In 2020, the GNC brand applied for bankruptcy protection due to debt issues.

This long-established company, founded in 1935 and having weathered 85 years of ups and downs, ultimately failed to keep pace with the times, falling behind and being washed ashore by the relentless waves of new competitors. There were even rumors at one point that “Hayao’s 2 billion yuan investment went down the drain.”

However, what no one expected was that in 2024, the GNC brand made a “full recovery,” soaring straight to the top of TikTok’s Black Friday hot-selling list,achieving a 160% GMV explosion in the first week.

Among them, a women’s nutrition pack product performed particularly well, selling 8,000 orders in just 9 days after launch, with total channel sales surging 50 times!

How did such an “old relic” in the health supplement industry manage to transform and “revive”?

It all started with that turning point.

Image source: GNC

The “Channel Dependence Syndrome” of a Long-established Giant

In 1935, Jewish immigrant David Shakarian founded Lackzoom Health Food Store in Pittsburgh, USA, with $500, focusing on natural honey and grains.

After the company was renamed General Nutrition Centers (GNC) in 1950, it capitalized on the post-WWII vitamin consumption boom, rapidly expanding through a “community store + membership” model. At its peak, it had over 6,000 stores worldwide, and when it was listed on the NYSE in 2011, its market value reached $4.6 billion.

David Shakarian Image source: Internet

But its success and failure both came from offline channels.

Although the GNC brand rose rapidly thanks to its offline stores, its excessive reliance on physical channels (accounting for 72% of total revenue) and severely lagging online presence (less than 5%) caused it to fall behind in the era of e-commerce.

In 2018, Harbin Pharmaceutical Group invested $299 million to acquire a 40.1% stake in GNC, attempting to reverse the decline, but failed to solve its core problems, and the GNC brand remained mired in difficulties.

In 2020, under the impact of the pandemic, GNC’s offline sales plummeted 34% year-on-year, and it was ultimately forced to apply for bankruptcy protection. At that time, it was like a giant beast trapped in cement, watching helplessly as DTC new brands ate away at the market.

Just when everyone thought this titan had met its end, a turning point appeared in 2024. That year, GNC bet on TikTok e-commerce, and in just three months, exploded sales of an online-exclusive product, with GMV surpassing $1 million, successfully achieving a “content-driven transformation” for the traditional brand.

Image source: Echotik

TikTok Breakthrough: From “Mom Brand” to Gen Z Favorite

As a health supplement company with nearly 90 years of history, GNC’s core advantage lies in its long-term accumulation of brand trust. However, this “old brand” image also brings certain challenges. For young consumers, it is often seen as a “brand for elders,” lacking resonance with the new generation of users.

Image source: GNC

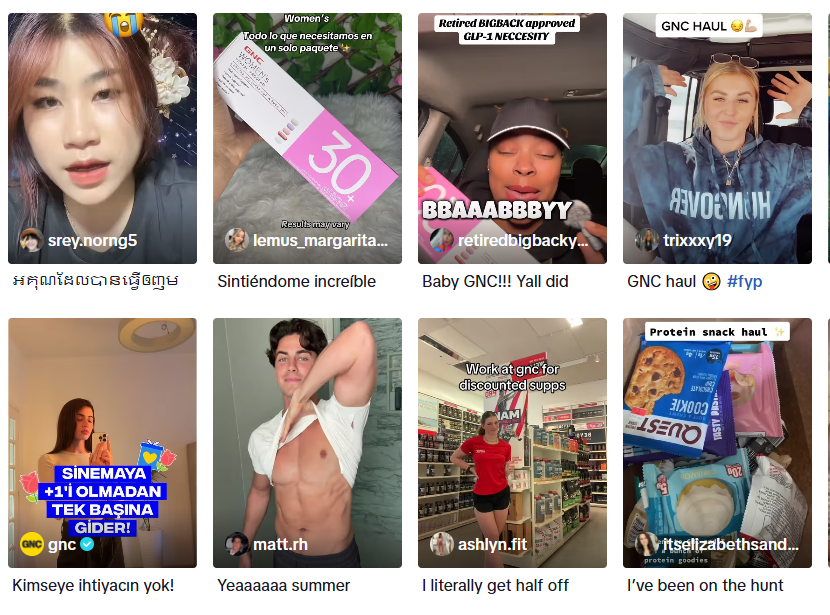

To break this cognitive barrier, GNC first adopted a strategy of co-creating content with influencers on TikTok, using short videos and other formats to visually showcase product efficacy and usage scenarios.

