When it comes to the European e-commerce market, people usually think first of traditional major countries like the UK and Germany, while impressions of Poland are often not as strong.

However, Poland's recent data is particularly impressive—despite an overall decline in retail, Polish e-commerce continues to rise against the trend, and this market is rapidly emerging.

How is it possible to achieve growth against the trend in a sluggish retail environment?

Data shows that in September this year, Poland's overall retail sales fell by 5.7% month-on-month and 3% year-on-year. However, e-commerce sales rose against the trend, with a year-on-year increase of 4.6%. At the same time, the proportion of e-commerce in total retail sales also increased from 8.3% in August to 8.9%.

Polish e-commerce sales rise against the trend Source: TVP WORLD

Behind this growth, on one hand, is consumers’ increasing preference for online shopping, and on the other hand, the improvement of payment and logistics. Online sales of clothing and home products are particularly prominent, with e-commerce sales of clothing up 6.5% year-on-year, and home products up an impressive 24.3%. The data for these two categories is especially eye-catching, reflecting a steady increase in demand for online shopping.

Data from Polish e-commerce giant Allegro also supports this trend.

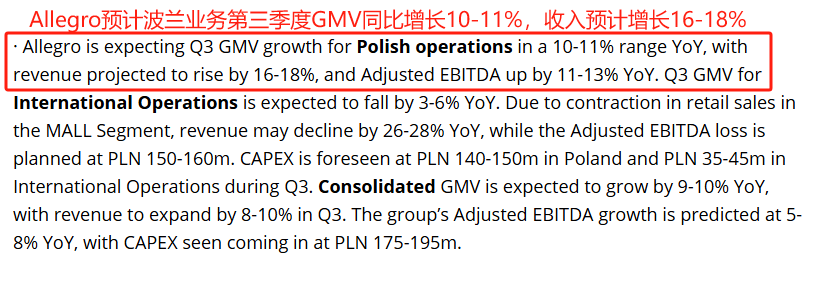

Allegro’s Q2 financial report shows its gross merchandise value (GMV) reached 15 billion PLN, up 11.6% year-on-year, while revenue reached 2.3 billion PLN, an increase of 23.8%. By the end of Q2, Allegro had 14.9 million active buyers, injecting strong momentum into Poland’s e-commerce market. It is expected that in Q3, the platform’s GMV growth rate will remain at 10%–11%, and revenue growth at 16%–18%. All signs indicate that Allegro has become the “engine” driving the steady rise of Polish e-commerce, injecting vitality into the entire e-commerce ecosystem.

Allegro expects Polish e-commerce performance to continue rising Source: en.media.allegro.pl

European e-commerce is booming, cross-border transactions continue to heat up

The growth of Polish e-commerce is not an isolated case; looking at the whole of Europe, the e-commerce market is equally vibrant.

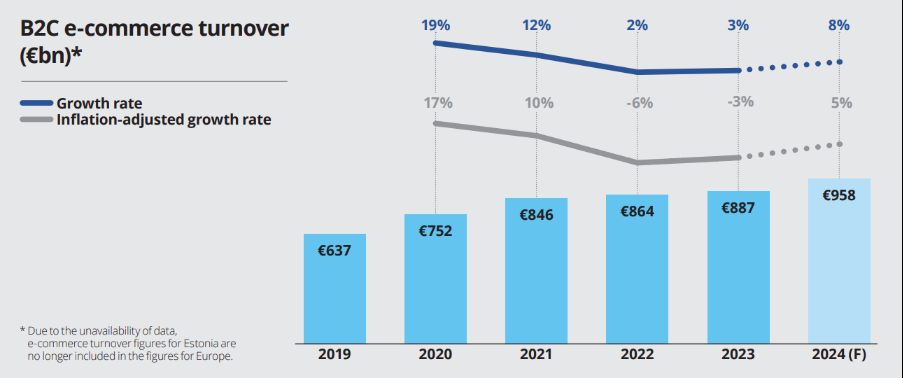

According to the “2024 European E-commerce Report” jointly released by Ecommerce Europe and EuroCommerce, European e-commerce sales will reach 958 billion euros this year, an increase of 8% year-on-year. The rise of cross-border e-commerce in the European market is particularly notable.

European e-commerce scale will reach 958 billion euros Source: eurocommerce.eu

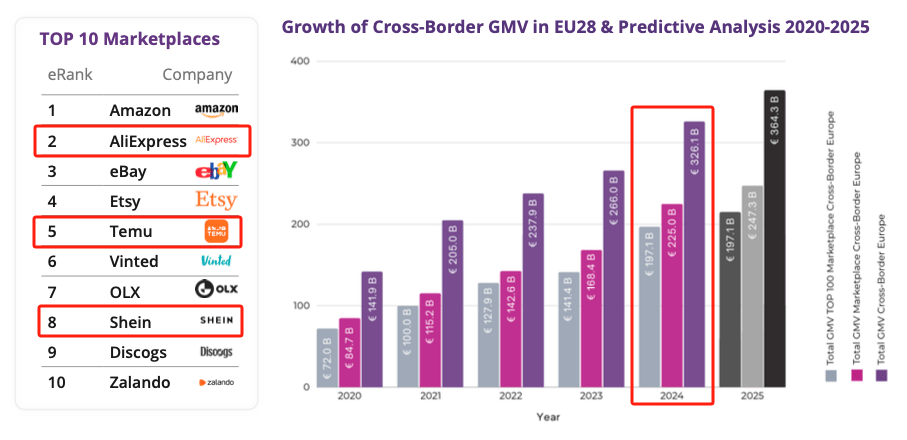

The “Europe Top 100 Cross-Border Marketplaces” report released by CBCommerce.eu mentions that by the end of this year, the European cross-border e-commerce market is expected to reach 326 billion euros, of which about 225 billion euros will come from cross-border e-commerce platforms, accounting for 69%.

Among these platforms, the market share of Chinese cross-border platforms in Europe is also significant.

Among the top ten cross-border e-commerce platforms in Europe, China’s AliExpress, Temu, and Shein rank second, fifth, and eighth respectively. They are very popular among European consumers and have injected new vitality into the European market.

Source: CBCommerce.eu

Seize the trend of Polish e-commerce and explore new possibilities in the European market

For sellers, whether entering through local platforms or operating independent sites, they can take advantage of the growth opportunities in the Polish market to create new possibilities for expanding their products in the European market.

The European market has already entered a fast lane of diversified development.

The rise of Polish e-commerce is a signal: a diversified pattern is taking shape in the European market. From focusing on user needs and optimizing local experiences to providing flexible payment and logistics support, the development of Polish e-commerce has undoubtedly opened the door for more sellers.