In today's ever-evolving global electronic accessories market, competition in the Bluetooth headset sector has long reached a fever pitch.

On one side, giants like Apple and Sony firmly occupy the high-end market with their brand halo and technological barriers, while on the other, countless brands fiercely battle in the quagmire of cost performance.Customer acquisition costs soaring, severe product homogenization, and solidified brand awarenesshave become three major mountains standing in front of all new players.

However,facing such a fiercely competitive market, a brand from Shenzhen, China——Picun, quietly achieved a beautiful“counterattack.” Its F5 ANC over-ear headphones, after joining Tuke US station for only half a year, achieved a monthly sales volume of over 5,314 units and sales exceeding $200,000, quickly ranking among the top of the platform category.

This inevitably arouses curiosity—what exactly did Picun do right?

Image source:Picun

From Behind the Scenes to Center Stage: OEM Genes and Brand Ambition

The story of the Picun brandis a classic microcosm of the transformation from “Made in China” to “Chinese Brand.”

Its parent company was established in2012, and at the beginning of the brand, like many manufacturing enterprises in South China, it remained behind the scenes of the global industrial chain for a long time, providing OEM services for international big brands.

Although this experience was not high-profile,it allowed them todeepen their understanding of the global supply chain system, accumulate solid production experience, and develop a keen sense of consumer trends in various markets.

It was based on this foundation that the Picunbranddecisively took a key step towards Tuke in2015.

The team discovered that although there were many choices for over-ear headphones in overseas markets, there was a gap for products that combined excellent sound quality, outstanding noise cancellation, and affordable prices. Therefore, the Picun brandchose to continuously explore and develop in the direction of“high sound quality, high cost performance.”.

Image source:rendeljkinait

In the following years,thebrand's development entered the fast lane.

In 2017, products covered more than 40 countries worldwide, and users exceeded 10 million.By2023, global users had surpassed 30 million, and a complete audio ecosystem covering TWS earphones, open-ear headphones, and gaming headsets was built, holding more than 50 patents, becoming one of the benchmarks for domestic wireless audio Tuke.

Image source:Picun

New Equation: Mature Technology+Emerging Channels=Tuke Opportunity

From an industry perspective,analyzingPicun's rise cannot be separated from“technology for all”and“channel innovation” working together.

On one hand, the rapid popularization of mature technology has provided a foundation for brands to break through with their products. As Bluetooth headsets become a global necessity,ANC active noise cancellation and other core technologies that used to build high-end brand barriers are quickly being released to the mid-range market.

This enables Picun, with its deep supply chain and R&D experience, to use a high cost-performance strategy to bring previously expensive, high-quality experiences to a wider range of users, quickly establishing a “high quality, affordable price” brand perception and finding a differentiated positioning.

On the other hand,social media e-commerce represented byTuke Shop isreshaping the consumer chain globally. For example, during this year's“Black Friday and Cyber Monday” peak,Tuke USachieved a total transaction volume of over$500 million in just four days, and sales from live streaming on the Japan station soared by 300%.

Andthe Picunbrand has leveragedTuke and its e-commerce advantages to achieve explosive growth in its development.

Image source:business insider

Channel Breakthrough: Omnichannel Layout and Tuke's “Explosion Point”

Specifically, in its Tuke layout,the Picunbrandadopted a“wide net + key breakthrough”marketingstrategy, which can be described asan All-in investment.

