Nowadays, short videos and live streaming are popular all over the world, and more and more people are joining the ranks of creators.

People not only want to shoot, but also to “shoot beautifully”. The threshold for image quality is constantly rising, and consumers’ requirements for lighting, stability, and detail texture have visibly changed.

Around this wave of creators, not only have hardware devices such as cameras and mobile phones been pushed to the forefront, but those photography and video accessories once considered “niche” and “professional” have also been brought back into the public eye.

Research institution Deep Market Insights provides a more intuitive annotation: in 2024, the global camera accessories market size is about $5.5 billion; it is expected to grow to $6.4185 billion by 2025, and surge to $13.89274 billion by 2030. The “fuel” behind this is social media content creation, the live streaming economy, and the ever-increasing demand for image quality from individuals and SMEs.

Image source:Deep Market Insights

It is in such industrial fluctuations that Neewer from Shenzhen, focusing on photography, live streaming, and video accessories, has quietly found a path “from Shenzhen to the world”.

Now, this brand has covered more than 100 countries and regions worldwide, including the United States, United Kingdom, and Germany, with a global user base exceeding 100 million. In the seemingly “niche” photography accessories track, it has completed the leap from zero to “annual revenue of over 100 million” in 13 years.

Image source:Neewer

From Enthusiast to Brand, Neewer Grown from Pain Points

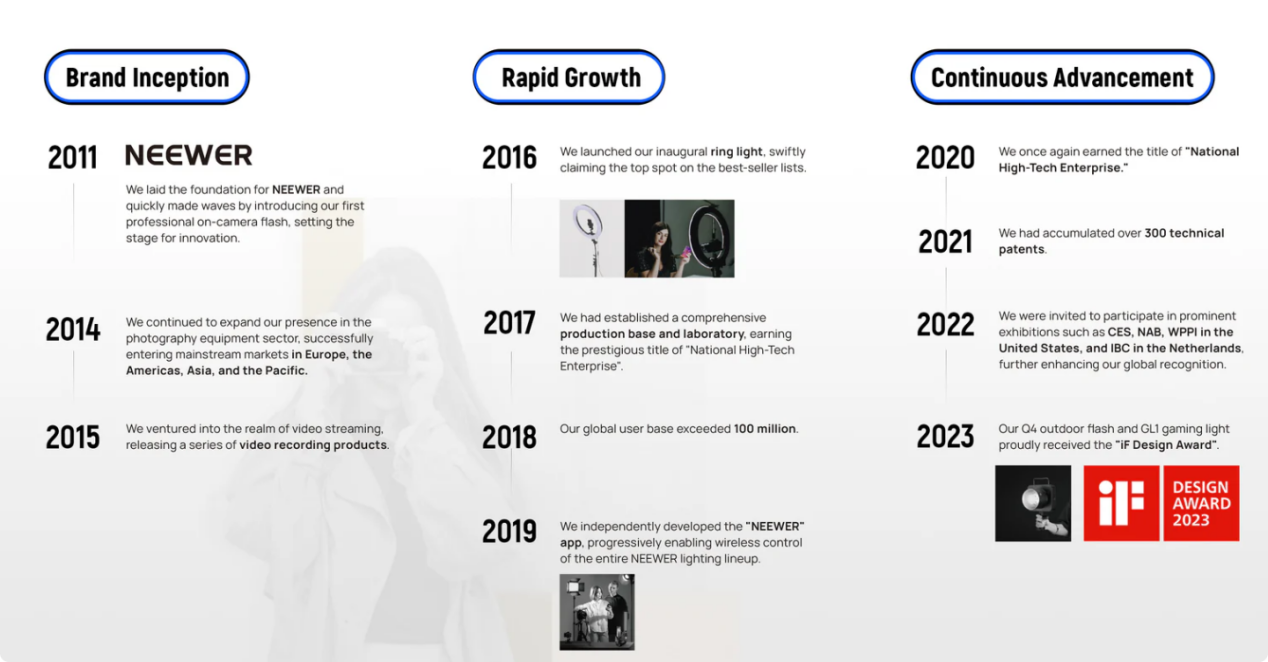

It is understood that,Neewerbrandwas founded in2011, headquartered in Shenzhen,its parent companyis a comprehensive imaging equipment enterprise integrating design, R&D, manufacturing, and sales.

Unlike many brands “starting from business”, Neewer’s founding team started as “players” rather than “businessmen”—they are a group of enthusiasts and geeks who have long tinkered with photography equipment, with a deep personal feel for every detail of lighting equipment in practice.

