When enterprises engage in overseas marketing via Tuke, the choice of target market is extremely important. Although some countries have not yet launched the Tuke Shop feature, they still attract the attention of certain businesses, such as Japan. Today, Tuke will give you a detailed introduction to the situation and development prospects of the Tuke Japanese market, helping you better leverage Tuke for overseas marketing.

△ Overview of the Japanese Market

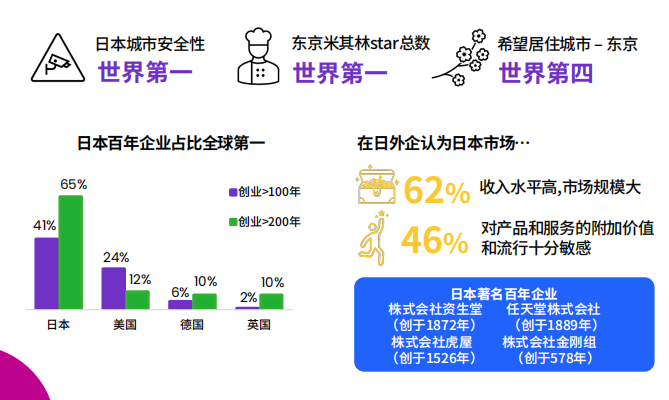

Japan is the world's third-largest economy, with its total GDP leading globally for nearly 40 years. At the same time, Japan is also the world's fourth-largest consumer market, with personal consumption accounting for 60% of total GDP, and the overall scale has remained stable in recent years.

Japan has a developed and long-term stable mature economic environment. As one of the world's leading economic powers, Japan's systems and infrastructure are highly developed. With a mature and stable economic environment, it is fertile ground for business development. The economies of various regions in Japan are equivalent to national-level GDP, and within a limited land area, Japan has cultivated economic power that can surpass countries like Switzerland, Sweden, Thailand, and Brazil. As society gradually adapts to the new normal, Japan's economic activities are steadily recovering, showing a positive development trend.

According to Tuke, in 2022, Japan's retail sales reached approximately 154.4 trillion yen, a new high in the past decade. Foreign companies in Japan believe that the Japanese market offers high income levels (62%) and a large market size; 46% are highly sensitive to the added value and popularity of products and services.

△ Smartphones as the Core Connected Device

Japan has a high internet penetration rate, with both smartphone ownership and internet usage at high levels. Mobile phones are the primary internet access medium for all age groups in Japan. The internet penetration rate is as high as 93%, covering 174 million people, with 88% owning smartphones. The internet usage rate among people aged 13-60 and households with annual incomes above 6 million yen exceeds 90%. Among these, teenagers and people in their 20s spend the most time online via mobile phones.

Economic and educational changes have created different values and consumption tendencies among three generations in Japan.

Bubble Generation: Born between 1965-1971, entered society during the peak of the bubble economy, enjoyed the dividends of the era, pursued consumption upgrades, liked luxury brands and glamorous lifestyles, willing to spend on appearance and maintaining youth. Representative brands: CHANEL/LV.

Second Baby Boomers: Born between 1971-1982, entered society when the bubble economy burst, faced employment difficulties and large income disparities. Life is simple and unadorned, with high requirements for product cost-effectiveness. Representative brand: MUJI.

Enlightened Generation: Born between 1983-2004, grew up in a stable economic era, dislike competition due to relaxed education. Do not like flashy lifestyles, reject unnecessary consumption, have nostalgic tendencies, and represent a Buddhist-like low-desire lifestyle. Representative brand: APPLE.

Japanese consumers' purchases are shifting from offline to online, with changes in the external environment being a major reason for choosing online shopping. The extension of home time under the new normal has also accelerated this shift. 82% have searched online for products or services they want to buy; 85% have visited online retail websites or stores; 73% have purchased products online.

Among them, Japanese consumers are most inclined to buy books/discs/game software online, followed by consumer packaged goods/hygiene products, cosmetics, personal computers/games, and furniture/appliances. The main reasons Japanese consumers choose online shopping are similar to those in other countries: the ability to place orders anytime with fast delivery, home delivery without having to carry heavy items, and the ability to compare the quality and prices of different products before purchasing.

