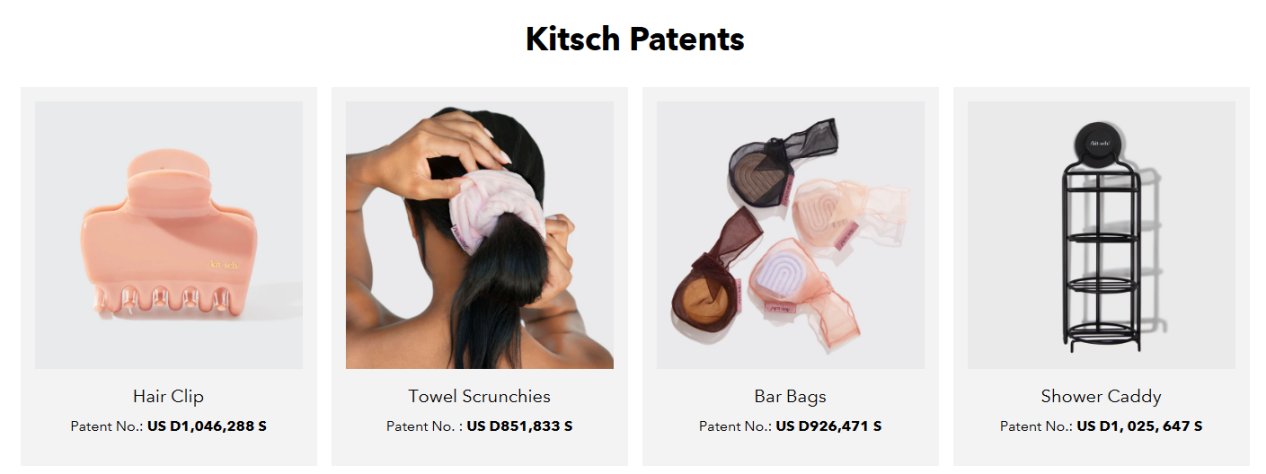

Recently, a wave has swept through the cross-border e-commerce circle... The American brand Kitsch has frequently initiated rights protection lawsuits due to copyright and patent issues involving products such as heatless curlers and bathroom storage racks. Case numbers 25-cv-00520 and 24-cv-05628 have successively topped industry hot searches.

Image source: Kitsch

This series of rights protection events has also brought this low-key, rising American DTC brand into the public eye. Starting as a small handmade hair accessory workshop, it has quickly risen to the top ranks in just over ten years, now present in 27 countries and over 27,000 retail stores. In 2023, global sales exceeded $120 million, a year-on-year increase of 25%.

Next, let TuKe lead everyone to take a look at how this brand has “developed quietly.”

Image source: Kitsch

From Family Workshop to Global Brand

On Thanksgiving in 2009, founder Cassandra Morales Thurswell noticed that her family's hair accessories clashed with their carefully coordinated outfits. This detail triggered her reflection on the “imbalance between aesthetics and practicality.” The following year, she began hand-making hair ties at home, selling directly to consumers, hair salons, and boutiques, officially launching the Kitsch brand's entrepreneurial journey.