Also because “they themselves are users”, they saw the common problems of lighting products on the market earlier than others: inflated prices, unstable performance, and high usage thresholds. To achieve professional results, you either pay a high price for big brands or take the risk of trial and error.

Against this background, they established a clear underlying concept for Neewer—“professional, high quality, entry-level price”, not only to meet the output requirements of professional creation but also to lower the entry threshold for ordinary users.

The first professional on-camera light product became Neewer’s entry ticket to the photography accessories market.

From that moment on, this brand that emerged from the “enthusiast circle” began to systematically enter the imaging accessories industry.

Image source:Neewer

Content Forms Have Changed, Product Boundaries Must Also Be Restructured

Around 2015, the content form of global social platforms underwent a fundamental change:Short videos and live streaming began to become mainstream. This trend gave rise to a huge new group:Independent Content Creators.

They are different from traditional professional photographers, less likely to enter studios and sets, and more likely to create in daily life and vertical interest scenarios. Their core demand for equipment is no longer “the more complex and professional, the better”, but “lightweight enough, easy enough to use, and fast enough to produce results”.

Neewerbrandquickly noticed this evolution in market structure, realizing that if the product line remained within the boundaries of traditional photography lighting, serving only a relatively professional small circle, it would miss the main battlefield of the new generation of creator economy. Sothey decisively extended the product line to the broad field of “image creation”.

Their product catalog began to feature a large number of portable fill lights for smartphones, phone holders, teleprompters, and compact lighting kits designed for solo live streaming.

It was this key strategic shift that allowed Neewer to resonate with the booming “creator economy”.

In 2016,the brand successively appeared onAmazon Best Seller lists for photography lighting, tripods, and other categories, with annual sales exceeding 100 million RMB that year, officially moving from “small team, good product” to “global bestseller”.

Brand history Image source:Neewer

Born in Video, Popular on Social Media: Building the Marketing Base Where Users “Live”

Neewer’s internet DNA means its business logic can hardly stay in traditional channel distribution.

The target users themselves are content creators active on social platforms. For the brand to be seen and understood, it must build its main marketing base in these people’s “online spaces of daily life”.

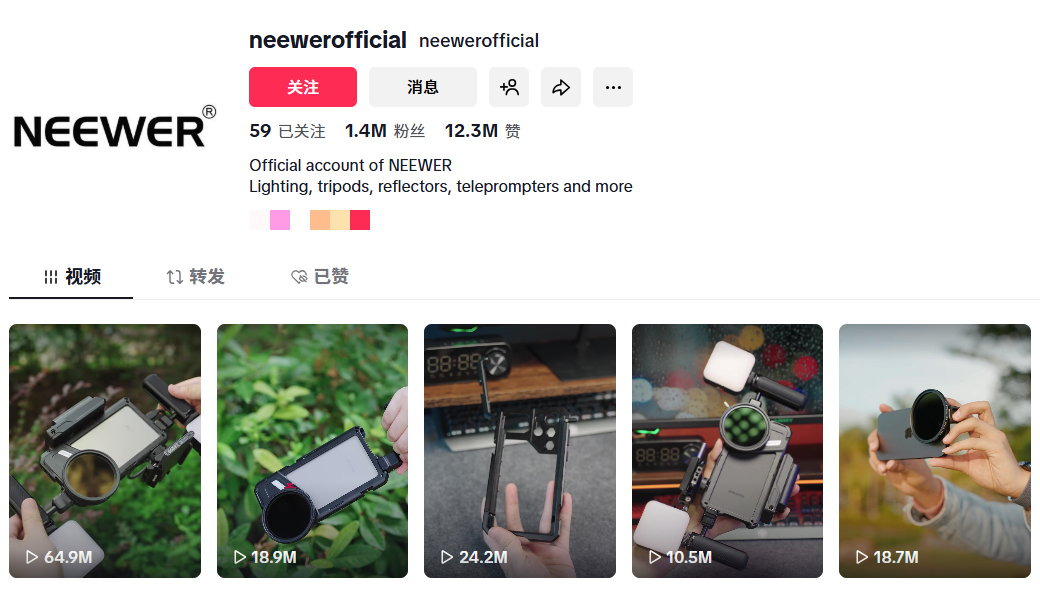

Among all platforms, Neewer’s deep cultivation of Tuke is particularly typical.

Currently, its official account@neewerofficial has accumulated over 1.4 million followers, with a total of about 560 million views, ranking among the top in the segmented photography accessories brands.

