Against the backdrop of the continuously expanding global pet economy, a market battle over "food" is shifting from North America to Asia and is gradually spreading to other corners of the world.

Pet food, a segment long dominated by foreign brands, is quietly undergoing a structural "displacement." Chinese brands are now attempting to move from the role of behind-the-scenes OEMs to become brand builders facing end consumers.

This transformation is not happening overnight.

In fact, over the past five years, China’s pet food industry has achieved a cumulative trade surplus of more than $8.2 billion, gradually gaining global competitiveness under the label of an "export powerhouse."

On the other hand, the industry has also realized that export growth achieved solely through price and scale cannot truly establish brand value and user recognition.

Image source: Internet

Southeast Asia as a Springboard, Europe and America Remain the High Ground

Looking at the overall market landscape, the global pet products market reached $296.8 billion in 2024, with a compound annual growth rate of 5%, of which more than 40% is contributed by the North American market.

Nearly 60% of American households own dogs, and over 40% own cats, with highly mature consumption capacity and awareness. Outside this high-threshold market, Southeast Asia is rapidly becoming the new focus of the pet economy.

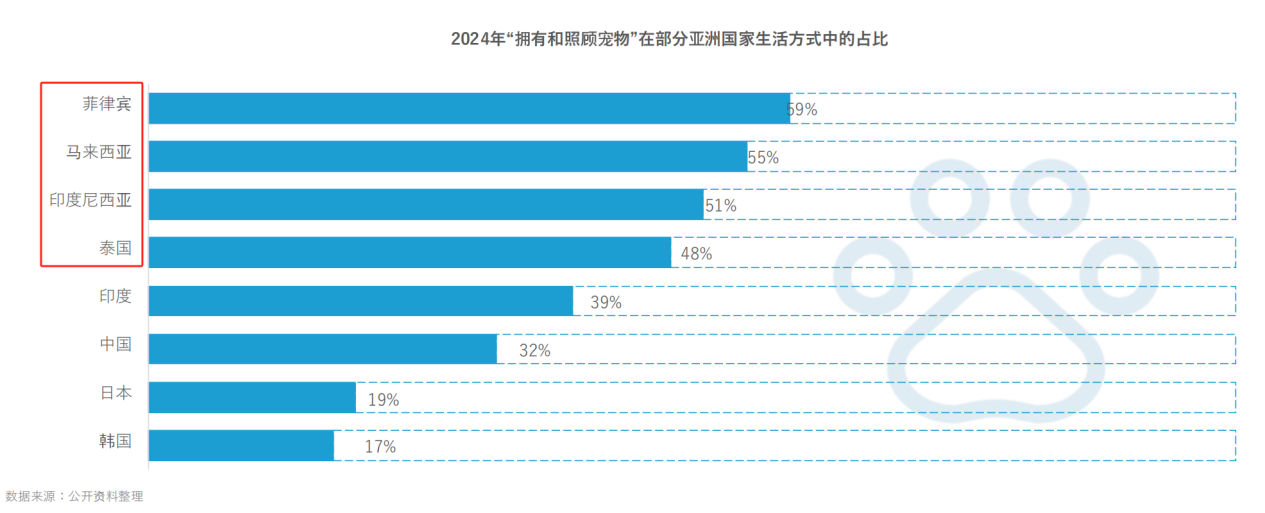

The pet penetration rate in countries such as Thailand, Indonesia, the Philippines, and Malaysia has approached 50%–60%, with cat consumption growth being particularly rapid. It is expected that by 2030, the Southeast Asian pet market will exceed $25 billion.

This structural regional shift provides a window of opportunity for Chinese pet food companies to enter the market.

Against the backdrop of high brand barriers, complex compliance, and fierce competition in the European and American markets, Southeast Asia’s policy dividends, cost advantages, and consumer habits that are closer to those in China have made it a "training ground" for many Chinese pet brands.

Image source: EO Intelligence "2025 China Pet Food Going Global Analysis Report"

Emerging Overseas Brands, Structural Weaknesses Remain

Although some Chinese companies have already shown an initial presence in overseas markets, such as smart pet product brands Nuoxue, Xiaopei, and CATLINK rapidly expanding in Southeast Asia and the Americas, in the pet food segment, the strength of overseas brands is still relatively weak.

