While most e-commerce platforms are struggling in the Brazilian market, Shopee from Southeast Asia has delivered an astonishing report card.

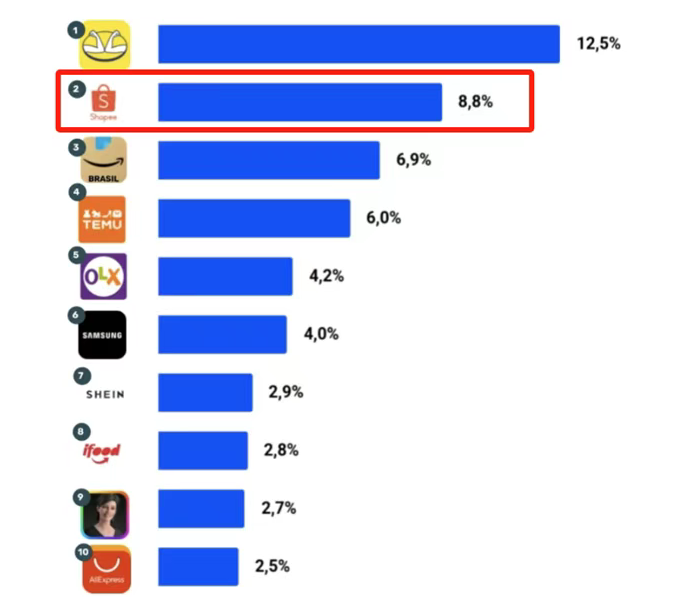

According to the latest data from market research agency Conversion, the overall performance of Brazil's e-commerce market was sluggish in February, but Shopee defied the trend, increasing its market share from 8.6% in January to 8.8%, firmly holding the second spot in Brazil's e-commerce market, second only to local giant Mercado Livre (12.5%).

Shopee successfully retains second place in Brazil's e-commerce market. Image source: Conversion

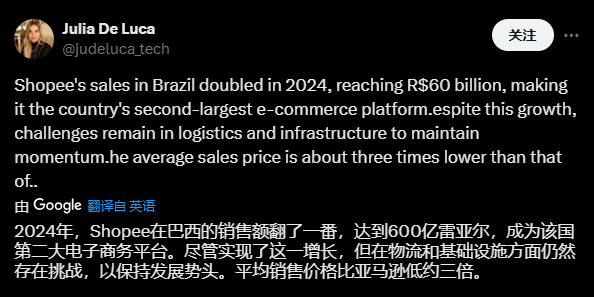

Shopee's rise is no accident. As early as May 2024, it surpassed Amazon for the first time, reaching 201 million monthly visits, while Amazon only had 195 million. Even more astonishing, Shopee's sales in Brazil reached 60 billion BRL in 2024, twice that of Amazon and 40% of Mercado Livre's Brazil business. This growth momentum has made Shopee the strongest challenger in Brazil's e-commerce market.

Shopee's annual sales reach 60 billion BRL. Image source: X

The Three Growth Engines of Shopee

Shopee's rapid rise in the Brazilian market is inseparable from its continuous investment in three key areas: logistics infrastructure, localized operations, and live-streaming e-commerce.

In terms of logistics, Shopee has continuously optimized its logistics network in Brazil. In 2024, Shopee Express shortened delivery times in major cities by 40%. In February 2025, it further adjusted its policy, requiring third-party warehouse sellers to speed up shipping to enhance user experience.

Shopee logistics warehouse. Image source: Google

Meanwhile, Shopee understands the importance of localized operations. It not only introduces international products but also actively recruits Brazilian local sellers, covering more local specialty products. This enables the platform to offer categories that better meet the needs of Brazilian consumers while achieving faster delivery efficiency.

Most noteworthy is Shopee's breakthrough in the field of live-streaming e-commerce. Brazilian consumers have a special preference for interactive shopping, and Shopee keenly captured this trend, increasing the number of daily live broadcasts from 50 at the end of 2023 to over 1,000 in 2024. Data shows that user views increased sixfold, comments increased fourfold, and live streaming has become an important source of traffic and conversion for Shopee.

Shopee live. Image source: Google

The Next Battle: Challenging Mercado Livre's Dominance

Currently, Shopee's biggest competitor in Brazil remains Mercado Livre. This Latin American e-commerce giant has cultivated the market for many years, with a mature logistics and user base. But Shopee is growing faster, especially in penetration among young users and small to medium-sized cities.

In the future, competition between the two platforms will revolve around logistics efficiency, price advantages, and localized operations. If Shopee can maintain its current growth rate, it is likely to further narrow the gap with Mercado Livre in the coming years, and may even reshape the landscape of Brazil's e-commerce market.

Image source: Google

What does Shopee's journey in Brazil teach the industry?

Shopee's success in Brazil proves that even a foreign platform can break through fierce competition as long as it accurately grasps local needs, optimizes logistics experience, and leverages innovative models such as live-streaming e-commerce.

For other cross-border e-commerce companies, Shopee's case is worth in-depth study. True globalization is not about simply copying models, but about deeply integrating into the local market.