In the past two years, many companies’ overseas maps have added a new coordinate: Saudi Arabia. Its consumption capacity, infrastructure investment, and population structure are indeed impressive. And right now may be a good opportunity for Chinese companies to enter Saudi Arabia.

Based on the "2025 Saudi Arabia Going Global White Paper" released by Horizons, we have compiled an operational guide for companies going overseas, covering everything from policy thresholds to labor costs, visa rules to payment habits, hoping to help everyone avoid those initial "culture shock" pitfalls.

Image source:Horizons "2025 Saudi Arabia Going Global White Paper"

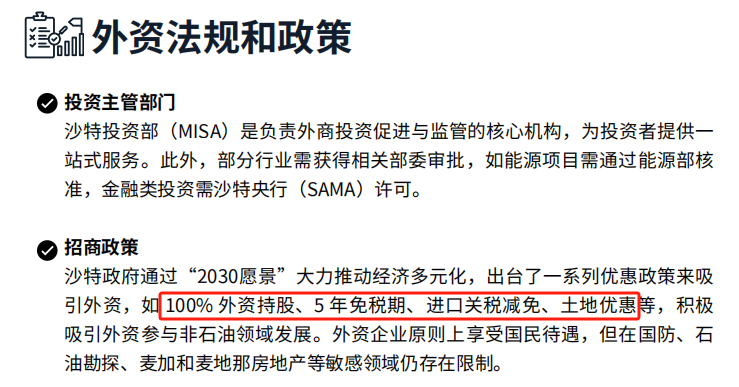

△Foreign Investment Holding

The Saudi government has been very proactive in recent years, especially under the "Vision 2030" framework, and has incorporated "attracting foreign investment" into its national strategy.

The most direct change is that foreign companies can now hold 100% equity without needing a local partner; they can also enjoy five years of tax exemption, reduced import duties, and land incentives.

If your industry is in a non-sensitive field (such as digital technology, manufacturing, healthcare, etc.), there are almost no significant investment barriers. As long as it does not involve defense, oil exploration, or real estate development in Mecca and Medina, foreign companies can basically enjoy the same treatment as local companies.

Image source:Horizons "2025 Saudi Arabia Going Global White Paper" (1)

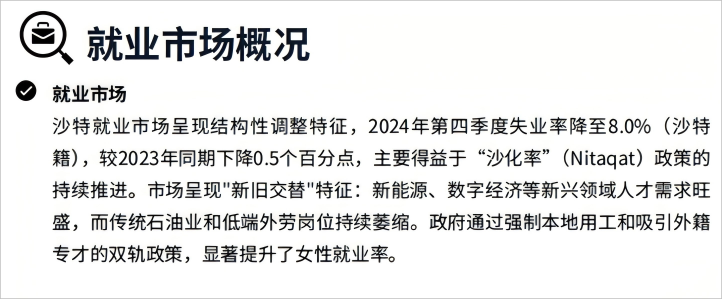

△Employment Market

Looking at the employment market, Saudi Arabia has undergone significant structural adjustments in recent years. By Q4 2024, the unemployment rate among Saudi nationals had dropped to 8.0%, and the proportion of female employment has also risen rapidly. It is clear that fields such as new energy, digital economy, AI, and electric vehicle manufacturing are "competing for talent."

Salary trends are also evident: for example, annual salaries in the oil and gas industry range from $90,000–$250,000, renewable energy is $70,000–$180,000, IT and AI positions are $60,000–$150,000, and even tourism and entertainment reach $35,000–$90,000. If companies need to send technical or management staff to Saudi Arabia, this salary system is not low, but compared to market potential, it still offers room for maneuver.

Image source:Horizons "2025 Saudi Arabia Going Global White Paper" (2)