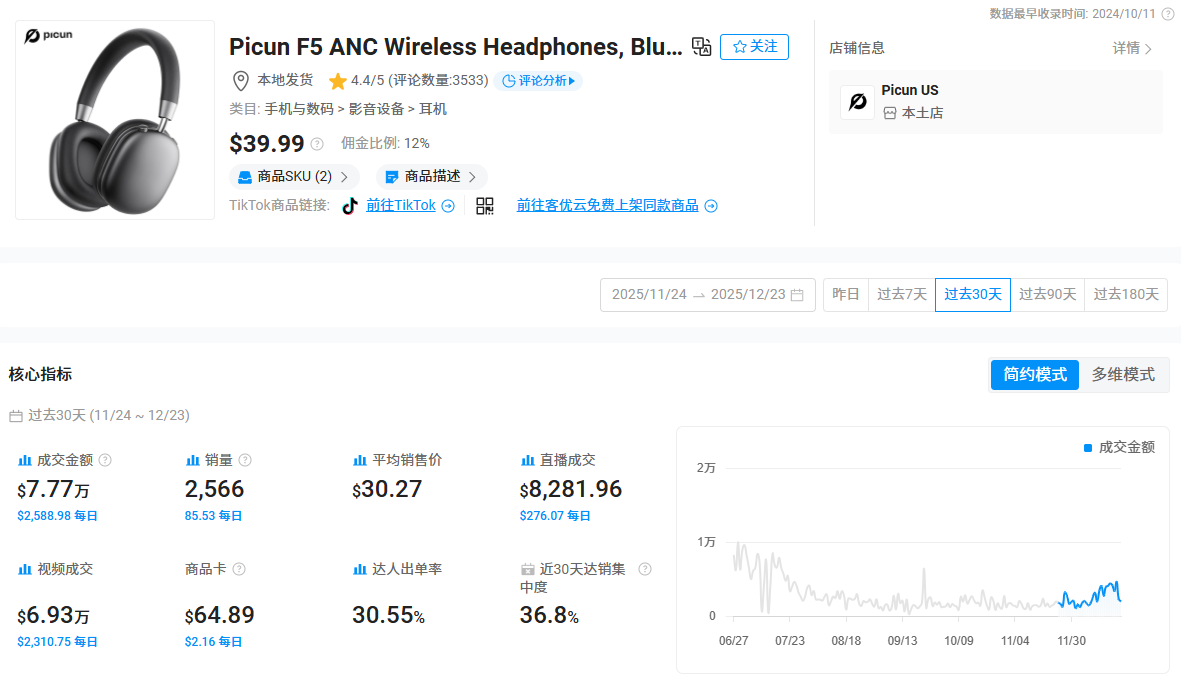

In October 2024, Picun officially joined Tuke US station. Within just a few months, its F5 ANC headphones achieved a monthly sales volume of over 5,314 units and sales exceeding $200,000, quickly entering the top of the category.

By2025December, this series of headphones still maintained2,566units sold in 30 days, with a transaction amount close to$77,700.

Image source:kalodata

OnTuke, Picunbrandmarketing is not simply crude advertising, but rather a layered, content-drivenmodel.

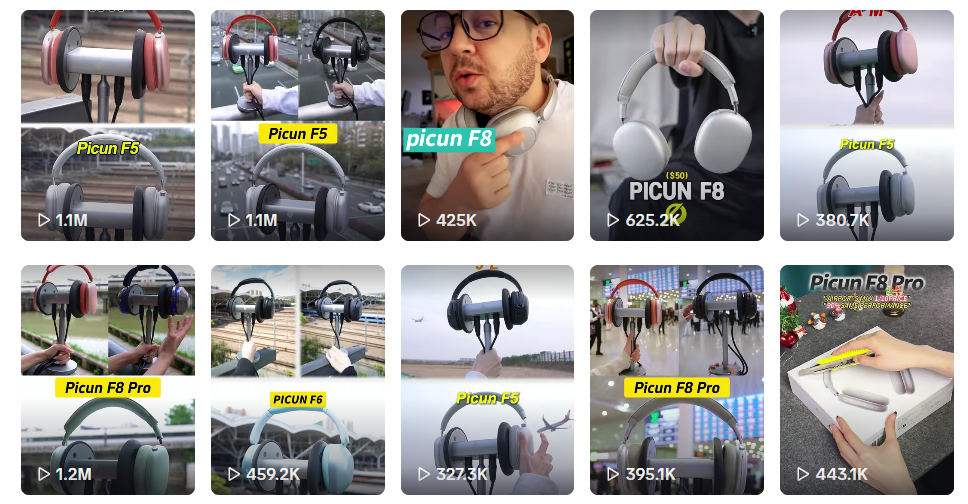

In the early stages,Picun's content model focused on product demonstrations. On their official account @picun_us, they posted a large number of noise cancellation comparison videos in high-noise environments, using the contrast between environmental noise and headphone noise cancellation effects to let users “see” the technological difference.

As shown in the figure, this type of content that demonstrates product reliability through real experience is obviously more likely to reach potential users under algorithmic distribution, and the traffic is relatively better.