Cassandra Morales Thurswel

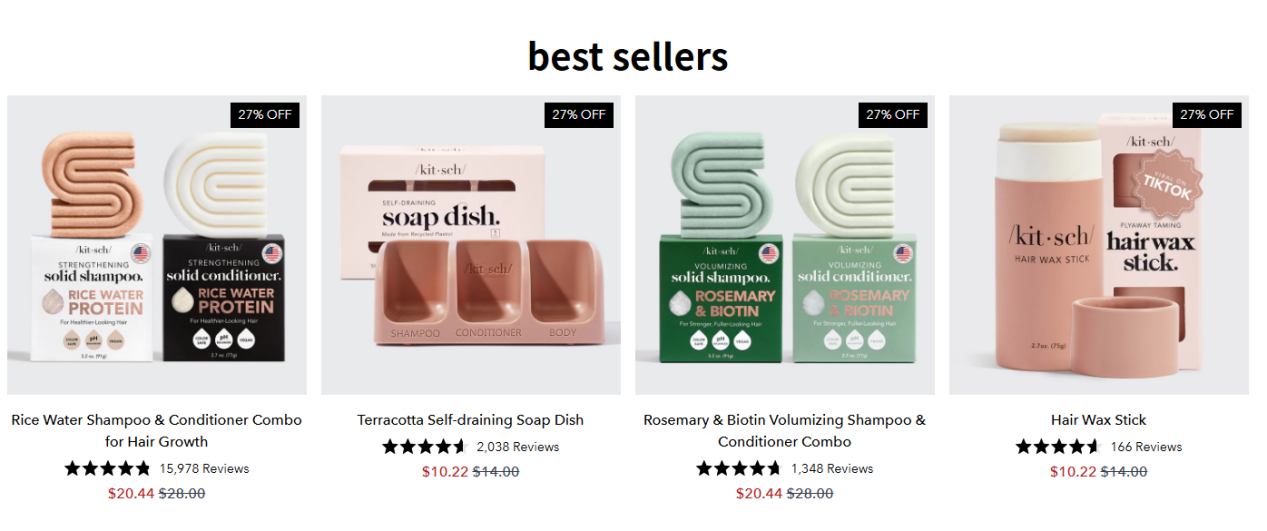

The early flexible customization model quickly built the brand's reputation. Over 14 years, Kitsch expanded from hair accessories to full categories of hair care, skincare, and lifestyle products, with more than 320 products covering 27 countries and 27,000 retail stores worldwide, including chain giants like Ulta Beauty and CVS.

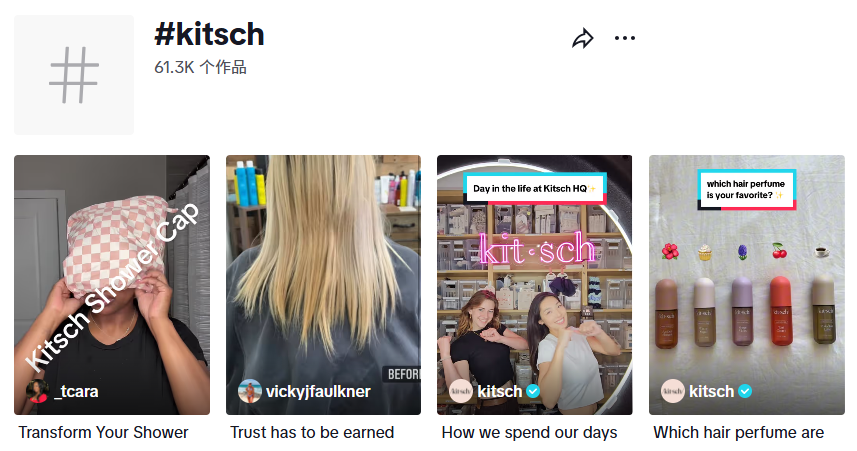

In 2023, its global sales reached $120 million, up 25% year-on-year, with online channels accounting for 65% and monthly visits to its independent site exceeding one million. Core products such as satin heatless curling sets and solid shampoos have long ranked among Amazon's bestsellers. The TikTok hashtag #kitsch has accumulated over 61,300 posts, becoming synonymous with “healthy hair care” for Generation Z.

Image source: TikTok

“Dual Drivers” of Industry Trends and Market Demand

The explosion of the Kitsch brand cannot be separated from two major trends: “sustainable consumption” and “social media e-commerce.”

According to third-party platform data, the global beauty and personal care market is expected to generate $677.19 billion in revenue by 2025, with the market projected to grow at a compound annual growth rate of 3.37% (2025-2030).

Image source: Statista

Among them, the proportion of consumers aged 18-35 is increasing year by year. Their demand for eco-friendly, cost-effective, and aesthetically pleasing products has spawned a trend of “practical aesthetics.” Under such market conditions, Kitsch has entered with zero-waste packaging and reusable designs (such as fabric hair ties), priced at $5-30, filling the gap between traditional hair accessories and high-end eco-friendly brands.

