Recently, Chinese trendy toys have sparked a craze in Thailand.

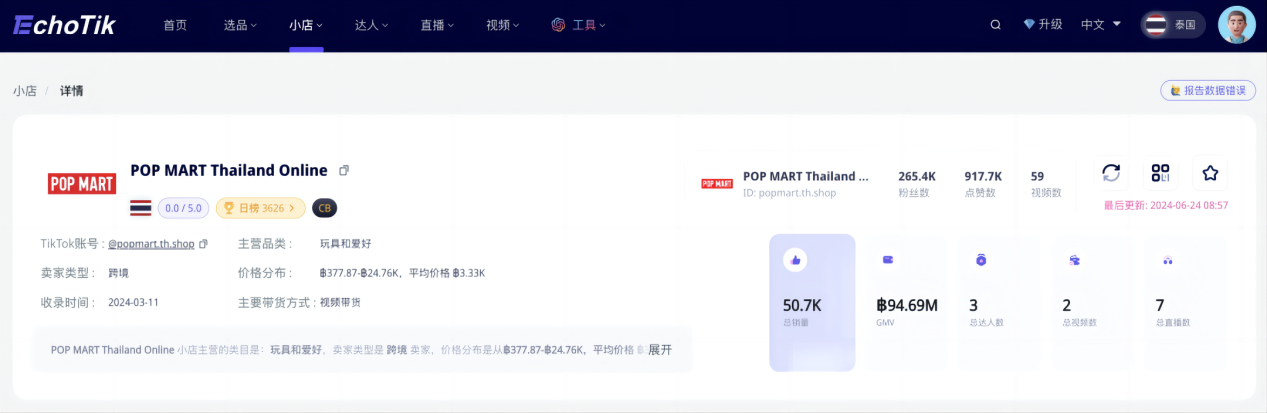

According to data from the platform Echotik, POP MART's TikTok Thailand store has recorded total sales ofover 50,000 items since it was included by Echotik in March this year!

Especially in the past 30 days, sales have surged, with nearly 28,000 items sold. This store (@POP MART Thailand Online) mainly relies on livestreaming, short videos, and product cards to promote sales, with hot-selling items priced mainly between 1,000-2,500 Thai Baht.

The best-selling single item in the past 30 days is a CRYBABY Powerpuff Girls series priced at 1.77K Thai Baht, which astonishingly sold 5,600 units!

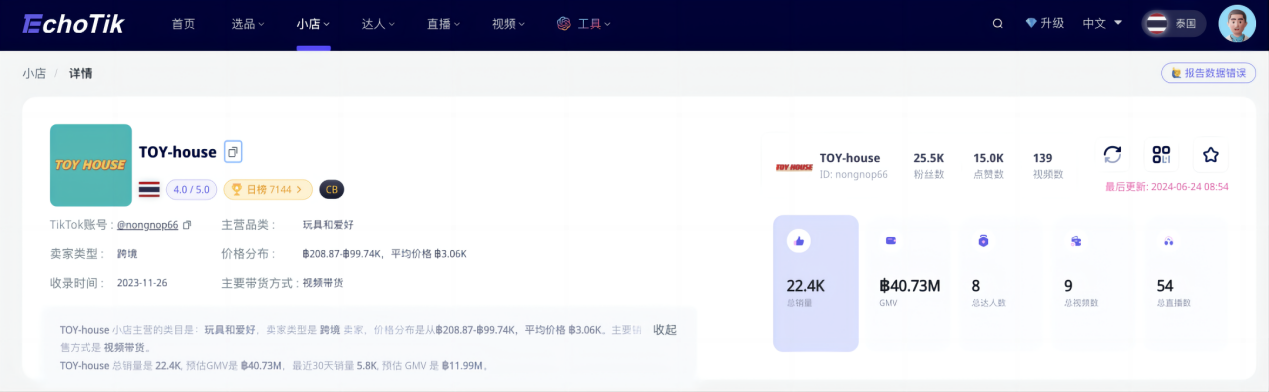

POP MART's situation is not unique in Thailand. According to Echotik data, a TikTok cross-border store called TOY-house (@nongnop66) has also seen a rapid increase in sales recently, growing to 22,400 items.

A hot-selling item launched in the store three months ago—the LABUBU Heartbeat Macaron series—has now sold nearly 5,000 units in total.Of these, 2,000 units were sold in the past month alone.

This shows that Chinese trendy toys are igniting the Thai market.

As for the reasons, part of it is because in April, Lisa, a member of the Korean girl group, repeatedly posted LABUBU trendy toys on Instagram, triggering a celebrity effect. This laid the foundation for trendy toys to explode in the Southeast Asian market.

Another reason is the current rise of trendy culture, with trendy toys gradually becoming a popular choice for young people to pursue trends and collect.

According to relevant department statistics, most trendy toy enthusiasts are concentrated between the ages of 15 and 40, accounting for 95%. Among them, more than 60% hold a bachelor's degree or higher.

This shows that trendy toys are not only more popular among young people, but also better meet the needs of highly educated individuals for trends and collections, serving as a social currency among like-minded circles.

Moreover, trendy toys often come in the form of blind boxes, adding fun and uncertainty, and increasing the sense of surprise in collecting, which is why they are loved by young consumers.

