Open TikTok and search for #realme, and you’ll see over 1.1 million short videos—from Indian youths filming festival fireworks with realme phones, to Brazilian Mother’s Day influencers unboxing and reviewing products, to Indonesian users launching product challenge contests. These posts are not only spontaneous celebrations by users, but also a microcosm of how a Chinese smartphone brand has “conquered” the global market in reverse.

Image source: TikTok

Founded six years ago, the realme brand has entered 61 markets worldwide. As of 2024, global smartphone sales have exceeded 200 million units, with 80% of users coming from overseas markets.

How did this Chinese smartphone brand manage to overtake competitors in the fiercely competitive global market?

The answer may lie in its precise insight into youth culture.

Image source: Internet

From “Marginal Market” to “Global Dark Horse”

In 2018, when Li Bingzhong left OPPO to found realme, the global smartphone market was caught in a red ocean battle. Apple, Samsung, and Huawei dominated the high-end market, while brands like Xiaomi and vivo fiercely competed in the mid-range segment.

Image source: Internet

But this former OPPO overseas executive keenly spotted a gap: the younger generation’s demand for “high cost-performance” was not being fully met. They craved powerful performance and stylish design, but were unwilling to pay a premium for brand names.

Based on this insight, the overall tone of the realme brand was set.

At first, realme’s founding team had only 40 people and such limited funds that they “couldn’t even afford a launch event,” yet they threw all their resources into product R&D. The first model, realme 1, launched on Amazon India, quickly topped the “bestseller list” thanks to its MediaTek P60 chip, diamond-cut body, and affordable price.

Image source: Amazon

The realme 2, released in August 2018, set a record on Flipkart by selling out 200,000 units in just five minutes. This “leapfrog experience” strategy—offering near-flagship performance at mid-range prices—became part of the brand’s DNA.

After that, the brand swept through Southeast Asia at a pace of “one new phone per month,” ranking among the global top 7 in shipments in 2019, and becoming one of the fastest brands to reach 100 million sales in 2021.

As brand founder Mr. Li said in an interview, “For realme, there are opportunities everywhere overseas. Because the market share is small, it’s waiting to enter a growth phase. But the Chinese market is many years ahead of overseas markets. If we do well in China, we’ll be more confident in doing well overseas.”

Image source: Internet

Industry Changes: Breaking Through with Cost-Performance and Socialization

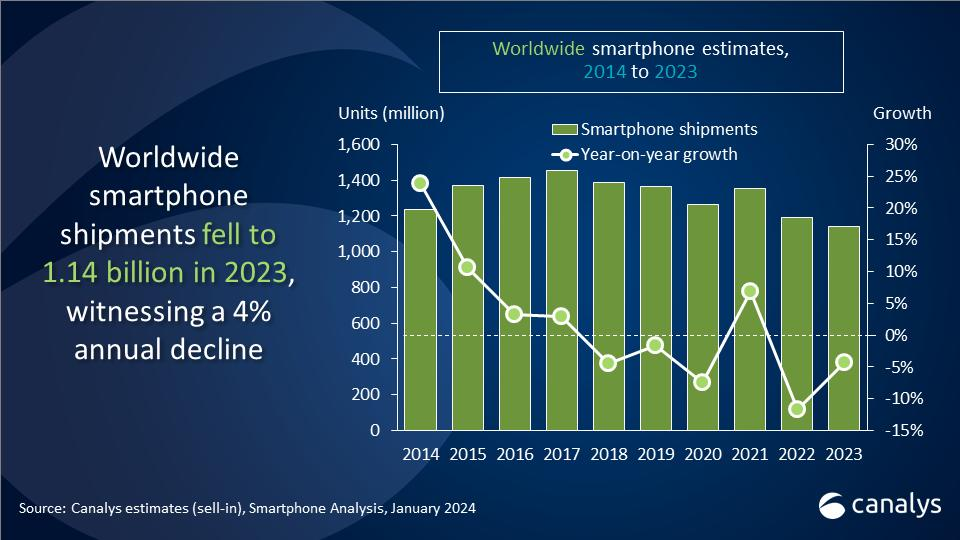

The rise of the realme brand coincided with a structural adjustment in the global smartphone market. At that time, the global smartphone market was sluggish due to longer replacement cycles. According to third-party data, global smartphone shipments fell to 1.14 billion units in 2023, a year-on-year decrease of 4%.