Image source:Tuke

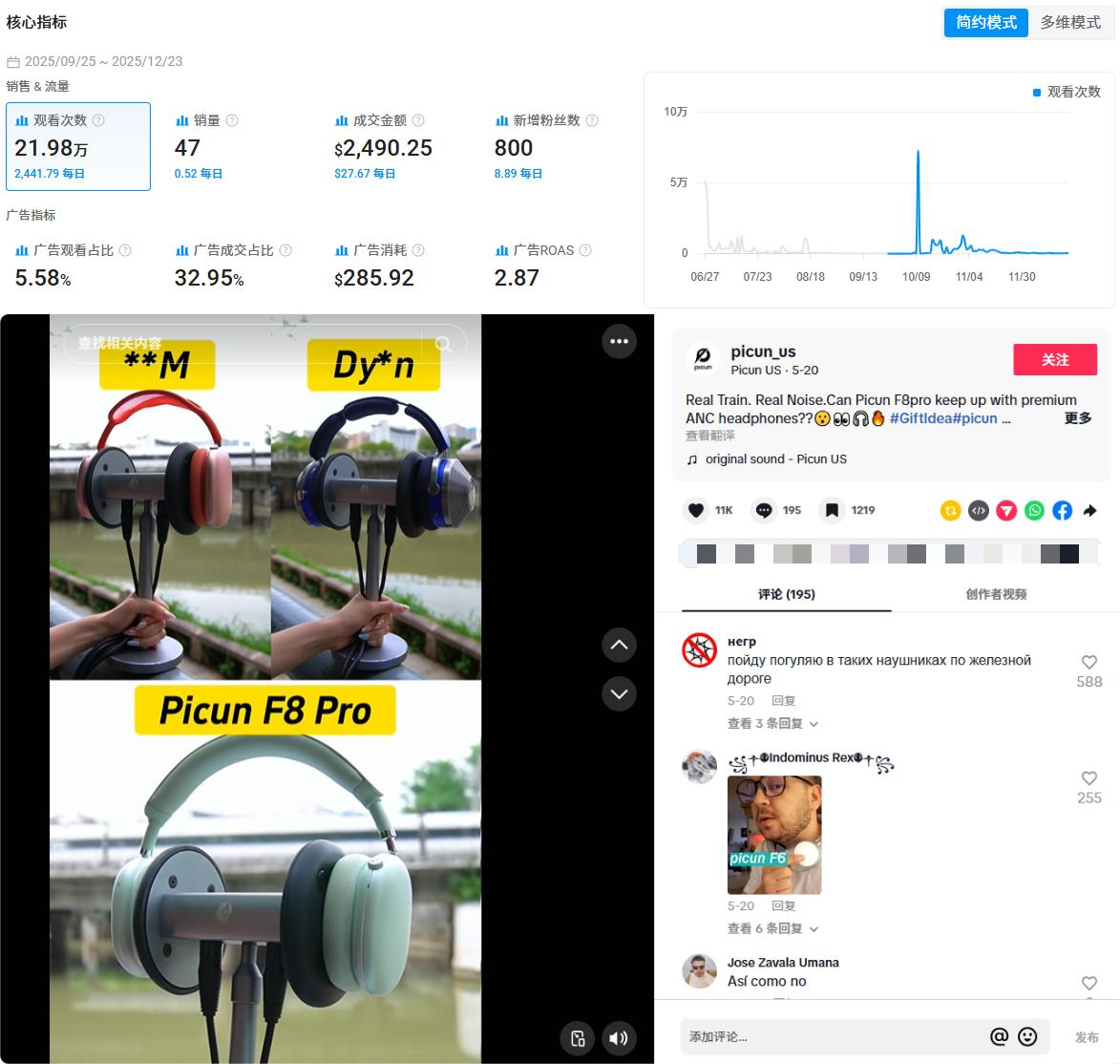

For example, a comparison video they posted in May this year has accumulated over 1.2 million views to date, with its long-tail effect continuing until now.

According tokalodata feedback, views of this video have continued to grow over the past three months, and even saw a small-scale explosion in October, with daily traffic increasing by over 70,000, and transaction amounts and follower numbers also continuing to rise.

This continuously growing data trajectory intuitively provesTuke's algorithm mechanism's long-term favor and stable recommendation for such highly interactive content.

Image source:kalodata (top) & Tuke (bottom)