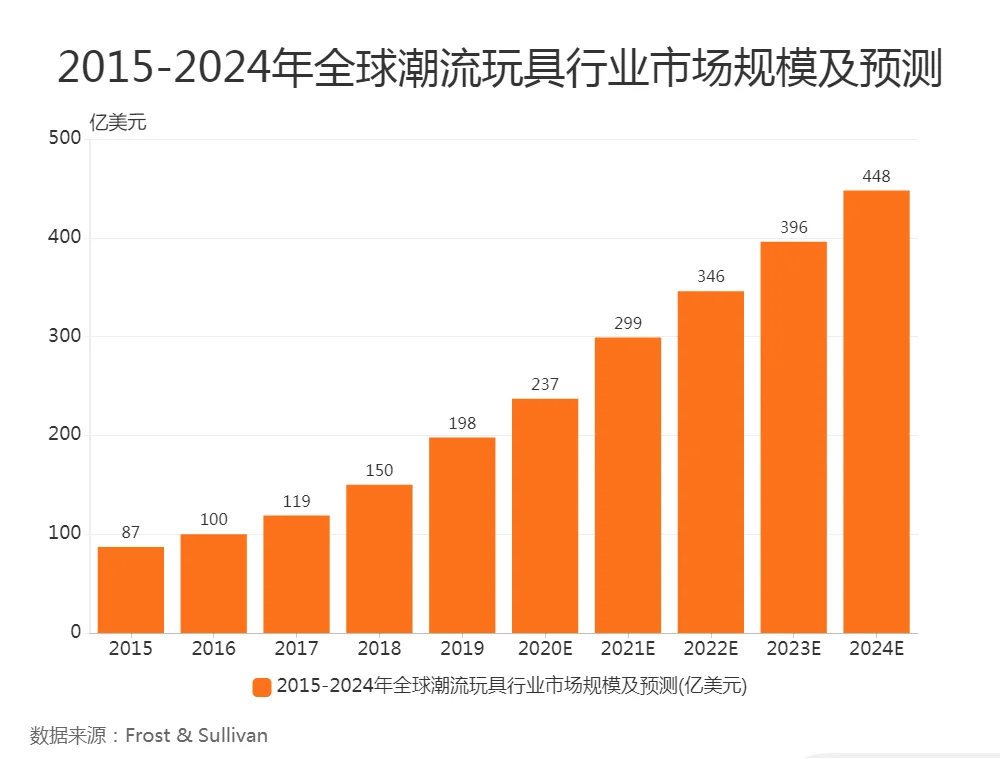

According to relevant data, the global trendy toy market size is expected to reach $44.8 billion in 2024. Among them, the Southeast Asian toy market continues to grow, with a market size of $5.64 billion in 2023, expected to grow to $6.52 billion by 2028, with an annual growth rate of 7%.

In 2023, the market size of Thailand's toy and game industry accounted for 14.35% of Southeast Asia, surpassing Hong Kong and Singapore in market volume, making it a hot spot for IP consumption.

This can be seen not only in the toy and game industry, but also in the film industry, where various major domestic IP films have been remade in Thailand. Moreover, the acceptance of IPs in Thailand is very high, which creates innate conditions for the domestic trendy toy market to go overseas.

Leading companies such as POP MART and 52TOYS have already laid out plans in Southeast Asia, and many cross-border sellers have begun selling Chinese trendy toys to Southeast Asia.

Of course, despite such a favorable external environment, there are still a few points to note when exporting trendy toys to Southeast Asia.

First is product localization. No matter which region or country you are exporting to, product localization is key to avoiding "acclimatization issues." For example, POP MART promotes different IPs to consumers in different countries.

For instance, to enter the Southeast Asian market, POP MART chose to collaborate with globally renowned IPs such as Minions and Sanrio, and signed local designers to incorporate local cultural elements into IP design. For example, CRYBABY created by a Thai designer entered the Top 2 of Thailand's hot-selling list within two months.

However, the popularity of IPs rises quickly and fades quickly. How to leverage this wave of popularity to achieve long-term brand recognition is the key to overseas brand expansion.

This is where social media intervention and support are needed, relying on social entertainment to boost trendy toys.

On TikTok, many Thai influencers unbox and introduce ways to play with trendy toys, with related topics involving tens of thousands of participants. With a little operation, products can sell explosively.

The popularity of trendy toys driven by Lisa is a typical example.

POP MART's overseas social media self-operated accounts have over a million followers, inviting KOLs to livestream and check in at offline stores, introducing the brand, IPs, and blind box gameplay. Every time a new market is developed, POP MART collaborates with local KOLs to conduct store exploration activities via social media, linking online and offline to further enhance brand influence.

TikTok is no longer just a video platform for young people to share their lives, but a huge market. Its users are all over the world, especially the younger generation. They love to explore new things and try new products. If your product is fun and attractive, it can easily gain massive exposure in a short time.

Moreover,promoting on TikTok is much cheaper than traditional advertising methods. Users can even interact directly with merchants on TikTok and provide feedback. This instant interaction not only increases user engagement, but also allows merchants to quickly adjust strategies and optimize products and services.

Overall, Chinese trendy toy IPs have huge potential in the global market, and Southeast Asia, with its geographical and cultural advantages, has become the first choice, but the future will certainly not be limited to one region.

Through localized transformation and viral marketing on social media, while expanding offline sales channels, both leading brands and niche trendy toys can gain a foothold in overseas markets.

Let us join hands to create more miracles on the TikTok stage!