In the past, when people mentioned Saudi Arabia, many people's first impression was still the "oil kingdom," a Middle Eastern country with the world's largest oil reserves and immense wealth.

However, as the "Vision 2030" continues to advance, this traditional image is gradually loosening. More non-oil industries are being encouraged to develop, and more foreign companies are beginning to focus their attention here.

For Chinese companies, Saudi Arabia is not a new market at present, but it is a market that needs to be re-understood.

If going overseas to Saudi Arabia in earlier years meant that doing business had to be related to energy, now it is new energy, AI, intelligent manufacturing, electric vehicles, healthcare, fintech, education and training, and even e-commerce and food delivery platforms—all can find entry points in Saudi Arabia.

Image source: Google Maps

Behind policy openness is structural reshaping

From a macro policy perspective, the Saudi government is reshaping the national economic framework with an "open-door" approach. Measures such as "100% foreign ownership," "5-year tax exemption," and "land and tariff incentives" have become labels of Saudi investment attractiveness.

This is not just empty talk. The Saudi Ministry of Investment (MISA) has been established as the core institution for one-stop approval of investment projects, and the entry channels for different fields are now clearer. For example, finance must go through SAMA, energy must communicate with the Ministry of Energy, while most emerging industries can directly connect with MISA.

Image source: Horizons "2025 Saudi Arabia Going Global White Paper"

Compliance is the first test for market entry

In the process of landing in Saudi Arabia, companies inevitably face a core issue: how to ensure labor compliance?

According to the Labor Law, Saudi Arabia implements two types of employment contracts—fixed-term and indefinite-term contracts. Most foreign companies choose fixed-term contracts in the initial stage, with a maximum term of 2 years and one renewal, but after 4 years, it must be converted to an indefinite-term contract.

All contracts must be written in Arabic, with an English version attached. At the same time, the termination mechanism during the contract period, overtime restrictions, and wage payment cycles are all strictly regulated by law.

These details are not complicated, but if ignored, they may cause unnecessary compliance risks in actual operations.

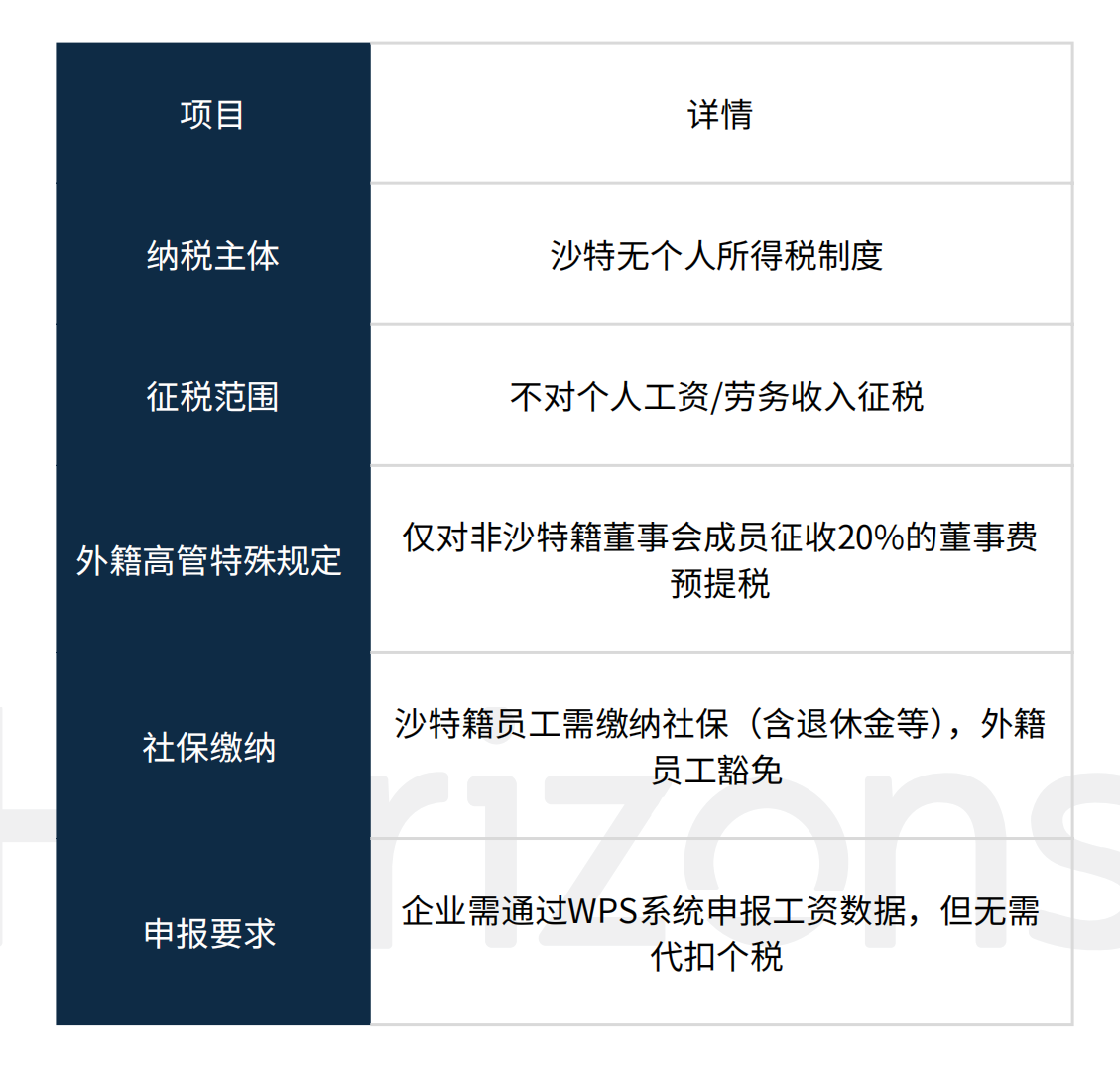

Although Saudi Arabia does not have personal income tax, employers must bear multiple costs including social insurance, visas, and work permits. Especially for foreign employees, the average direct employment cost per person per year can reach tens of thousands of riyals.