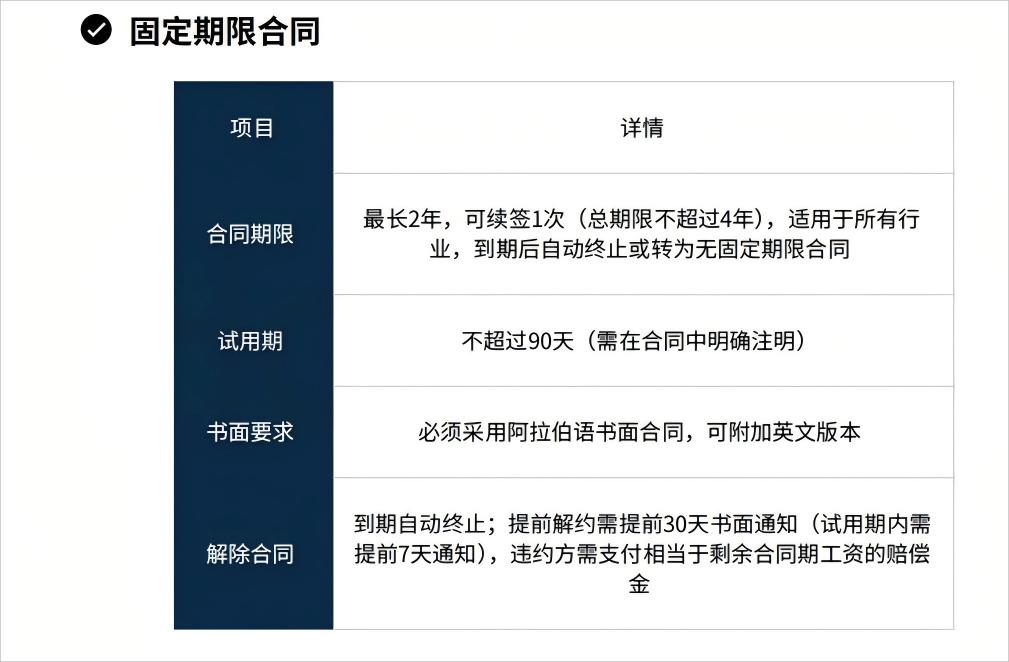

△Labor Compliance

Saudi Arabia also has detailed requirements for labor compliance. For example, labor contracts must be written in Arabic (an English translation can be attached), and the probation period cannot exceed 90 days. You can sign a fixed-term contract (maximum 2 years, renewable once) or an indefinite contract.

Wages must be paid through the official WPS wage protection system and must be credited no later than the 1st of the following month. Overtime is limited to no more than 2 hours per day, with a maximum of 120 hours per year. Overtime pay is calculated at 150%, and holidays at 200%. Saudi labor regulations are basically the same for foreign and local employees, though special industries such as domestic work may differ slightly.

Image source:Horizons "2025 Saudi Arabia Going Global White Paper" (3)

