This document mainly focuses on topics related to the overseas expansion of China's furniture industry, including an overview of going abroad, development background, industry status, export situation, analysis of typical enterprises, and overseas opportunities. It provides detailed information for a comprehensive understanding of the overseas situation of China's furniture industry. The specific content is as follows:

1. Overview of China's Furniture Industry Going Abroad

- Definition and Classification of Furniture: Furniture is used in various places and can be classified by material, use, and structure. Materials include wood, metal, etc.; uses cover tables, chairs, stools, etc.; structures are divided into assembled, disassembled, and other types.

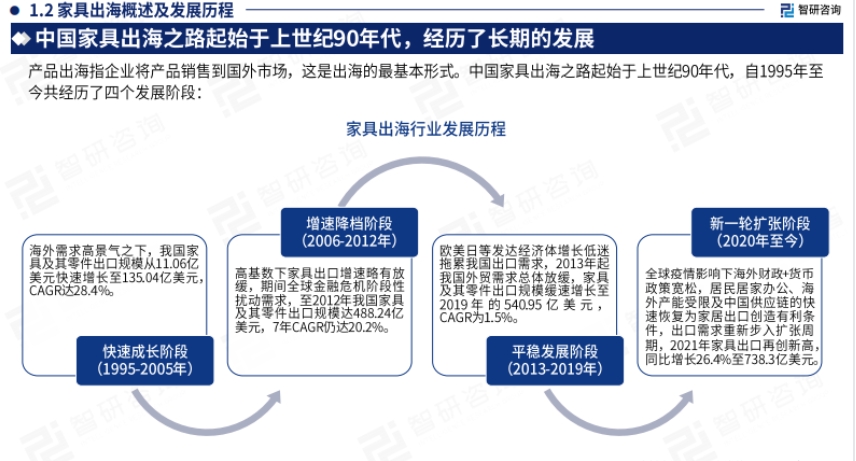

- Development History of Going Abroad: The overseas expansion of Chinese furniture began in the 1990s, going through four stages: rapid growth, steady development, deceleration, and a new round of expansion. Each stage was influenced by different factors, with changes in export scale and growth rate.

- Analysis of Overseas Expansion Models: The main models include OEM/ODM manufacturing, cross-border e-commerce, capacity going abroad, and brand/channel expansion. OEM is mature, cross-border e-commerce is developing rapidly, capacity going abroad helps avoid risks, and brand/channel expansion enhances brand value.

2. Analysis of the Development Background of China's Furniture Industry Going Abroad

- Policy Background: Multiple domestic policies have been introduced to stabilize foreign trade; EU environmental regulations are becoming stricter; Vietnam offers investment incentives; the business environment in the Philippines is continuously improving. These policies affect furniture companies going abroad.

- Economic and Social Background: Domestic economic growth is slowing, the real estate sector has entered a stock era, and competition in the furniture industry is intense; the "Belt and Road" and RCEP promote opening up; logistics facilities are well-developed, and the China-Europe Railway Express is progressing well; the furniture industry has made significant achievements in green, intelligent, and high-end transformation.

3. Analysis of the Current Development Status of China's Furniture Industry

- Global Market Share: The global furniture manufacturing center is shifting to developing countries. China is the largest producer and exporter. From January to September 2024, the revenue and profit of large-scale furniture manufacturing enterprises were favorable.

- Industry Overview: The industrial chain is mature, raw material supply is sufficient, sales channels are smooth, and industrial clusters have formed five major furniture industry zones.

4. Analysis of China's Furniture Industry Exports

- Overall Export Situation: In the first nine months of 2024, exports of furniture and parts increased, but the export value in September declined. The export value of key categories varied.

- Export of Subcategories: Exports of metal, wooden, and furniture parts show different characteristics in terms of trade methods, export regions, and main export countries.

5. Analysis of Overseas Expansion of Typical Chinese Furniture Enterprises

- Mlily: Transformed from OEM, developed its own brand after listing, mattresses are the main product, inventory pressure remains, goes abroad through various sales models, and overseas revenue accounts for a high proportion.

- QM Furniture: Faces operational pressure, sells through multiple channels, acquires overseas companies to expand abroad, overseas income accounts for a high proportion, and its brands offer diverse products.

- Markor Home: Business faces challenges, focuses on both wholesale and retail, overseas business is mainly wholesale, and there is room for improvement in gross profit margin.

- Kuka Home: Sofa business stands out, sales models are diverse, overseas income grows rapidly, and a company was established in Hong Kong to handle import and export.

- Loctek: Performance is improving, main business is clear, pioneered the "Loctek Model," overseas revenue accounts for a high proportion, and sales models are diversified.

6. Analysis of Opportunities for Chinese Furniture Enterprises Going Abroad

- Improvement of Regional Economic Environment: U.S. economic growth and favorable trade environment provide space for Chinese furniture exports; EU economic growth makes it a major foreign trade partner, and Chinese furniture has development potential in Europe.

- RCEP Helps Expand Southeast Asian Market: Its preferential terms promote Southeast Asian countries to use Chinese furniture parts and raw materials, and tariff agreements enhance the competitiveness of Chinese furniture exports.

- Rise of Cross-border E-commerce Channels: Import and export totals are increasing, the semi-managed model is emerging, providing new opportunities for furniture enterprises to go abroad.