This content-driven strategy not only helped GNC reshape its brand image, but also brought it closer to the needs and preferences of young consumers.

Image source: TikTok

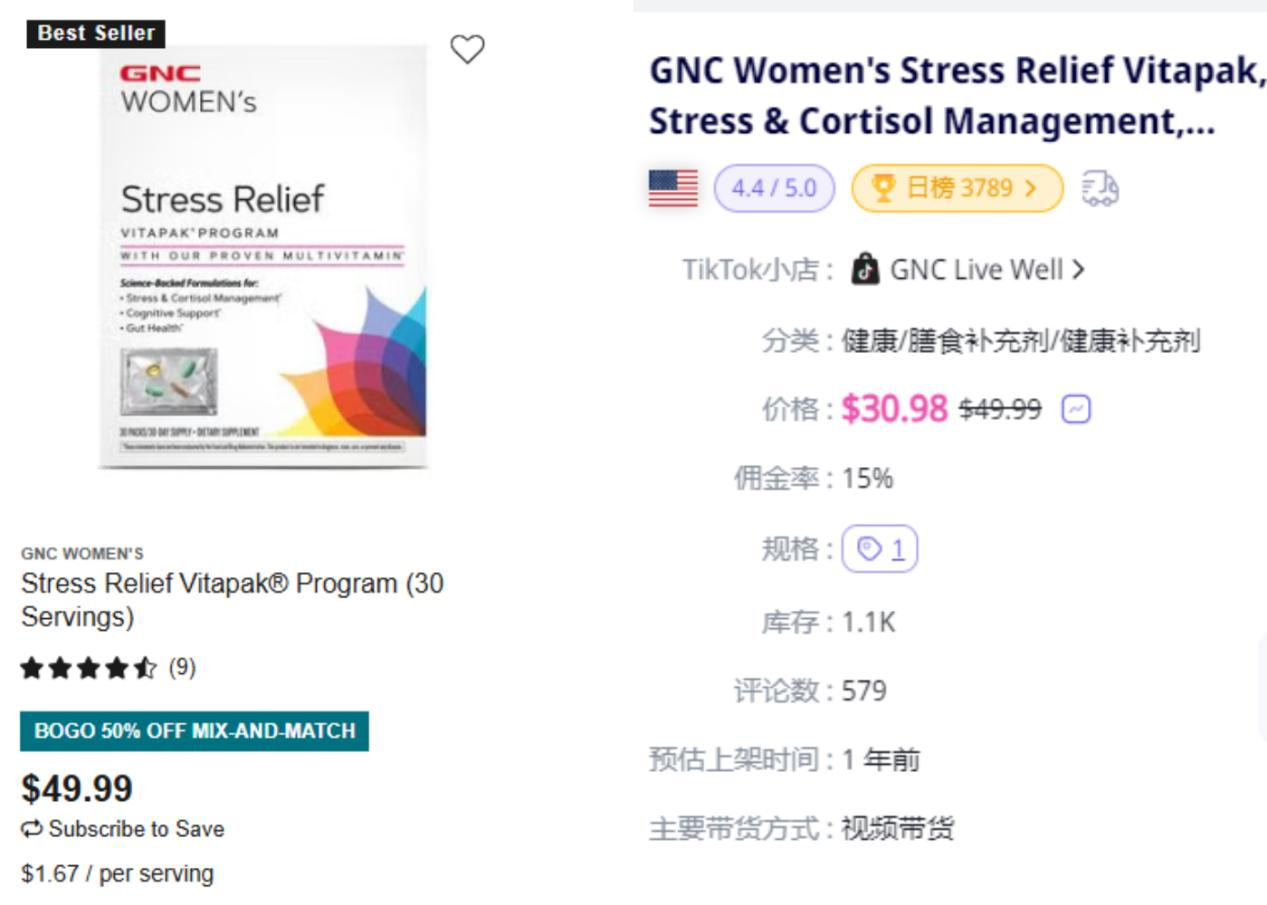

The effectiveness of this strategy was fully validated in September 2024, when GNC launched its first blockbuster product on TikTok, “Woman Stress Relief Vitapak.” It took only a week and a half from launch to sell out, with sales exceeding 8,000 orders, making it a hot item on the platform.

So far, this product has sold about 12,000 orders, with a total GMV of $345,900.

