In 2025, cross-border e-commerce has shifted from being a "trend" to a "realistic choice".

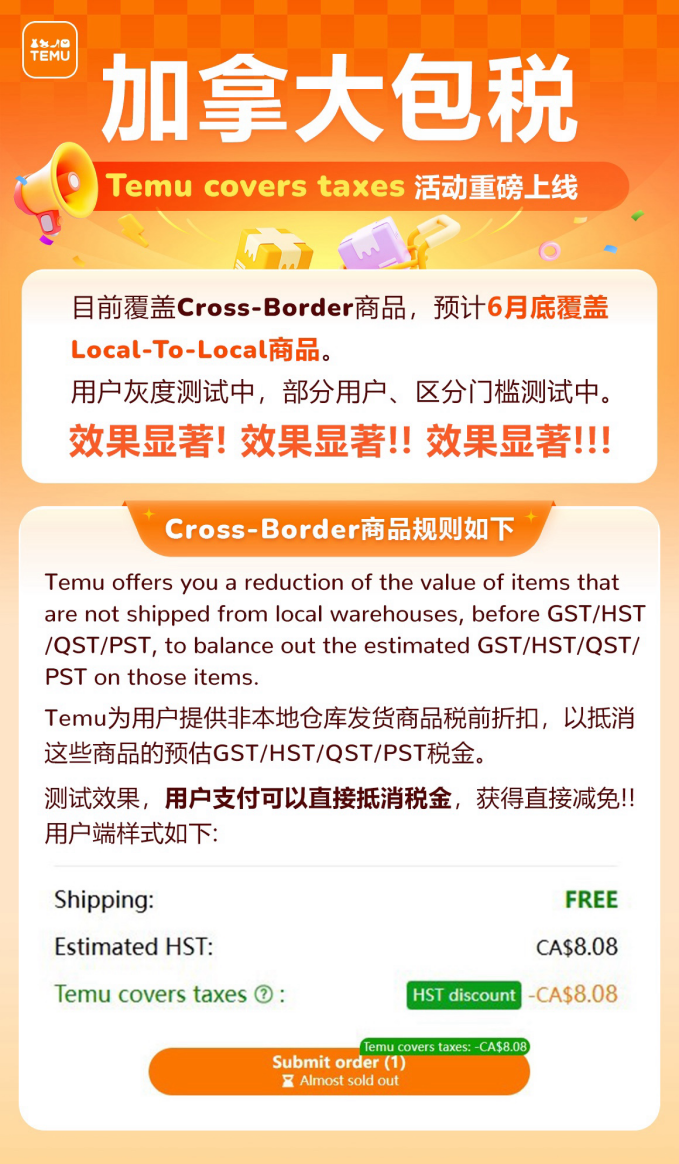

Whoever can grasp the rhythm of the overseas market may be able to break through in the competition for stock. And on this increasingly crowded road, TEMU is still ramping up its efforts. This time, it has set its sights on North America's neighbor—Canada—and has launched a heavyweight policy:Comprehensive "tax-included" subsidies.

Unlike previous small-scale tests, this round allows almost all merchants participating in TEMU's semi-managed model to enjoy the policy benefits. No category restrictions, no thresholds—the platform directly covers the taxes that consumers need to pay, while merchants still receive the pre-tax selling price—simple, direct, and full of sincerity.

Behind this is not just a traffic play by the platform, but also a clear adjustment of TEMU's market focus.

Image source: Internet

Why has Canada become the new focus?

Compared to the bustling Southeast Asian and Middle Eastern markets, Canada has always been somewhat "low-key". But for players who truly focus on long-term growth, this North American market actually hides many opportunities.

On the one hand, Canada relies heavily on imports in many categories. From electronics and home goods to clothing accessories, the local supply chain is not well developed, and Chinese manufacturing can just fill the gap.

On the other hand, as consumer habits change, Canadians' acceptance of online shopping is rising rapidly. Not only do users in first-tier cities order online frequently, but even the purchasing power of remote areas is gradually being activated by e-commerce platforms.

