This report mainly introduces the economic, trade, and investment situations of ten major countries in the Middle East, providing reference for Chinese enterprises planning to invest in the Middle East. The content includes the current economic status of these countries, trade and investment conditions, cooperation with China, investment opportunities and risks, tax policies, as well as the assistance that PwC can provide.

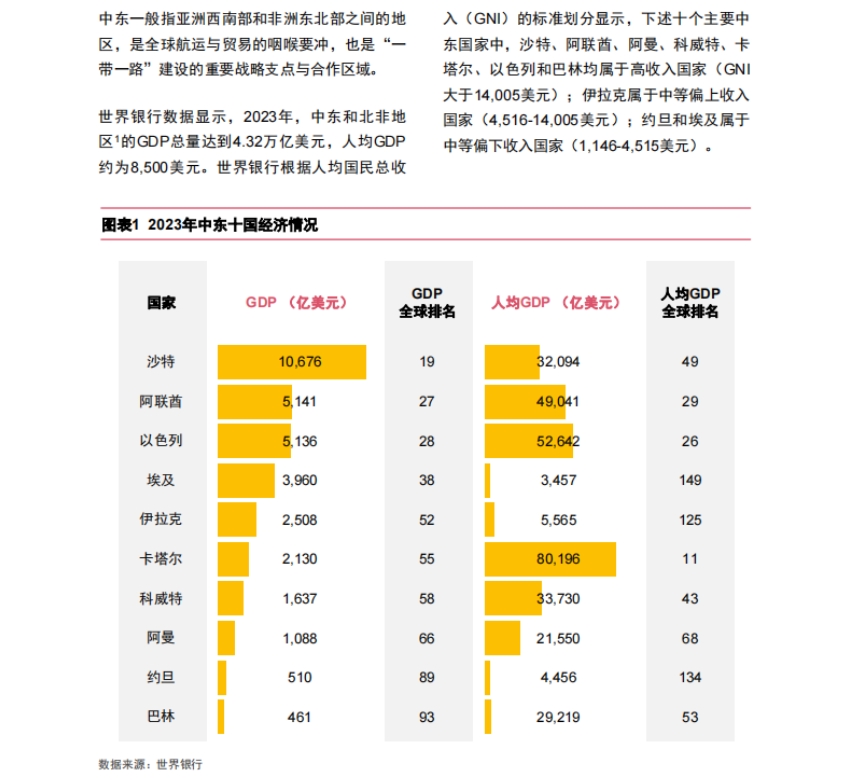

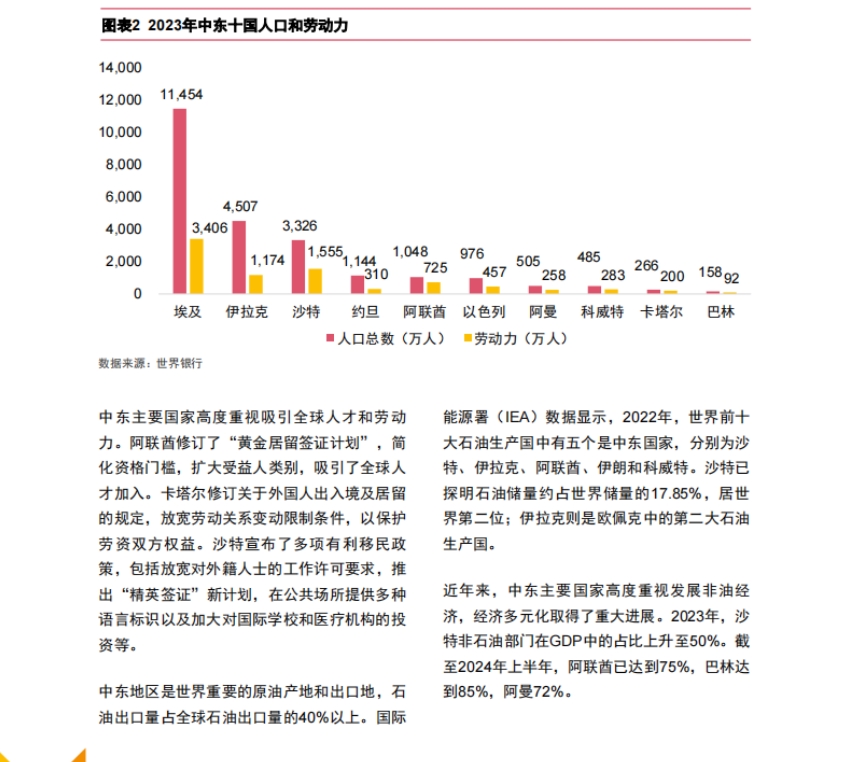

1. Economic Situation: The Middle East is an important global oil producer and trade hub with a significant geographical location. The region's economic development is becoming increasingly stable, with large differences in per capita GDP—some countries are high-income, while others are middle-income. The total population is large, labor resources are abundant, and there is a strong emphasis on attracting global talent. In recent years, major Middle Eastern countries have focused on developing non-oil economies, achieving progress in economic diversification. However, due to factors such as oil prices, economic growth slowed in 2023-2024. Nevertheless, future economic growth prospects remain optimistic, and each country has set long-term economic development goals.

2. Trade and Investment: The ten Middle Eastern countries have a high degree of economic openness and developed trade, mainly importing products such as machinery and automobiles. China is an important source of imports for several countries. In terms of attracting foreign investment, the UAE stands out, and many countries have clear strategic plans and have taken measures to optimize the business environment.

3. Cooperation with China: The relationship between China and major Middle Eastern countries continues to deepen. In terms of trade, China is the largest trading partner for several Middle Eastern countries, with each side focusing on different trade products. In terms of investment, the Middle East is an important destination for China's outbound direct investment, with investment fields continuously expanding, and the layout of Chinese banks in the Middle East is also being improved.

4. Investment Opportunities: In the process of developing non-oil economies, Middle Eastern countries have seen investment opportunities in energy, finance, tourism, technology, and other fields. For example, the renewable energy industry is developing rapidly, the financial sector is highly attractive to global financial institutions, tourism is growing well, and technological innovation and the digital economy are also receiving attention.

5. Investment Risks: Investing in the Middle East faces challenges such as geopolitical conflicts, economic dependence on oil and gas resources, rising sovereign debt in some countries, and difficulties in developing non-oil industries. The level of investment risk varies among countries.

6. Tax Policies: In recent years, major Middle Eastern countries have promoted tax reforms. The overall tax burden in the region is relatively low, and each country has its own characteristics in terms of corporate income tax, value-added tax rates, and tariff policies.

7. PwC Assistance: PwC has an extensive global network and has operated in the Middle East for many years, with rich experience and professional teams. It can provide professional services and support for Chinese enterprises going global to the Middle East.