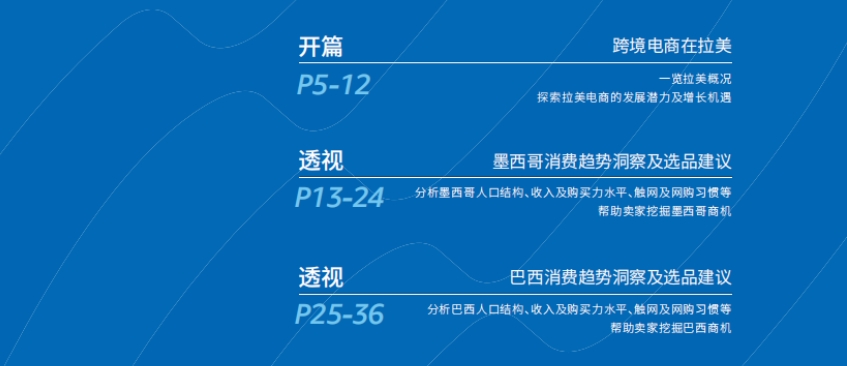

The "Export Latin America Cross-border E-commerce Industry Insight Report" is released by Amazon Global Selling, aiming to provide Chinese sellers with a comprehensive and in-depth analysis of the Latin American e-commerce market, helping them seize opportunities and formulate strategies. The report covers an overview of the Latin American region, e-commerce potential, consumer trends in Mexico and Brazil, business environment, successful seller cases, and launch models.

1. Overview of the Latin American E-commerce Market

- Regional Overview and Potential: Latin America is rich in natural resources and cultural heritage, with increasing internet penetration and improving e-commerce infrastructure, showing huge e-commerce potential. In 2024, the number of e-commerce users in Latin America is expected to reach 290 million, making it one of the fastest-growing e-commerce regions in the world.

- Opportunities for Chinese Sellers: China's cross-border e-commerce exports to Latin America are developing rapidly, with a significant increase in total exports in the first half of 2024. The number of active Chinese sellers on Amazon Latin America sites has grown substantially, providing new opportunities for Chinese sellers.

2. Consumer Trends and Product Selection Recommendations in Mexico

- Consumer Profile and Behavior: The ratio of male to female users is close, young people are the main force of online shopping, and online consumers have strong purchasing power. Consumers pursue practicality, focus on quality and health/environmental protection, are greatly influenced by social media, and cash is the mainstream payment method.

- Popular Categories and Product Recommendations: Consumer electronics, leisure & hobbies, and fashion categories lead in sales. There are many festivals, such as Three Kings' Day, Easter, etc., and each festival has corresponding popular products. Amazon Mexico has 16 promotional events throughout the year, with specific product recommendations in categories such as home living, consumer electronics, beauty & personal care, and fashion.

3. Consumer Trends and Product Selection Recommendations in Brazil

- Consumer Profile and Behavior: Women are the main force in online consumption, with a high proportion of young and middle-aged people, and the proportion of the elderly population is rising. Consumers value smart home technology, prefer credit cards and installment payments, and social media shopping is on the rise.

- Popular Categories and Product Recommendations: Consumer electronics account for a high proportion of sales, and festivals such as Carnival and Christmas have a significant impact on consumption. Amazon Brazil has 13 promotional events throughout the year, with specific product recommendations in categories such as home living, daily necessities, and fashion.

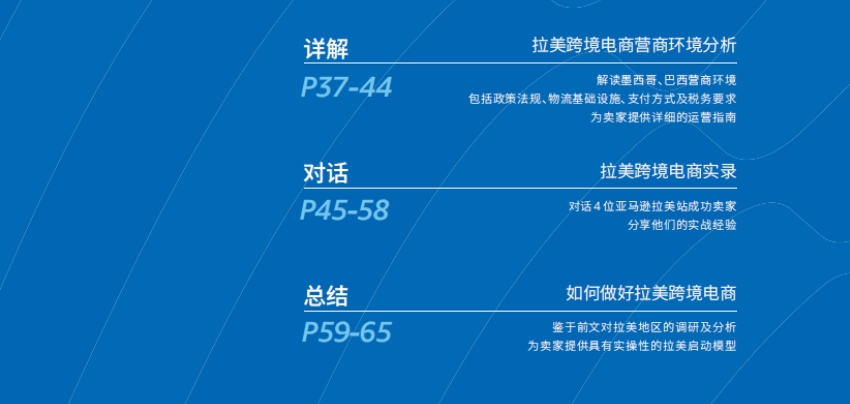

4. Latin American Cross-border E-commerce Business Environment

- Policies and Regulations: Economic and trade cooperation between China and Latin America continues to deepen, and relevant policies support the development of e-commerce. Mexico and Brazil have clear tax rules, which are constantly being adjusted and optimized, so sellers need to pay attention and comply.

- Logistics and Payment: The trend of digital payment in Latin America is obvious, and sellers need to manage exchange rate risks. Amazon has a well-established presence in Latin America, providing sellers with a variety of services, including easy onboarding, overseas warehouses, global payment solutions, etc.

5. Analysis of Successful Seller Cases

- Early Entry and Initial Accumulation: Some sellers entered the Mexico site early, leveraging regulatory advantages to accumulate resources, such as overseas warehousing and logistics partners, and achieved initial capital accumulation through product selection strategies.

- Multi-channel and Localization Strategies: Brands such as Cyxus have made efforts through multiple channels, integrating online and offline, focusing on localized adjustments, including product pricing, cultural preferences, and style design, successfully building their brands.

- Forward-looking Layout and Product Innovation: Companies such as HAYLOU have taken a forward-looking approach to the Latin American market, adjusting product strategies according to local consumer trends and cultural differences, launching differentiated customized products, and achieving sales growth.

6. Latin American Cross-border E-commerce Launch Model

- Replicating the European and American Model: Latin America resonates with European and American consumption trends. Sellers can use Amazon tools, refer to hot-selling category trends and product selection indexes, and quickly deploy in the Latin American market.

- Cooperating with Professional Service Providers: In terms of logistics, Amazon's related programs can be used to improve efficiency; for payments, its functions can simplify processes; for listing operations, GSO services can be used to solve minor language issues.

- Building Brand Advantages: Amazon provides a series of support and tools for brand sellers. Sellers can plan their brand growth path through the "Brand Growth Ladder" and build a first-mover advantage.

- Focusing on Local Differences and Highlights: Sellers should pay attention to local Latin American culture, consumption habits, and demand differences, and create localized features from product, channel, and promotion aspects to improve competitiveness.