According to Statista's forecast, by 2025, the scale of Canada's e-commerce market will exceed$72 billion, maintaining a compound annual growth rate of over 8%, and is expected to enter the$100 billion club before 2029.

And TEMU, after just one year in the market, has captured12.7% market share, quickly ranking among thetop three local e-commerce platforms, forming a three-way rivalry with Amazon and Shein.

Obviously, this is not a casual trial, but a well-planned and rhythmic deep cultivation.

Image source: Internet

What is being subsidized? Analysis of TEMU's "tax-included" approach

To understand the weight of TEMU's "tax-included" policy, we must first look at how heavy the tax burden is for local e-commerce in Canada.

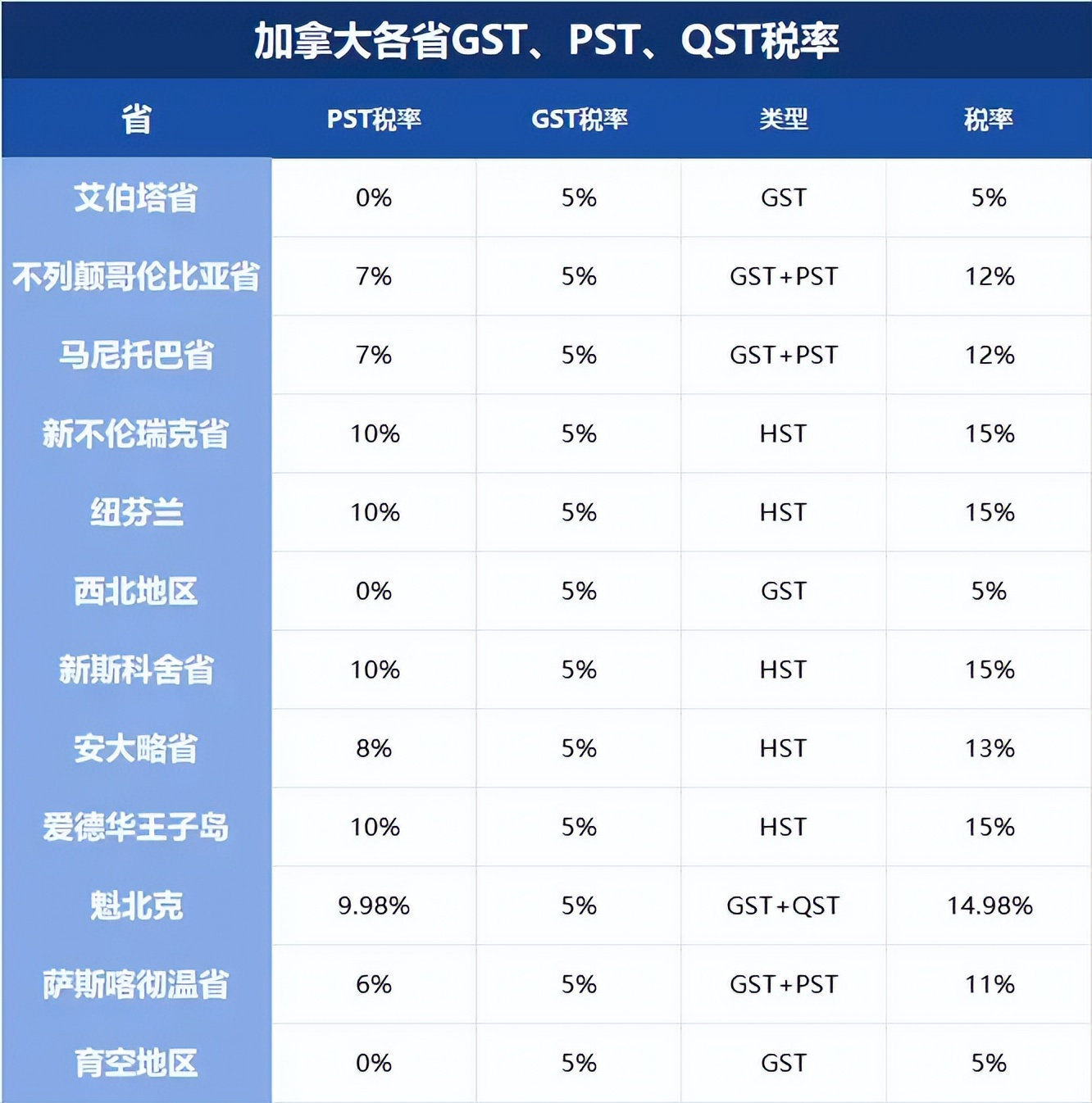

In this country with unified national rules but provincial "flexibility", common taxes include:

GST (Federal Sales Tax), fixed at 5%;

HST (Federal + Provincial Combined Tax), implemented in some provinces, with rates as high as 13%-15%;

PST (Provincial Sales Tax), in provinces not levying HST, usually 6%-7%;

Quebec's customized tax system, with a rate close to 10%, not interoperable with other provinces.

For sellers, these taxes are not only numerous and complicated to calculate, but also, when added to the product price, directly affect users' purchasing decisions.

TEMU's "tax-included" policy is to cover all these taxes—the platform pays, consumers are relieved, and merchants feel nothing. One-click tax inclusion, no need to change prices, and even Quebec's complex local regulations are included in the subsidy scope.

Behind this is the platform's bet on the Canadian market, and even more so, an amplifier of merchants' confidence in growth.

GST and PST tax rate chart for some regions in Canada

How can merchants participate? Two shipping paths, choose your own track

If you want to seize this wave of benefits to open up the Canadian market, merchants need to choose the right shipping model. According to TEMU's current operating model, there are two mainstream ways:

① Local Fulfillment

Advantages include:

Faster fulfillment, better timeliness, improved user satisfaction;

Less likely to encounter qualification/policy restrictions;

Products are more likely to gain platform recommendation weight.

