In recent years, Chinese small appliance brands have frequently emerged in the global market. From kitchen appliances to environmental home appliances, domestic brands have gradually shed the label of "cheap OEM" thanks to their supply chain advantages and innovation, becoming synonymous with quality and cost-effectiveness.

Among this wave, the rapid development of the Levoit brand is particularly noteworthy. Its various humidifiers have maintained the top market share in the US, with monthly sales on Amazon exceeding 500,000 units, sales revenue surpassing $47 million, and Google search popularity up 48% year-on-year.

What efforts has the Levoit brand made to achieve these results?

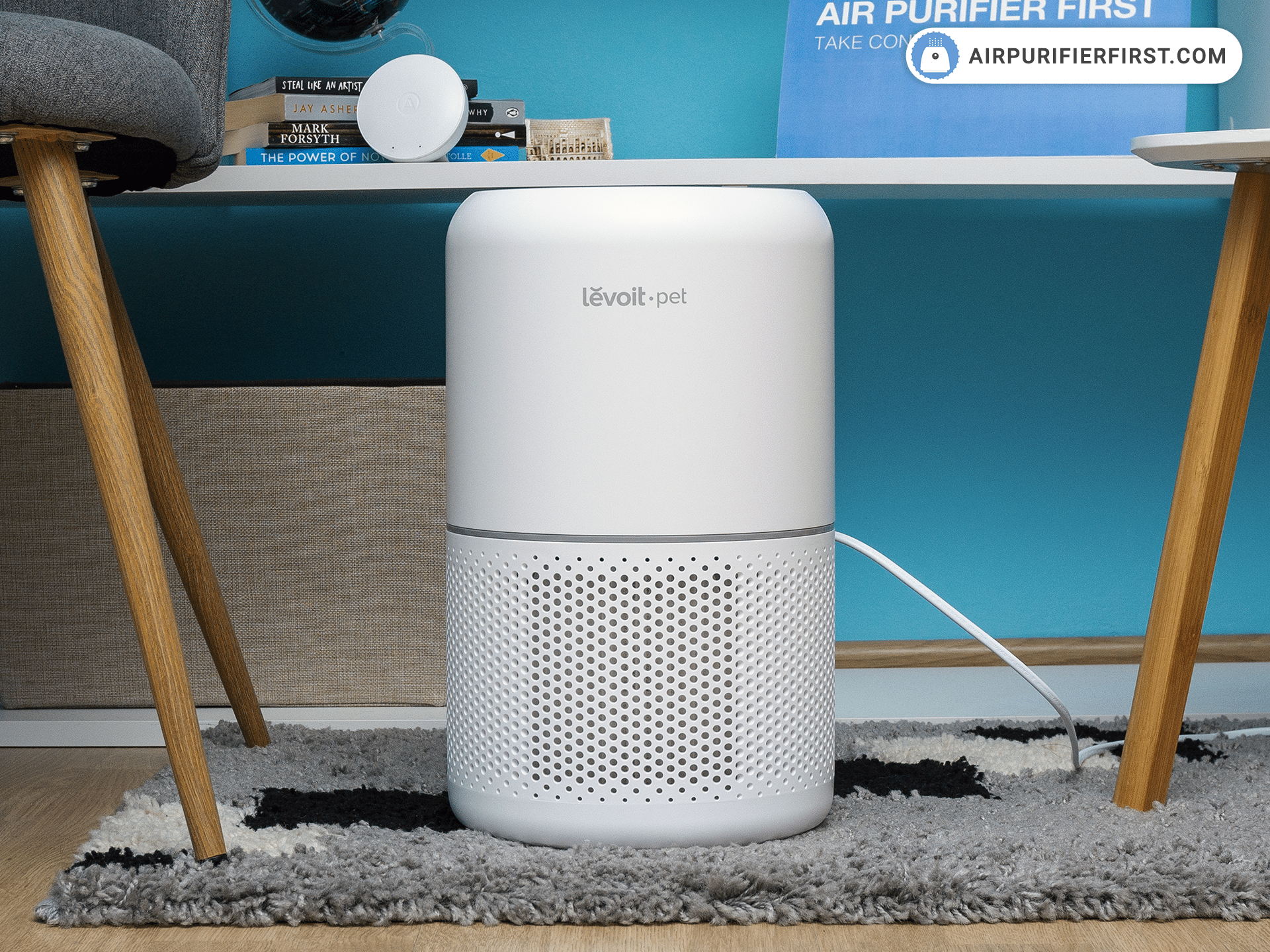

Image source: Internet

From Basement to Listed Company: Levoit's Ten-Year Comeback

Levoit is the core brand of Shenzhen VeSync Co., Ltd., and its founder Ms. Yang has a legendary experience.

