"Magic Mirror Insights: 2024 Overseas Home Appliance White Paper" is released by Magic Mirror Insights, mainly exploring the overview of overseas markets and the development of the home appliance industry in overseas markets. The specific content is as follows:

1. Overview of Overseas Markets

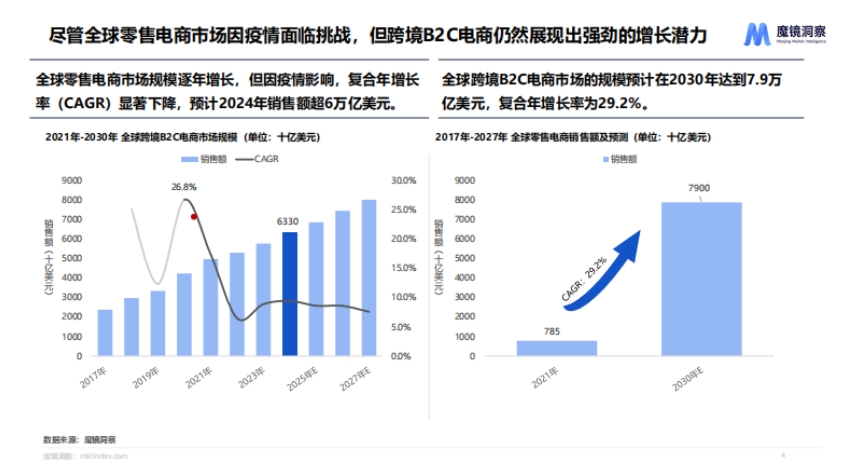

- Market Size: The global retail e-commerce market size has been growing year by year, with sales expected to exceed $6 trillion in 2024; the cross-border B2C e-commerce market is projected to reach $7.9 trillion by 2030, demonstrating strong growth potential.

- Growth Drivers: Including technological advancements, changes in consumer shopping habits, logistics optimization, and support from import and export trade policies.

- Limiting Factors: There are policy differences, cybersecurity risks, logistics costs and delivery efficiency issues, as well as cultural differences and lack of market localization.

- Major Market Situation: China's e-commerce market is mature but growth is slowing; the US market is also in a mature phase; emerging markets such as Southeast Asia have great growth potential. Chinese brands are actively expanding overseas, adopting various strategies and sales models.

2. Home Appliance Industry

- Domestic and International Differences: The domestic home appliance market has entered a stock stage, while overseas countries are developing differently, presenting opportunities. Domestic home appliance penetration is high and competition is fierce; overseas markets have greater room for expansion and growth potential, with a more fragmented competitive landscape in some regions.

- Overseas Scale: Mature markets such as North America are large in scale, while emerging markets such as Southeast Asia are growing rapidly. The combined size of emerging markets accounts for 30% of the global major home appliance market.

- Online Home Appliances: E-commerce penetration in mature markets still needs improvement, while emerging markets offer great entry opportunities. In 2022, US e-commerce sales were high but penetration was still low; Southeast Asia and Latin America have bright prospects for e-commerce development.

- Situation in Various Countries

- United States: The Amazon platform's home appliance market sales reached about 54.9 billion yuan in the first half of 2024, with brand concentration around 25%, indicating a relatively dispersed market. Different price segments are stable, some categories have seen price increases, and the TOP30 subcategories in the home appliance market show varied performance.

- Southeast Asia: The home appliance market is developing rapidly with lower pricing, reaching sales of 23.8 billion yuan in 2023, and sales in the first half of 2024 increased by over 92% year-on-year. Shopee and Lazada platforms are large in scale and show promising trends. Japanese and Korean companies have a first-mover advantage, but domestic brands are accelerating their entry.

In addition, the report also introduces Magic Mirror Insights' data products and service models, including the data product matrix, CMI product system, service models, etc., emphasizing its support for brands going overseas.