Mr. Liang Qichao once said: "A hundred years of life is founded on early education."

Early education influences the beginning of a person's life, and as scientific parenting concepts gradually gain popularity, early education toys have rapidly developed into a formidable industry in the global market.

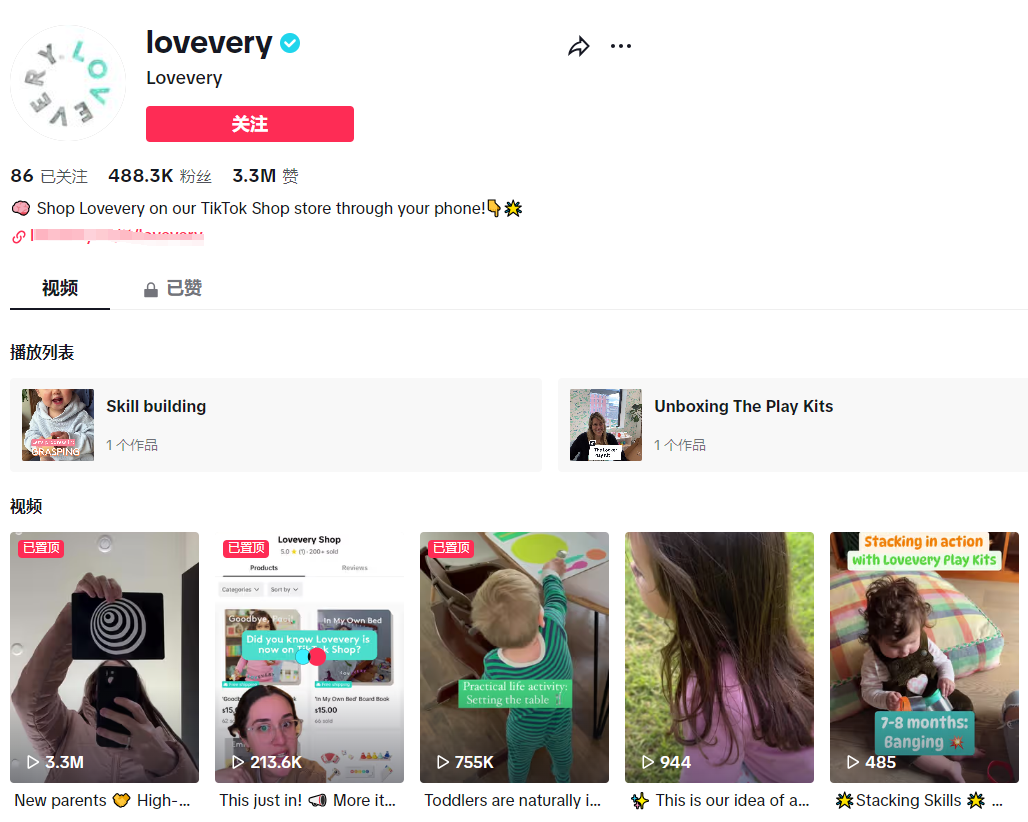

Lovevery, an American toy company, is an outstanding early education toy brand.

In the past five years, it has received $20 million in Series B funding and $100 million in Series C funding. By the end of 2021, its valuation had already exceeded $800 million!

By the end of 2022, it went public through an IPO, leaping to become a capital giant among early education toy brands.

However, Lovevery was only founded in 2017. In just a few years, how did this brand, known for its innovative subscription-based early education boxes, achieve such success?

01 Winning Users' Hearts Fundamentally

We can take a look at Lovevery's development history.

Since its inception, Lovevery has followed the Montessori educational philosophy, focusing on the growth needs of children aged 0-4. Through subscription-based early education boxes, it provides toys and books tailored to different developmental stages, promoting multi-sensory development in infants and toddlers. This was a significant gap in the huge demand of the early education market at the time.

Later, Lovevery kept pace with the times, directly addressing user pain points by launching products such as play toys, play gyms, block sets, and furniture for storing toys, allowing parents to choose according to their baby's age.

In addition, Lovevery provides comprehensive services for new parents, from toys to parenting knowledge, helping busy and inexperienced parents solve early education problems.

This is how it fundamentally won users' hearts.

In terms of marketing, Lovevery not only sells through its official website but also opened an Amazon store and entered retail channels such as Target and Babylist, distributing its products to 32 countries worldwide.

In recent years, it has also entered global social media platforms like TikTok, continuously updating product usage videos to attract more customers. As of the time of writing, Lovevery's main account on TikTok has accumulated 488,300 followers and received over 3.3 million likes.

02 Strong Momentum in the Early Education Toy Track

Lovevery's current status is not only due to its own operations, but also closely related to theexternal market environment.

