Recently, TikTok has increased the commission rate of its e-commerce platform in several Southeast Asian markets. Starting fromSeptember 16, 2024, the commission rate for the Indonesia site will be raised to within 10%, covering multiple categories such as electronics, fashion, and lifestyle.

This adjustment is not an isolated incident; several Southeast Asian sites have successively increased their platform commission rates, posing new challenges for many TikTok Shop sellers.

Commissions for TikTok Shop in Southeast Asia Rise Across the Board

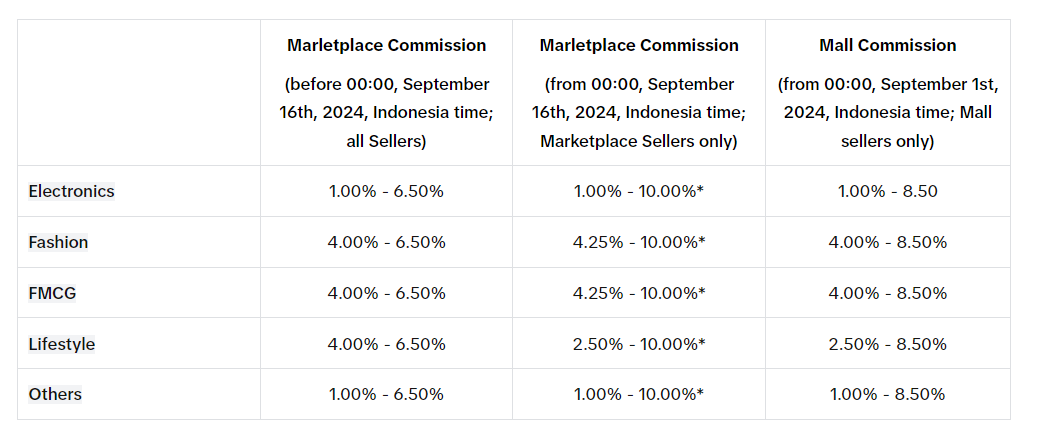

The adjustment in the Indonesia site is one of the representatives of this wave of commission increases in Southeast Asia. Starting from September 16,Indonesia site commission for electronics products will be1% to 10%, fashion and FMCG categories will be4.25% to 10%, and other lifestyle products will be2.5% to 10%.

Compared to previous policies, the increase in some categories has reached 3.5%. The adjustment in the Malaysia site is even more significant, with commission for FMCG mall sellersas high as 14.58%. Other sites such as the Philippines, Thailand, and Singapore have also adjusted commission rates for various products.

According to statistics, since TikTok Shop first entered Indonesia in 2021, commission rates in the Southeast Asian market have undergone several rounds of increases, with an overall rise of more than 10%. TikTok claims these adjustments are to improve platform functions and services, helping sellers enhance the overall user experience, but this undoubtedly increases the cost burden for sellers.

Image source: TikTok/Tokopedia official website

The Game Between Platform and Sellers: Survival Challenges Under High Commissions

This adjustment has a significant impact on sellers. Taking Indonesia as an example, some sellers reported that participating in the platform's free shipping and cashback activities already resulted in a commission of 11.5% on the previous basis. After the new policy is implemented, the overall commission for some category products will reach as high as 15.5%, further squeezing seller profits.

Meanwhile, advertising costs and live streaming fees on TikTok Shop remain high, further increasing sellers' operating costs.

An anonymous seller revealed that TikTok's advertising cost ratio is about 30%, and live streaming room fees are also much higher than those of competitor platforms. This puts sellers at a disadvantage in competition, especially when facing relatively lower commission and advertising fees on other e-commerce platforms.

In addition,the platform's transaction fees are also rising. For example, transaction fees for the Malaysia site have increased from 2.16% to 3.78%, and for the Thailand site from 3% to 3.21%. These changes intensify the cost pressure on sellers, forcing them to reassess their business strategies.

The Changes in the Southeast Asian Market Behind the Commission Increase

TikTok's commission increase is not an isolated phenomenon; in fact, the entire e-commerce environment in Southeast Asia is undergoing changes. Tax policies and trade regulations in various countries have further increased compliance costs for e-commerce sellers.

For example, since July 2024, Thailand has imposed a 7% value-added tax (VAT) on low-priced goods imported from abroad, directly affecting the profit margins of cross-border sellers.

In addition, as countries such as Indonesia strengthen the supervision of imported goods, compliance requirements for e-commerce platforms are also increasing, further raising the difficulty for sellers to operate in the Southeast Asian market.

TikTok's commission adjustment may be closely related to these policy changes.

So far, more than 80% of TikTok Shop's sales come from Southeast Asia

Is the Dividend Period of the Southeast Asian Market Over?

Despite rising commissions and increasing costs, the Southeast Asian market still has huge potential. According to statistics, Southeast Asia remains one of the fastest-growing e-commerce markets in the world.

Many sellers believe that despite the many challenges, they can still remain competitive in the market by optimizing the supply chain and improving operational efficiency.

However, for small and medium-sized sellers, the commission increase undoubtedly brings greater survival pressure. Compared with top sellers, these sellers have weaker bargaining power and limited profit margins. With rising costs, it is difficult for them to cope with this wave of adjustments simply by raising prices.

A senior seller pointed out that top sellers often receive more subsidies and support from the platform, while mid- and tail-end sellers face greater survival pressure. They cannot easily raise prices, as price competitiveness is key to attracting consumers. “The platform commission increase has little impact on top sellers, but for small sellers, it may mean more challenges.”

As TikTok e-commerce gradually expands in the Southeast Asian market, the increase in platform commissions seems to have become an inevitable trend. While this supports the platform's service upgrades and function optimization, it also forces many sellers to reassess their operating strategies.

In this market full of opportunities and challenges, finding new profit points in a high-cost environment has become an urgent problem for sellers to solve. The future of Southeast Asian e-commerce is still full of potential, but the balance between the platform and sellers also requires new adjustments and exploration.