In July 2024, a special Chinese company appeared on CCTV's "Dialogue" program.

It is neither an infrastructure giant building high-speed railways nor a tech upstart selling new energy vehicles, but a brand that has established itself in Southeast Asia by selling ice cream—Aice.

Aice appeared on CCTV's "Dialogue" program. Image source: CCTV.com

In ten years since its founding, Aice has become No.1 in Indonesia's traditional channel market share, with annual revenue exceeding3 billion yuan, even placing freezers in small rural shops.

This kind of"encircling the cities from the countryside" strategy may provide new inspiration for domestic companies to explore overseas markets.

Image source: Aice

Former Mengniu Executive Turns to Selling Popsicles

The story of Aice begins in thesummer of 2014.

It is reported that at that time,Niugen Sheng, founder of Mengniu, led a team to conduct field research in rural Indonesia. They discovered a paradox: in this tropical country with an average annual temperature of 28°C, the ice cream market was monopolized by foreign brands such asUnilever and Nestlé, and prices were generally high, while low-income people accounted for as much as 70% of the population, making ice cream unaffordable for most.

It was this discovery that made Niugen Sheng determined to go abroad.

Image source: XINHUA news

In 2015, a former core team from Mengniu returned to Indonesia with mature Chinese ice cream production technology and established the Aice brand. They replicated Mengniu's earlier"no man's land, blank priority" strategy against Yili: avoiding convenience stores crowded with giants and focusing on small rural shops.

The team carried foam boxes through the streets, provided freezers to merchants for free, subsidized electricity bills, and taught shop owners how to display products. By 2017, this"capillary-style" channel had penetrated79 cities in Indonesia, covering70,000 rural small shops.

Image source: Aice

As word spread that "you can eat good ice cream for just 0.9 yuan," Aice's sales soared from 20 million to 1.2 billion yuan in three years, tearing open a gap in the territory of many giants.

In 2021, Aice was officially acquired by Mengniu. With Mengniu's global supply chain, its products were quickly replicated to Vietnam and the Philippines. By 2024, total sales exceeded 10 billion yuan, accounting for 70% of Mengniu's overseas revenue, making it theNo.1 ice cream brand in Indonesia by market share.

Official acquisition of Aice by Mengniu. Image source: Sohu

Building Schools, Signing Messi: The "Trust Economics" of Chinese Ice Cream

Low-price strategy is just a stepping stone; the real key to Aice's rooting is"deep localization".

Indonesians still remember that during the COVID-19 pandemic, Aice built its own mask factory and distributed supplies for free; in small shops in poor areas, tens of thousands of families relied on Aice's free freezers for their livelihood.

This strategy of "exchanging real money for trust" has continued for ten years.

Aice has built12 Hope Primary Schools in Indonesia and has won the government’s"Top Social Responsibility Enterprise" award for three consecutive years. But charity is only the first step. During Ramadan, Aice would book an entire street to distribute free ice cream, and on factory open days, many students were invited to visit the production line.

Indonesian students visit Aice factory. Image source: Internet

What really made Aice break out of the circle, however, was theirsports marketing. In 2018, Aice became theonly official ice cream supplier for the Jakarta Asian Games.

In 2022, Aice sponsored theQatar World Cup, and also obtained theFIFA "Official Prepackaged Ice Cream of Southeast Asia" authorization, cooperating withMessi, Mbappé and other football stars. Online, they launched the #AiceStarlympic topic, encouraging consumers to upload sports-themed videos, deeply linking ice cream consumption with sports spirit.

Aice cooperates with Messi and Mbappé. Image source: Mengniu

Behind these moves is a clear logic:establish brand height through top-level events, and penetrate the youth circle with celebrity effects.

But the Aice team knows very well that the heat on the field will eventually fade, and true localization must be implemented in daily life. This understanding directly promoted Aice's deep layout on overseas social media platforms.

