If short videos are redefining the way global consumers shop, then Africa is undoubtedly the next battleground for this transformation.

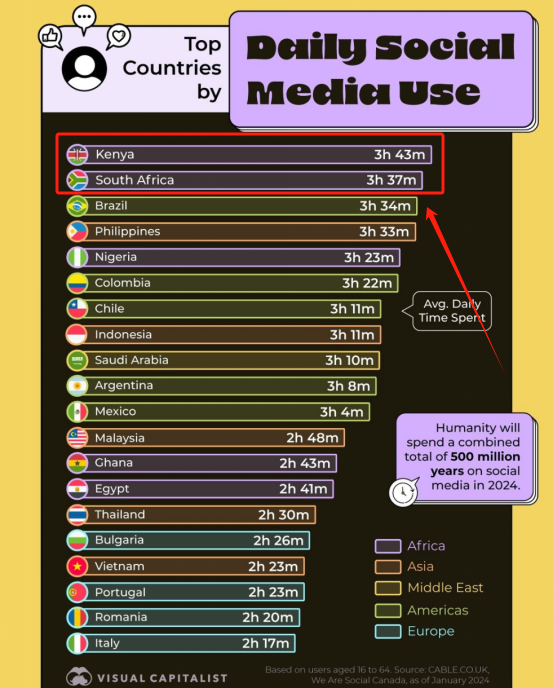

Data shows that Kenyans spend an average of 3 hours and 43 minutes per day on social media, with South Africans close behind at 3 hours and 37 minutes per day, a third higher than the global average. TikTok is one of their favorite short video platforms, and its popularity in Africa is not only changing entertainment habits but also reshaping African consumers’ shopping behaviors.

Kenyans spend the most time on social media globally. Image source: Visual Capitalist

The E-commerce Blue Ocean of the African Market

Africa is the world’s second most populous continent, with over 1.4 billion people and a very young demographic—the average age is only 19.4 years. A young population not only means consumption potential, but also a higher acceptance of new things. Compared to other regions, Africa’s digital development started relatively late, but this is changing rapidly. Especially in e-commerce, Africa shows huge growth potential—by 2022, the African e-commerce market reached $32.5 billion, and is expected to double to nearly $60 billion by 2027.

However, low e-commerce penetration remains a key feature of Africa. Currently, Africa’s e-commerce penetration rate is only 35%, a stark contrast to the over 80% levels in Europe and the US. Yet, this low starting point and rapid growth make Africa a new blue ocean for agile sellers and cross-border platforms to compete for.

Africa’s e-commerce market has huge potential. Image source: en.people.cn

TikTok: The Catalyst for Short Video E-commerce

Faced with such a young and high-growth market, short video platforms have become key drivers of consumption trends, with TikTok at the center of this wave.

A consumer survey in South Africa shows that over 60% of users make direct purchases after discovering products through TikTok videos, and this proportion rises to 64% during holidays. TikTok’s recommendation algorithm exposes consumers to products they may be interested in, and short video content directly fuels the “see it, want to buy it” impulse among young Africans.

TikTok has also deeply cultivated Africa’s content ecosystem. After entering the African market in 2019, the platform quickly launched the Africa Creator Hub, an intensive eight-week training program teaching local content creators how to produce high-quality videos, collaborate with brands, and master livestream selling and other monetization skills. This localized support has rapidly produced a batch of “African livestream sellers” who not only generate traffic for TikTok but also directly drive product sales.