Image source: Kitsch

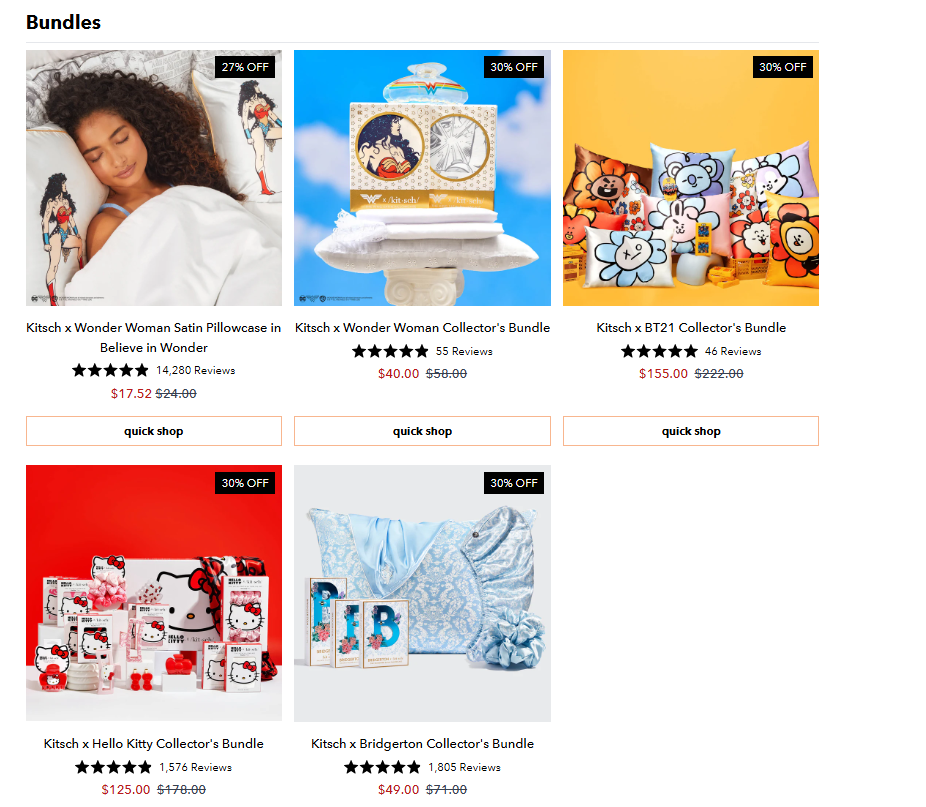

Meanwhile, the “content e-commerce” model has also reshaped the consumer chain for the brand's subsequent development. Kitsch seized this opportunity by leveraging influencer recommendations, IP collaborations (such as Hello Kitty and Wonder Woman), and retro aesthetic content to embed products into users' daily scenarios.

Image source: Kitsch

Multi-Platform Strategy: Full-Penetration from Traffic to Brand

Kitsch's overseas expansion does not rely on a single channel, but rather builds an ecosystem closed loop through “social media traffic + independent site retention + omni-channel coverage.”

-TikTok

Kitsch uses TikTok as its core battleground, mainly completing overall operations through influencer promotion and live-streaming sales.