Image source: Aice

Conquering Southeast Asia with a "Combination Punch" of Social Media

It is reported that in order to truly integrate the brand into the daily life of Southeast Asians, Aice launched a "content blitz" on four major platforms: TikTok, Instagram, YouTube, and Facebook, with a tailor-made strategy for each platform.

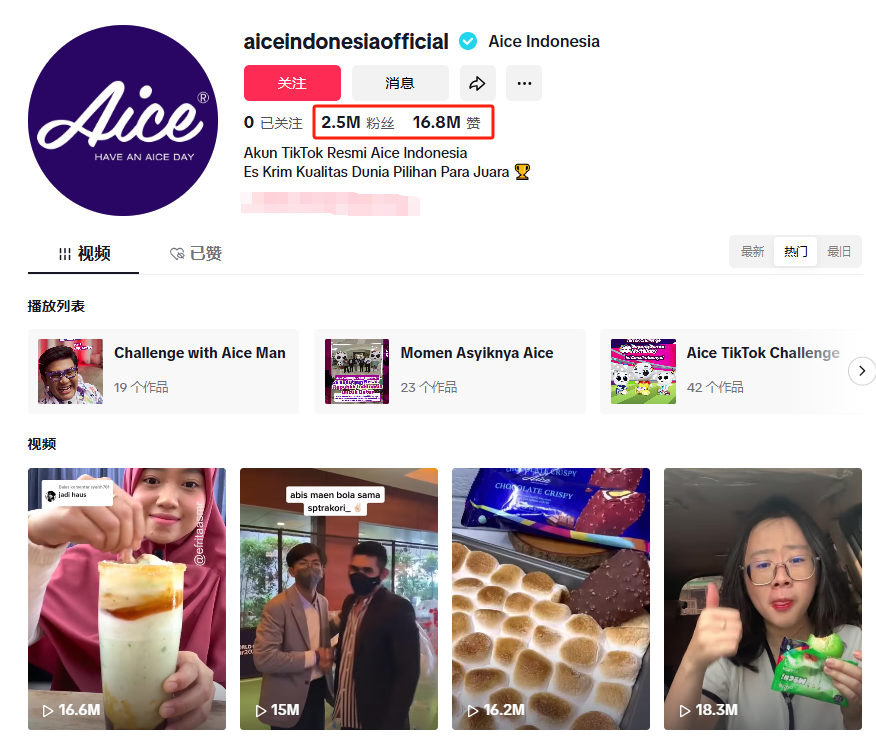

--TikTok

Aice's approach on TikTok is clear: use the most down-to-earth content to gain traffic.

So far, its official account@aiceindonesiaofficialhas attracted2.5 million followers, with over16.8 million likes, mainly posting three types of videos: direct product ads, well-designed funny shorts, and random street taste tests.

The brand topic#aicealone has reached1.4 billionviews, with quite good communication results.

Image source: TikTok

They have also collaborated with many TikTok influencers. For example, with Indonesian blogger@tamarajessica, who has9.3 million followers, they released a picnic vlog where the Aice mascot suddenly appears with a new product in the second half. This "soft placement" video garnered4.2 million viewsand was loved by many Indonesian users.

Image source: TikTok

There is also Filipino influencer@reinitsu..02 (2.7 million followers), who participated in Aice's Paris Olympics campaign#EmbrAICEyourWinningSpirit, cheering for Filipino athletes he supports.

In the video, he eats Aice ice cream while watching the Olympics live, making the content very relatable. The video eventually reached1.9 millionviews, and many users in the comments cheered for their favorite athletes, effectively boosting brand traffic.