Image source: Echotik

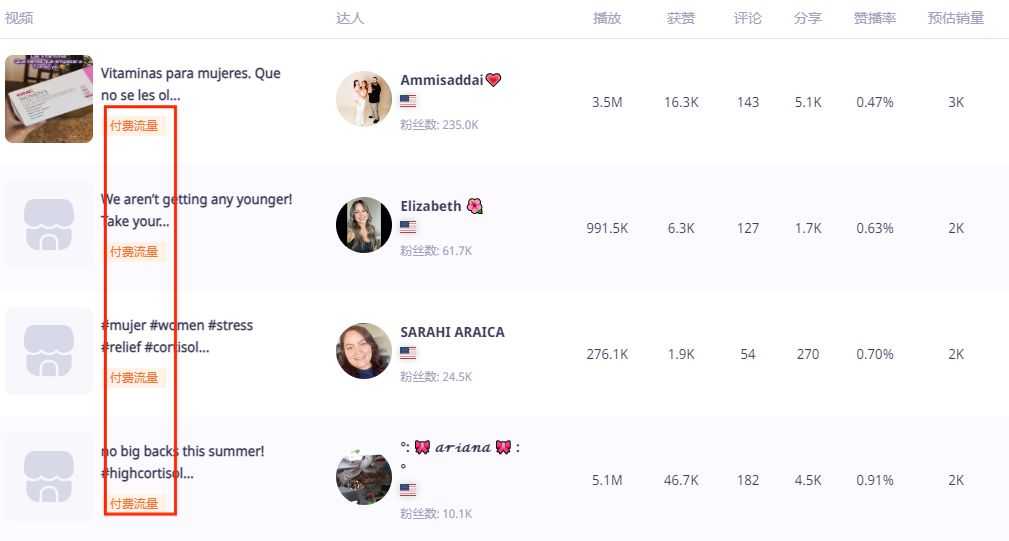

During operations, GNC’s content marketing strategy has always been flexibly and dynamically adjusted around different stages of the product lifecycle.

In the early stage of product promotion (when sales are less than 1,000 orders), influencer content mainly focuses on the core efficacy, applicable scenarios, and usage methods of the product. When sales enter the explosive period (sales reach more than 3,000 orders), the content focus gradually shifts to price advantages and promotional information, further driving users to make purchase decisions through “price comparison” strategies.