Image source: canalys

Against this backdrop, realme’s “leapfrog” strategy precisely hit on consumers’ conflicting psychology regarding phones at different price points. Technologies like 65W fast charging, 240W super charging, and flexible screens were brought from flagship to mid-range models, breaking the prejudice that low price = low quality through “technological leapfrogging.”

More importantly, realme deeply understands that “social media is the battlefield.” Through a strategy of “platform characteristics + content stratification,” they increased interaction rates by 367% during Ramadan activities in 2023.

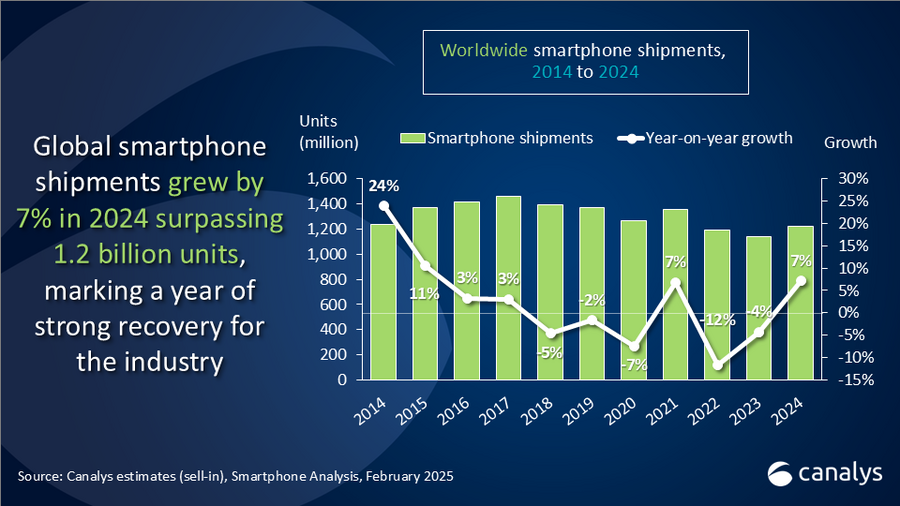

Now, the smartphone market is entering a year of strong recovery. The industry has ended two consecutive years of decline, with shipments expected to rebound to over 1.2 billion units and a promising outlook.

Image source: canalys

Behind this counter-trend growth lies a strategic model of great reference value for overseas brands. While traditional companies are still struggling with whether to go global, perhaps they can learn from realme’s social media layout.

Multi-Platform Matrix: From “Traffic Harvesting” to “Brand Accumulation”

Founder Mr. Li once mentioned, “In terms of ‘brand power,’ realme will focus on young people, deepen the user insight mechanism, and let the needs of young users reshape products in reverse, creating a brand experience that is participatory and co-creatable.”

Based on this concept, realme combines the characteristics of different platforms to launch diversified strategies, effectively reaching and attracting young users and further enhancing brand influence.

1. TikTok

As the main battleground for Gen Z, TikTok has gradually become the core traffic engine for the realme brand.