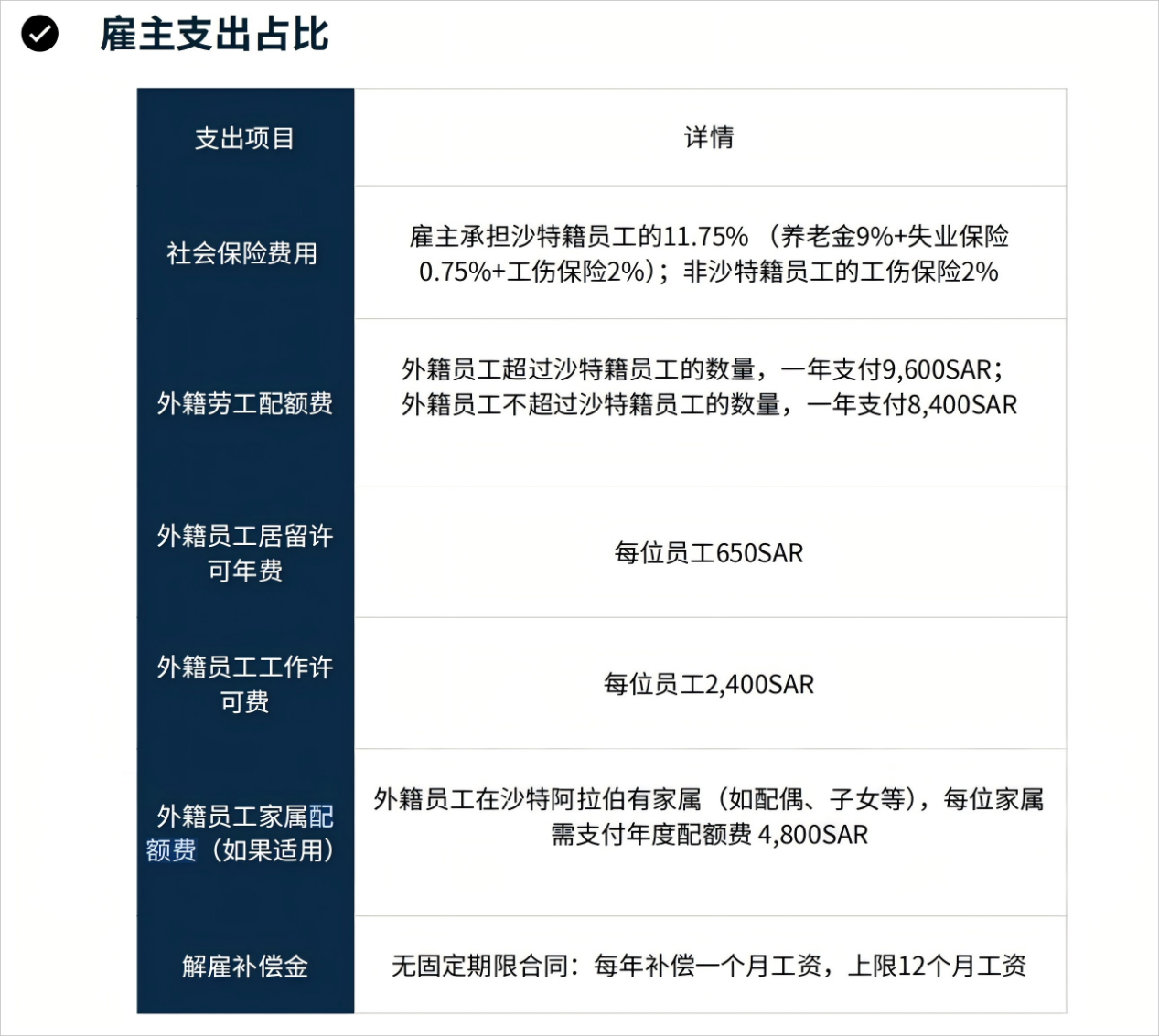

△Employment Costs

From the employer’s perspective, labor costs also need to be budgeted in advance. The annual residence fee for foreign employees is 650 SAR, and the work permit fee is 2,400 SAR. If employees bring family members to Saudi Arabia, each family member must pay an additional 4,800 SAR quota fee per year.

Another point to note: if the number of foreign employees in the company exceeds the number of local employees, the government will charge a "quota fee" of 9,600 SAR/year/person; if not exceeded, it is 8,400 SAR. Therefore, it is recommended that companies balance their labor structure early on to avoid unexpected overall costs due to overlooking these expenses.

Image source:Horizons "2025 Saudi Arabia Going Global White Paper" (4)

△Visa + Benefits

Currently, Saudi Arabia does not levy personal income tax, which is a benefit for overseas companies. Employees’ salaries and labor income are not taxed. However, note that if dispatched personnel serve as board members in Saudi Arabia and are not Saudi nationals, board income is subject to a 20% withholding tax.