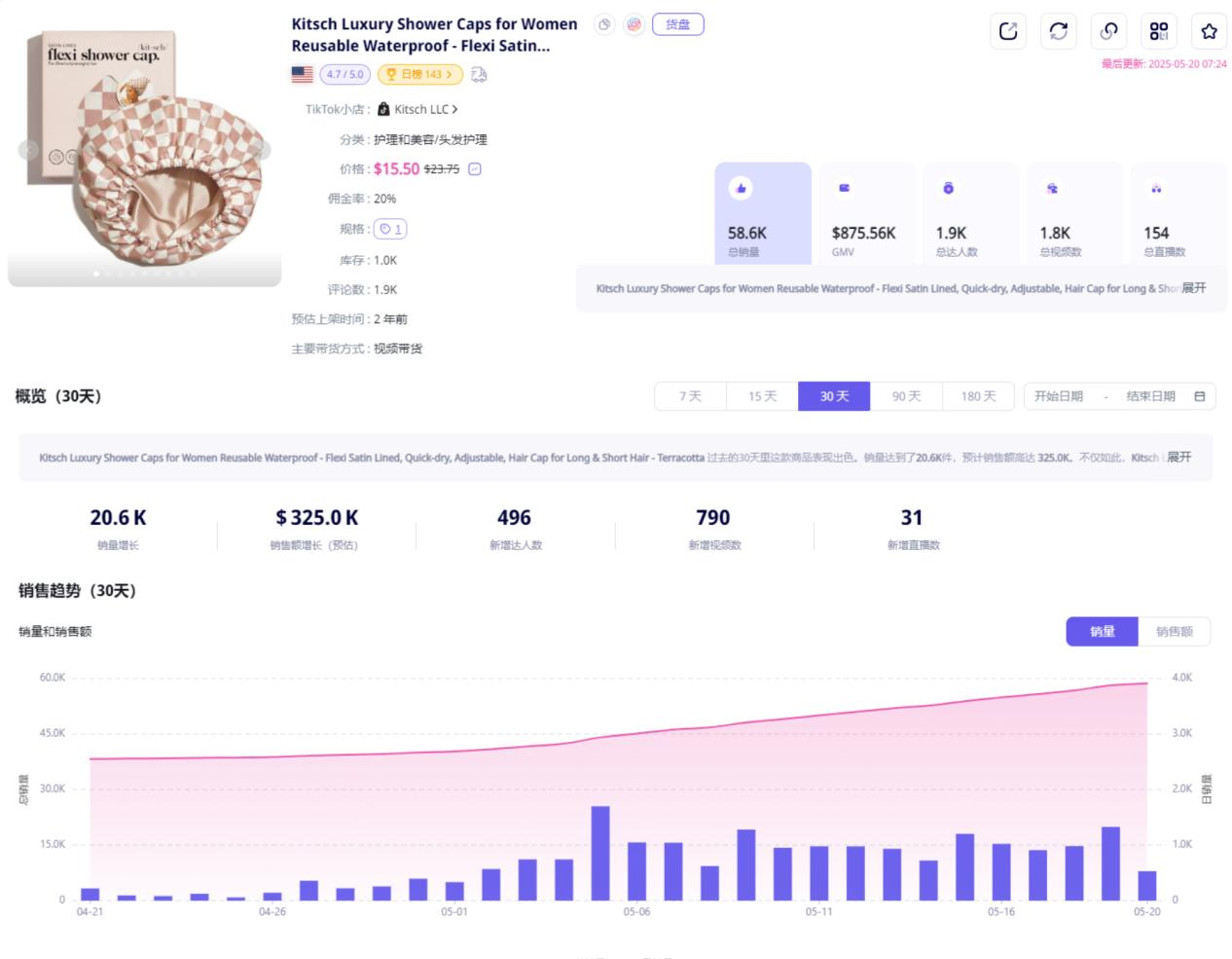

Taking the recently popular Kitsch women's retro dry hair cap as an example, in the past 30 days, there have been 496 new influencers, a total of 790 sales videos, and 31 live streams, with estimated sales reaching $325,000, confirming the effectiveness of the “high-frequency content exposure + scenario-based instant interaction” strategy in accelerating user decision-making.