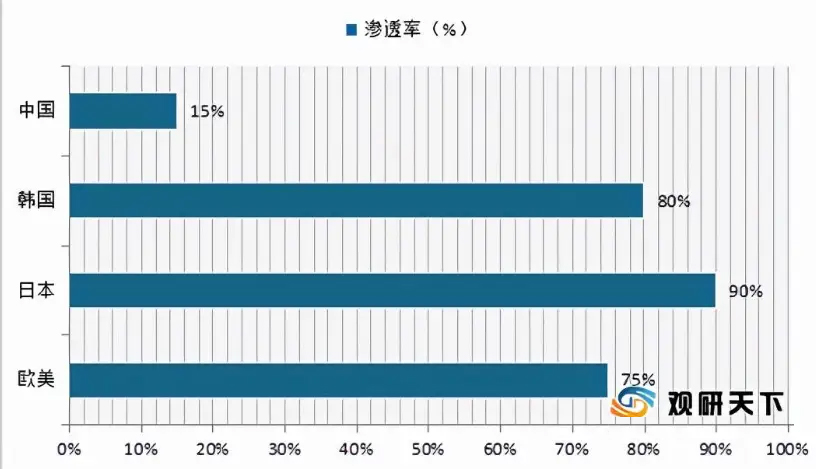

The European and American markets differ from the domestic market; early education demand in China started relatively late, and even by 2023, the penetration rate is only about 15%, while in Europe and America it has reached 75%, far surpassing the domestic market. Accordingly, market demand is much more apparent.

Therefore, now is the best time for cross-border expansion in the early education toy segment.

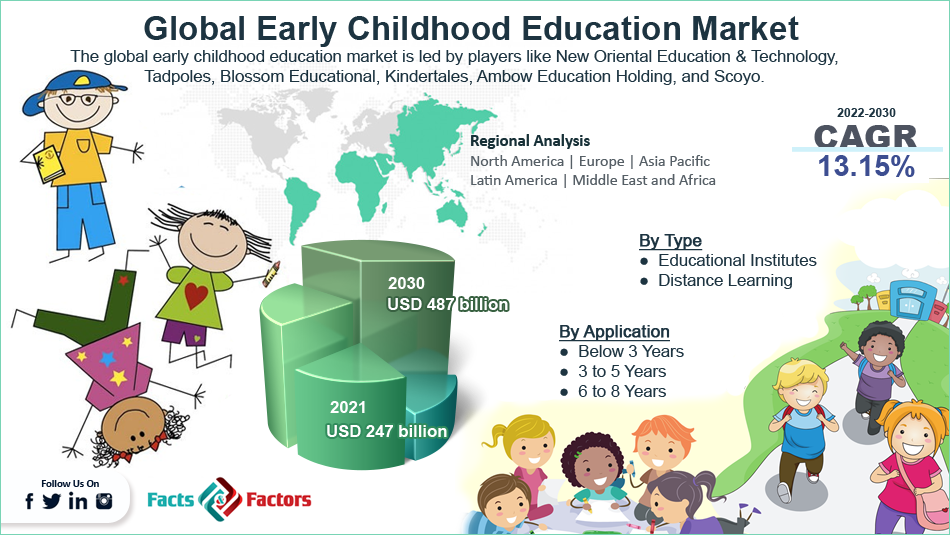

Market research also shows that from 2022 to 2030, the global early childhood education market is expected to have a compound annual growth rate of 13.15%, with the market size projected to reach $487 billion.

Despite the continuous decline in global birth rates, the potential of the early education market remains huge, especially in North America and Europe, where income levels are high and educational resources are abundant.

Expansion of the global early childhood education market size. Image source: facts

Of course, besides Lovevery, brands like Melissa&Doug and Fisher-Price in the US are also actively expanding their early education product lines, launching a variety of educational toys, from wooden puzzles to smart toys.

These toys include not only traditional physical toys but also educational hardware with smart features, such as Learning Resources' programmable robot mouse and interactive electronic devices, enabling children to learn programming and problem-solving skills while playing.

Domestic early education toy brands such as Logic Dog, Auby, GOODWAY, and Huohuotu are also popular in the market due to their unique product features. Some brands have even gone Tuke and are gradually expanding their global presence.

Overall, the early education toy market has broad development prospects. Whether on the B2B or B2C side, the overseas early education market has considerable capacity.

However, given the globalized market environment and cultural differences, early education brands still need to adapt to local conditions and formulate effective marketing strategies to attract international consumers. At the same time, brands should focus on continuous product and service innovation to meet the ever-changing consumer needs and educational trends.

In the future, with further innovation in educational methods and further expansion of the global market, the early education toy industry is expected to usher in more development opportunities.