Currently, representative overseas enterprises are mainly concentrated among leading players such as Zhongchong and Guaibao. Although they own brands like Zeal, Wanpy, and Great Jack's, most of their products are still snacks, with staple food products still in the trial stage.

This is an industry where technical and brand barriers are superimposed. Pet staple foods involve animal nutrition science, formula R&D, and raw material traceability systems, coupled with overseas consumers’ high demands for "healthy, organic, and functional" labels, leaving brands with very little margin for error.

Even though the domestic market is already accustomed to the "high cost-performance" proposition, this logic often fails in foreign markets. For example, established foreign brands such as Royal Canin and ZIWI still dominate the high-end market despite their high prices.

If Chinese brands want to gain a foothold, they cannot rely solely on cost, but need to rebuild a dialogue mechanism between product strength and trust.

Image source: Internet

Changes in the Chinese Market Are Shaping Overseas Paths in Reverse

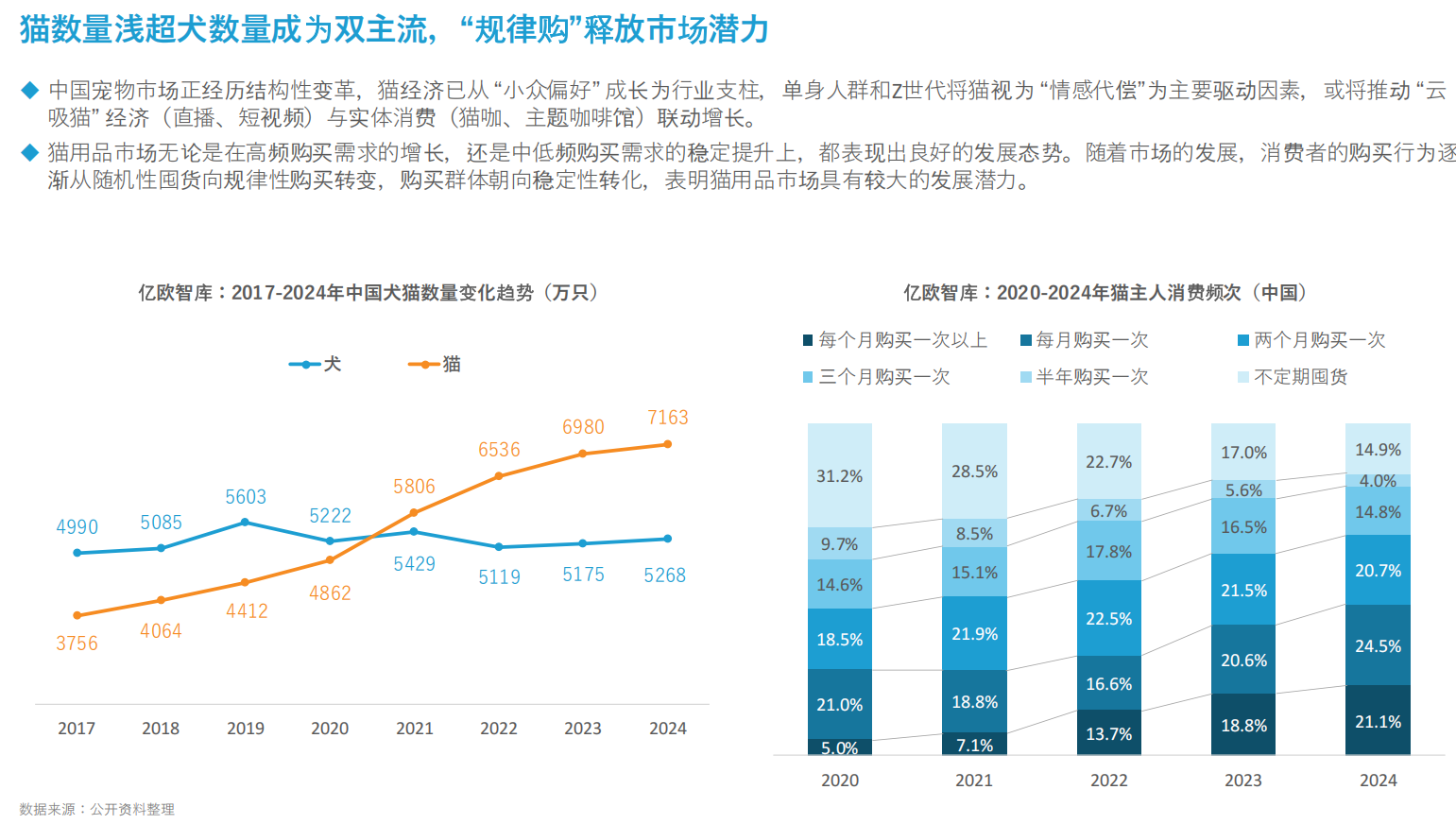

Meanwhile, the domestic Chinese consumer market is also undergoing a structural shift, with the number of cats surpassing that of dogs, becoming the main driver of the pet food sub-market.

Single people and Generation Z are choosing cats as emotional companions, which in turn drives the growth of the "cloud cat economy" and cat product consumption. Users’ purchasing behavior is also shifting from stockpiling to regular purchases, showing higher loyalty and brand stickiness.

This evolution in consumer habits provides an important insight for companies regarding overseas expansion: to gain long-term space in the international market, brands must transition from one-off sales to ongoing relationship management.

Image source: EO Intelligence "2025 China Pet Food Going Global Analysis Report"

Diversified Export Structure, Structural Dependence Still Needs Attention

The rapid rise of the Southeast Asian market has also exposed another problem: most Chinese companies are still "exporting products" rather than "exporting brands."

Data shows that the export destinations of Chinese pet food are mainly concentrated in Asia, Europe, and the Americas, with exports to the Asian market increasing from $377 million in 2020 to $582 million in 2024.

In contrast, imports are mainly from the Americas, indicating that there is still a dependence on certain high-end pet foods domestically.