Image source: Echotik

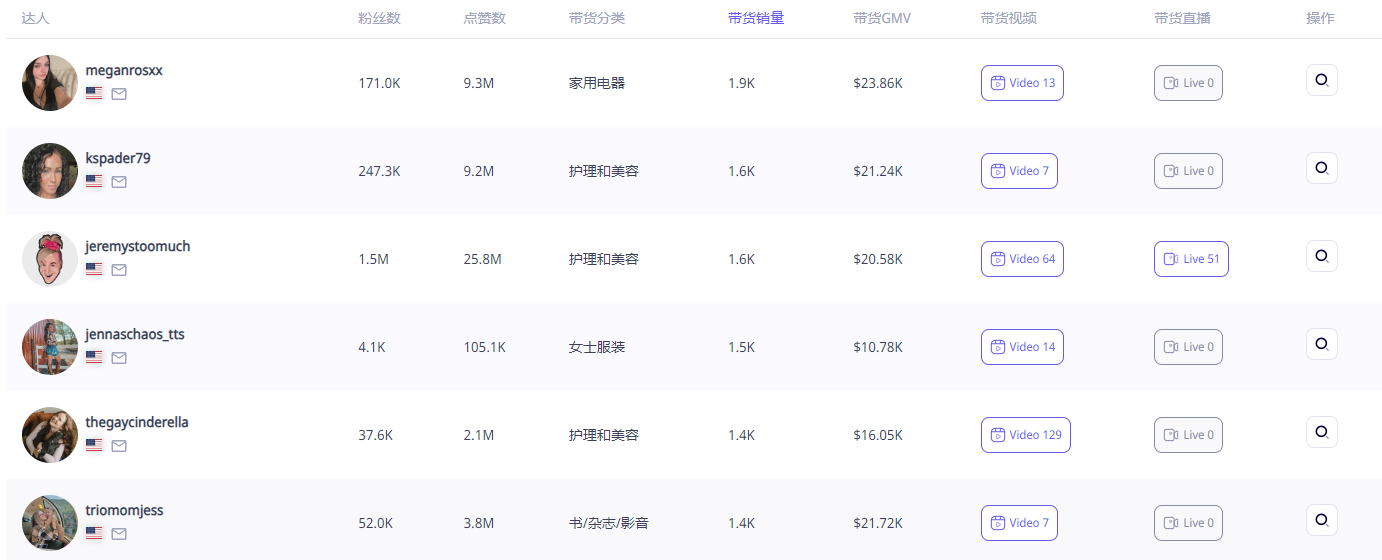

In terms of influencer selection, from the brand's associated influencer list, it can be seen that Kitsch does not stick to the size of follower counts, but rather uses “vertical matching + scenario adaptation” as its core standard.

This layered cooperation model quickly builds trust through top influencers' influence, while high-frequency reach by mid-tier influencers penetrates niche groups, ultimately forming a “wide coverage - strong penetration - high conversion” communication path.