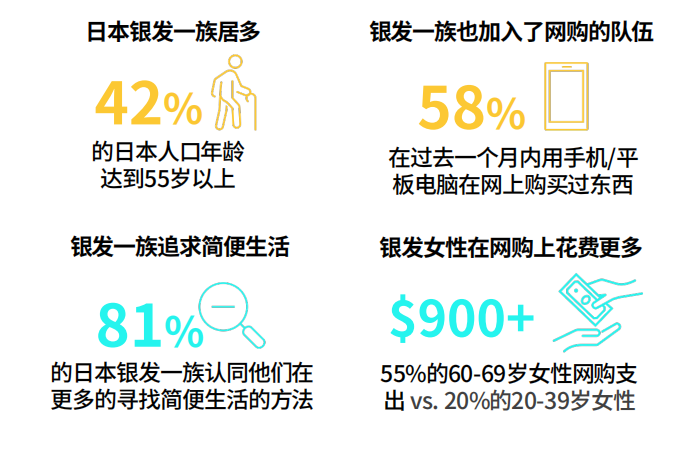

It is also worth noting that Japan's elderly population is very enthusiastic about online shopping, and compared to younger women, they prefer to spend money online and pay great attention to convenience and service experience. Therefore, brands can appropriately add or optimize services to attract more elderly Japanese consumers to place orders with confidence.

△ Tuke: Japan's Trendsetter

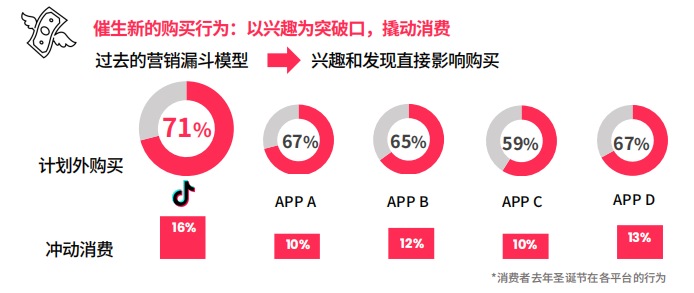

The consumer behavior of "carefully considering before buying what you want" changed in 2021 to "buying what you like when you encounter it by chance," and Tuke is a typical representative of this phenomenon.

Videos of users introducing purchased products have reached 1.4 billion views in six months. Tuke売れ (Tuke-driven sales) ranked first in the best 30 annual best-selling products in Nikkei Trendy business magazine in 2021.

What activates Japanese Tuke users' desire to buy?

Shorter, skippable, more authentic!

Compared to other leading platforms, Tuke offers a self-driven, non-forced viewing environment.

For Japan's Gen Z, Tuke is a trustworthy trend indicator. When seeking the latest information, 20% use Tuke; when collecting information about cooking and housework, 17% use Tuke; when searching for business-related information on their phones, 11% use Tuke. 42% found desired products on Tuke, 36% have practiced methods introduced on Tuke, and 38% have purchased products or services introduced on Tuke.

Japanese millennials view Tuke as energetic and positive, with a large amount of entertaining content different from what is seen on other social sites. When motivation is needed, 11% use Tuke; when collecting fashion information, 9% use Tuke; when sending private messages to acquaintances, celebrities, or influencers, also 9% use Tuke.

Six Popular Product Categories

--Food

Tuke is a hotbed for explosive food and beverage products. Use ads to capture hot trends and expand sales! In the food and beverage industry, sales booms triggered by Tuke are common.

Nikkei has commented: "Among many video services, one video publishing app is especially popular among young people, and that is Tuke from China's ByteDance. More and more manufacturers are turning Tuke into a PR base for promoting genuine discussions."

Tuke food and beverage trends:

#TukeFoodie - video views 1.9 billion+

#TukeRecipe - video views 1.7 billion+

--Automobiles

Representative 1: BMW

Videos posted by the Tuke account not only increased visits to car dealerships and the number of signed sales contracts, but also had a positive impact on BMW dealerships in other regions of Japan. Achieved 90 million video views and 300 million likes.

--Retail

Representative: FamilyMart

After gaining widespread attention on Tuke for being "cool" and "fashionable," #FamimaSocks (FamilyMart socks) sold out quickly. People posted review videos and photos of trying on these socks on social media, always using hashtags like "#FamimaSocks." Actor Takuya Kimura also posted photos of himself wearing these striped socks, sparking even more interest in the product.

--Media & Publishing

Explosive content continues to emerge on Tuke, and dedicated Tuke sales areas have even appeared across Japan. The latest advertising slogan in pop culture is "Tuke popular products"!

--Games

Japan has always been a pivotal market in the gaming industry and is home to global leading console platforms like Sega, Nintendo, and PlayStation. The number of gamers reaches 70 million, more than half of Japan's total population. In 2022, annual revenue from Japan's app market dropped slightly from $20.7 billion in 2021 to $17.8 billion, but still exceeded pre-new-normal levels. Japan is thus the world's third-largest app market, after the US and China. The number of smartphone users in Japan continues to grow. Japanese users spend about 4.8 hours per day on mobile apps, an increase of more than an hour compared to 2019.

