The cross-border e-commerce industry is ushering in a new wave of policy changes. As the world's fourth largest e-commerce market, Japan has recently been reported to be planning to abolish its long-standing import tax exemption policy.

Image source: Yomiuri Shimbun

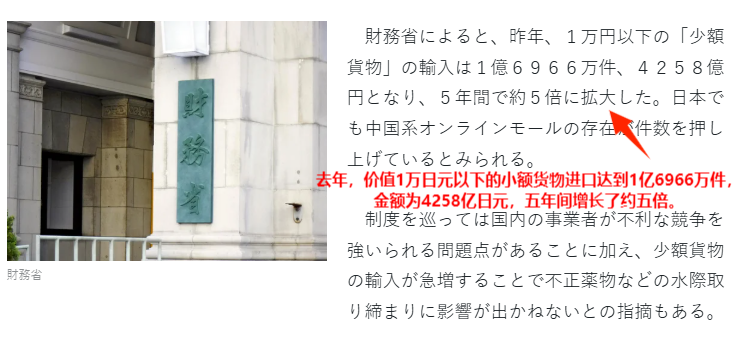

According to the tax reform roadmap disclosed by Japan's Ministry of Finance, the current exemption from tariffs and consumption tax for imported goods valued below 10,000 yen (about 495 RMB) may officially end in 2026. Data shows that in 2023, the number of small tax-free parcels imported into Japan soared to 169.66 million, a fivefold increase compared to pre-pandemic levels, with a total value exceeding 425.8 billion yen.

Image source: Yomiuri Shimbun

Behind this policy change, Chinese cross-border e-commerce platforms have become a key driving force. The latest report from Sensor Tower shows that Temu continues to expand rapidly as the world's most downloaded e-commerce app, while Shein firmly holds the second spot. Coupled with Amazon's overwhelming advantage of 67 million monthly active users in the Japanese market, the combined efforts of the three have driven exponential growth in the number of cross-border parcels in Japan. According to a survey by the Japan Retailers Association, 83% of domestic companies believe the tax exemption policy has led to a "price inversion," causing domestic products to lose competitiveness.

Image source: CROSS COMMERCE Studio

Across the Atlantic, the European market is also in turmoil. Data released by the European Commission in February is staggering: in 2024, 4.6 billion small parcels valued at less than 22 euros will flood into the EU, with a daily processing volume as high as 12 million parcels.

According to a sample survey by the EU Anti-Fraud Office, about 18.7% of tax-free parcels have issues such as underreporting of value, incorrect product classification, or lack of safety certification, resulting in an annual tax loss of about 2.9 billion euros.

To cope with this "parcel flood," the EU has introduced three key reforms: first, it plans to impose a fixed customs clearance fee on each cross-border parcel, which will be borne directly by e-commerce platforms or importers; second, it plans to completely abolish the long-standing 150-euro tax exemption threshold; and most importantly, it is preparing to establish the EU Central Customs Authority (EUCA), which will achieve real-time customs data connectivity among 27 countries through a "product safety scanning" system.

In response, France has taken the lead in announcing a reform timetable. Budget Minister Amélie de Montchalin announced during an inspection of the Paris logistics hub that starting in 2026, a fixed fee will be charged for each imported parcel.

Image source: france24

The UK Treasury has followed suit by launching a tax review, and the current £135 tax exemption threshold is in jeopardy. It is estimated that if the UK cancels the tax exemption policy, the comprehensive cost of imported goods will soar by 20%-30%, with the "double whammy" effect of a 20% VAT rate plus up to 25% tariffs not to be underestimated.

Faced with the upcoming industry changes, leading platforms have already started to prepare in advance. Temu has recently increased its shipping subsidies for the Japanese site by 30%, while Shein is accelerating the layout of local warehousing in Europe. Amazon Japan has also launched a "Compliance Acceleration Program" to help sellers adapt to the new customs declaration regulations in advance.

This global tax storm is essentially a restructuring of international trade rules in the digital economy era. For millions of cross-border sellers, the transformation from "making quick money" to "building a brand" is no longer a choice, but a compulsory course for survival.