TikTok Shop's global expansion has added a new location—the Japanese market.

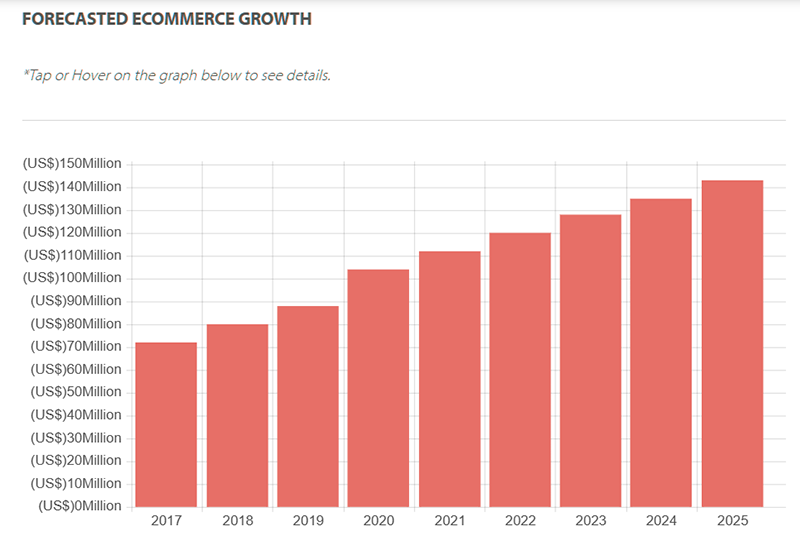

According to official sources, the platform will officially launch in June 2025, with the first batch of local sellers being recruited to leverage the “short video + livestream” model to tap into the Japanese e-commerce market. Behind this move lies not only the allure of Japan’s e-commerce market, which is expected to reach $206.8 billion (2025 forecast), but also the incremental space created by a livestream e-commerce penetration rate of less than 5%.

However, this seemingly “fertile” market actually hides “hardcore” challenges.

Image source: Nikkei

Market Opportunities: High Net Worth Users and Structural Dividends

Japan is the world’s third-largest e-commerce market, with transaction volume exceeding 22 trillion yen in 2023 (about 1.1 trillion RMB), and is expected to reach $206.8 billion by 2025. In stark contrast to its market size is the “traditional undertone” of its e-commerce landscape—livestream e-commerce penetration is less than 5%, far lower than China (20%) and the US (15%). This contradiction is precisely TikTok’s ideal entry point: leveraging the “short video + algorithm recommendation + livestream” model of “interest-based e-commerce” to unlock the incremental space for Japanese consumers to shift from “search-based shopping” to “discovery-based shopping.”

Image source: Internet

In terms of user base, TikTok Japan has over 26 million monthly active users, with the 18-34 age group accounting for more than 60%, and average daily usage exceeding 60 minutes. This group’s acceptance of “content as shopping” is increasing—42% of Japanese users admit to impulse purchases triggered by short videos, with strong demand in categories such as beauty, trendy brands, and home goods. More importantly, Japan’s e-commerce average order value has remained high for a long time, with the average transaction in the apparel category reaching 8,000 yen (about 400 RMB), 2.3 times that of the Chinese market. This means that even a slight increase in penetration rate can unleash considerable GMV potential.

Image source: Internet

The “Hard Bones” in Reality: Cultural Barriers and Encirclement by Giants

However, the particularities of the Japanese market make it one of the toughest e-commerce battlegrounds in the world. The first challenge comes from consumer culture: Japanese consumers are known for their attention to detail, with return rates long higher than those in Europe and the US. The return rate for apparel is 15%-20% (three times that of Southeast Asia), which places stringent demands on supply chain management and fulfillment costs. Even more challenging is the “sense of ritual” in consumer psychology—Japanese users enjoy the refined experience of the selection process, rather than the instant gratification of “9.9 RMB free shipping” at home. If TikTok blindly copies low-price strategies, it may damage brand premium and fall into the trap of “gaining traffic but not profit.”

Image source: Internet

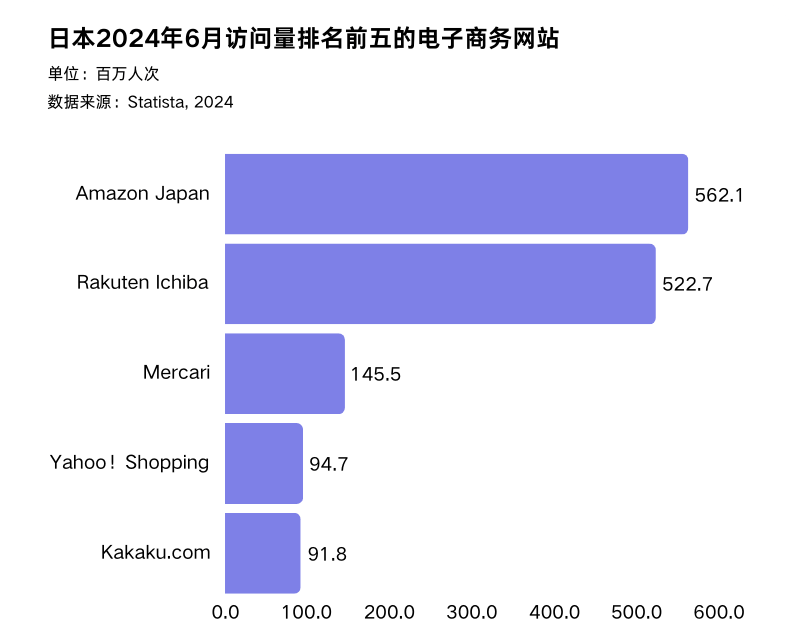

The second challenge comes from the competitive landscape. Rakuten and Amazon Japan together occupy over 70% of the market share, and both have built comprehensive logistics networks (Rakuten’s next-day delivery coverage nationwide reaches 98%), payment systems (Rakuten Pay has over 40 million users), and membership ecosystems. If TikTok wants to break through, it must “outflank” with localized operations: for example, partnering with local MCN agencies to incubate vertical influencers, focusing on strong industries such as beauty and anime; or launching “limited-time flash sales” and “exclusive discounts for hosts” to reinforce the low-price mindset. However, at present, its logistics still rely on cross-border direct mail and third-party service providers, and local warehousing has yet to be established, which may result in fulfillment timeliness lagging behind competitors.

Image source: Internet

Conclusion: A Long-Term Game of Risk and Reward

TikTok Shop’s entry into Japan is essentially a “high investment, high return” adventure. For sellers, whether they can tackle this “hard bone” depends on three key capabilities: lean supply chain (quality control), depth of localized operations (cultural adaptation), and flexibility in cost control (logistics and returns management). In the short term, early entrants will have to bear the cost of trial and error; in the long term, successful players will establish competitive barriers that are difficult to replicate.