"Selling on TEMU used to feel like eating fast food, but now I realize TikTok is the real homemade dish."

——A seller who switched to TikTok lamented

1. Americans' "cheap happiness" suddenly disappeared

Last week, an American friend sent me a message complaining: "What's going on with you Chinese sellers? Those $15 pants on TEMU have gone up to $22!"

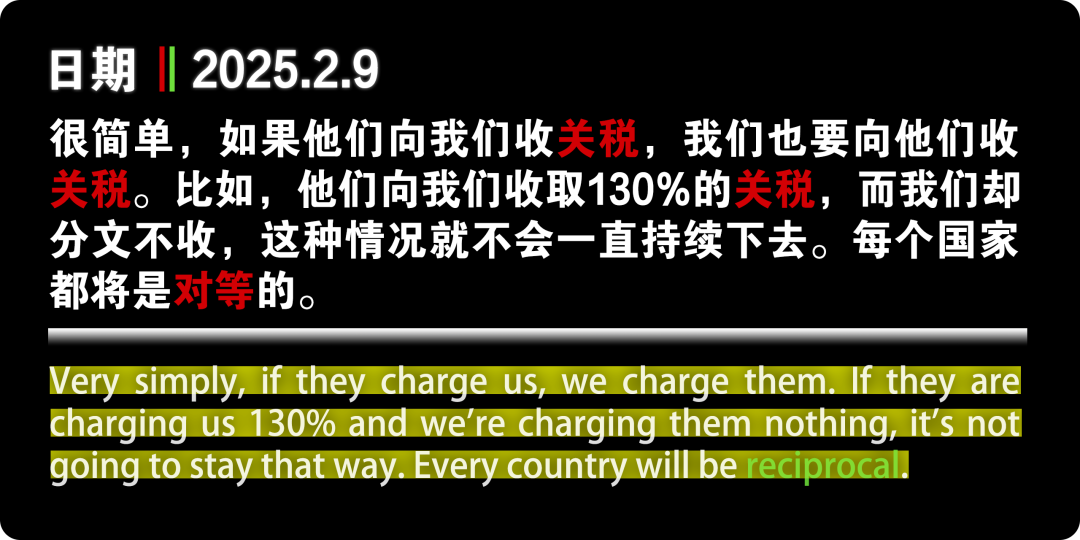

Behind his grumbling isthe U.S. government's new tariff policy: Starting February 4, the tax exemption for packages under $800 is canceled, and Chinese goods collectively increased in price.

In this storm, the worst hit are TEMU's "fully managed sellers." These sellers used to just hand over their goods to the platform and wait for their share, but now they've been stunned by the tariffs—a skirt's cost increased by 13%, a frying pan is nearly 30% more expensive, and American consumers have simply turned their backs and stopped buying.

A seller cried out on Xiaohongshu:

"Yesterday I could still sell 500 orders a day, today it's zero! TEMU silently took down our products and replaced them with local warehouse goods, without even an explanation..."

This "use and discard" feeling has left many sellers disheartened. Ironically, while TEMU is scrambling to implement semi-managed solutions, good news exploded in the TikTok Shop seller groups:

"My livestream blew up today! Tariffs? Not a thing!"

A post-95 seller of power banks shared backend data showing that day's sales tripled.

However, for now, this situation probably won't last long.

After Trump, another executive order was issued, stating that the U.S. will temporarily allow small parcels from China to continue enjoying tax exemption, postponing the cancellation of the "de minimis exemption" to avoid trade disruption.

Although Trump's flip-flopping makes people suspect he's making concessions under pressure from Beijing,

the truth is otherwise. A Reuters report pointed out that after the ban was issued, some U.S. airports experienced severe pile-ups of small parcels, putting huge pressure on cargo transport and causing chaos in the logistics system.

That's why the White House paused the ban and is working to address the emergency to ensure efficient operation of the goods import system.

Once the White House resolves all issues, the tax exemption ban is very likely to be implemented.

2. TikTok's "magical moves": Making Americans shop while watching videos

After deep conversations with several sellers who switched to TikTok, Tu Ke found that their ability to dodge the tariff blow relies entirely on the platform's three tricks:

1. Hide the goods in Americans' backyards

"You think we're shipping from China? We've already stocked up in the New Jersey warehouse!" revealed a home goods seller. TikTok requires sellers to pre-stock in overseas warehouses. Tariffs up 10%? Spread over each cup, it's only $0.2 more—consumers don't even notice.

In contrast, TEMU ships large quantities directly from Shenzhen to New York. When tariffs hit, costs soar, forcing price hikes that cut into consumers—resulting in buyers cursing and sellers taking the blame.

2. Turn selling into "binge-watching"

"Listing products on TEMU used to feel like throwing stones into the sea. Now, making short videos on TikTok is like casting bait into a school of fish." A women's clothing seller demonstrated her viral formula:

· Shoot an office "one-second outfit change" video, skirt purchase link gets 200 clicks

· During livestreams, have American hosts try on and comment, clearing 500 units on the spot

The platform is even crazily handing out incentives: no commission for video creation, traffic bonuses for livestreams, turning selling into a content competition.

3. Pull sellers into "brand upgrading"

What surprised Tu Ke most is that TikTok is actually teaching sellers to raise prices.

"They clearly said that during Black Friday, products under $8 won't get subsidies, forcing us to focus on quality."

A digital seller showed his new headphones—same factory goods, but with a "trendy youth exclusive" label, the price is 40% higher than TEMU, and they're selling even better.

3. Underlying currents: Chinese sellers are "changing their fate"

In recent days, after visiting the Shenzhen industrial belt, Tu Ke noticed three interesting changes:

1. Warehouse owners' anxiety

"Previously, clients asked 'Can it be 0.5 yuan cheaper?' Now they ask 'Can you get it into a U.S. warehouse within a week?'" said a logistics company owner. Overseas warehouse orders have surged 300%, and warehouse rent increases twice a month.

2. Booming streamer training

"English livestream training classes have raised tuition from 3,888 to 12,888 and are still packed." A training agency head revealed that some sellers even form groups to learn how to use American humor to pitch products.

3. AI tools' miraculous support

At Bantian's seller hub, Tu Ke met Xiaolin, a post-2000 seller using the AI tool DeepSeek: "Let it analyze trending topics and generate 20 video scripts, I just pick two to shoot." This former "invisible" seller with monthly sales of 30,000 now earns $100,000 a month on TikTok by using AI for product selection and trending topics.

Looking at the devastated TEMU seller groups, Tu Ke recalled the 2015 Amazon store shutdown wave—back then, sellers relying on fake orders collapsed, and those who survived were the ones who focused on their products.

Therefore, Tu Ke offers three suggestions for cross-border sellers:

1. Warehouses are more important than price:Overseas warehouses are your bulletproof vest—don't wait for bullets to fly before looking for cover

2. Content is more important than product pages:Americans stopped looking at cheap product photos long ago—they want to see you tell jokes

3. Branding is more important than low price:The same data cable, labeled "TikTok influencer's pick," can sell for $5 more

"We used to say 'cheap is the hard truth,' but now we realize the real hard truth is making yourself irreplaceable."

The tariff hammer has woken up Chinese sellers: the days of making quick money by exploiting policy loopholes are over. While TEMU sellers complain in rights protection groups, TikTok's early players are already driving Porsches to negotiate overseas warehouse deals.

"Low price is a dead end; content is the new channel."

The world always rewards those who see the direction clearly—it's not too late to turn around now.

(At the request of interviewees, some names have been changed)