Image source:Tuke

In terms of content structure, Neewer did not take the “hard advertising route”, but instead broke down the real needs of creators:

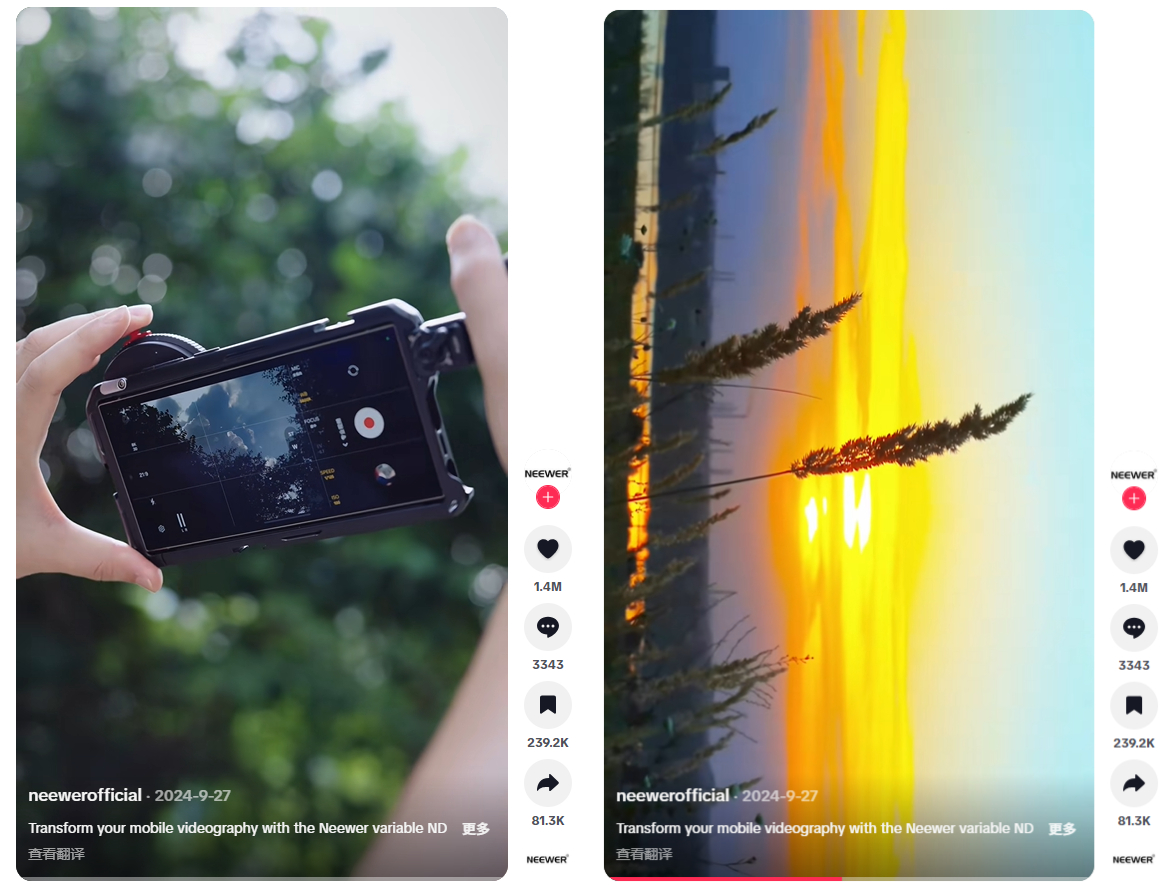

Product demonstrations, shooting tutorials, lighting comparisons, creative shooting cases—through high-quality short videos, products like lights and tripods are truly embedded into specific creative scenarios. What users see is not a cold equipment parameter, but a whole set of replicable shooting methods.

For example, in a video released in August 2024, they clearly demonstrated the role of accessories in the entire shooting system from installation to shooting results, and the video eventually received 18.9 million views.

This type of intuitive tutorial not only solves users’ practical operation confusion, but also conveys the core message that “professional creation can be so simple”, effectively eliminating the sense of distance from professional equipment.