But the threshold is also high: warehouse construction costs are high, inventory must be precise, and if sales are slow and turnover is difficult, the risk is not small.

② US to Canada Forwarding

That is, the "US-to-Canada" model, where goods are first stored in US warehouses and then shipped to Canada after orders are placed.

Suitable for merchants still in the initial testing phase and not yet familiar with the Canadian market. High flexibility, shared inventory, covering both the US and Canada. But the logistics cycle is longer, which has a greater impact on fast-moving or time-sensitive products.

No matter which method, the platformnow uniformly applies the "tax-included" subsidy, making it a rare opportunity to test the waters.

Image source: Internet

Want to amplify this wave of benefits? What merchants can do

First, expand categories and target niches.

Now is a good time to enter blue ocean tracks, especially with TEMU's traffic support, even niche categories have the potential to explode. You can extend your product matrix from existing bestsellers and occupy positions through a combination strategy.

Second, test high-ticket products.

High-priced products limited by tax rates now have the "tax-included" boost, and the previously "hard-to-sell" price range may see breakthroughs. Consumer electronics, large home goods, gardening tools, etc., are currently in a supply-demand imbalance in Canada and have potential.

For example, Bluetooth earphones, lawn mowers, portable air conditioners, home projectors, and other categories are currently high-growth categories for TEMU in Canada, suitable for mid-to-high price merchants to secure their positions in advance.

Image source: Internet

In conclusion

The Canadian market is not that "hot", but it is precisely because of this that the opportunities are rare.

For Chinese sellers familiar with domestic e-commerce rules, Canada has clear advantages:

High per capita consumption; relatively mild competition; the market has not yet become "involuted".

Currently, TEMU's daily active users in Canada have exceeded 3.2 million and are still growing steadily. More importantly, with simultaneous efforts in policy, resources, and platform support, this is the window period for small and medium-sized merchants to enter new markets.

This wave of "tax-included" is not a simple profit-sharing, but the beginning of the platform and merchants trying to leverage more incremental growth together.