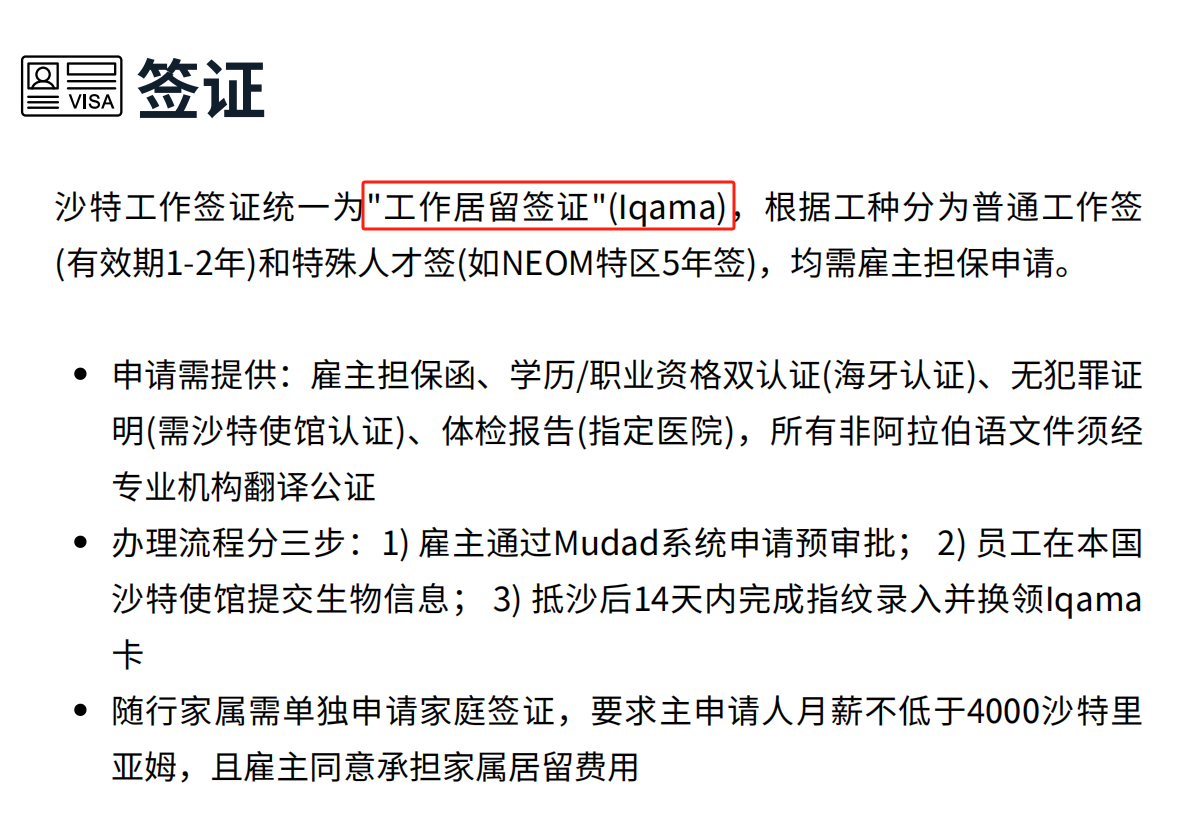

Regarding visas, Saudi work visas are collectively known as "Iqama," usually valid for 1–2 years. High-end talent in special zones such as NEOM can apply for up to 5-year visas.

Visa processing involves three steps: first, the employer applies for pre-approval through the Mudad system; second, the employee provides biometric information at the Saudi embassy in their home country; third, within 14 days of entry, fingerprint collection is completed and the Iqama card is issued. If employees bring family members, their monthly salary must reach 4,000 SAR, and the employer must be willing to cover the family’s residence fees.

As for employee benefits, Saudi Arabia’s leave system is also quite formal: after one year of service, employees are entitled to 21 days of annual leave, increasing to 30 days after five years. Sick leave is 30 days per year, with 100% pay for the first 20 days and 75% for the last 10 days; female employees receive 10 weeks of fully paid maternity leave and 1 hour of daily breastfeeding leave for 24 months; male employees receive 3 days of fully paid paternity leave. There are also provisions for marriage leave, bereavement leave, and pilgrimage leave, applicable to both foreign and local employees.

Image source:Horizons "2025 Saudi Arabia Going Global White Paper" (5)

△Payments

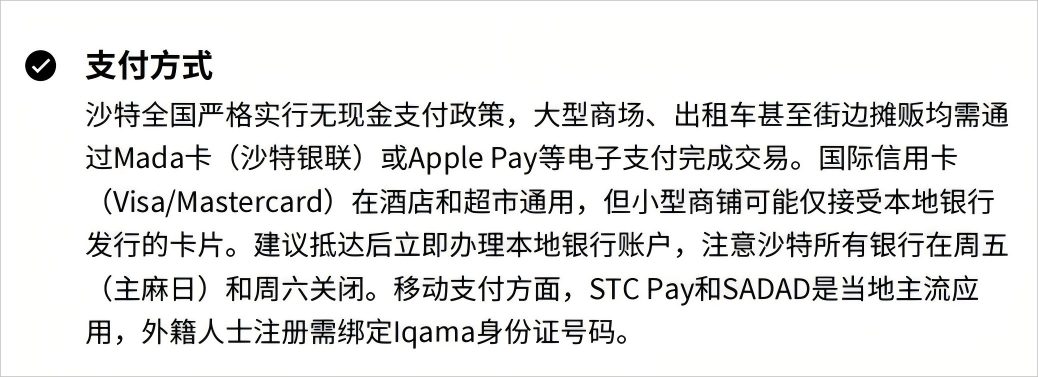

In local Saudi life, the financial and payment systems are highly digitalized. Basically, from large shopping malls to taxis and street vendors, you can use STC Pay, Mada cards, and Apple Pay is also widely accepted.

It is recommended to open a bank account as soon as possible after arrival. Local banks require a passport, Iqama, employer letter, and payslip, with a minimum deposit of 1,000 SAR. If companies have cross-border payment needs, they can choose multi-currency accounts (supporting SAR/USD/EUR).

Image source:Horizons "2025 Saudi Arabia Going Global White Paper" (6)

△Conclusion

Overall, now is a key window period for companies to lay out their plans in Saudi Arabia:

Macro policies are positive, market space is large, and digital infrastructure is well-developed. Especially in non-oil industries such as new energy, automotive, manufacturing, IT, and education, there are far more opportunities than imagined.

But Saudi Arabia is a country with clear rules and strict enforcement. Compliant landing, accurate cost calculation, and familiarity with employment rules are far more important than blindly chasing trends.

If you are considering the Saudi market, we hope this guide will help you avoid detours and leave more time for your actual business.