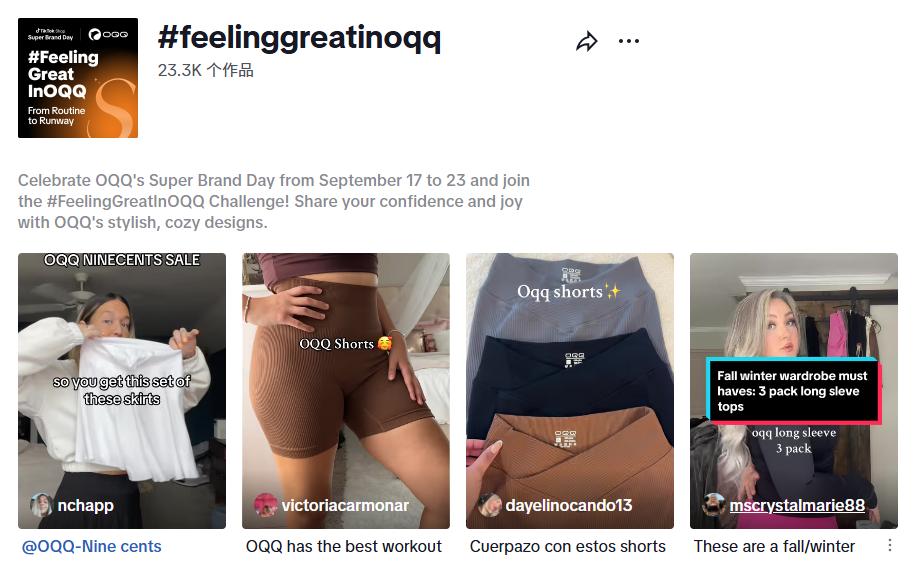

Since TikTok Shop launched its overseas business in 2021, its content ecosystem centered on short videos and live streaming has gradually become its core competitiveness. After the US cross-border self-operation model opened in 2023, early sellers who tested the waters have entered the harvest period. Take the sports brand OQQ as an example: in 2022, it attracted traffic through influencer content cooperation, and after transforming into a self-operated brand in 2023, it set a record of $5.19 million GMV in seven days during "Super Brand Day," with a new customer acquisition rate exceeding expectations by 50%.

Image source: OQQ

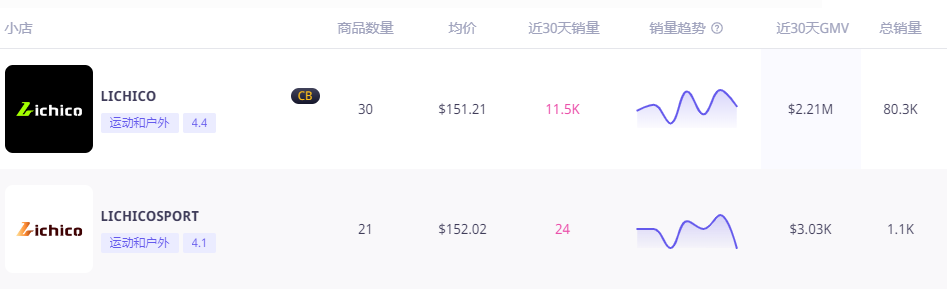

High unit price categories have also performed brilliantly. In March 2024, fitness brand LICHICO launched a foldable treadmill priced at $169. With precise "American home style" scenario-based content, it broke into the top five in the sports and outdoor category within three months and topped the category sales chart during Black Friday promotions. The brand manager revealed: "During the cold start phase, we published 20 differentiated videos daily, screened for viral content logic through data, and then optimized product presentation in reverse."