More notably, among export categories, canned food is the only one with a trade deficit. The cumulative deficit over five years is about $310 million, which also indirectly reflects the domestic shortcomings in R&D and branding capabilities for wet and functional products.

In contrast, retail-packaged dry food and additive products have achieved trade surpluses of $3.438 billion and $5.081 billion, respectively, indicating that Chinese companies already have a certain scale advantage in these two basic categories, but there is still a gap in "occupying consumer mindshare."

Image source: Internet

Going Global Is No Longer Just Exporting, But a Systematic Upgrade

To truly shed the "OEM" label, Chinese pet food brands need to re-examine their globalization paths. In the future, going global will no longer be simply about channel building and supply output, but a systematic project advancing on multiple fronts: "brand + capacity + channels + risk."

For example, in Southeast Asia, by setting up factories and moving production capacity to Thailand, Cambodia, and other places, companies can not only avoid some of the risks brought by international trade frictions, but also get closer to raw material sources and reduce logistics and warehousing costs. At the same time, they can reach end consumers through cross-border e-commerce platforms, quickly establishing local market awareness with flexible product combinations and content-driven marketing.

In mature markets such as Europe and the United States, a longer-term brand management strategy is required. Some companies have begun to accumulate experience through OEM/ODM, and then gradually build their own brand recognition by establishing independent websites, participating in pet exhibitions, and obtaining FDA certification.

Beyond brand building, some companies can also try to enter vertical segments and gain supply chain or technological advantages by cooperating with or even acquiring local small and medium-sized enterprises, thus forming a localized operational closed loop.

Image source: Internet

Final Words

Overall, Chinese pet food brands have already moved beyond the first stage of "manufacturing-led" and are entering a new cycle with "brand at the core."

With the dual overlay of overall industry structural transformation and global market evolution, going global is no longer just a trial for a few companies, but a breakthrough for the overall industry upgrade.

The path has been laid out, but every step is not easy and requires keeping the right pace and advancing steadily.