Part 1 Indonesia Launches Buy Now, Pay Later Service

Amid the wave of digitalization, e-commerce platforms are continuously seeking innovation to provide a more convenient and flexible shopping experience.

Recently, the globally renowned short video social platform Tuke announced a partnership with Indonesian tech giant GoTo Group, planning to launch a "Buy Now, Pay Later" (BNPL) service in the Indonesian market to further enhance the shopping experience.

Tuke and GoTo collaborate to launch Buy Now, Pay Later service. Image source: Fintech News Singapore

To some extent, this service is equivalent to Douyin Monthly Pay and Alipay's Huabei in China, which have already developed quite maturely domestically.

However, for overseas markets, the "Buy Now, Pay Later" shopping model is just beginning. Even in the United States, a country known for overdraft consumption, credit card payments remain the mainstream payment method.

Even international shopping sites like Amazon and Shopee have only just entered the open testing phase for Buy Now, Pay Later shopping methods.

Tuke's move not only demonstrates its ambition in the e-commerce sector but also reflects the global popularity and acceptance of Buy Now, Pay Later.

Part 2 Buy Now, Pay Later Has Become an Inevitable Evolution of Payment Methods

As a new shopping method, Buy Now, Pay Later allows consumers to pay after receiving goods, providing greater flexibility and convenience. With the increasing global internet penetration and the improvement of online payment functions, Buy Now, Pay Later has become an unstoppable trend.

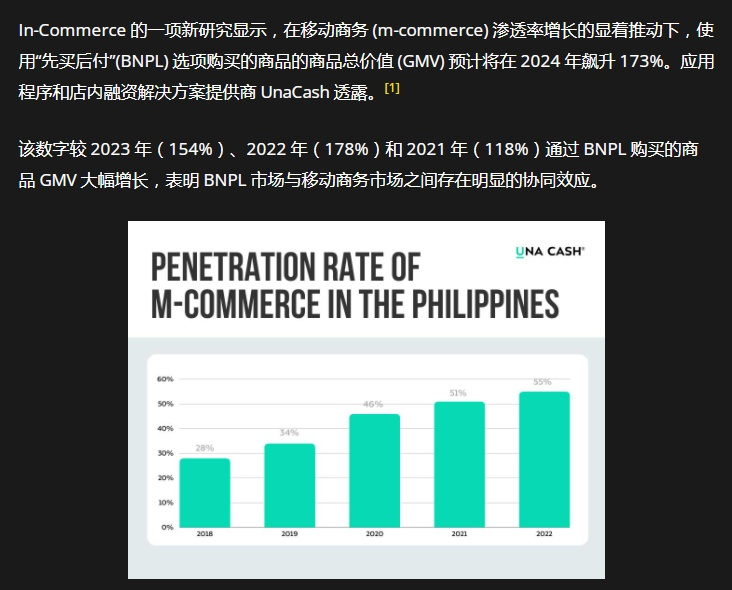

From the Philippines to Malaysia, to Singapore and the UAE in the Middle East, this payment method is rapidly sweeping the globe.

Philippines Buy Now, Pay Later product GMV surges. Image source: dailyguardian

The Buy Now, Pay Later feature not only greatly facilitates consumers but also effectively improves e-commerce platforms' conversion rates, making it favored by major e-commerce giants.

Last August, Polish e-commerce giant Allegro, which had just entered the Czech market, quickly launched the Buy Now, Pay Later feature to meet the growing shopping demands of consumers.

Shortly after, in September, Amazon teamed up with payment provider Affirm and the largest US bank, JPMorgan Chase, to add two new Buy Now, Pay Later services, further enriching its payment product line and enhancing the user shopping experience.

By October, Indonesian local e-commerce platform Bukalapak partnered with Indonesian bank AlloBank to jointly launch the Allo PayLater Buy Now, Pay Later service, providing Indonesian consumers with a more convenient shopping method.

Last December, retail giant Walmart further expanded its cooperation with Affirm, successfully introducing Buy Now, Pay Later services in more than 4,500 stores across the United States, further consolidating its market leadership.

Amazon adds two new Buy Now, Pay Later services. Image source: The Financial Brand

This series of initiatives all indicate that Buy Now, Pay Later has become one of the key competitive strengths in the e-commerce industry.

In the Indonesian market, Tuke Shop just made its comeback at the end of last year through a merger with Indonesian e-commerce platform Tokopedia, and it is bound to optimize the shopping experience by offering more diverse payment options.

The "Buy Now, Pay Later" feature has become its top choice.

According to a GoTo Group report, in the most recent quarter, consumer loans in Indonesia have grown significantly quarter-on-quarter, and local consumers' acceptance of loan-based consumption is also increasing.

With all these factors combined, the joint launch of Buy Now, Pay Later by Tuke and GoTo is the result of their deepening cooperation.

Part 3 Even Though the Die Is Cast, Risks Must Still Be Guarded Against

However, behind the popularity of Buy Now, Pay Later, there are also hidden risks and challenges. When e-commerce platforms bet on this business, they must pay attention to risks related to consumer data and credit. By formulating reasonable rules and strategies, platforms can ensure the healthy development of this feature while protecting consumers' rights and interests.

The launch of the Buy Now, Pay Later feature will undoubtedly inject new vitality into Tuke's e-commerce business in Indonesia and even globally. As more e-commerce platforms join in, this payment method is expected to continue expanding its influence worldwide, bringing consumers a more convenient and flexible shopping experience.

In this digital era, e-commerce platforms are constantly innovating to meet the diverse needs of consumers. As a new payment method, Buy Now, Pay Later not only provides more payment options but also brings higher conversion rates for e-commerce platforms. With the continuous improvement and popularization of this feature, we have reason to believe that the future e-commerce market will be more prosperous and vibrant.