Amidst the wave of the digital era, TikTok has become a global leader in e-commerce with its unique charm and innovative model. The release of the "2024 First Half TikTok E-commerce Data Report" unveils the platform's performance and future development trends worldwide. Below, TuKe will analyze TikTok e-commerce's performance in the global market based on real data from the report, helping everyone better leverage TikTok for international expansion.

1. The Pace of Global Expansion: The Miracle of Downloads and Active User Growth

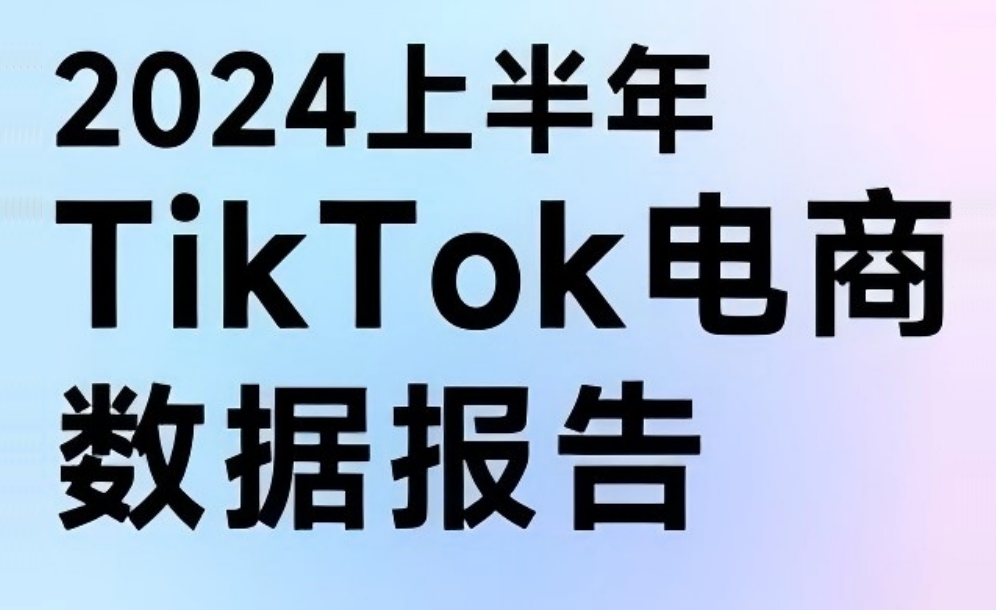

·Global download surge: In the first half of 2024, TikTok's global average monthly downloads reached 81.73 million, a year-on-year increase of 6.6%. This figure peaked in May, hitting 86.7 million downloads.

·Steady growth in the US market: Despite policy uncertainties, the number of monthly active users in the US remains above 170 million, demonstrating a strong user base and brand loyalty.

Image source: "2024 First Half TikTok E-commerce Data Report"