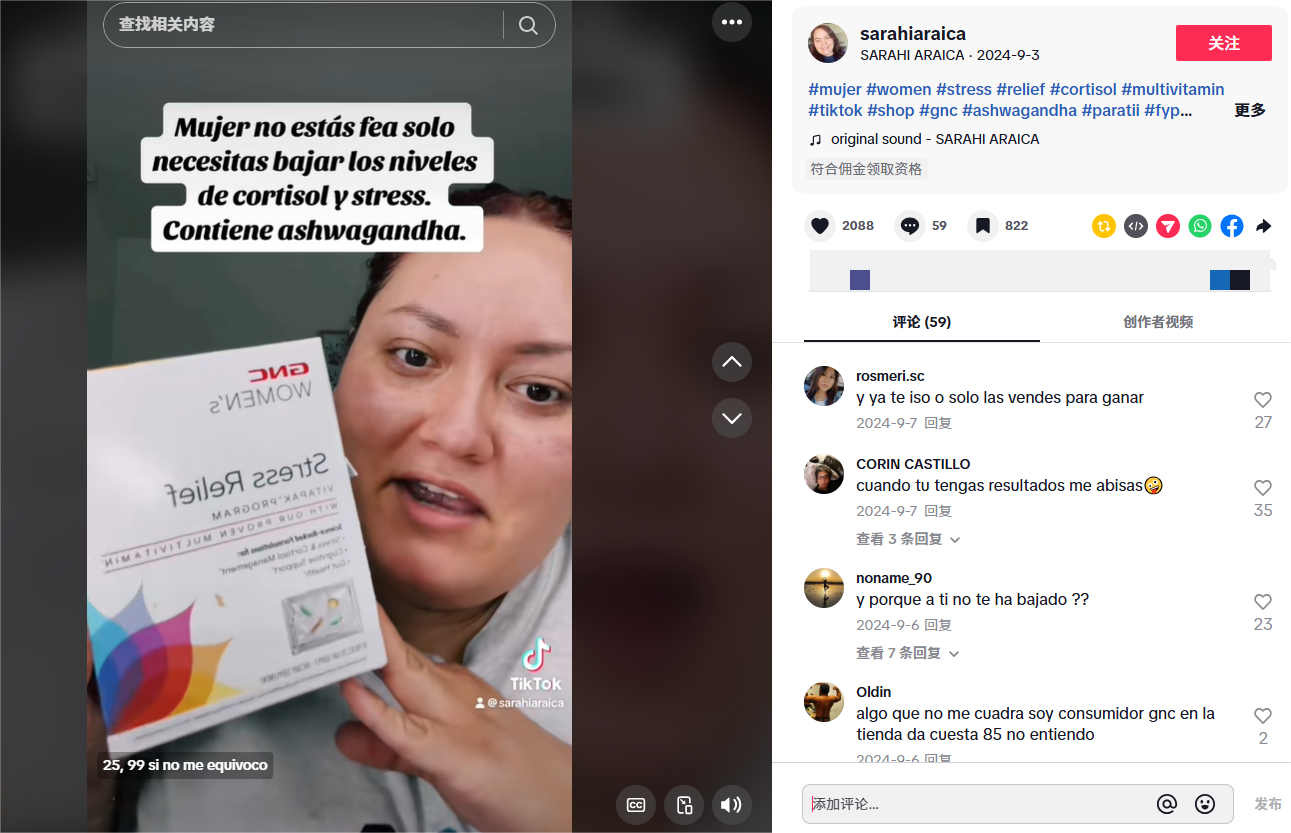

For example, TikTok influencer @SARAHI ARAICA published a video in September using “price comparison” content for promotion. This video ultimately received 334,100 views, with estimated sales of 2,000 orders, bringing about $70,600 in sales for the GNC brand.

Image source: TikTok

In addition, GNC has strengthened TikTok Shop’s channel advantage through exclusive pricing strategies.

For example, its product “Woman Stress Relief Vitapak” is priced at $30.98 on TikTok Shop, while the official website and offline stores maintain the original price of $49.99 (prices may fluctuate).

This price difference not only attracted a large number of online users, but also helped GNC achieve efficient traffic conversion within the platform.

Official website price (left) TikTok Shop price (right)

In addition to phased adjustments in content direction, GNC’s refined operations in influencer collaborations are also key to its success. Specifically, the brand divides influencer promotion into the following levels:

Top influencers set the brand image: Cooperate with top influencers who have high-quality content capabilities, ensuring content quality and consistency through paid invitations, and establishing a professional and trustworthy brand image.

Long-tail influencers test creative volume: Use a “sample + commission” model to cooperate with mid-tier and long-tail influencers, relax content control, encourage creativity, and explore more content possibilities.

Content placement maintains traffic effect: After influencers publish content, continue to amplify exposure through product cards and short video ads, ensuring traffic heat remains high.

Image source: Echotik

This layered operational strategy not only enhances the breadth and depth of content dissemination, but also continuously optimizes content direction through data feedback, providing strong support for GNC’s blockbuster product creation on TikTok.

Lessons from GNC for Chinese Companies Going Global: Multi-platform Deployment and Localization Are Key

GNC’s transformation reveals a clear path: traditional brands need to break channel dependence, use content e-commerce as a breakthrough, and achieve growth through localized operations.

For example, TikTok’s pulse-like traffic requires brands to quickly iterate content, while independent sites and offline channels need to undertake brand building and trust accumulation functions.

This path is equally instructive for Chinese companies going global,for Chinese companies, going global is not just about “selling products,” but also about cultural adaptation and value transmission.

Specifically, this can be reflected in two aspects:

First, content marketing: leveraging platforms like TikTok, using influencer recommendations and scenario-based content to lower user decision thresholds and quickly reach target audiences;

Second, data-driven: using tools or professional teams to analyze industry trends and competitor strategies, dynamically adjusting product selection and pricing to ensure brand competitiveness in overseas markets.

Image source: Internet

Conclusion: In the Era of Globalization 2.0, Content E-commerce Reshapes the Logic of Going Global

GNC’s comeback confirms a trend: with platforms like TikTok driving the way, overseas markets have entered a new stage where “content is channel.”

According to third-party platform forecasts, by 2025, transactions through social e-commerce will account for 17% of global e-commerce sales, compared to just 5% in 2021.

For Chinese companies, going global is no longer simply about “stocking goods,” but rather a competition of three capabilities: building brand awareness through content, driving localized operations with data, and using a flexible supply chain to respond to market changes.

As Gen Z becomes the mainstream of the global consumer market, whoever can tell product stories in their language will seize the initiative in the next round of global competition.

(Note: All information in this article comes from public reports and platform data; actual circumstances are subject to official information.)