Image source: Echotik

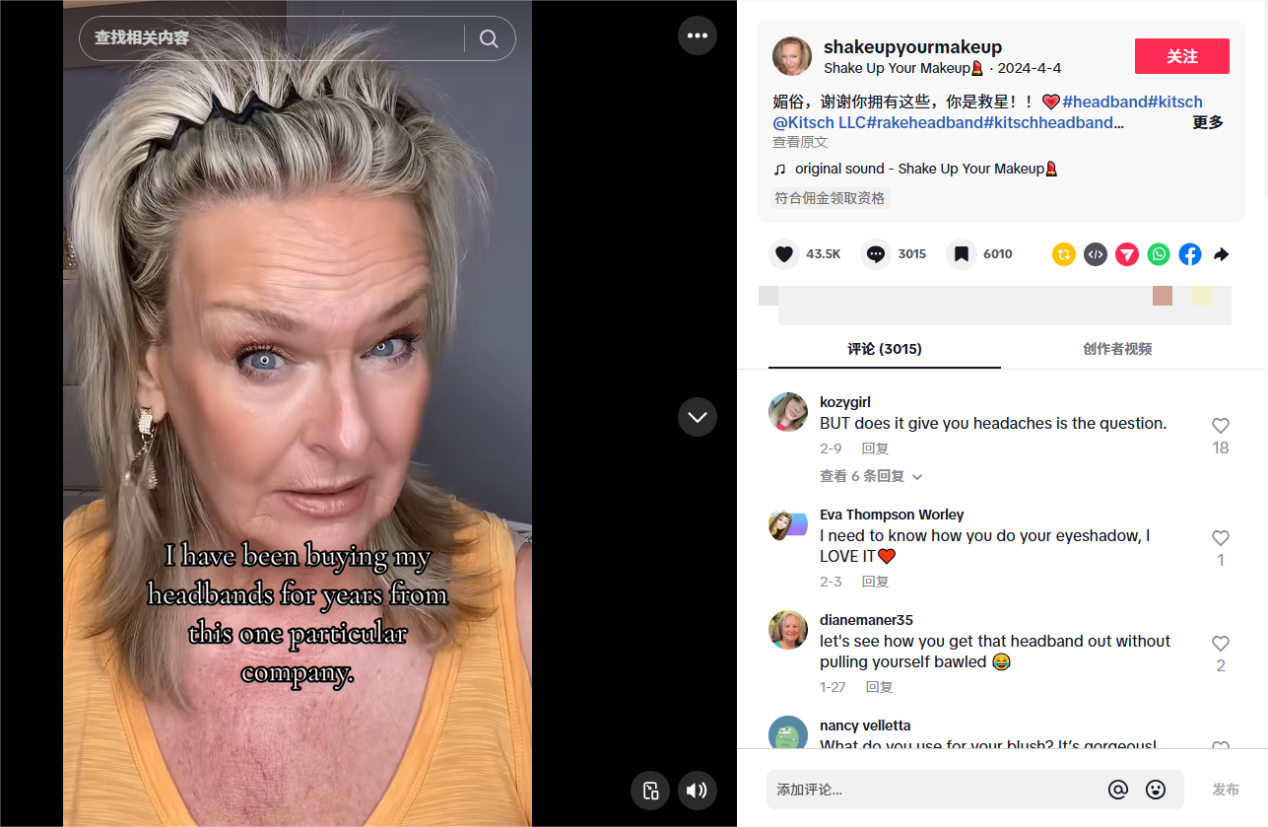

Take TikTok influencer @shakeupyourmakeup as an example. Although this influencer has only 73,500 followers, during cooperation with Kitsch, a single video achieved a record 12.5 million views, bringing considerable traffic and attention to the brand.