Image source: TikTok

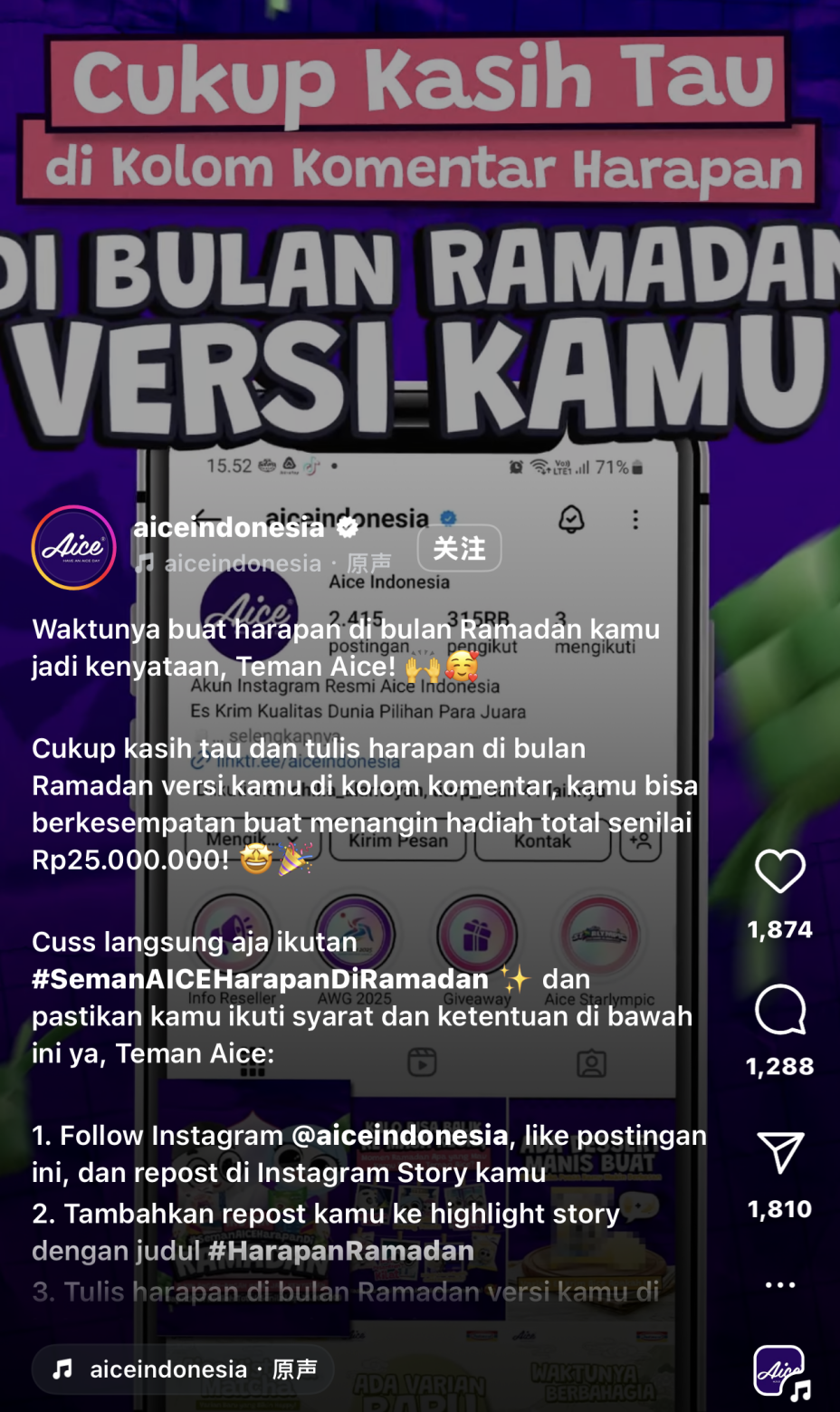

On Instagram, Aice's official account@Aice Indonesiahas attracted315,000followers.

Image source: Instagram

The content is diverse. For example, during the recent Ramadan, Aice held a wish lottery, offering 25 million Indonesian rupiah as a prize, encouraging users to post with the hashtag #harapanramadan, with great results. The event attractedover 100,000participants, which is considered above average for FMCG social media operations.