Role-playing, puzzle, and strategy games are the most popular genres among Japanese gamers. Japanese players are also enthusiastic about "pay-to-win" (in-game purchases), with over 60% believing that spending money is necessary to fully experience games. The main reasons for Japanese mobile gamers to spend money are: 42% to obtain new characters/heroes; 39% to enhance character/hero abilities; 31% to get new weapons.

--Beauty

Japanese consumers pay great attention to skincare and have strong purchasing power and willingness. Compared to the global beauty market, skincare products account for a large proportion of Japan's beauty market. However, since wearing perfume in public is considered impolite, Japanese people generally do not use perfume, and its market share is small, which companies need to pay special attention to.

Many Japanese domestic beauty brands perform well, so competition is fierce. However, the "Chinese style" in the beauty industry has also spread to Japan. Demand for Chinese cosmetics in Japan is rising, with imports from China reaching $82 million by 2022. This is mainly due to the popularity of Chinese-style makeup in Japan.

With the growth of Chinese beauty imports and the development of the internet and e-commerce, Chinese makeup products are gradually becoming popular among Japanese youth. Since 2019, Chinese-style makeup featuring thick eyebrows, fair skin, red lips, and black eyeliner has become trendy in Japan. There is even a new buzzword, "Chiborg" (チャイボ一グ), combining "China" and "Cyborg," originally meaning "so beautiful it's like a robot," now referring to Chinese-style beauties and makeup.

Chinese beauty brands such as Flower Knows, ZEESEA, and Florasis have achieved impressive sales after entering Japan. In terms of skincare, Japanese consumers with stable disposable income and a pursuit of fashion and quality are very willing to pay for mid-to-high-end products.

Tuke beauty and personal care trends:

#Beauty - video views 2.2 billion+

#BeautyTransformation - video views 1.3 billion+

#Cosmetics - video views 1.3 billion+

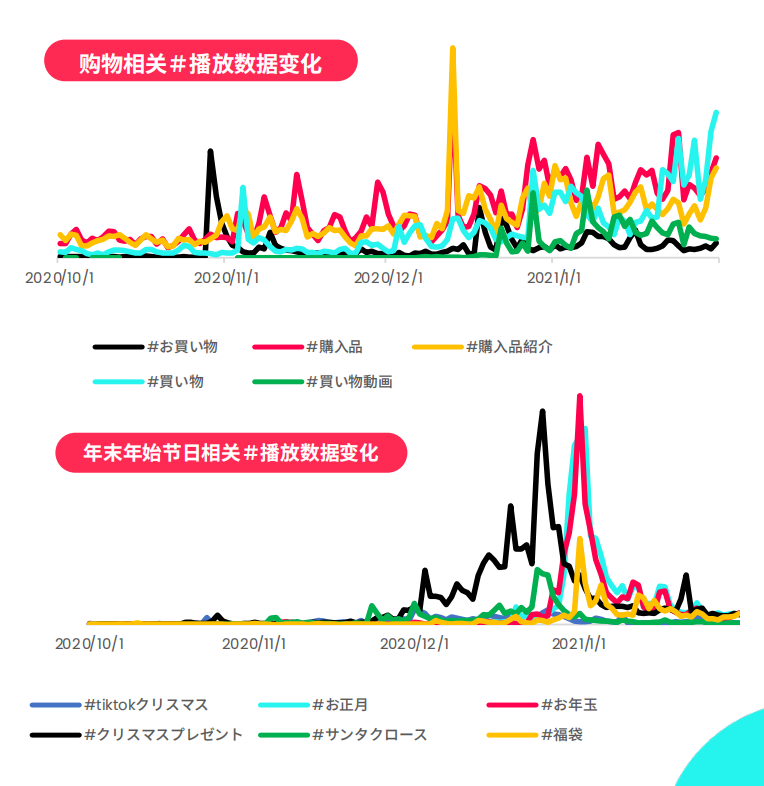

△ Important Marketing Nodes in Japan

--Summer Festival

Keywords: fireworks, cooling off, yukata, snacks, festival, Tanabata, parade.

Popular tag:#TukeSummerFestival

July to December is Japan's peak sales season, especially after the Obon Festival promotions in August, the second half of the year's sales officially begin. The Obon Festival is highly valued in Japan and has become the most important holiday after New Year's Day.

During the summer festival, various regions in Japan hold parades and performances. People wear beautiful kimono yukata, go shopping, and buy things. Local events include temple fairs or garden parties, with snack stalls selling fried noodles, takoyaki, taiyaki, and other foods. There are also many entertainment activities, such as goldfish scooping and water balloon fishing. Surrounding shops are decorated for the occasion, holding special events and selling small items like wind chimes, folding fans, and masks.

The highlight of the summer festival is the fireworks display at night, which lights up the summer night sky.

