According to the latest data from the U.S. Department of Commerce, e-commerce sales in the first quarter of 2025 grew by only 6.1% year-on-year, marking the lowest growth rate in more than two years. This figure not only ends the record of e-commerce growth outpacing overall retail by more than double for two consecutive years, but also makes it the "weakest quarter" in recent years.

Although online channels continue to erode the offline market, accounting for 16.2% of total retail sales, the single-digit growth rate stands in stark contrast to the high of 13.9% in the second quarter of 2021.

Economic uncertainty, tariff fluctuations, and weak consumption are having a profound impact on the industry.

Image source: Internet

Economic uncertainty has become the primary shadow hanging over the market. Under inflationary pressure, American consumers are tightening their wallets, with 49% listing inflation as the top factor influencing purchasing decisions, even surpassing their attention to promotional discounts.

Consumer behavior is shifting toward caution, with a "no unnecessary purchases" mindset spreading and discretionary spending being significantly reduced.

In this context, drastic changes in tariff policy have directly pushed up the cost of cross-border goods. In May 2025, the U.S. officially canceled the tax exemption policy for small parcels from China, causing the tax rate on Chinese goods to soar to 54%, in addition to a global 10% base tariff.

Small and medium-sized cross-border sellers are caught in a dilemma of "losing customers if prices rise, losing money if they don't," and platforms like Temu, which rely on low-price direct sales, are forced to accelerate their shift to local inventory layouts.

Image source: Internet

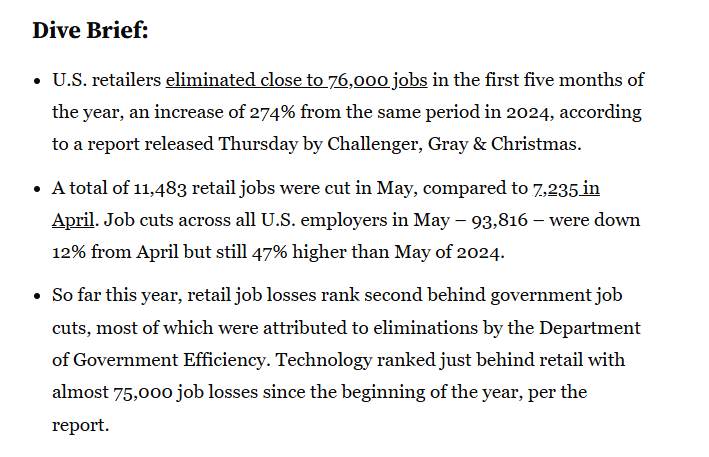

Moreover, the domestic retail market is also shrouded in gloom. In the first five months of 2025, about 76,000 retail jobs were cut in the U.S., a year-on-year surge of 274%, marking the most severe wave of layoffs since the pandemic.

The wave of layoffs reflects the struggles of traditional retail models and also signals that the focus of competition will further shift online.

Image source: retaildive

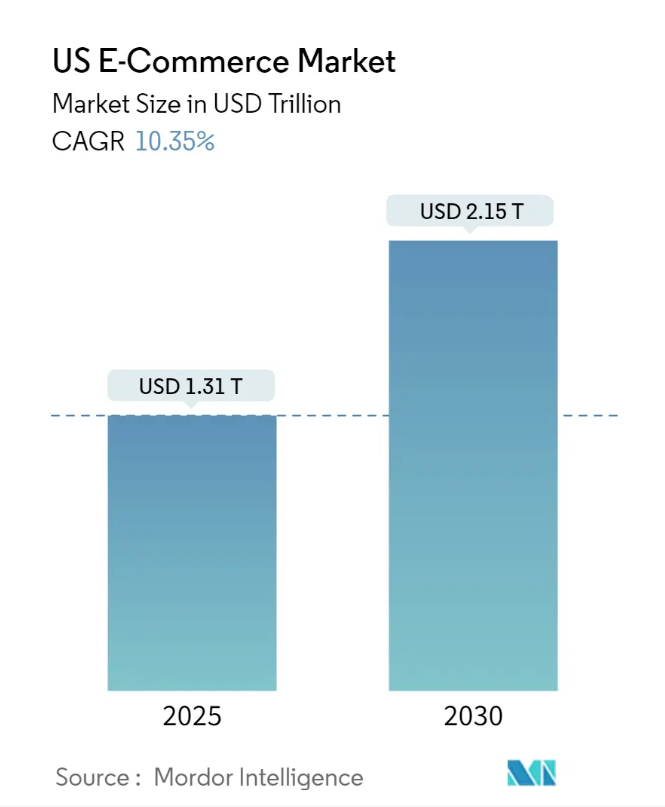

Despite overall market pressure, the competitive landscape among leading platforms is undergoing dramatic changes. Data shows that the U.S. e-commerce market is expected to reach $1.31 trillion in 2025 and surpass $2.15 trillion by 2030, leaving considerable room for growth.

Image source: Mordor Intelligence

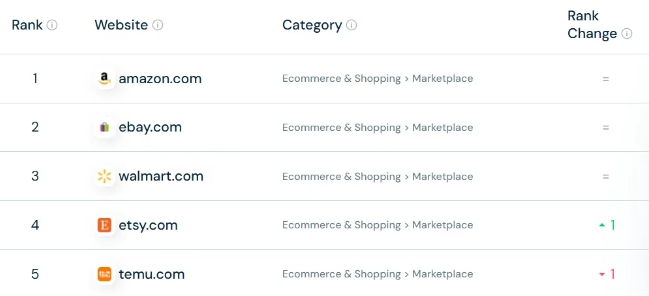

Amazon firmly holds the top spot with a 40% market share. As of April 2025, its total visits reached 2.5 billion, with 80% coming from U.S. users. Among these, the continuous expansion of the third-party seller ecosystem is particularly crucial, especially as it relies on the Chinese supply chain to support growth, forming an unshakable moat.

Temu, on the other hand, has achieved rapid expansion through ultra-low prices and a flexible supply chain, with visits reaching 1.3 billion in the same period, surpassing Walmart to enter the top five platforms. Its fully managed model controls pricing, holds weekly product bidding, and directs traffic to the lowest-priced items, successfully creating the consumer mindset of "shopping like a billionaire."

Image source: SimilarWeb

From another perspective, the current low growth rate is actually a mandatory stress test for the market.

It forces all participants to answer a fundamental question: In an environment where "low price" has become the new normal, policy risks are high, and consumer loyalty is diluted, what is the real moat for enterprises? Is it the extremely compressed supply chain cost? The precisely captured counter-cyclical categories? The barriers built by localized fulfillment? Or the creation of emotional or experiential value that cannot be easily compared by price?

The answers may vary, but one thing is certain: relying on old maps can no longer lead to new lands. The second half of U.S. e-commerce is destined to belong to those players who can reconstruct the value chain, deeply explore structural opportunities, and establish unique resilience for survival.