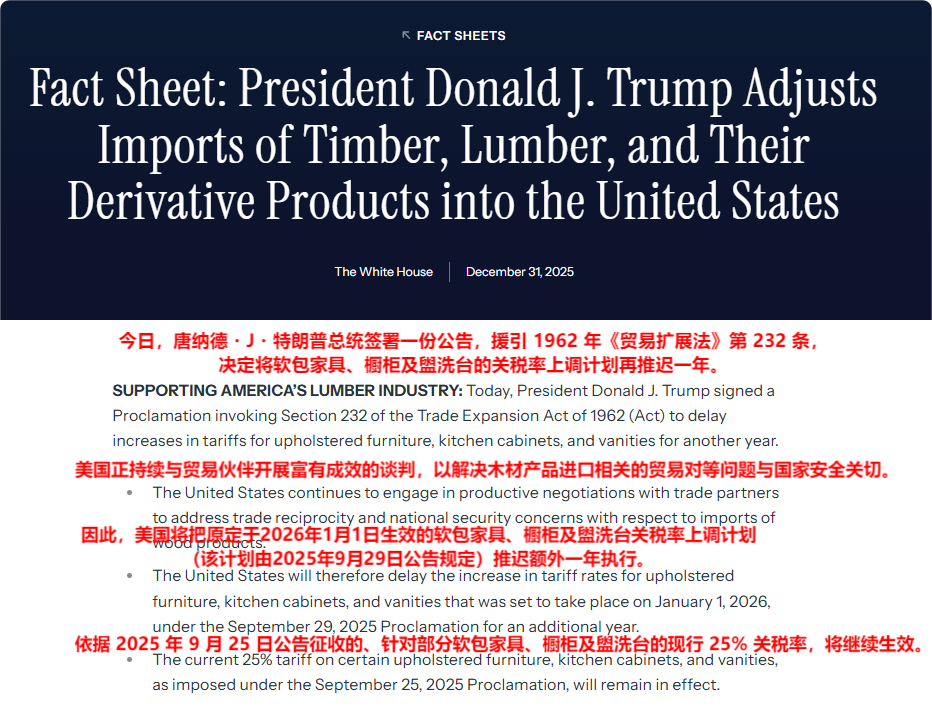

In January 2026, an announcement on the official website of the White House drew attention from the cross-border e-commerce community: President Trump officially signed a presidential order to postpone for one year the planned tariff increase on upholstered furniture, cabinets, and vanities, which was originally scheduled to take effect on January 1.

This move has cast a “buffer bomb” on the U.S. furniture market, which is highly dependent on imports, as well as the closely connected global supply chain.

Image source:google

What happened? The tariff plan suddenly “hit the brakes”

According to the announcement released by the White House, the U.S. President has signed an order to postpone the tariff plan, which was originally scheduled to take effect at the beginning of this year, to next year.

This means that the tariff rate on upholstered furniture will temporarily remain at 25%, instead of being raised to 30%; the tariff rate on cabinets and vanities will also stay at 25%, avoiding the scenario of a sharp increase to 50% as originally planned.

The White House explained that this move was made because relevant trade negotiations are still ongoing, and the U.S. hopes to address these issues within a broader negotiation framework, emphasizing that this “does not mean abandoning the trade agenda.”

Image source:The White House

Inflation pressure and political considerations may be key

Analysts generally believe that this policy adjustment is by no means accidental. Against the backdrop of persistently high inflation and sensitive living costs for ordinary families, furniture and cabinets are considered major household improvement expenditures, and their price fluctuations are highly politically sensitive.

Several industry executives have previously warned that if tariffs are raised, costs will quickly be passed on to the retail end, further squeezing already tight consumer budgets. The postponement of the tariff increase can be seen as the Trump administration seeking a balance between trade pressure and alleviating domestic livelihood pressures.

Data shows that furniture prices in the U.S. market have risen significantly over the past year. Since last November, the overall price of furniture products has increased by about 4.6% year-on-year, while the annual increase in the overall Consumer Price Index (CPI) is only 2.7%.

In this situation, imposing additional high tariffs would undoubtedly add fuel to the fire.

Image source:finance.yahoo

What is the impact on the industrial chain? Short-term breathing space and long-term uncertainty

For the U.S. furniture industry, which is heavily dependent on imports, this postponement is undoubtedly a valuable buffer period. The United States is one of the largest furniture consumer markets in the world, with its supply long dependent on overseas sources. China and Vietnam are the two main sources, with annual export volumes exceeding tens of billions of dollars. In recent years, under multiple rounds of tariff measures, the profit margins of importers and retailers have been continuously squeezed.

With this temporary postponement of the tariff increase, in the short term:

1.Importers and Tuke sellers: They are able to temporarily ease the pressure of sharply rising costs, maintain existing pricing strategies, and stabilize supply chain arrangements.

2.U.S. domestic retailers and consumers: They avoid immediate price hikes caused by soaring costs, and the pressure on consumer spending is slightly reduced.

3.Exporters from China, Vietnam, etc.: They gain a relatively stable export policy window for one year, which is beneficial for order and production planning.

However, the industry is generally clear that this is not the cancellation of tariffs, but merely a postponement. A complex tariff system has already taken shape. Furniture categories have always been a key target for adjustment in U.S. trade policy, from anti-dumping and countervailing measures more than a decade ago to multiple rounds of Section 301 tariffs since 2018. The policies are “layered upon layers,” and long-term uncertainty remains huge.

Image source:google

Buffer, not shift—the game continues

In summary, the postponement of the tariff plan is a tactical adjustment by the Trump administration under the current economic and political environment. It has won a crucial breathing space for the global furniture industry chain and has allowed U.S. consumers to temporarily avoid another wave of price increases.

However, this by no means represents a fundamental change in the direction of trade protectionism. In the coming year, the progress of relevant negotiations, the domestic inflation situation in the U.S., and the political landscape will all directly affect the policy direction one year from now.

For Tuke sellers and related manufacturing enterprises, making good use of this buffer period, optimizing supply chain layout, enhancing product added value, and strengthening risk resistance are the pragmatic ways to cope with long-term uncertainty.