India's e-commerce market has been booming in the past two years, but it also faces a host of problems.

Amazon and Flipkart, the two giants of the Indian market, have not had it easy recently. First, they were investigated for non-compliant products, and then their operating models came under scrutiny, with more and more issues being uncovered. Behind this is the Indian government's determination to overhaul the e-commerce industry. As regulatory pressure increases, both platforms and sellers are facing unprecedented challenges. How to find a balance between compliance and growth has become a pressing issue for the industry.

Image source: Internet

Compliance Issues Erupt: From Product Certification to Monopoly Controversy

Recently, the Bureau of Indian Standards (BIS) conducted surprise inspections of the warehouses of e-commerce giants such as Amazon and Flipkart, covering cities like Delhi, Gurgaon, and Lucknow, and seized a large number of products that had not passed mandatory certification. For example, 215 toys and 24 handheld blenders in Amazon's Lucknow warehouse were seized for lack of BIS certification; in the Gurgaon warehouse, non-compliant products such as aluminum foil, metal water bottles, and PVC cables were found. In Flipkart's associated warehouse, 534 vacuum insulated bottles, 134 toys, and 41 speakers were also seized due to missing certifications.

Image source: THE NEWINDIAN EXPRESS

BIS emphasized that uncertified products pose safety risks and may threaten consumer safety. This action sends a clear signal: India's regulation of e-commerce compliance has entered a high-pressure phase.

Antitrust Investigations Intensify: Giants Deep in Multiple Accusations

In addition to product compliance issues, Amazon and Flipkart are also facing antitrust investigations by the Competition Commission of India (CCI).

In November 2024, the Indian Ministry of Consumer Affairs, together with BIS, launched the "Online Consumer Review Guidelines," requiring e-commerce platforms to:

1. Strictly verify the identity of reviewers: Confirm user authenticity through multiple methods such as phone, email, and IP address;

2. Establish review officers: Manually or with tools, screen for fake reviews and trace violating accounts;

3. Disclose real review data: Prohibit hiding or altering low-score reviews.

Previously, Amazon was investigated in the UK, Spain, and other countries for rampant fake reviews. India's new regulations are considered one of the strictest review governance frameworks in the world. Data shows that in 2023, complaints about Indian e-commerce surged by 366%, with fake reviews being the main reason for the collapse of consumer trust.

Image source: inc42

Challenges and Response Trends for Cross-border Sellers

For cross-border sellers, the Indian market presents both opportunities and risks. As regulation tightens, the following trends are worth noting:

1. Rising compliance costs

Platforms must ensure that products pass BIS certification, comply with environmental standards (such as Amazon's "Climate Friendly Certification" green label), and must not involve trademark infringement.

2. Transformation of operating models

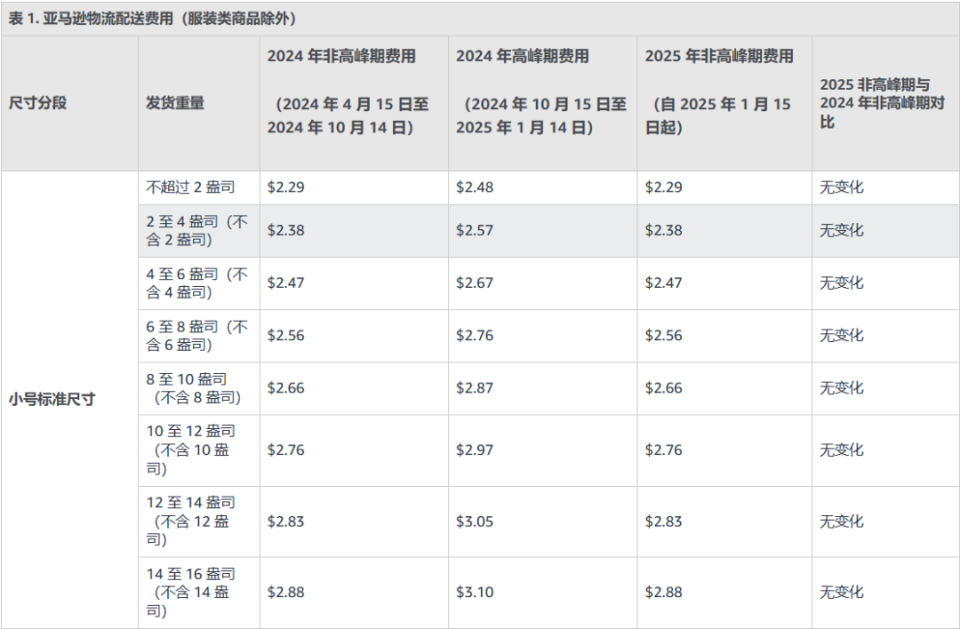

India prohibits foreign-funded e-commerce from directly participating in inventory management, so sellers need to adjust their supply chain strategies. Some companies are turning to cooperation with local agents or adopting a "light asset" model, providing only drop-shipping services. At the same time, policy changes such as Amazon FBA fee adjustments and increased storage fees in the European market are forcing sellers to optimize inventory turnover rates.

Image source: Internet

3. Intensified differentiated competition

Simply relying on low prices is no longer enough to break through. Amazon's algorithm favors organic traffic, and products with "green label" certification can be prioritized for exposure, prompting sellers to invest in ESG (Environmental, Social, Governance) initiatives. For example, some major sellers enhance product premiums through carbon footprint accounting and eco-friendly packaging. In addition, the application of AI tools in advertising and customer service is becoming widespread, with 80% of sellers already using AI to optimize operational efficiency.

4. The necessity of multi-platform deployment

To diversify risks, sellers need to expand into other channels such as TikTok Shop and local platforms. Indian local e-commerce platforms Snapdeal and Meesho have rapidly emerged due to policy support, becoming new choices for cross-border sellers.

Image source: Internet

Conclusion

India's e-commerce market is shifting from "barbaric growth" to an era of "compliance is king." Whether giants or small and medium sellers, only by making compliance a strategic core can they navigate steadily in this trillion-dollar blue ocean. For cross-border enterprises, choosing partners with localized experience and full-chain compliance services may be the best solution to cope with the regulatory storm.