In 2011, founder Yang Lin established the predecessor of VeSync in a basement in the US, starting with selling sockets, switches, and other small items through online stores. With keen insight into the North American market, she shifted the business focus to small appliances and launched the Levoit sub-brand specializing in environmental appliances in 2016.

Image source: VeSync

At that time, attention to air quality in the European and American markets surged again due to the COVID-19 pandemic. Levoit entered the market with "high cost-effectiveness + professional features," quickly filling the gap in the mid-range market. Its products expanded to humidifiers, air purifiers, tower fans, vacuum cleaners, thermostats, and other series of small appliances.

In 2020, parent company VeSync was listed in Hong Kong, becoming the first company to enter the capital market as a cross-border e-commerce enterprise.

According to the 2024 financial report, VeSync's annual revenue reached $653 million, of which Levoit brand revenue exceeded $423 million, up 29.5% year-on-year, accounting for 64.9% of the parent company's total revenue, making it the main engine driving VeSync's overall growth.

VeSync 2024 Financial Report

Industry Tailwind: Air Safety Creates a Billion-Dollar Track

From the development history of the Levoit brand, it can be seen that the explosion of this type of environmental appliance market is essentially a "crisis-driven consumption upgrade."

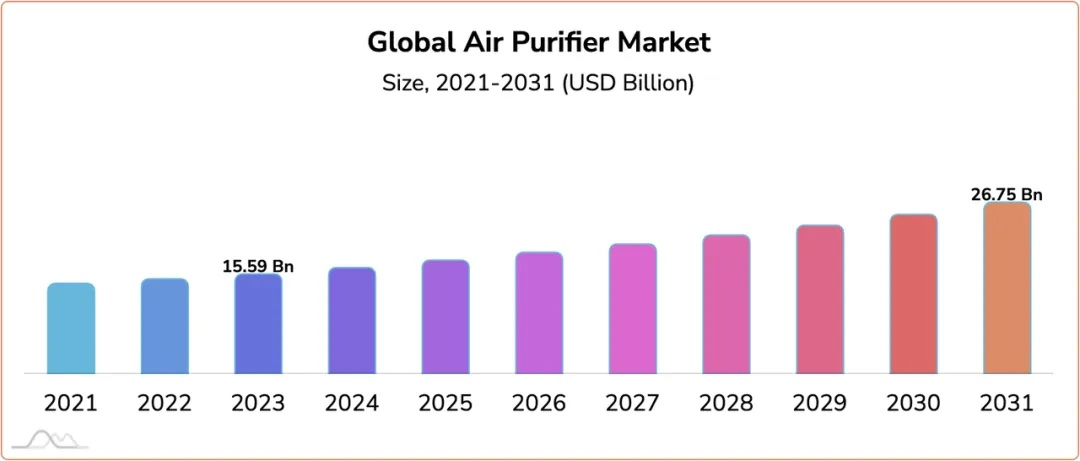

After 2019, global consumers' anxiety about indoor air safety peaked. According to research institute KingsResearch, the global air purifier market reached $15.59 billion in 2023 and is expected to grow to $26.75 billion by 2031, with a compound annual growth rate of 7.07%.

Image source: KingsResearch

The North American market is particularly unique, with both the environmental awareness legacy left by the New York smog incident and the rigid demand for healthy enclosed spaces after the pandemic.