Image source: Instagram

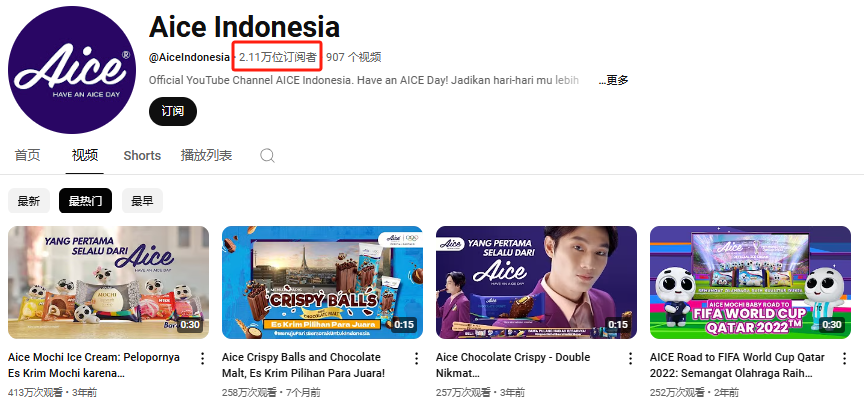

--YouTube

On YouTube, Aice's official account@Aice Indonesiahas only21,100subscribers, but the content design is smart.

They film ordinary people buying ice cream on the street and eating as they walk—this"not deliberately advertising"style has instead built trust among Indonesia's middle class.

Image source: YouTube

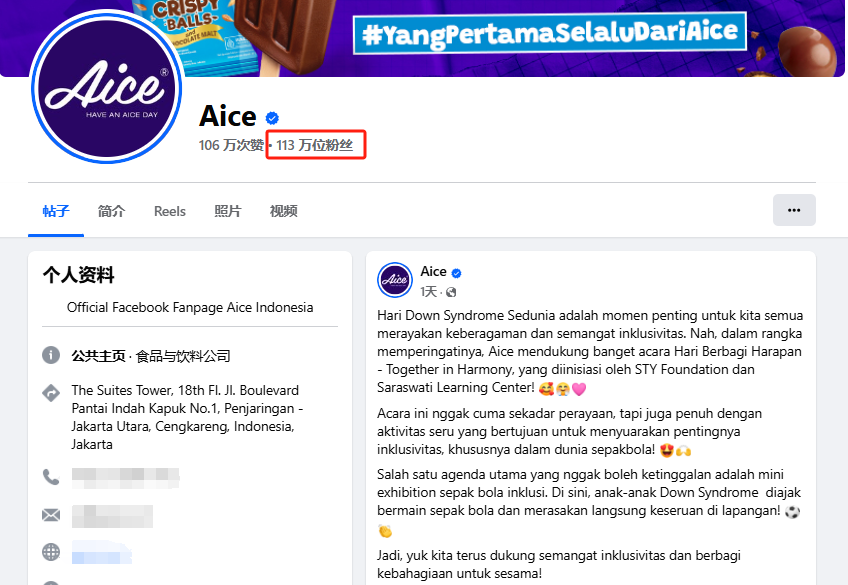

Facebook is themain battlefield for emotional connection.

Aice's official account@Aicehas1.13 million followers, many of whom are family users. Recently released charity videos from poor areas have drawn many emotional comments.

This also shows to some extent that in a market like Indonesia, which values family,warm contentis indeed more effective than hard advertising.

Image source: Facebook

In Conclusion

As the case of Aice shows, what Chinese brands need most to explore overseas markets is apragmatic attitude of getting personally involved.

For current Chinese companies, instead of blindly chasing market trends, it is better to build on the deep foundation of manufacturing, anchor on technological R&D, use cultural heritage as a value link, and build competitive barriers through differentiated market positioning.

This sea of stars ultimately belongs to those who are willing to bend down and understand the world.