2. The Rise of Emerging Markets: Geographic Shift in Incremental Markets

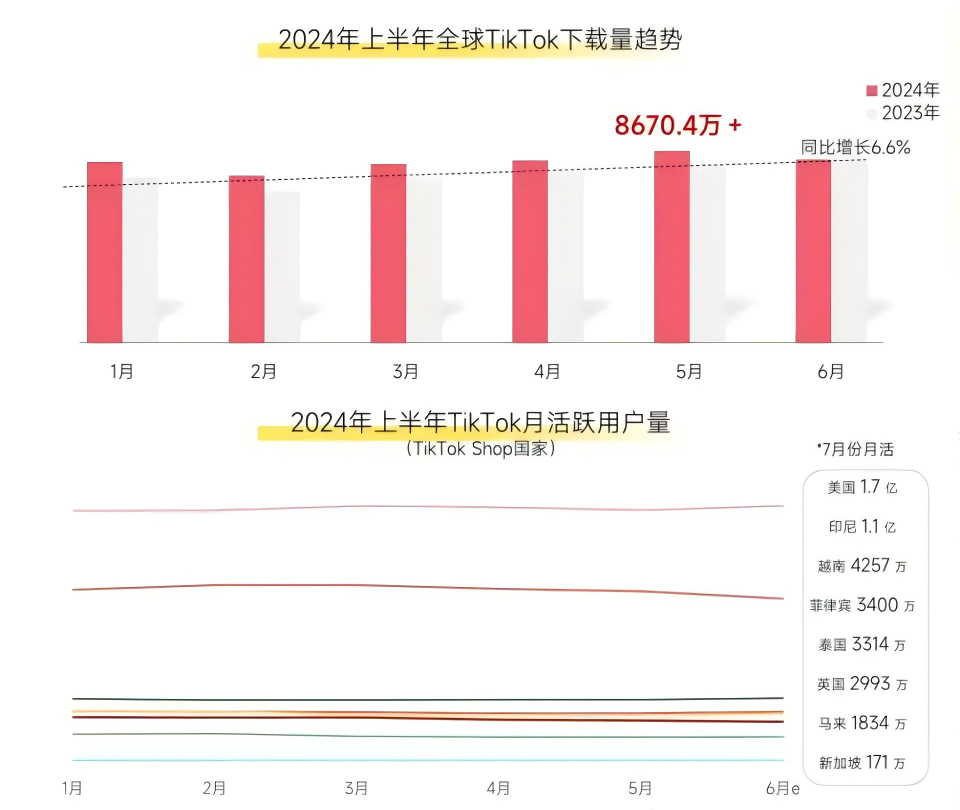

·New opportunities in emerging markets: Most new downloads come from Southeast Asia, South Asia, and Latin America, marking a strategic shift in TikTok's global layout towards the East.

·Southeast Asia leads the trend: Countries like Thailand and Indonesia have become hotspots for sales and user growth, showcasing the tremendous potential of emerging markets.

Image source: "2024 First Half TikTok E-commerce Data Report"

3. Sales and Market Share: Impressive Results from a Global Perspective

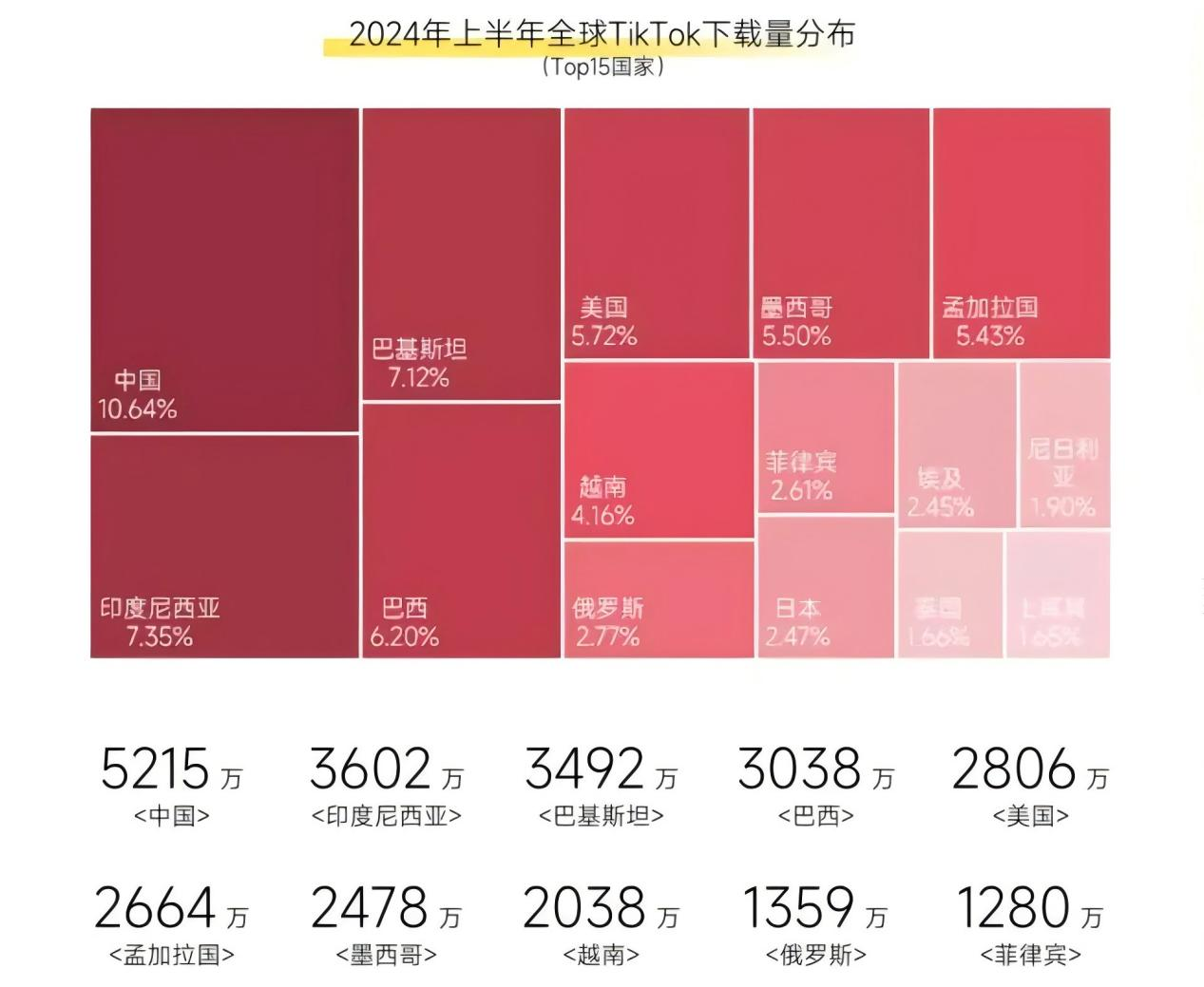

·Sales ranking: Thailand tops the list with $3.78 billion GMV, while the US market is close to $3 billion, with market share steadily increasing.