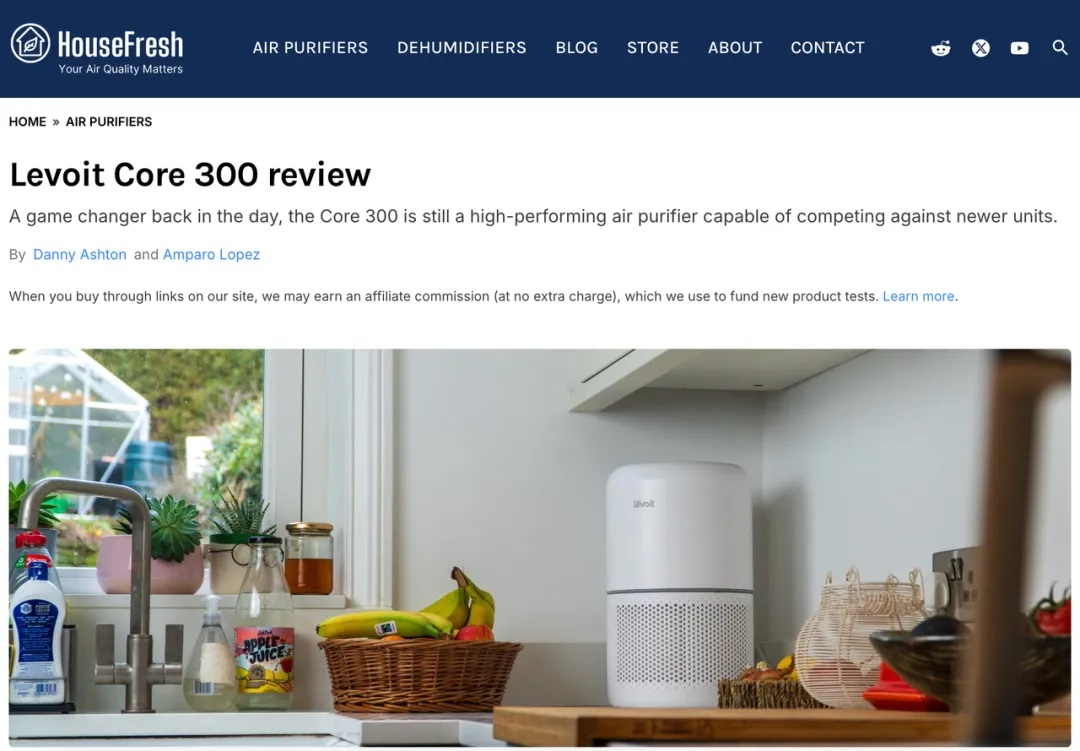

Levoit accurately captured this trend, pricing its products at only 1/3 of Dyson and Honeywell, and used content endorsements from professional review organizations (such as HouseFresh, TechGearLab) to prove that its performance rivals high-end brands. This successfully established its image as a "professional affordable model" and broke into the market.

Image source: HouseFresh

Multi-Platform Breakthrough: The Brand's Traffic Code

To break through in the fiercely competitive overseas market, relying solely on product strength is far from enough. Thus, Levoit turned its attention to a broader traffic battlefield.

1. TikTok: Using "Decentralization" to Ignite Buzz

On TikTok, Levoit is well versed in the art of "decentralized" communication.

