The "2024 China Manufacturing Industry Going Global Guide" mainly analyzes the overseas expansion trends of China's manufacturing industry, covering key aspects such as overview and trends, destinations, industries, case studies, and SBD services, providing comprehensive guidance for enterprises going global.

1. Overview and Trends of Going Global

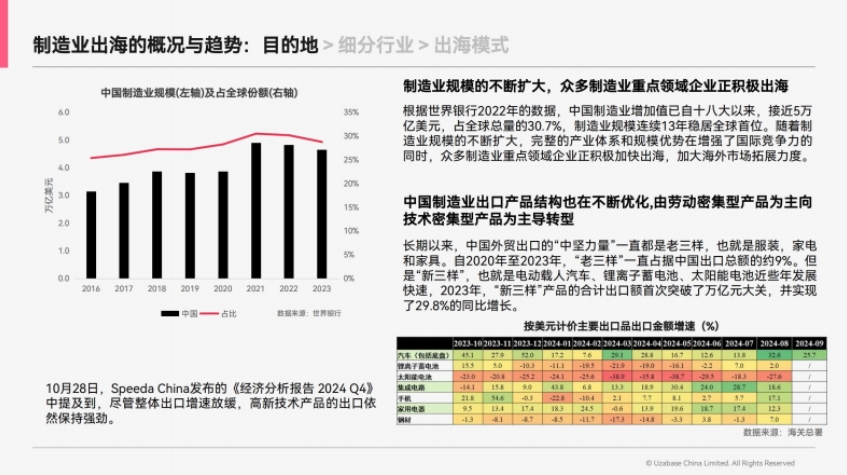

- Scale and Export Structure Optimization: According to World Bank data from 2022, China's manufacturing value added reached nearly $5 trillion, accounting for 30.7% of the global total, ranking first for 13 consecutive years. Exports have shifted from labor-intensive to technology-intensive, with the "new three" export value exceeding one trillion yuan in 2023, up 29.8% year-on-year, and strong exports of high-tech products.

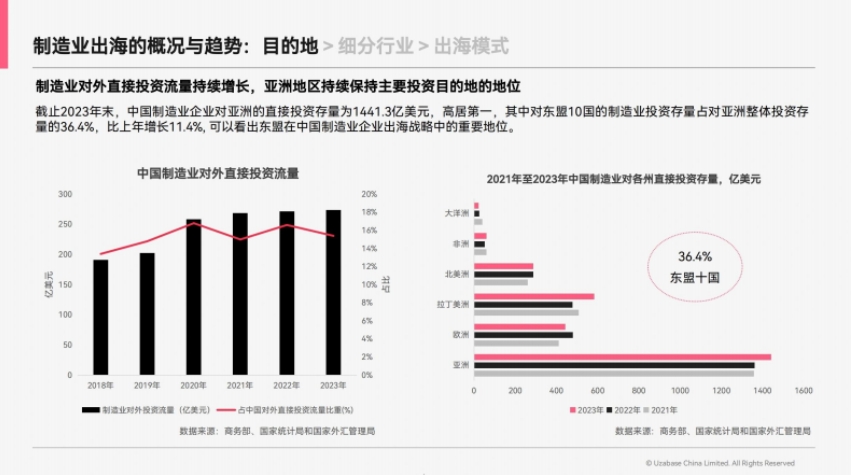

- Investment Growth and Model Changes: Outbound direct investment flows continue to rise, with Asia as the main investment destination and ASEAN standing out. Greenfield investment is on the rise, with automotive manufacturing investment ranking first in 2023, accounting for 63.8%.

- Diversified Overseas Layout: Most regions are in Southeast Asia, followed by North America and Central Europe. STAR Market companies have prominent overseas business, due to high technology and innovation capabilities.

2. Popular Overseas Destinations

- Overall Situation and Industry Distribution: China's outbound investment flows are generally rising, with significant growth in Asia and Africa in 2023. Overseas enterprises are mostly in wholesale and retail, with manufacturing accounting for 19.3%.

- Details of the Japanese Market: China's investment stock in Japan has risen to $5.77 billion, involving multiple industries, with trade enterprises accounting for 17.4% and manufacturing 14.53%. The prospects for digital and green cooperation between the two countries are good, with many enterprises working together.

- Southeast Asia Opportunities: Close geography, large market potential, and low costs make it a popular location for cross-border e-commerce and manufacturing enterprises to set up factories, with models varying by industry.

- Belt and Road Achievements: China's investment in Belt and Road countries continues to grow strongly, with considerable enterprise and investment stock by the end of 2023. In the energy sector, investment in the Middle East accounts for 56%.

3. Overseas Trends of the New Energy Industry Chain

- Growth in Automobile Exports and Diverse Models: Domestic competition drives NEV car companies to go global, with export volumes exceeding one million units in 2023, and destinations expanding from Europe to Asia. Overseas models include whole vehicle export, factory construction, investment and acquisition, and direct brand operation, each with its own characteristics.

- Overseas Layout of Car Companies: SAIC, BYD and other car companies lead in exports, mostly building factories in Southeast Asia and South America. Export value of auto parts is rising, and manufacturers are accelerating overseas deployment.

4. Successful Case Analysis and SBD Services

- Framework for Analyzing Overseas Strategies: Gain market insights from five dimensions—macro, industry, customer, competitor, and self—using models such as PESTEL to analyze opportunities and challenges and formulate strategies.

- SBD Value Demonstration: Accurately provide core information to help enterprises make quick decisions. With global standard data and a professional team, achieve efficient and stable analysis, collect information in multiple languages, and leverage its database, reports, and consulting desk to support enterprises going global.