Amazon, the e-commerce giant, has recently made another big move—testing a new feature called "Offsite Product Display," which directly "sends" its own platform traffic to brand independent sites. As soon as the news broke, many brand sellers exclaimed "never thought I'd see the day," since Amazon has long been known as the "gatekeeper of traffic." Now, with this sudden change, what is the real intention behind it?

Image source: Internet

1. New Feature Revealed: Amazon Actively "Sending Customers" to Independent Sites

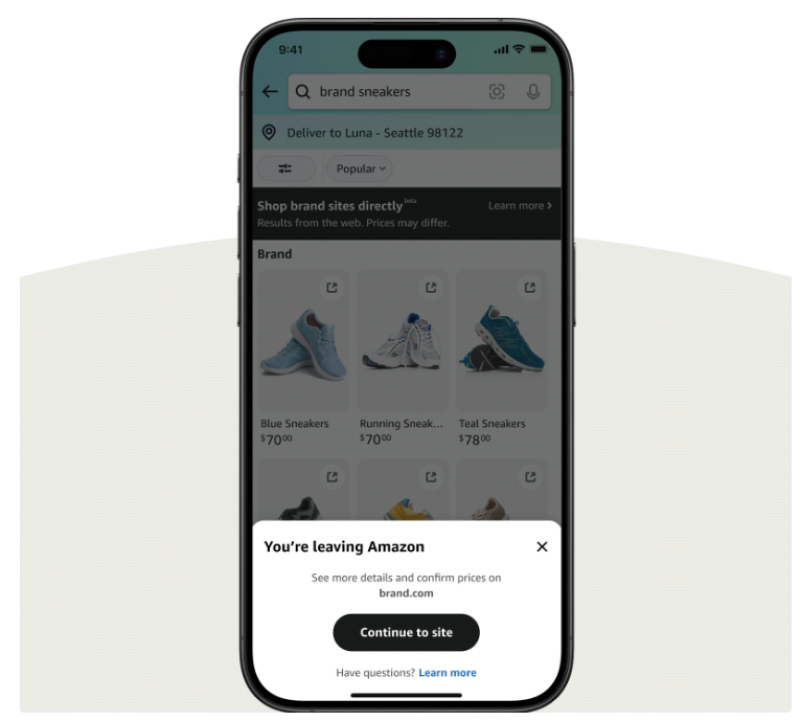

According to Amazon's official announcement, when users search for a brand or product in the Amazon App, search results will be divided into two categories: first, products available for purchase on the Amazon platform; second, products not sold on Amazon but available on the brand's official website. After clicking "See More," users will receive a prompt to jump to the brand's independent site, and upon confirmation, can complete the offsite purchase.

Currently, this feature is only open for testing to some US users, and is limited to iOS and Android clients. However, which brands can participate and whether traffic will be charged are still unclear.

User Perspective: Experience Upgrade

For consumers, this feature is equivalent to getting more comprehensive product information in a "one-stop" manner on Amazon. For example, searching for "Oura Smart Ring" allows users to see products from Amazon itself or third-party sellers, as well as exclusive styles or lower prices (if available) on the brand's official website. Meanwhile, Prime members who jump to brand sites supporting the "Prime Shopping" program can still enjoy free shipping, fast delivery, and other exclusive services.

Image source: aboutamazon

2. Amazon's Calculations: Fending Off Rivals, Strengthening Its Moat

Amazon has always been known for its "closed-loop traffic." Why suddenly be "generous" and help others? The answer may lie in competitive pressure.

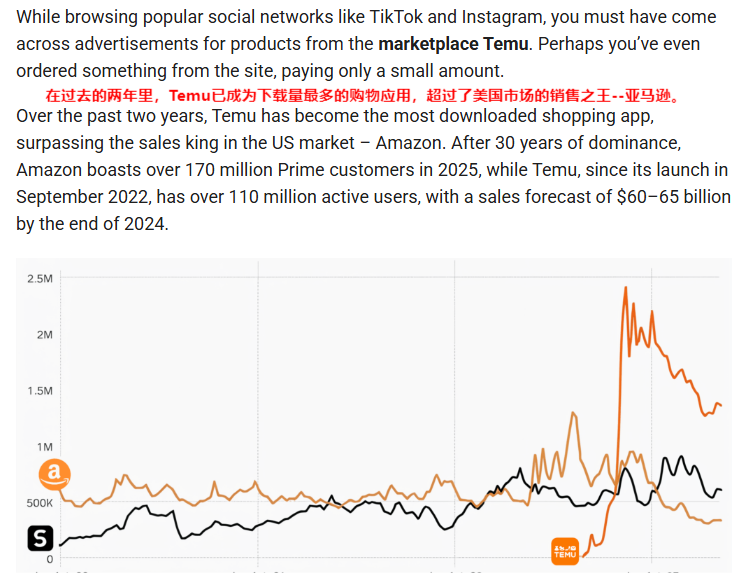

Counterattack Against Emerging Platforms Like Temu

In recent years, platforms like Temu, SHEIN, and TikTok Shop have quickly seized market share with low-price strategies. For example, Temu uses a fully managed model to push product prices extremely low, and in 2024, its monthly active users in the US even briefly surpassed Amazon. Although Amazon launched the low-price mall "Amazon Haul" to fight back, user awareness and usage are still below expectations (only 8% of consumers have purchased).

The new feature takes a different approach: allowing brands to sell at lower prices on their independent sites (saving platform commission and advertising costs), indirectly lowering prices of similar products on Amazon, and forming a "low-price encirclement" against Temu.

Image source: webycorp

Benchmarking Google Shopping

Google allowed merchants to display product links for free as early as 2020, enabling users to jump directly to retailer websites for price comparison and purchase. Amazon's newly tested feature is seen by outsiders as a key step in transforming into a "comprehensive shopping search engine," aiming to compete with Google for traffic entry points.

Image source: google

3. Opportunities and Concerns for Brand Sellers

Benefits: From "Platform Dependence" to "Dual-Track Operation"

In the past, brands listing on Amazon had to pay commissions, were subject to platform rules, and found it difficult to accumulate user data. While independent sites allow for autonomous operation, they face traffic challenges. The new feature provides brands with a "third path":

Low-cost traffic acquisition: With Amazon's precise traffic (users are mostly "ready to buy"), brands can quickly boost exposure for their independent sites.

Brand building: Independent sites can more fully showcase brand stories and product details, enhancing user trust. For example, home brand Aosom has successfully built brand influence with a "Amazon + independent site" dual-track model, achieving annual revenue of over 3.4 billion yuan.

Risks: Traffic Allocation and Policy Uncertainty

Traffic tilt: Amazon may prioritize displaying offsite links for big brands or paid sellers, making it difficult for small and medium sellers to get a share.

Policy changes: If Amazon charges for traffic redirection or adjusts rules in the future, brands will need to reassess cost-effectiveness.

Image source: Internet

Conclusion

Amazon's "traffic sharing" experiment is both a reluctant response to competitive pressure and a bold attempt at the evolution of the e-commerce ecosystem. For brands, opportunities and risks coexist; for the industry, it may trigger a new wave of "platform + independent site" integration. As for whether this experiment can rewrite the e-commerce landscape, only time will tell.

(Note: The information in this article is based on Amazon's official statements and industry analysis. Some details are still being tested, and the actual effect is subject to the final version.)