Brand Inspiration:

During the summer festival, many brands launch limited summer products. Brands can incorporate summer elements (such as folding fans, yukata, goldfish, etc.) to boost product sales. Meanwhile, many Japanese people prepare summer necessities during the Obon Festival or get ready for summer trips before the season arrives. Brands should extend the marketing cycle and prepare early for the summer festival.

--Valentine's Day

Keywords: gratitude, gifts, candy, return gifts, couples

The way Japanese people celebrate Valentine's Day is quite the opposite of ours. Usually, women take the initiative to give chocolate to their crush on February 14. Later, Valentine's Day became a holiday for women to give chocolate to people around them, including not only their loved ones but also classmates, colleagues, and friends, leading to the concept of "giri-choco" (obligation chocolate). Giving giri-choco is not to express love, but more to show gratitude or respect, reflecting friendship. Candy industry merchants saw that Valentine's Day on February 14 opened up sales for chocolate, so they leveraged the Japanese habit of return gifts to create "White Day" on March 14. On March 14, men return gifts to women, and this day is called "White Day." There is also an interesting tradition: some men, to impress the women they like, practice "sanbai-gaeshi" (triple return), preparing a gift worth three times the value of the chocolate received on February 14.

Brand Inspiration:

Because Japanese people love giving and returning gifts, during Valentine's Day, locals not only buy flowers, candy, and other gifts for their partners but also for family, friends, and colleagues. Merchants can increase brand promotion during this period and appropriately launch special Valentine's Day products or beautifully packaged gift sets to boost conversion.

--Golden Week

Keywords: travel, consecutive holidays, leisure, parent-child.

Unlike China's Golden Week in October, Japan's Golden Week is from late April to early May and is one of the most anticipated holidays for Japanese people, comparable to New Year's in January and Obon in mid-August. During this time, various holidays are clustered together, and with weekends, it forms a long holiday of up to 7 days or more.

Brand Inspiration:Many Japanese people use this long holiday to relax and travel. Shops at tourist attractions launch various souvenirs to attract consumers. Travel, sunscreen, and cosmetics are essential, and Japanese people also take this opportunity to rest and reward themselves.

--Halloween

Keywords: costumes, parade, Shibuya, trends.

Halloween is an indispensable national carnival day in Japan, closely related to its national character and cosplay culture. During Halloween, people in Japan come up with various costume ideas, friends gather to cosplay together, creating a unique "Halloween Night" in Japanese culture.

Brand Inspiration:Many stores decorate early for Halloween to attract customers, launch Halloween-themed products, and sales of costumes and cosmetics for Halloween cosplay surge. Shops in cosplay hotspots like Shibuya and Ikebukuro also offer various Halloween discounts, and drinks sell well on this day.

--Christmas Eve & Christmas

Keywords: lucky bags, New Year, Christmas, blessings, celebration.

Popular tag:#TukeChristmas

In Japan, Christmas is spent with lovers and friends. Every year, many Japanese families celebrate Christmas at KFC. Besides eating KFC, Japanese people also share cream strawberry cakes with family and friends to celebrate.

Brand Inspiration:Many merchants launch Christmas limited or related products to attract customers to pre-order, and staff dress up as Santa Claus to attract customers.

--Japanese New Year + First Sale of the Year

Keywords: lucky bags, New Year, Christmas, blessings, celebration.

Every year from January 1 to 3 is Japan's statutory New Year holiday. Families gather to eat New Year's dishes and watch the New Year's Eve show "Kohaku Uta Gassen." On January 1, Japanese people go to shrines or temples to pray for blessings, and the first visit of the year is called "hatsumode." They also prepare their favorite New Year's red envelopes "otoshidama" for children.

Brand Inspiration:Many merchants take advantage of the New Year to hold "promotional activities," launching special New Year products "lucky bags" to reward consumers. Generally, the value of the products inside exceeds the marked price, and consumers cannot know the contents in advance, giving a blind box-like thrill. Depending on the merchant, the contents of lucky bags have become increasingly diverse—food, daily necessities, and even anime merchandise. Merchants can use this opportunity for a major product promotion.

Summary:

The Japanese market is an overseas market that domestic enterprises cannot ignore. Through the detailed introduction above, we hope to help everyone better understand the Japanese market and thus achieve better overseas development in Japan via Tuke, with orders pouring in!

Source: Tuke for Business

![[ حصري ] ريال مدريد بدء الأعمال التجارية فقط في السنة ، كيف يعتمد على tiktok البث المباشر ، الدخل السنوي كسر مليار دولار ؟](/_next/image?url=https%3A%2F%2Fadmin.tktk.com%2Fuploads%2Fallimg%2F240402%2F1-2404021H2400-L.png&w=640&q=75)