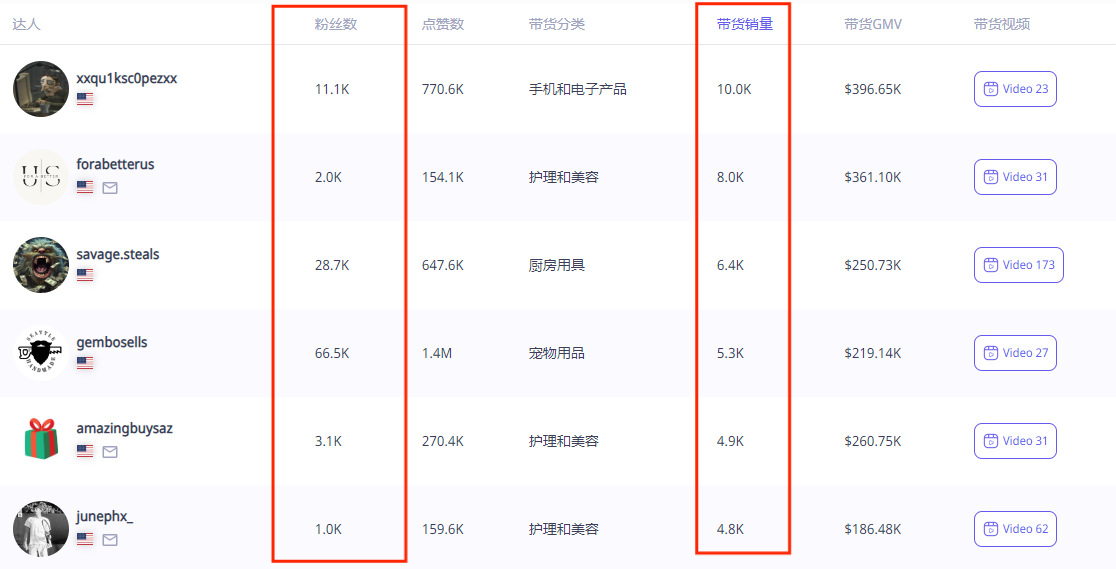

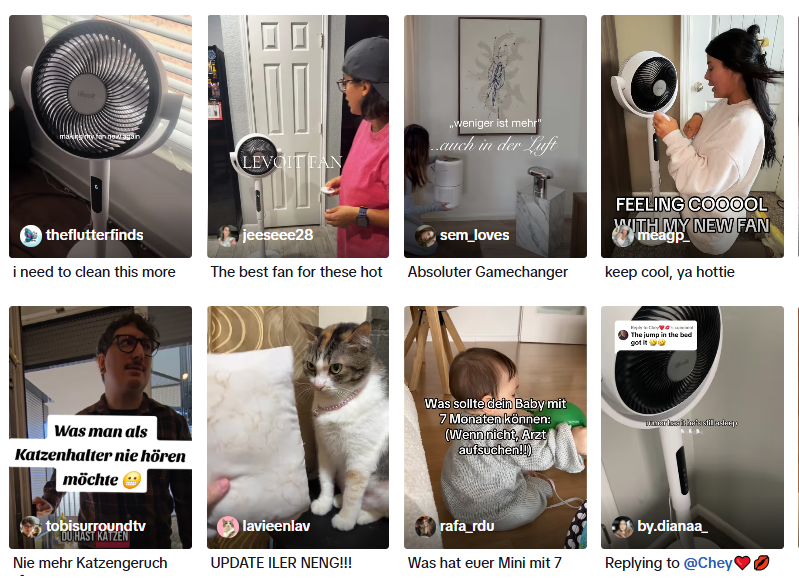

Unlike some brands that chase top influencers, Levoit chooses to collaborate with a large number of mid- and long-tail creators. This approach not only expands brand exposure but also reduces marketing costs, as can be seen from the list of creators associated with the Levoit brand.

Associated creator list Image source: echotik

In terms of content strategy, rather than tightly controlling content scripts, Levoit prefers to "empower" creators by providing only basic product information and encouraging free creation.

Searching #levoit on TikTok, you can see nearly 17,000 videos covering almost all video categories, from reviews to spoken introductions to lifestyle scene performances. Creators can fully unleash their creativity and showcase the diversity and practicality of the products.