Image source: Echotik

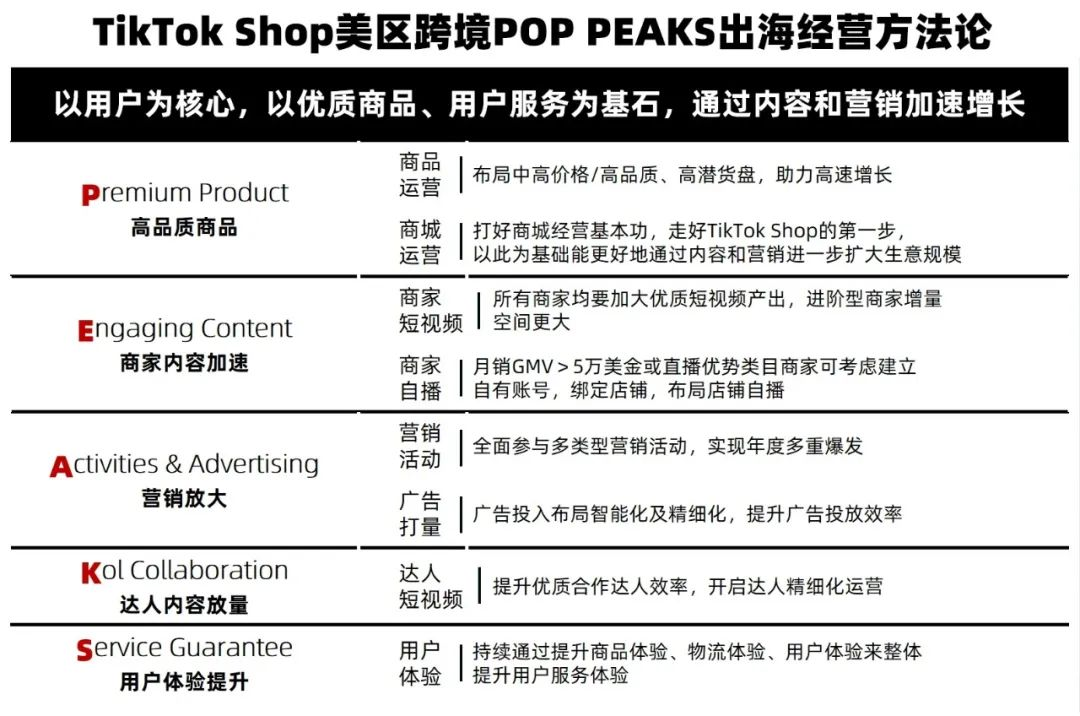

Platform Ups the Ante: First Launch of "PEAKS Methodology," Accelerating Global Layout

Faced with the surging demand from merchants, TikTok Shop released the "PEAKS Overseas Business System" for the first time at the 2025 Merchant Conference, covering five major growth engines:

Product Power (Product): Focus on differentiated, high repurchase categories;

Content Acceleration (Enhance Content): Encourage merchants to build their own content teams, reducing dependence on influencers;

Marketing Amplification (Amplify Marketing): Make use of challenges, Super Brand Day and other IPs;

KOL Collaboration: Establish a "grassroots + mid-tier influencer" pyramid cooperation model;

Service Upgrade (Service): Optimize logistics and after-sales experience, reduce return rates.

"The essence of the content arena is the 'trust economy'—users buy because they are inspired, and repurchase because of their experience," emphasized Mu Qing, Vice President of Cross-border E-commerce at TikTok Shop. Currently, the platform has opened the POP model to UK cross-border sellers, and in 2025 will focus on expanding into new markets such as Europe and Southeast Asia.

Image source: TikTok Shop

Breaking the "Low Price Competition": Building Barriers with Service and Innovation

With changes in cross-border policies (such as US tariff adjustments and the cancellation of EU tax-free quotas), the profit margins of sellers relying solely on low-price strategies have been further squeezed. The home brand YitaHome's response is quite representative—targeting fragile large-size vanity mirrors, they invested months in developing shockproof packaging, reducing the damage rate to 0.5% through "drop box testing," and designed packaging structures that allow safe returns and exchanges.

Meanwhile, platform-level events have become a springboard for brand advancement. For example, during OQQ's "Super Brand Day," the brand combined influencer videos in skating scenarios, the #feelinggreatinoqq challenge (88 million views), and an online fashion show to achieve both brand and sales effectiveness; pop culture giant Pop Mart quickly sold out new products through TikTok exclusive launches. These cases show that content e-commerce is driving cross-border trade from "shelf transactions" to "value recognition."

Image source: TikTok

From "Traffic War" to "Mindshare War," Global Brands Usher in a New Competition Point

As TikTok Shop's GMV curve becomes increasingly steep, Chinese sellers face not just an order battle, but the ultimate competition of "content creativity + brand awareness." As the founder of a leading brand said, "On TikTok, every product needs a 'reason to be remembered'." This may well be the fairest yet most ruthless rule of the content e-commerce era.

(All data and cases in this article are from TikTok Shop official disclosures and public reports)