·Average order value comparison: The US market's average order value reached $19.5, far exceeding the platform average of $7.1, highlighting its high consumption capacity and market value.

Image source: "2024 First Half TikTok E-commerce Data Report"

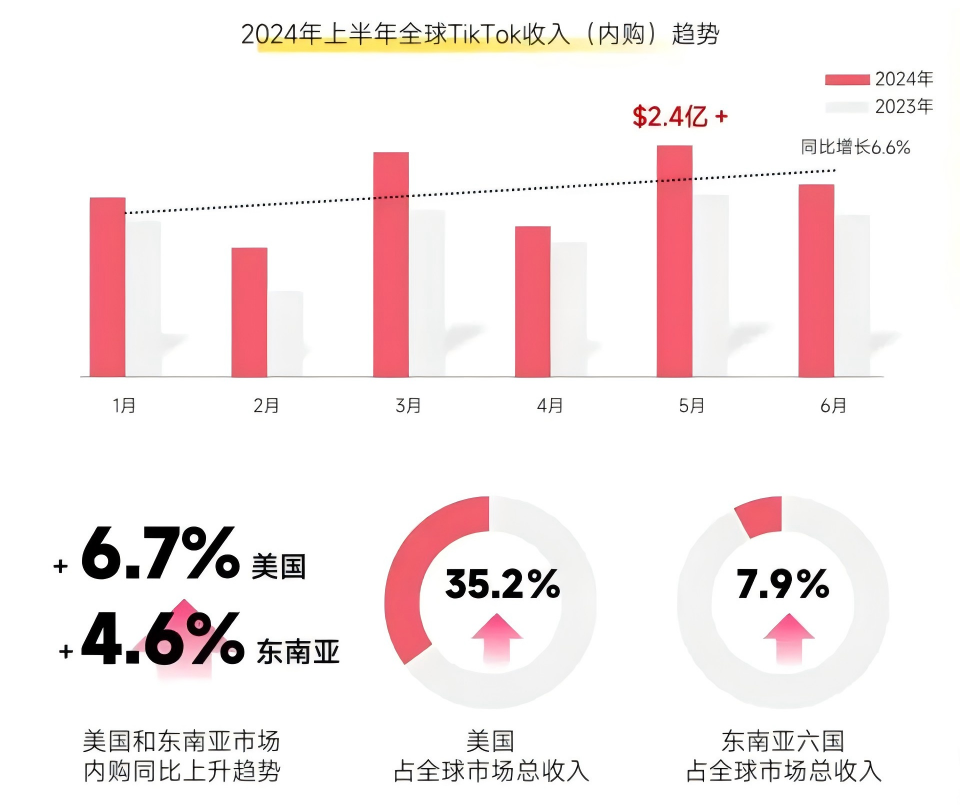

4. In-app Purchase Revenue: Global Growth Led by the US

·Strong global in-app purchase revenue growth: In the first half of 2024, TikTok's global in-app purchase revenue averaged $220 million per month, a significant year-on-year increase of 6.6%. May alone set a record with $240 million, showing TikTok's strong momentum in e-commerce.

·Outstanding contribution from the US market: As the core battleground for TikTok's commercialization, the US accounts for 35.2% of global in-app purchase revenue, with a year-on-year growth rate of 6.7%, far surpassing Southeast Asia's 4.6%.

Image source: "2024 First Half TikTok E-commerce Data Report"