Image source: TikTok

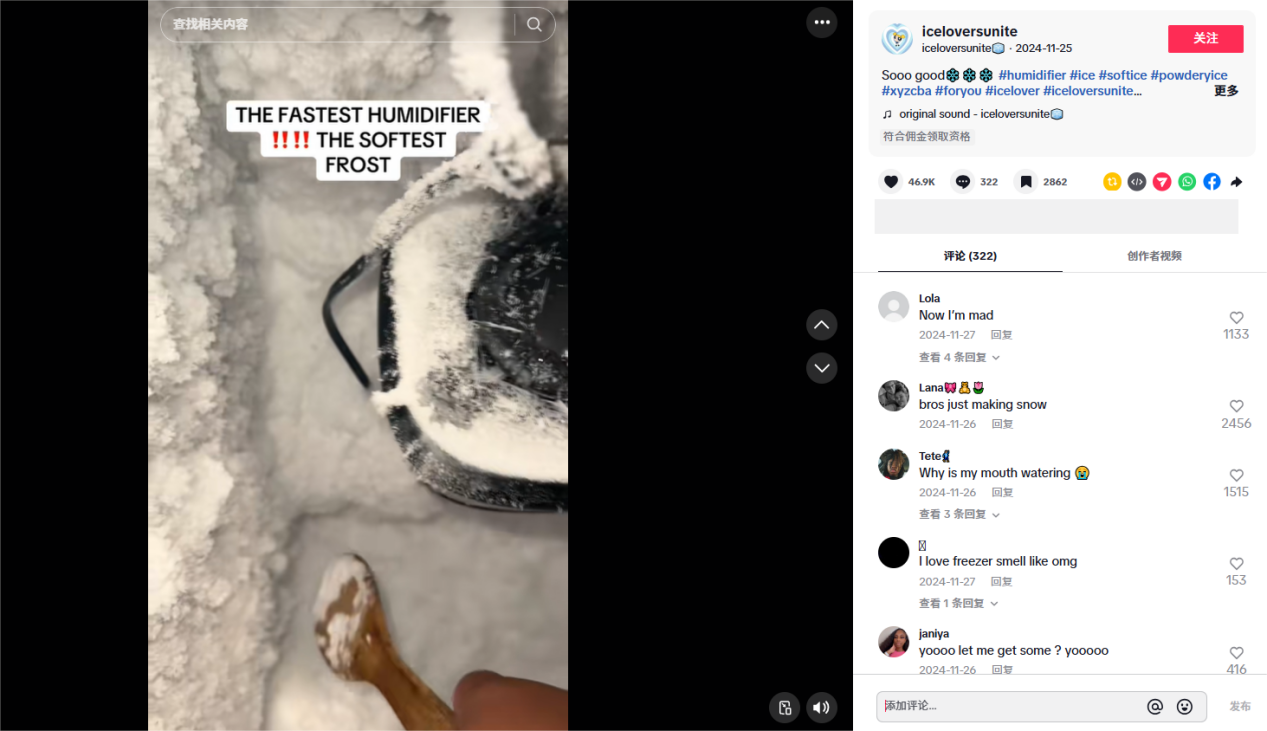

For example, TikTok creator @iceloversunite (3,181 followers) posted a video in November 2024 using a Levoit humidifier to make ice. With a novel perspective, the video showcased the product's stable mist and large capacity, ultimately gaining 1.5 million views and bringing considerable traffic and exposure to the brand.

Image source: TikTok

2. Instagram: Penetrating Minds with Lifestyle

Unlike the free creation on TikTok, Levoit is much more traditional on Instagram. They mainly cooperate with lifestyle KOLs to create scenario-based content, embedding products into daily life narratives.

For example, parenting blogger @Joy Green cleverly combined humidification with parenting anxiety by sharing "baby sleep health" scenarios. The video achieved an interaction rate of 8% and ultimately received 3,381 likes.

This "scenario marketing" avoids the awkwardness of hard advertising, allowing the product to become a natural part of users' ideal lives and organically driving brand traffic and exposure.

Image source: Instagram

3. Independent Website: Building a Brand Moat

As Levoit's core base, its independent website has shown steady traffic growth since its launch in 2018.

According to monitoring data from May 2024, its average monthly visits remain around 300,000, with 55.87% from organic search and 32.71% from direct URL entry.

This traffic structure shows that users' active search behavior for the Levoit brand (such as keywords like "air purifier" and "humidifier") constitutes the main source of visits, and more than 20% of users choose to visit the official website directly, further confirming the brand's accumulated recognition.

Image source: SimilarWeb

Conclusion

From Levoit's growth trajectory, it is clear that the key to Chinese companies going global lies in identifying needs and leveraging channels. Rather than endlessly competing in the domestic market, it is better to combine mature supply chain capabilities with gaps in overseas markets.

From Southeast Asia to Latin America, from North America to Europe, every region has urgent consumer pain points to be addressed. When products truly resonate with users' lives, "Made in China" is no longer just a label, but a synonym for competitiveness. Now is the perfect time to re-examine the overseas landscape.