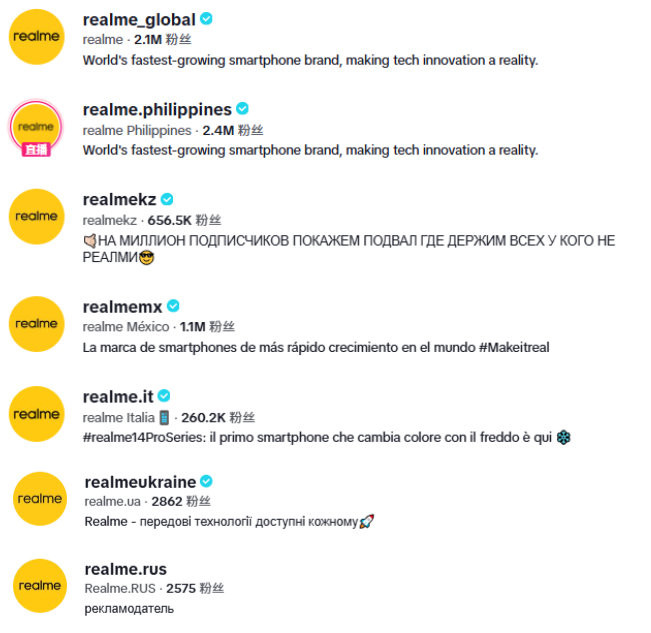

So far, the brand has established seven regional official accounts on TikTok, with a total fan base exceeding 6.52 million, forming a “central kitchen-style” content distribution system.

Image source: TikTok

Operating separate accounts not only reduces the risk of cultural barriers but also maximizes traffic efficiency.

Take the brand’s European account @realmeglobal as an example. Targeting European and American consumers’ high attention to battery life and fast charging technology, this account mainly showcases technical scenarios. Its “4-minute ultra-fast charging” video hit the pain points of European and American users, quickly gaining over 12.4 million views after release.

This refined “one country, one policy” operation allows realme to maintain a unified global brand tone while avoiding the embarrassment of “cultural misfit” content.

Image source: TikTok

In addition to operating its own accounts, realme also works deeply with a large number of local KOLs. At key moments such as new product launches and holiday celebrations, different influencers are featured.

For example, during Mother’s Day in Brazil, the brand invited many influencers to create short videos on family themes, further expanding the reach of the content through holiday topics and customized H5 pages.

TikTok influencer @alcala.creativo is one of them. By using “voiceover + unboxing” to showcase the topic of “gifts for mom,” the video received 763,100 views during Mother’s Day, bringing considerable traffic benefits to the brand.

Image source: TikTok

2. YouTube

Unlike TikTok’s fast-paced short videos, realme mainly invites tech bloggers to conduct in-depth reviews on YouTube, focusing on performance parameters and real-life shooting effects, which in turn boosts e-commerce conversion.

Image source: Youtube

This strategy not only meets users’ needs for in-depth product understanding, but also leverages the professionalism and influence of bloggers to enhance the brand’s credibility and appeal.

For example, a deep review video of the Realme P3 Ultra by YouTube blogger @Gyan Therapy brought the brand 350,000 views and attracted a large number of user comments and interactions.

Image source: Youtube

3. Instagram

In realme’s multi-platform layout, Instagram serves as the “brand aesthetics hub.” Through high-quality visual storytelling, it elevates the phone from a functional tool to a symbol of trendy culture. Currently, its global main account @realme has accumulated 413,000 followers, while the regional account matrix (such as @realmeglobal, @realmesea) has over 1.2 million followers in total, becoming a key lever for the brand to attract high-value users.

By building an account matrix, realme can not only reach target audiences from different dimensions and expand brand influence, but also strengthen the brand’s sense of trendiness and technology by leveraging Instagram’s visual expression features.

Image source: Instagram

The “Non-Standard Answer” for Chinese Brands Going Global

The rise of the realme brand reflects the deep logic of the transformation from “Made in China” to “Chinese Brand”—not relying on low-price dumping, but winning hearts and minds through localized storytelling. Going global is not just about selling products, but about building full-chain capabilities from product to service, from traffic to brand.

Standing at the threshold of 2025, overseas markets are not only a way for Chinese companies to avoid internal competition, but also a touchstone for testing innovation capabilities. As Mr. Li said, “There are opportunities everywhere overseas.”