If the keyword for China's content industry in the past few years was "stock competition," then in 2025, more and more companies will begin to look for new growth areas, and short drama going overseas is becoming a proven effective path.

Image source: Internet

According to Sensor Tower's "2025 Short Drama Overseas Market Insight Report," the revenue and user scale of global short drama apps are experiencing rapid expansion.

By the first quarter of 2025, the cumulative in-app purchase revenue of global short drama apps had reached $2.3 billion, with single-quarter revenue in Q1 2025 alone reaching $700 million, nearly four times higher than Q1 2024.

Meanwhile, downloads are also climbing rapidly, with Q1 2025 downloads surpassing 370 million, 6.2 times that of the same period last year.

Behind this is a brand-new content form that is crossing cultural, linguistic, and technological boundaries, rapidly penetrating globally.

Unlike traditional long-form videos that require heavy production, high investment, and low frequency, short drama apps achieve the business logic of "fast content + fast feedback" through high-density plot arrangement, lighter production formats, and clearer monetization models.

Image source: Sensor Tower "2025 Short Drama Overseas Market Insight Report"

Monetization in the US, Traffic Acquisition in Latin America: Differentiated Operational Strategies Across Regions

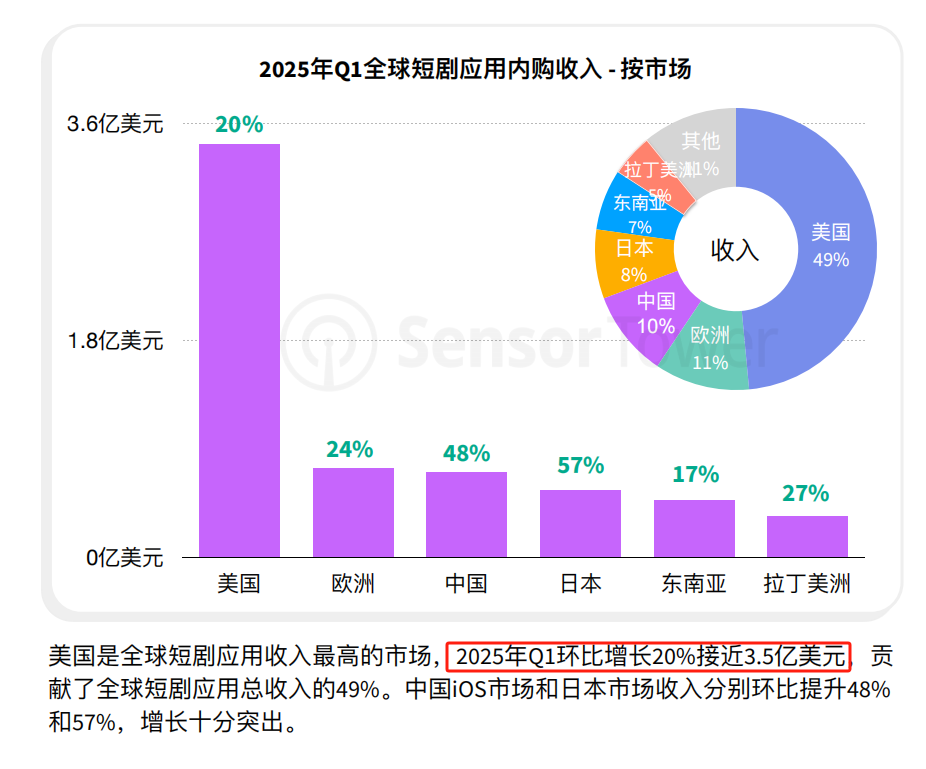

Among all markets, the United States is currently the most important revenue source for short drama apps, with Q1 2025 in-app purchase revenue reaching $350 million, accounting for 49% of global total revenue. The relatively mature mobile payment environment and content payment habits make it easier for products that achieve paid conversion paths in the US market to gain capital and operational support.

In Latin America and Southeast Asia, although overall payment capability is limited, the user scale and growth rate have great potential. The report shows that Latin America's Q1 2025 downloads grew 69% quarter-on-quarter, Southeast Asia grew 61%, and together they contributed 51% of global short drama app downloads.

