This document is the 2024 Cutlery Category Overseas Research Report produced by Dashu Cross-border, with main contents including market overview, consumer insights, industry trends and overseas prospects, brand case studies, etc. It aims to provide comprehensive market insights and strategic guidance for cutlery brands going global.

1. Market Overview

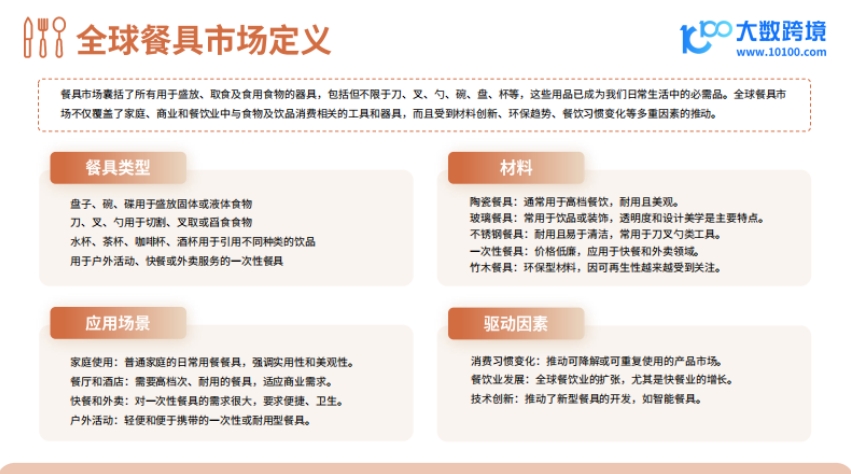

- Definition and Classification: The cutlery market covers a variety of utensils used for holding, serving, and eating food, including different types (such as knives, forks, spoons, bowls, plates, cups, etc.), application scenarios (home, restaurant, fast food, outdoor, etc.), and materials (ceramic, glass, stainless steel, disposable, bamboo and wood, etc.).

- Market Size and Drivers: The global cutlery market size is estimated at $114.9 billion in 2023, expected to reach $192.4 billion by 2032, with a CAGR of 5.9%. Europe is the largest consumer market and has the highest CAGR, while the Asia-Pacific market is moderate in size but growing rapidly. Drivers include changes in consumption habits, development of the catering industry, technological innovation, increased disposable income, social media influence, advances in manufacturing technology, and sustainability trends.

- Segmented Markets

- Ceramic Cutlery: Market size in 2024 is $58.29 billion, expected to grow to $78.8 billion by 2029, with a CAGR of 6.21%. Europe is the largest market, and Asia-Pacific has strong growth potential.

- Disposable Cutlery: Market size in 2024 is $35.35 billion, expected to grow to $43.95 billion by 2029. North America is the largest market, Asia-Pacific has the fastest growth rate, but faces restrictions from environmental regulations.

- Stainless Steel Cutlery: Market value in 2024 is $6.81 billion, estimated at $9.46 billion by 2031, with a CAGR of 4.8% from 2024 to 2031. North America is expected to dominate, with emerging markets in Asia-Pacific and Latin America rising.

- Distribution Channels and Industry Chain: Offline sales remain the main method, but e-commerce development has increased online purchases. The industry chain includes upstream materials (porcelain, metal, glass, plastic, etc.), midstream production, and downstream applications (supermarkets, stores, online platforms, etc.).

- Development History of China's Cutlery Industry: It has undergone continuous innovation and progress from the Neolithic Age to the present, with constant improvements in technology and product functionality.

2. Consumer Insights

- American Consumers

- Purchase Choices: Focus on quality and practicality, cutlery sets are more popular, and style/color are also important considerations.

- Price Sensitivity: Consumption downgrading is prevalent, switching retailers and delaying purchases are common, with more attention to price and cost-effectiveness.

- Price Expectations: Low-income consumers tend to choose low-priced monochrome cutlery, while high-income consumers are willing to pay higher prices for modern-style high-end cutlery.

- Purchase Channels: Discount stores are the main channel, and the proportion of online shopping is expected to increase, especially in the high-end market.

- Japanese Consumers: Dietary culture influences cutlery demand, with a preference for high-quality and beautifully designed cutlery, and relatively stable annual household expenditure.

- Chinese Consumers: Young consumers pursue personalized and fashionable cutlery, while older consumers focus on high-quality, durable, and culturally meaningful ceramic cutlery; ceramic cutlery has diverse uses, and replacement frequency varies by consumer.

3. Industry Trends and Overseas Prospects

- Environmental Protection and Sustainability: Countries have introduced policies to restrict disposable plastic cutlery, promoting the development of degradable and organic cutlery. The biodegradable plastic cutlery market will grow rapidly, and the organic cutlery market will also expand steadily.

- Intelligence and Innovative Design: Intelligent design includes functions such as automatic temperature adjustment, remote control, voice commands, and IoT connectivity; innovative design is reflected in 3D printing customization, integration of fashion elements, enhanced functionality, and cross-industry collaboration.

- Overseas Prospects: China's total cutlery export value first declined then rose, with high export value to the US and concentrated export markets, requiring expansion into new markets. The "Belt and Road" initiative provides opportunities but faces challenges such as competition, quality standards, and trade barriers.

4. Brand Case Studies

- SERAX: A Belgian brand driven by design, with diverse products, positioned as high-end, and covering over 100 countries. Independent site traffic is stable, mobile visits are high, natural search traffic is large, and female users are the majority with evenly distributed ages. Success is achieved through differentiated design, diversified product lines, high-end market positioning, and international expansion.

- Our Place: An American brand focused on environmentally friendly and sustainable kitchenware. Independent site traffic is steadily increasing, with the US as the core market. Attracts consumers through social media strategies, emphasis on sustainability and brand storytelling, and flexible after-sales service, providing reference for Chinese brands going global.

5. Overseas Recommendations: Chinese cutlery brands can emphasize design and multifunctionality in internationalization, incorporate traditional cultural elements, build cultural stories, use eco-friendly materials, leverage social platforms for promotion, and offer trial and free return services.