With the rapid development of the Internet and the popularization of smart devices, consumers' shopping methods have undergone tremendous changes. Especially in Germany, the continuous expansion of the e-commerce market is remarkable.

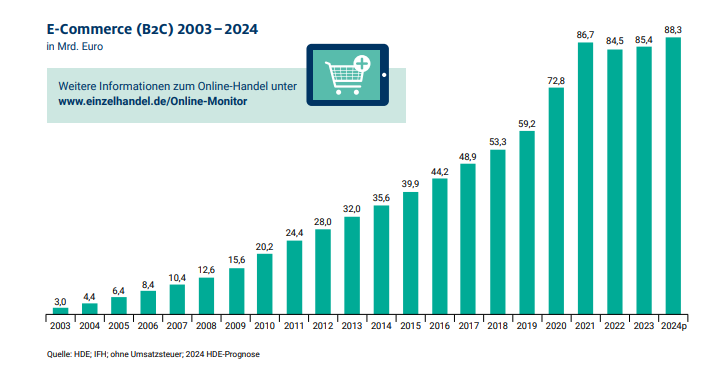

According to data from the German Retail Association (HDE), in 2024, Germany's online transaction volume is expected to exceed 88.3 billion euros. This figure not only surpasses the peak of 86.7 billion euros set in 2021, but also marks a new record for the German e-commerce market.

Image source: German Retail Association (HDE)

Even more impressive, HDE's survey shows that almost all German adults participate in online shopping. Specifically, as many as 99% of adult German consumers are already accustomed to shopping online. This online shopping model has been fully integrated into the daily lives of Germans. Whether buying daily necessities or purchasing gifts for festivals, e-commerce platforms have become the main choice for people.

01

Continuous Growth in E-commerce Sales: Online Consumption Becomes Mainstream

In recent years, Germany's e-commerce market has shown strong growth momentum, partly due to changes in consumer shopping habits and convenient online payment methods. As more and more consumers become accustomed to buying goods online, the German e-commerce market has ushered in unprecedented opportunities.

Despite global economic challenges, especially the pressure brought by inflation, German consumers' enthusiasm for online shopping has not diminished. Especially with the arrival of the holiday shopping season, consumers' desire to buy remains strong. Many Germans have made online shopping their first choice for holiday purchases, especially during the shopping season of Black Friday (November 29) and Cyber Monday (December 2), when promotional activities on e-commerce platforms attract a large number of consumers.

Holiday Shopping Season: Black Friday and Cyber Monday Still Ignite Consumption

Black Friday and Cyber Monday are important promotional days in the global e-commerce industry. In Germany, the total sales for these two days in 2024 are expected to reach 5.9 billion euros. Although the economic situation is not optimistic, the appeal of discounts and promotions can still stimulate consumers' shopping enthusiasm. This further proves that, despite the uncertainty of the macroeconomic environment, consumers' desire for bargains when shopping always exists.

Image source: German Retail Association (HDE)

Especially during festive periods, consumers tend to buy goods at these specific shopping nodes. This is not just about the appeal of price, but also a cultural phenomenon of holiday shopping. During the major promotions of Black Friday and Cyber Monday, major platforms launch targeted discounts, further driving sales growth.

02

Expansion of the German E-commerce Market: Intensified Global Competition

With the continuous growth of the German e-commerce market, not only are local e-commerce platforms growing, but global cross-border e-commerce platforms are also flocking in to compete for the market share of German consumers. Data shows that the size of the German e-commerce market is expected to exceed 98.3 billion US dollars in 2024, and is expected to further grow to 146 billion US dollars by 2029, with a compound annual growth rate (CAGR) of 8.22%. This trend indicates that the growth potential of the German e-commerce market remains huge.

Image source: Statista

Local E-commerce Platforms Expand into International Markets

German local e-commerce giants such as Otto and Kaufland have long begun to expand their e-commerce business to other countries. In April 2024, Otto announced that it would open its platform model to sellers from more EU countries, further expanding its market share and opening up more channels for cross-border e-commerce. At the same time, Kaufland is also expanding its international market. This summer, it expanded its e-commerce business to Poland and Austria, further strengthening its competitiveness in the Central and Eastern European market.

The expansion of these local e-commerce platforms not only increases the intensity of market competition, but also provides more opportunities for cooperation and competition for other e-commerce platforms. For cross-border e-commerce companies, the German market is undoubtedly a "battlefield" full of potential.

03

Conclusion

For cross-border e-commerce sellers, the potential of the German market cannot be ignored. Whether by optimizing localized services or by strengthening logistics systems and improving delivery efficiency, the German e-commerce market provides brands with multiple expansion paths. At the same time, consumer demand will become more diverse and personalized, and merchants need to constantly adapt to changes and provide more precise products and services.

Against the backdrop of increasingly fierce global e-commerce competition, the German e-commerce market is still an important market worthy of attention. Cross-border e-commerce companies and brands can make strong deployments here, leveraging the strong consumption power and highly digitalized shopping environment of the German market to embrace new opportunities in the coming years.