App publishers adopt significantly different strategies in different markets: in high ARPU markets such as the US and Japan, they focus on VIP subscriptions and one-time purchases with high-frequency IAP (in-app purchase) logic; while in Latin America and Southeast Asia, the focus shifts to ad monetization and high-frequency daily active maintenance. The modular content structure of short drama apps provides great room for adjustment.

Image source: Sensor Tower "2025 Short Drama Overseas Market Insight Report"

Multiple Apps Compete: Leading Pattern Emerges but Still Uncertain

In Q1 2025, "ReelShort" and "DramaBox" remain at the top of the overseas short drama market in terms of revenue and active users.

Among them, ReelShort's cumulative in-app purchase revenue reached $520 million, DramaBox reached $470 million, ranking first and second in revenue respectively. Both share the characteristics of early market entry, stable content reserves, and have gradually established a certain level of user brand awareness.

Meanwhile, a group of new entrants are catching up quickly. "FlickReels" saw quarterly revenue grow 375% year-on-year, while "NetShort" and "StardustTV" also showed outstanding growth in downloads and revenue.

Most of these products were launched in the second half of 2024, with rapid product iteration and aggressive marketing strategies, making them typical "latecomer advantage" cases.

Image source: Sensor Tower "2025 Short Drama Overseas Market Insight Report"

"DramaWave": A Standardized Breakthrough Sample

Take "DramaWave" as an example. This product, released by the Chinese team SKYWORK AI, has achieved 53 million downloads and $47 million cumulative in-app purchase revenue from its launch in September 2024 to the end of April 2025.

Its rapid growth relies on two points: first, dramatic tension in content and localized language subtitle strategies; second, centralized operations in marketing.

During Q1 2025, more than 73% of its downloads came from paid acquisition, with 98% of ad displays completed via the Unity platform.

More interestingly, "DramaWave" accounted for 72% of its total downloads in the emerging markets of Southeast Asia and Latin America.

In these regions, Android device ownership is high, so 86% of downloads also come from Android. These data indirectly confirm that emerging markets are becoming important support points for medium and light content products.

Image source: Internet

Social Media and Advertising Channels Become New Levers for Expansion

In terms of app promotion paths, short drama products increasingly rely on social platforms for user penetration. Social media represented by TikTok is providing additional amplification effects for short drama apps.

Sensor Tower data shows that "DramaWave" ad audiences in the US are twice as active on TikTok as the general population. Leading products such as "DramaBox" and "ReelShort" have already built a fan base of millions on social platforms.

However, social is only one part; more important is still the matching mechanism between content and marketing.

The report points out that in Q1 2025, the top ten short drama apps are all strongly marketing-driven products, most of which rely on ad networks such as Unity and IronSource to acquire initial traffic, and then achieve retention and conversion through refined content selection.

Image source: Internet

Content Structure Moves Towards Platformization, "Drama Within Drama" Model Provides Long-Term Flexibility

The development of short drama products is shifting from single-hit dramas to platform-based content operations. Platforms such as "GoodShort" and "ShortMax" have launched more than a dozen "drama within drama" series, allowing users to freely switch and watch by horizontal sliding.

The report also points out that these content platforms mostly adopt real-time data feedback mechanisms, quickly adjusting homepage content based on click-through rates, viewing duration, and conversion rates in different markets.

This system has higher response speed and localization adaptability than traditional film and television products. To some extent, short drama products are no longer just "content going overseas," but more like "operational systems going overseas."

Image source: Internet

Going Overseas Is Not the End, But a Challenge of Systematic Capability

Although the data shows that this wave of short drama going overseas is impressive, it is not hard to see its underlying fragility: current success is mostly built on highly concentrated paid acquisition, high-frequency updates, and strong operational rhythm, and has not yet truly entered the "brand building" stage.

How to continuously build product vitality and enhance user loyalty under different cultural and legal systems will be an unavoidable issue for all overseas companies.

Especially as global market regulation tightens, advertising costs rise, and content differences widen, the challenges faced by Chinese short drama teams go far beyond technology and marketing, but also whether they can build a long-term healthy product structure and localization strategy.

In the future, only by moving from "hit thinking" to "system building" can companies better gain a foothold in the global market.