Image source:Tuke

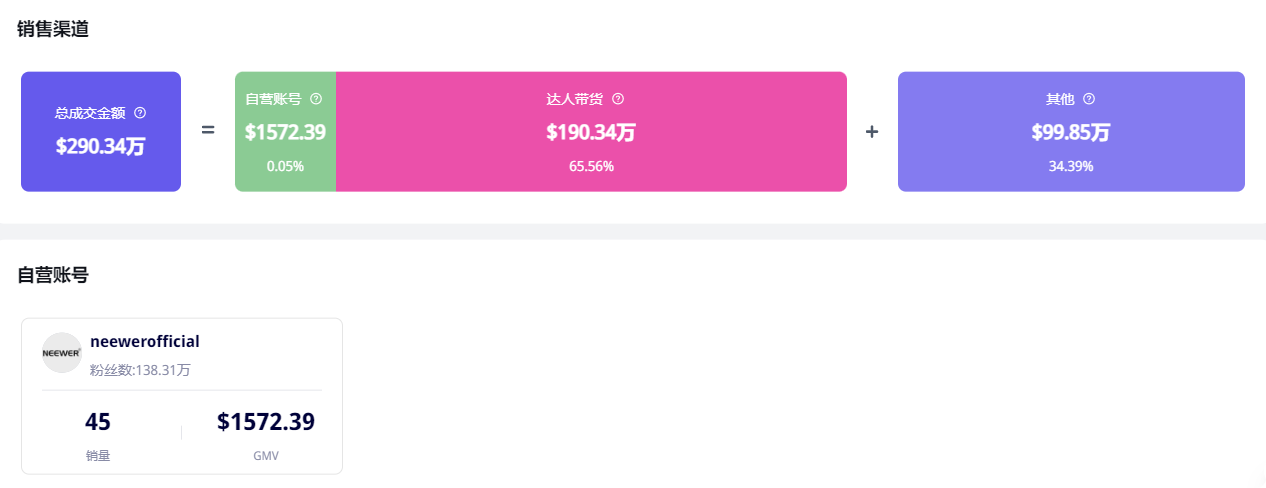

However, from a transaction structure perspective,Neewer brand’sTuke self-operated account mainly serves the function of product seeding and brand exposure, while the real bulk of transactions comes from conversions brought by influencer collaborations.

Public data shows that the total transaction amount of the brand’s Tuke shop NEEWER is$2,903,400, of which the transaction amount contributed by influencer marketing reached$1,903,400, accounting for65.56%.

This means that Neewer has built its social media base into a joint battlefield of “content + influencers”: the brand is responsible for clarifying value, while influencers are responsible for completing the “last mile” of persuasion in their respective vertical circles.

Image source:Echotik

Not Obsessed with Top Influencers, Giving “Penetration Power” to the Right People

An interesting detail is that Neewer’s influencer collaboration strategy is not tied to “top traffic”.

From the list of associated influencers, you can see that the influencers they work with include both big accounts with nearly 2 million followers and many mid-tier creators with only a few thousand to tens of thousands of fans.

These small and medium influencers,though their fan base seems small, are often rooted in niche scenarios: mobile tech, car modification, outdoor activities, lifestyle, etc.

The content they produce is more vertical, simpler, and closer to “this is my real usage scenario”, so they have stronger trust and persuasion in their own small circles.

Image source:Echotik

Tuke influencer @mamba_tech is a typical example.

She has less than 5,000 followers, but can contribute a leading sales performance among Neewer’s partnered influencers, with a transaction amount of about $18,400, far surpassing a top influencer @official.nilla with nearly 2 million followers.

This comparison intuitively proves a fact: in the creator economy era, what really matters is not “who is bigger”, but “who is more suitable”.

From the perspective of content creation, @mamba_tech’s videos always hit the psychological points of the product’s target audience.

Whether it’s selfie lighting or food photography, the essence is answering one question in specific life scenarios—“How can I look better and get better shots”. When content highly overlaps with pain points, traffic and conversion naturally rise.

Image source:Tuke

Conclusion: The Canvas of Overseas Markets Is Reserved for the Prepared

Looking out from Neewer’s path,one will findthat the vast overseas market still contains a large number of opportunities yet to be fully explored.

Global consumption is evolving towards more segmentation, more scenarios, and more emphasis on experience. Especially for products that can solve clear pain points and offer high cost performance, China’s supply chain and R&D capabilities have natural advantages.

The rise of social e-commerce and the improvement of global logistics infrastructure are accelerating the last few kilometers “from Shenzhen to the world”: brands have the opportunity to reach overseas consumers directly through content platforms and tell product stories in the language they understand.

For Chinese companies that are prepared and strategic, today’s overseas market is no longer just a distant concept, but a canvas that is gradually unfolding and can be actively participated in—the key is who can be the first to run out a verifiable long-term strategy in the face of the next Neewer-style opportunity.