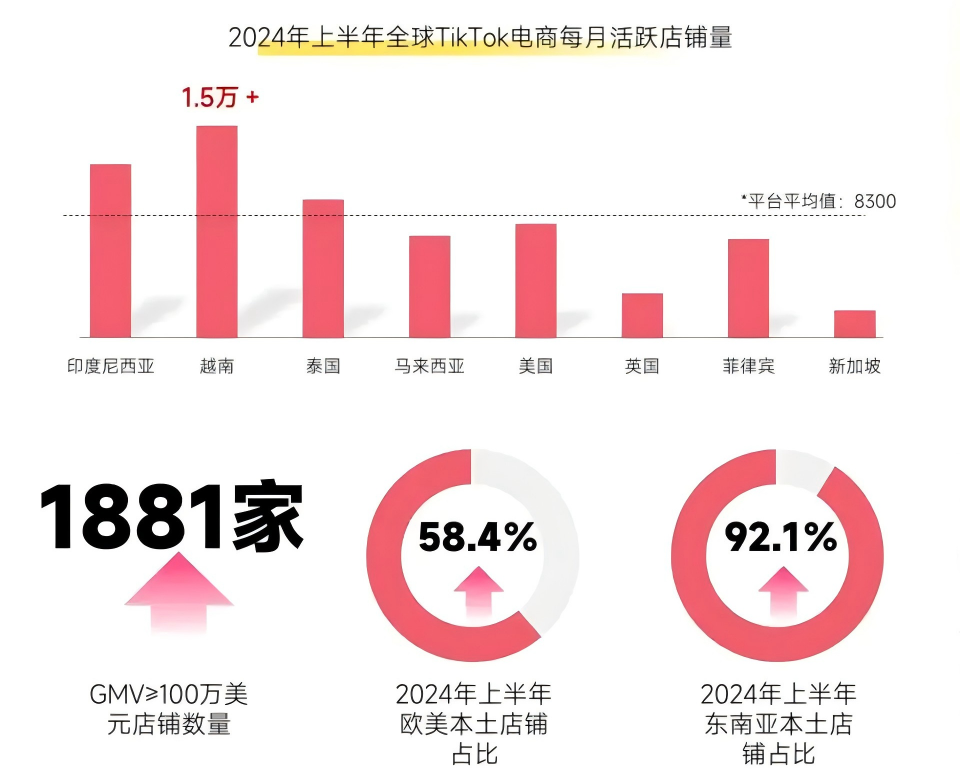

5. Global Store Overview: Diverse Distribution with Unique Characteristics

·Emergence of high-sales stores: During the first half of the year, the number of stores with sales exceeding $1 million reached 1,881, including businesses from various countries and regions. These successful cases provide valuable experience for other merchants and promote the prosperity and development of TikTok's e-commerce ecosystem.

·Uneven store distribution: Data shows that Vietnam has the most active stores, exceeding 15,000. In contrast, the UK and Singapore have fewer active stores, reflecting significant differences in e-commerce activity across markets.

Image source: "2024 First Half TikTok E-commerce Data Report"

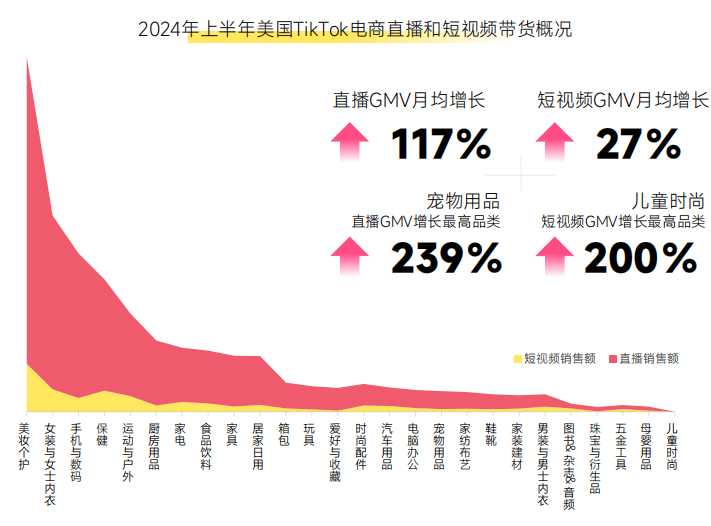

6. In-depth Analysis of the US Market: Opportunities and Challenges Coexist

·Store dynamics: The number of active stores in the US reached nearly 8,331 per month, surpassing 11,000 in June, mainly dominated by local self-operated stores.

·Hot-selling categories: Beauty & personal care, mother & baby products, and children's fashion categories showed strong growth momentum. Among them, beauty & personal care ranked Top 1 with cumulative sales exceeding $440 million.

·Innovative marketing models: Dual engines of live streaming and short video sales. In the first half of 2024, live streaming GMV grew by an average of 11% per month, while short video GMV grew by an average of 27% per month.

Image source: "2024 First Half TikTok E-commerce Data Report"

Against the backdrop of digital transformation, TikTok is reshaping the global e-commerce landscape with its unique social attributes and innovative business model. From the surge in global downloads to the solid position in the US market, and the rapid growth in emerging markets such as Southeast Asia, South Asia, and Latin America, all point to TikTok e-commerce's broad prospects and infinite possibilities.

Facing future opportunities and challenges, TikTok e-commerce needs to continue deepening localization strategies, strengthen cooperation with local merchants, and expand diversified product categories, especially in beauty & personal care, mother & baby products, and tech products, to meet the specific needs of different markets and achieve further development.