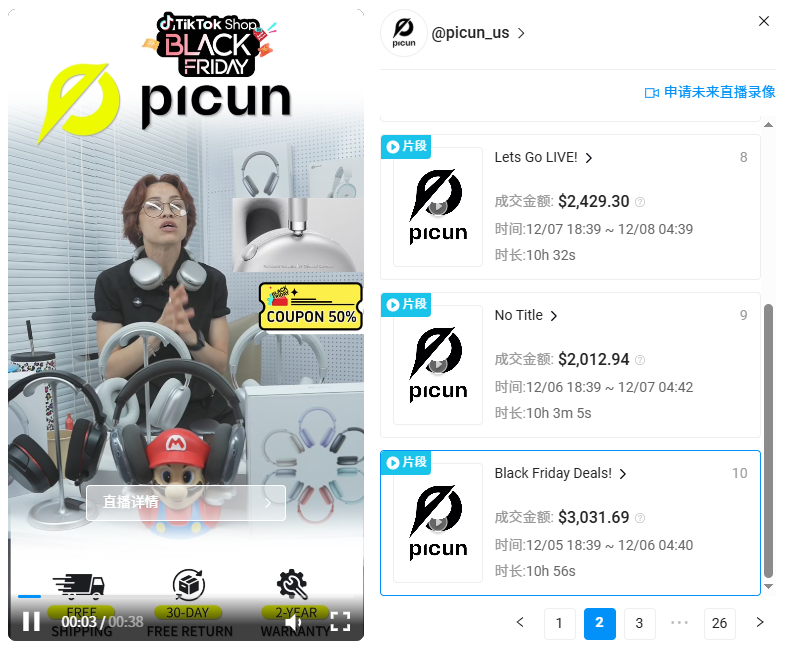

After the official account formed stable traffic and a user community,the Picun brand shifted from video content to the currently faster-converting Tuke live streaming.

This can be seen directly from the data: its account's monthly transaction amount is$26,800, of which live streaming transactions reached $25,300, accounting for more than 94%. It can be said that live streaming has become the key tactic for operating their self-owned account.

Image source:kalodata

Picun brand'slive streaming setup is not complicated—just a solid color background with discount information, looking very pragmatic. Simply put, it adapts to the platform style at low cost, which is also a“lightweight” setup approach.

It is worth noting that the brand is very accurate in controlling the live streaming time slots.

They choose to maintain high-frequency live streaming during the US prime time from6pm to 12am, steadily occupying the peak window for target users' evening browsing and leisure shopping, establishing the most direct conversion path at the time when consumer intent is most active.

Image source:kalodata

In addition to self-operated accounts,the Picun brand also collaborates extensively with various creators on the platform to expand brand influence.

These collaborations cover influencers of different follower levels, who integrate the products into real-life scenarios such as tech reviews, daily commuting, or sports and fitness, effectively reaching a broader range of potential consumers.

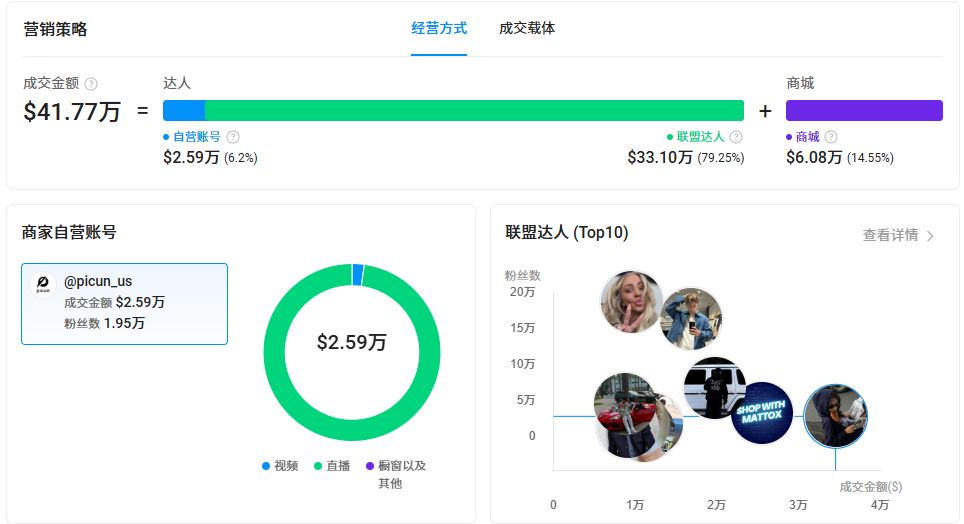

From the data, in the past30 days, Picun brand's US store achieved a total transaction amount of about $417,700, of which sales contributed by influencers accounted for about $330,000.

This fully demonstrates that building a healthy influencer collaboration ecosystem has become the core driver for brand growth onTuke.

Image source:kalodata

Final Words

Standing at this point in time, it can be said that the overseas market is both fiercely competitive and full of gaps and opportunities.

For more domestic companies considering Tuke, rather than worrying about“being too late,” it is more important to clarify target regions and audiences early in strategy, and to learn to use localized content and multi-channel coordination to reduce trial-and-error costs in tactics.

Andthe Picun brand's exploration provides a concrete reference for this path.

In the future, how to turn technological strength into product advantages, and connect overseas consumers through efficient localized operations, will be a topic that more Chinese brands need to continuously address.

Here, we also look forward to more brands providing different answers.