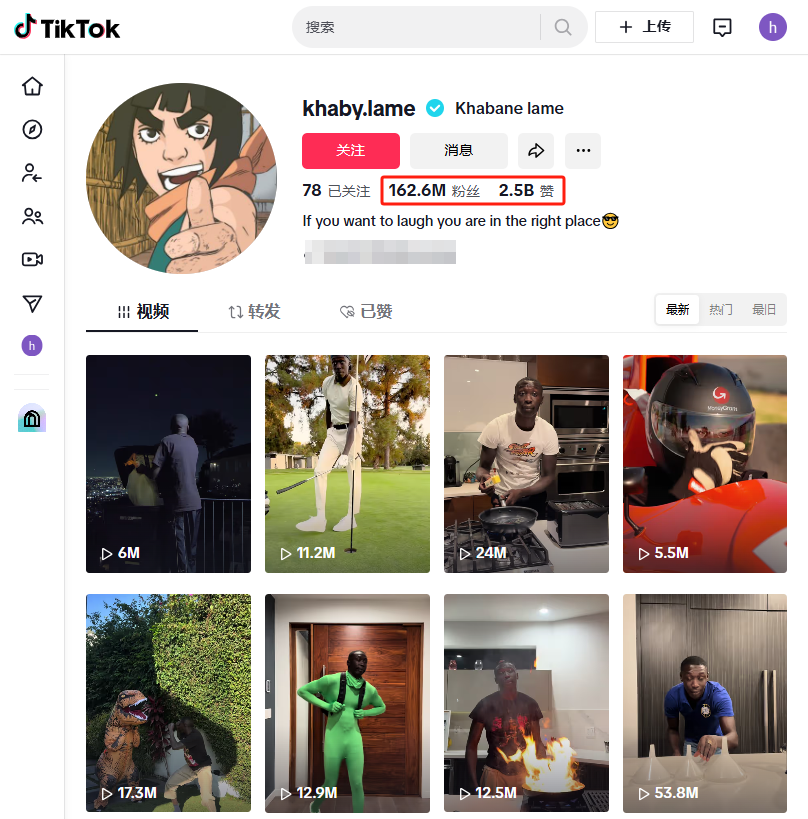

Among Africa’s short video stars, the most famous is “Hand Gesture Guy” Khaby Lame. With his humorous, silent content, he has won over global audiences, attracted more than 162 million followers, and become TikTok’s most-followed creator worldwide. This not only landed him a contract with luxury brand HUGO BOSS, but also directly boosted TikTok’s influence in Africa. Similar influencer sales models are being replicated by TikTok, building new bridges between brands and consumers.

Khaby Lame’s TikTok homepage

New Opportunities for Chinese Sellers

For Chinese sellers, the unique consumption needs of the African market bring brand new opportunities.

Due to Africa’s hot climate and special hair types, wigs have become daily necessities for African consumers. Data shows that Chinese-made wigs account for 35% of Africa’s wig market and are still growing rapidly. Some Chinese merchants promote wig products via TikTok ads, and during holiday promotions, even need to work overtime to fulfill orders.

Besides wigs, consumer electronics are also hot-selling categories in Africa. Poor infrastructure means African consumers have high demand for accessories like power banks. For example, a power bank costing 50 yuan can sell for 80 to 90 yuan in Africa, leaving about 15% profit margin after costs. Additionally, smartphones with small memory make SD cards essential products, providing further opportunities for Chinese sellers.

Cultural identity further drives the success of Chinese brands. For example, in apparel, African consumers prefer brightly colored and boldly designed clothing, closely tied to local traditions and aesthetics. Chinese exporters design clothes to meet African consumer preferences and showcase these products on TikTok, not only boosting sales but also building deep emotional connections with local consumers.

Image source: Xinhua

Giants Enter, Market Structure Emerging

Seeing the potential of the African market, many cross-border e-commerce giants have already taken action.

Shein entered the South African market as early as 2020 and quickly became the mainstream platform for online apparel consumption. This year, it surpassed Amazon and Walmart to become the most downloaded shopping app on South Africa’s Google Play.

Temu also launched its South Africa site early this year, quickly winning users with highly competitive low prices and subsidies. Amazon provides same-day and next-day delivery through its South Africa site and launched the “Shop Mzansi” project to bring local South African brands to market, giving users more choices.

TikTok is also actively ramping up its presence in Africa. In addition to improving African users’ content creation abilities through creator training programs, it plans to set up an office in Kenya to further drive the development of Africa’s influencer economy.

Challenges and Potential: The Next Decade of African E-commerce

Despite the broad prospects, the African market is not without challenges.

High logistics costs, low network coverage, and weak infrastructure are all issues that e-commerce platforms and cross-border sellers need to solve. For example, “last mile” delivery costs in Africa account for 35% to 55% of total product costs, far higher than the global average. These high costs are undoubtedly a bottleneck for the development of African e-commerce.

Today, Africa is at a turning point in e-commerce development, and TikTok’s strong entry is undoubtedly one of the catalysts.

In this blue ocean market full of opportunities, whoever can identify needs and quickly deploy will likely become the leader in the next wave of African e-commerce growth.