Image source: TikTok

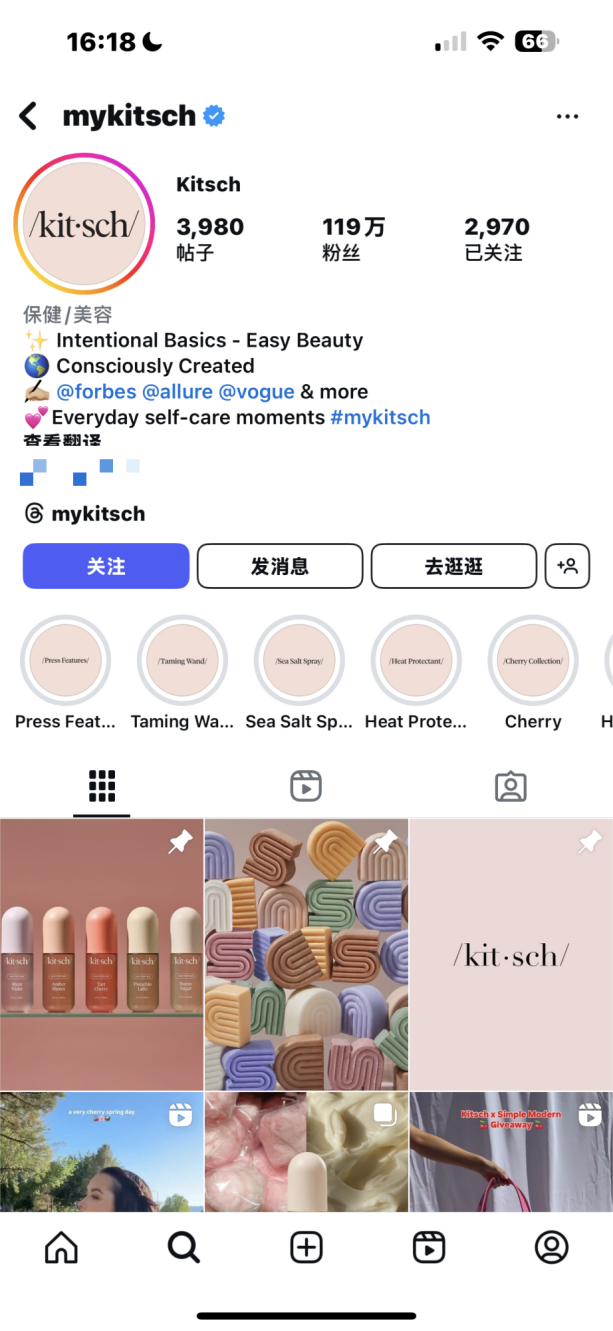

Unlike TikTok's traffic-driven promotion, Kitsch's Instagram operations always revolve around “visual storytelling.” According to the account homepage, the brand has posted 3,980 posts, attracting 1.19 million followers.

Its content focuses on hair care, beauty, and lifestyle fields. From its long-standing “retro fashion pioneer” positioning, products are presented through scenario-based photo shoots to create a “refined utilitarian” image.

Image source: Instagram

-Independent Site

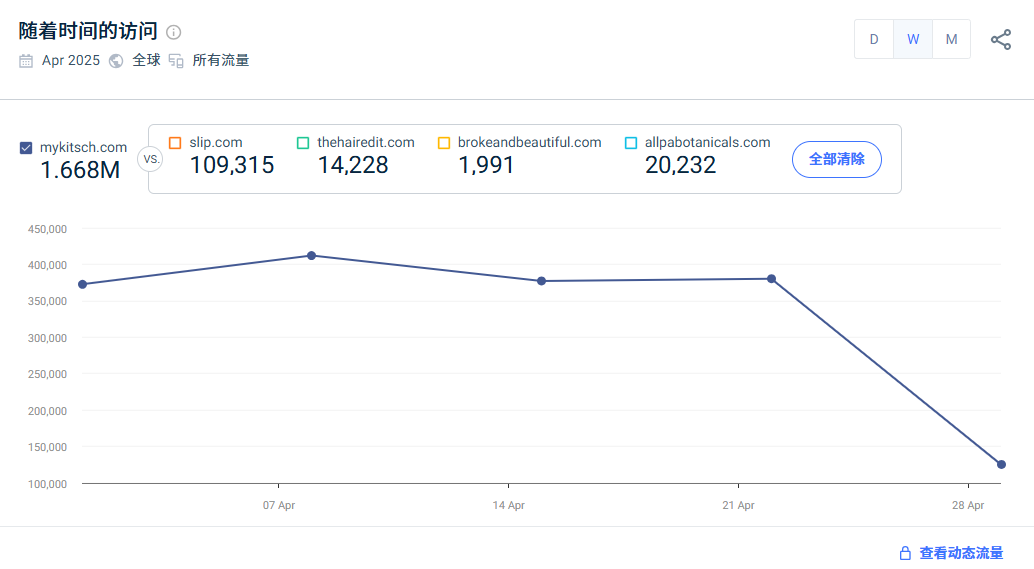

Kitsch's independent site is not only a sales channel but also a brand experience center. As of April 2025, through its membership system, limited-time collaboration launches, and user UGC collection, the site's total visits reached 1.668 million. Despite a 22.7% month-on-month decline, it still leads its track by an absolute advantage.

Image source: similarweb

In terms of traffic structure, direct traffic accounts for 41.58%, and social traffic accounts for 25.59%. It is evident that the brand's operations with TikTok and Instagram have formed a synergistic effect.

This “de-platforming” strategy not only reduces reliance on third-party channels but also provides data support for personalized marketing.

Image source: similarweb

Conclusion

The overseas market is not “winner takes all”; precise positioning, deep social media cultivation, and omni-channel operations can still break through. For Chinese companies, going global is not just about selling products, but about expressing brand value worldwide.

Today, the global consumer market is undergoing a new round of reshuffling. Whether it is the social media dividend in Southeast Asia or the rigid demand for sustainable products in Europe and America, both provide Chinese brands with opportunities to “overtake on a curve.” But behind the opportunities lies a triple test of product strength, content strength, and compliance. The story of Kitsch tells us: there are no shortcuts to going global; only those who cultivate value deeply can weather the cycles.