In addition, if the number of foreign employees hired by a company exceeds the number of local employees, an "expatriate labor quota fee" of 9,600 riyals per person must be paid.

Image source: Horizons "2025 Saudi Arabia Going Global White Paper"

Cultural adaptability determines organizational stability

Cultural adaptation is another difficulty that is often overlooked. Although Saudi Arabia has made many social reforms in recent years, such as allowing women to legally drive and participate in the workplace, society as a whole is still deeply influenced by Islamic traditions.

For example, working hours must include prayer breaks; during Ramadan, government agencies and companies must suspend operations at iftar; in some workplace settings, gender segregation is still an informal consensus.

Foreign employees who are unaware of these unwritten rules can easily cross the line unintentionally.

In addition, even taking photos in the office, dress code in meetings, and which hand to use when handing over a business card all have certain etiquette requirements.

Therefore, when a Chinese company builds a team in Saudi Arabia, in addition to HRBP understanding the regulations, the operations team needs to have basic respect and coping skills for the local culture.

Image source: Horizons "2025 Saudi Arabia Going Global White Paper"

Employee living systems: Don't wait for problems to arise before paying attention

On the living side, there are also many practical obstacles. For example, in terms of payment systems, although Mada cards, Apple Pay, and STC Pay are already very popular locally, for newly arrived employees, handling local bank cards, opening mobile phone numbers, and obtaining Iqama residency status are still complicated processes with cumbersome verification steps.

And the foundation of all these services is based on the premise that the relationship between employee and employer is legal and compliant, with complete materials and unified information.

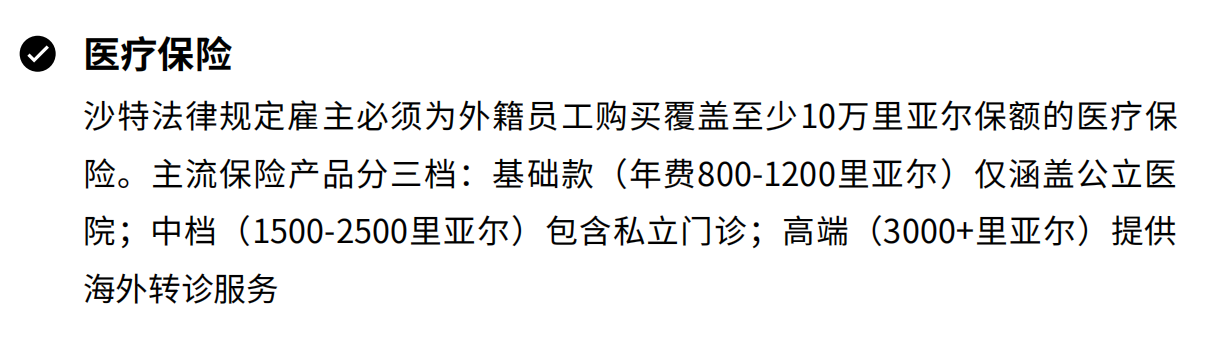

According to Saudi law, companies must purchase medical insurance for foreign employees, with a minimum coverage of 100,000 Saudi riyals. The basic plan can only be used in public hospitals, while mid-range and high-end insurance cover private clinics and emergency services.

Although public hospitals are low-cost, waiting times are long. If a company assigns employees to work in Saudi Arabia for the long term, it is recommended to determine the appropriate insurance level and recommended hospital list before onboarding to avoid being caught off guard in emergencies.

Image source: Horizons "2025 Saudi Arabia Going Global White Paper"

As for urban transportation, Uber and Careem (a local ride-hailing platform) are already quite popular, but female employees still need to consider cultural sensitivities in some areas. Careem's recently launched "female driver service" has become the first choice recommended by many companies for female expatriate employees.

In addition, although Saudi Arabia drives on the right and the roads are wide, drivers tend to have aggressive driving habits, and frequent sandstorms occur. Companies usually advise new employees to avoid driving themselves and to rely on professional drivers or ride-hailing services, at least in the initial period.

Image source: Horizons "2025 Saudi Arabia Going Global White Paper"

Saudi Arabia is a market map that needs to be "read"

Overall, Saudi Arabia is a market that is both challenging and has huge potential.

It is indeed not as "familiar" as Southeast Asia, nor as "institutionalized" as the European and American markets. But it has policy space, demographic dividends, and real needs for industrial transformation.

Whether you can gain a foothold here often depends not on marketing ability, but on your understanding and coordination of multiple dimensions such as people, culture, policy, compliance, and daily life.

Future overseas companies will not only export products and capital, but also a comprehensive adaptability. The key is whether they can maintain resilience and efficiency in foreign systems, cultures, and social contexts.